I don't know how to start asset building.

I don't know how to allocate my money.

Do you have such a problem?

By categorizing your money, you can understand how you should build your assets.

Asset management may sound risky and scary.

It is important to understand your current asset situation and determine how much risk you can tolerate.

Four Steps to Asset Formation

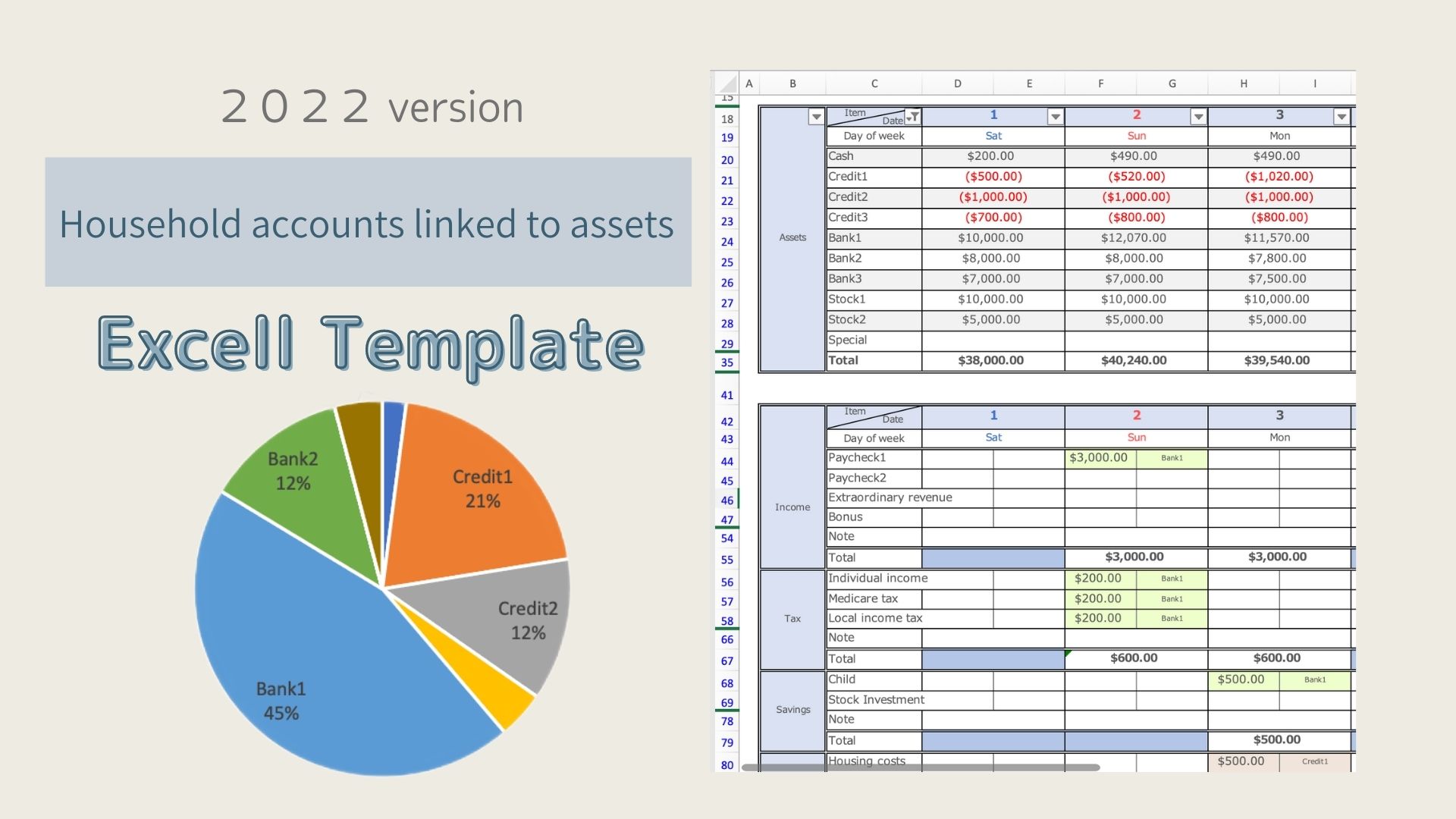

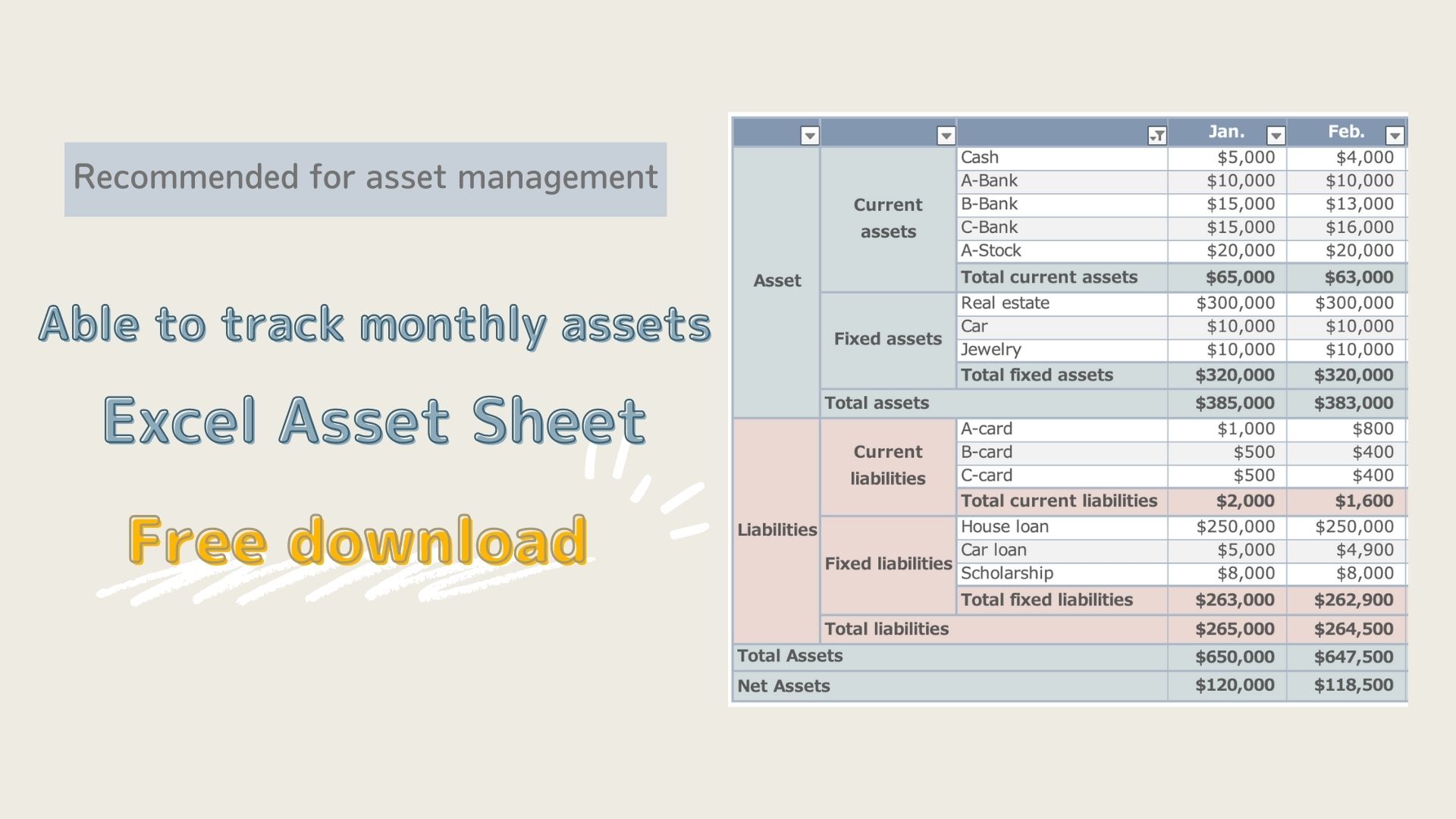

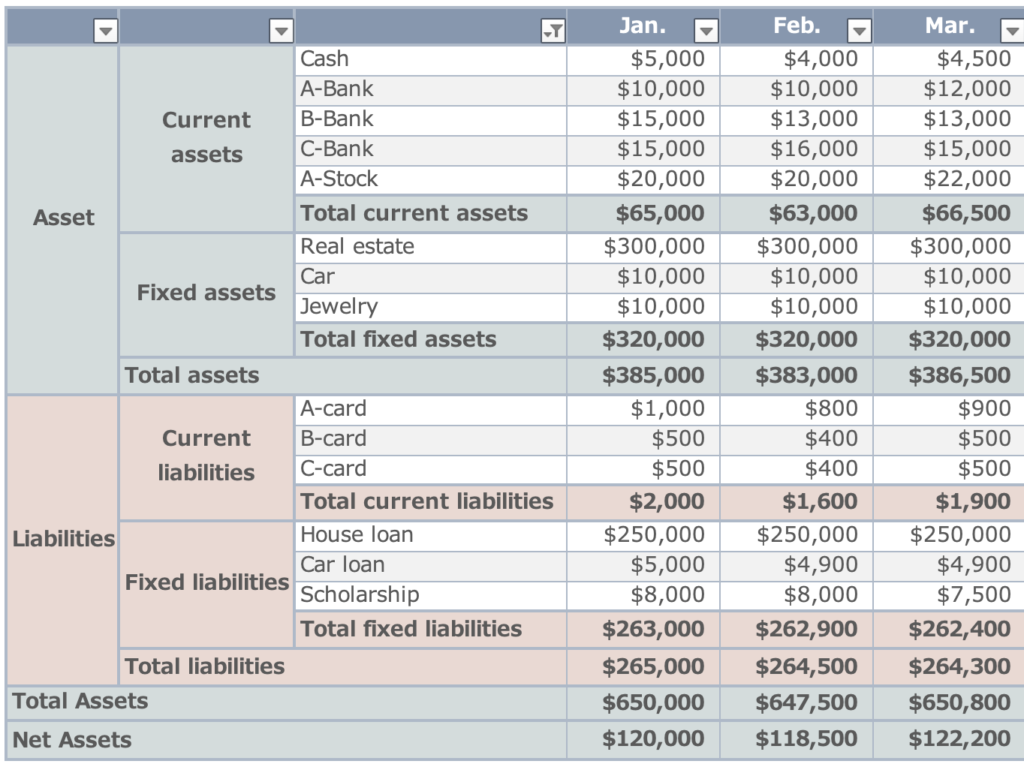

Understand the assets you currently have

Before you begin asset building, make a list of what assets and liabilities you currently have and how much you owe.

Listing Assets

Assets

- Current assets: Assets that can be converted into cash within one year.

Typical items that fall under current assets are cash (savings), securities (stocks, investment trusts, receivables, etc.), and insurance. - Fixed assets: Assets held for more than one year

Typical items that fall under fixed assets are real estate (land, buildings, etc.), jewelry, and brand-name goods.

Liabilities

- Current liabilities: Liabilities to be paid off in less than one year.

Typical examples of current liabilities are credit cards and unpaid taxes. - Fixed liabilities: Liabilities due in more than one year

Typical fixed liabilities include the borrowed portion of land and buildings owned (mortgage), car and scholarship loans.

