I want to manage my savings.

I would like to know how much I will need to save within the last 5 years.

Do you have such a problem?

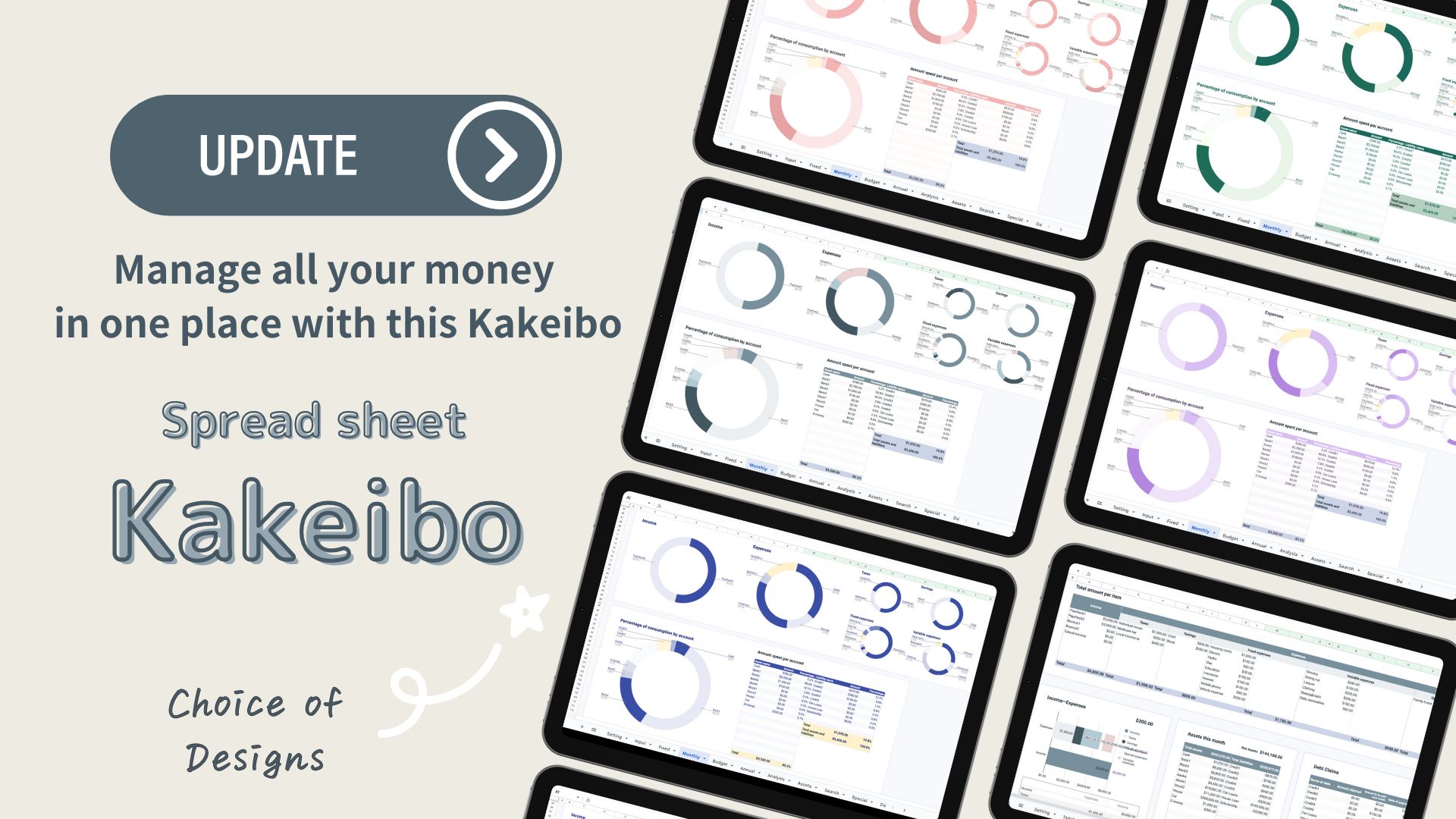

This savings management sheet identifies money that you know you will need to use within the last 3-5 years and visualizes your monthly progress.

- I don't know how much money I should save.

- I want to know how much to save each month.

- Want to manage savings by account.

This sheet is recommended for people who want to know how much money to save each month.