Net Assets (capital not required to be repaid)=Assets - Liabilities

-

-

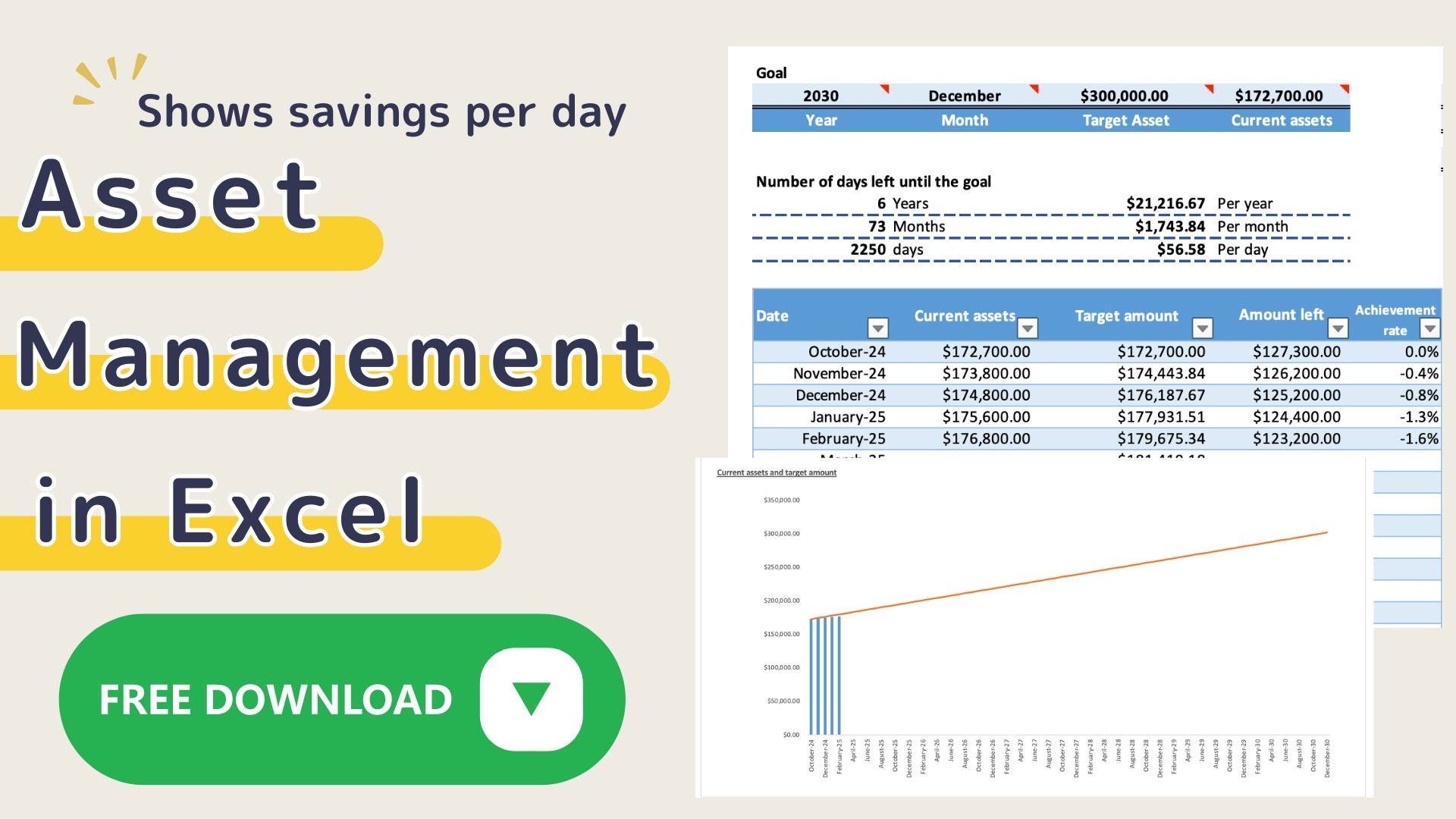

Recommended for asset management! Excel template (free download) to keep track of your monthly assets.

How do I start with asset management? Do you have such a problem? It is important not only to check the monthly flow of money ...

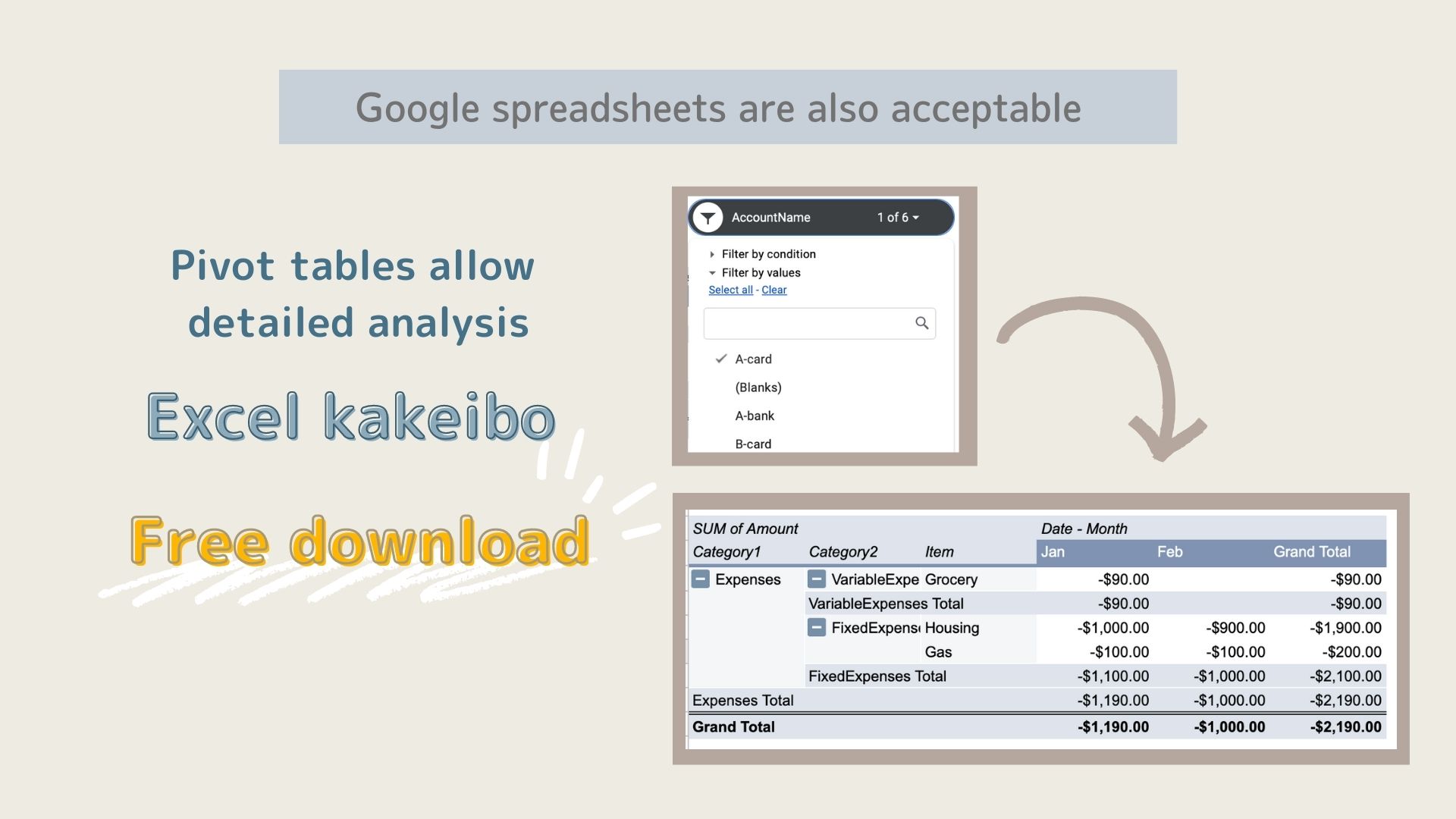

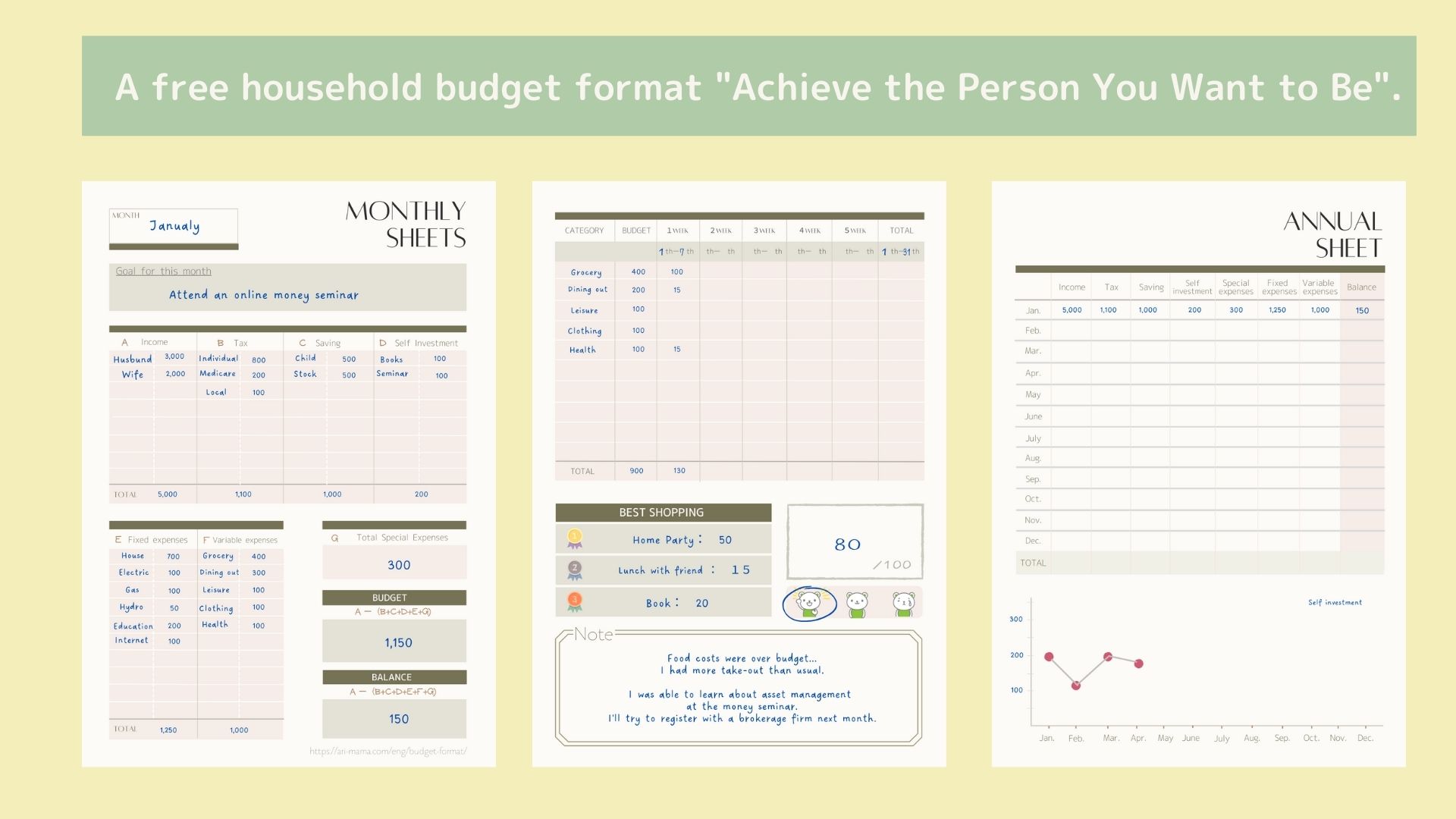

Know your monthly living expenses

Use a household account book to track monthly living expenses.

- Basic living expenses (food, daily necessities, utilities, education, communication)

- Housing-related expenses (rent and home loan)

- Vehicle expenses (parking fees, gazolins, transportation, insurance, etc.)

- Monthly insurance premiums

- Other expenses (entertainment, clothing, medical expenses, entertainment, etc.)

-

-

[2023 Edition] Excel Kakeibo Specializing in Recording Credit Card Transactions (Free Templates Available)

This Excel Kakeibo is the 2023 version of the [2022 version] Excel Family Budget Book (with free templates), which specializes in credit card records. The ...

Identify special expenses

This includes the cost of a car, a down payment for a house purchase, and education funds that will be needed within 3-5 years.

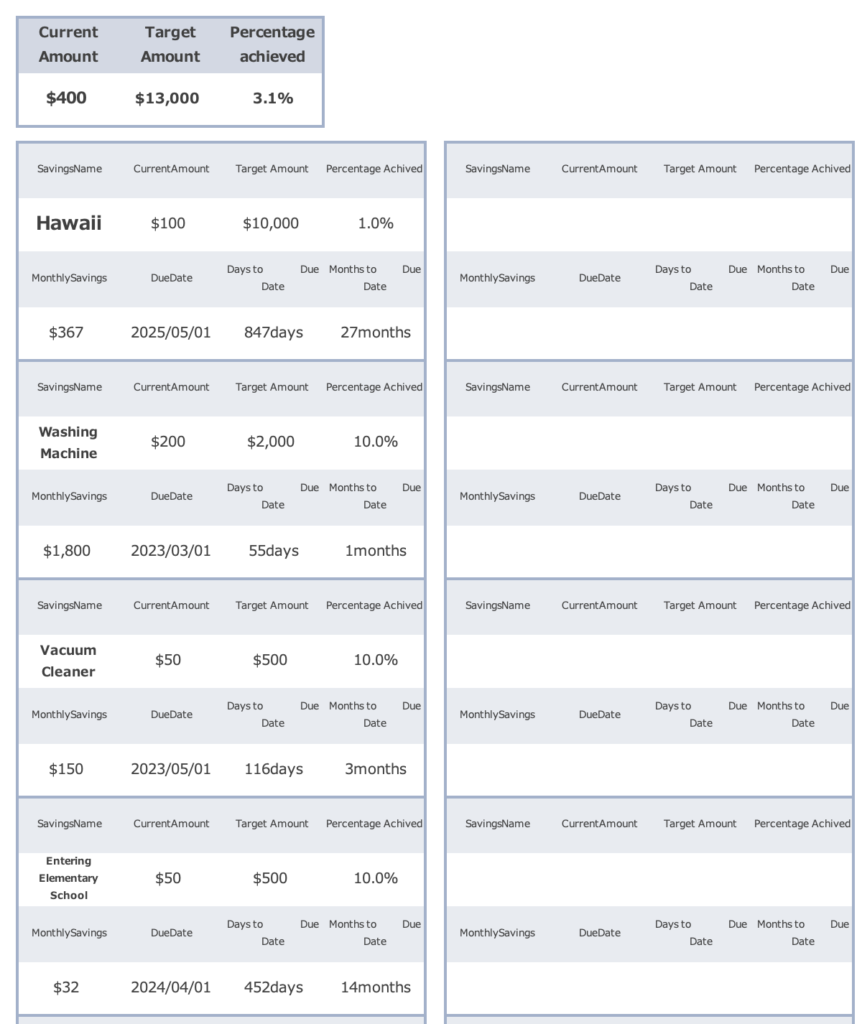

The savings book template allows you to list how much money you need for each purpose.

-

-

Excel template to visualize your savings goals within 5 years (free download)

I want to manage my savings.I would like to know how much I will need to save within the last 5 years. Do you have ...

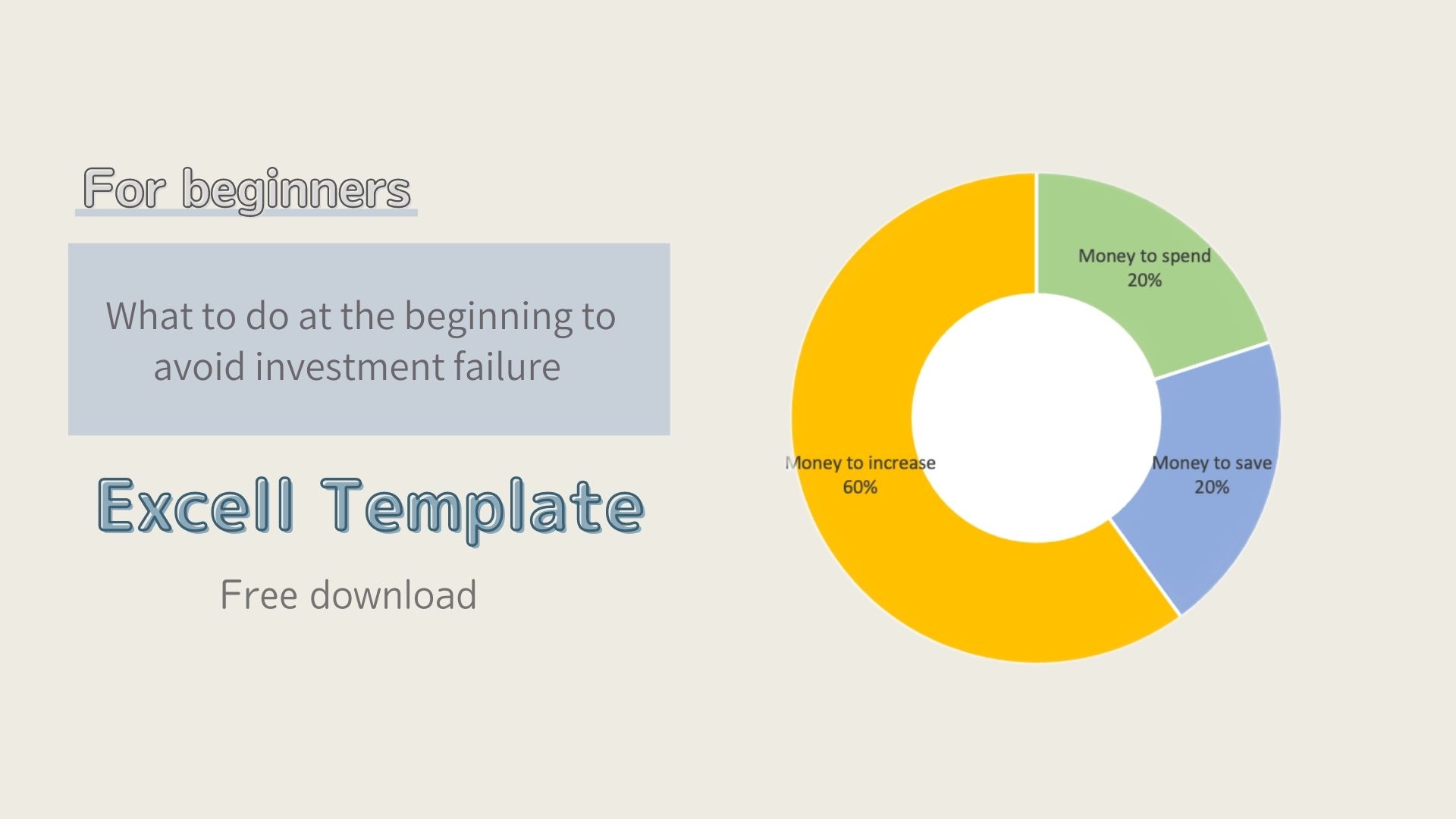

Categorize your money

Categorize money by use.

- Money to spend

Set aside 3-6 months of monthly living expenses - Money to save

Special expenses that will be needed within 3 to 5 years - Money to increase

Net worth - (money to spend + money to save)

Operating Account

- Money to spend (liquid funds)

Savings, savings, and other deposits that are guaranteed principal and can be withdrawn at any time - Money to save (safe funds)

Time deposits, government bonds for retail investors, etc., which ensure stable investment of principal - Money to increase (profit-earning funds)

Stocks, mutual funds, ETFs, foreign currency deposits, etc.

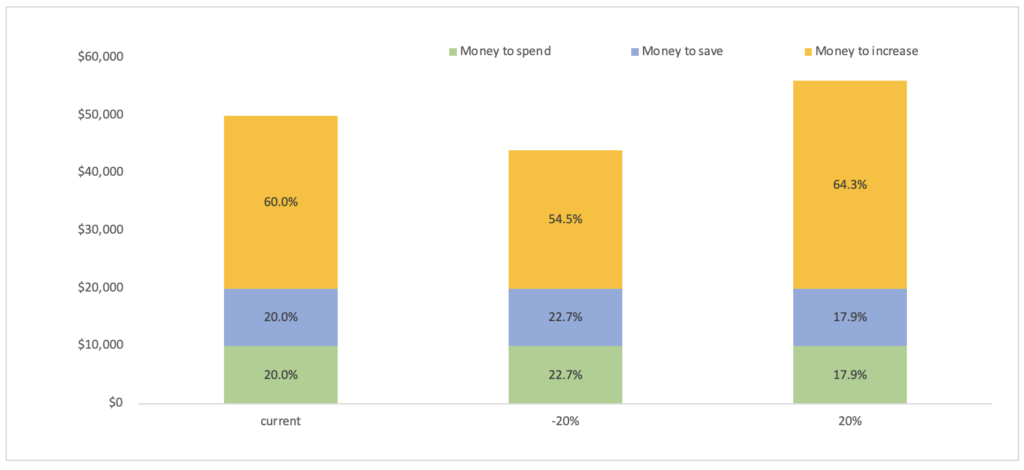

Visualizing Risk

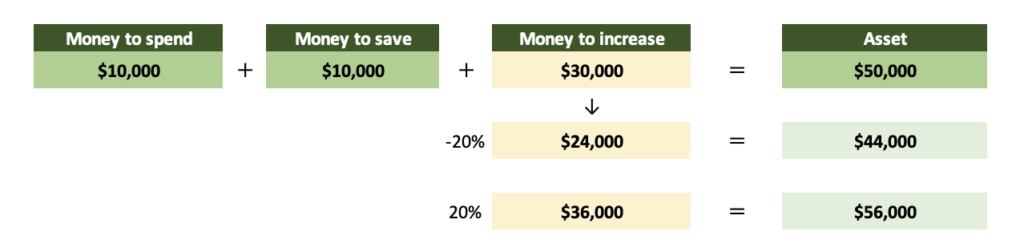

I have created a sheet that shows you how much risk you will incur and how much risk you can tolerate when you start managing your assets.

Enter the amount of money to spend, money to save, and the top asset item.

The amount of money that can be put into asset management (money to increase) is displayed in the "Money to increase" column.

The amount of money and assets when the asset management results in -20% and the amount of money and assets when the asset management results in +20% will be displayed.

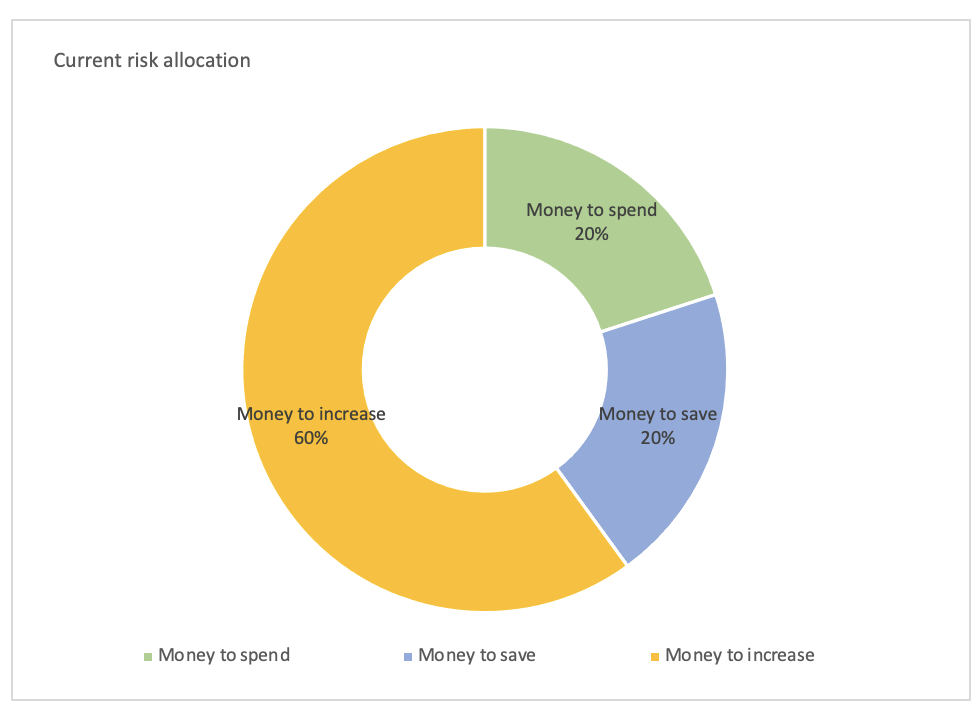

Pie chart showing current money classification ratios

Compare the percentage of each classification currently ー20% and +20%.

Asset management can range from relatively low to high risk.

In this case, it is set up to take into account the possibility of a temporary ー20% or a +20%.

Of course, it does not mean that you have to invest in assets other than the money you spend or save.

If you want to avoid the risk of losing money, you can choose a lower-risk asset management or set up more money accounts to save.

The settings on this sheet are only to visualize temporary risks.

Free Download

Click on the download button.

Excel includes a sample.

This sheet is not intended to predict future investment performance.

Please note that actual asset management and investment decisions can be made by yourself.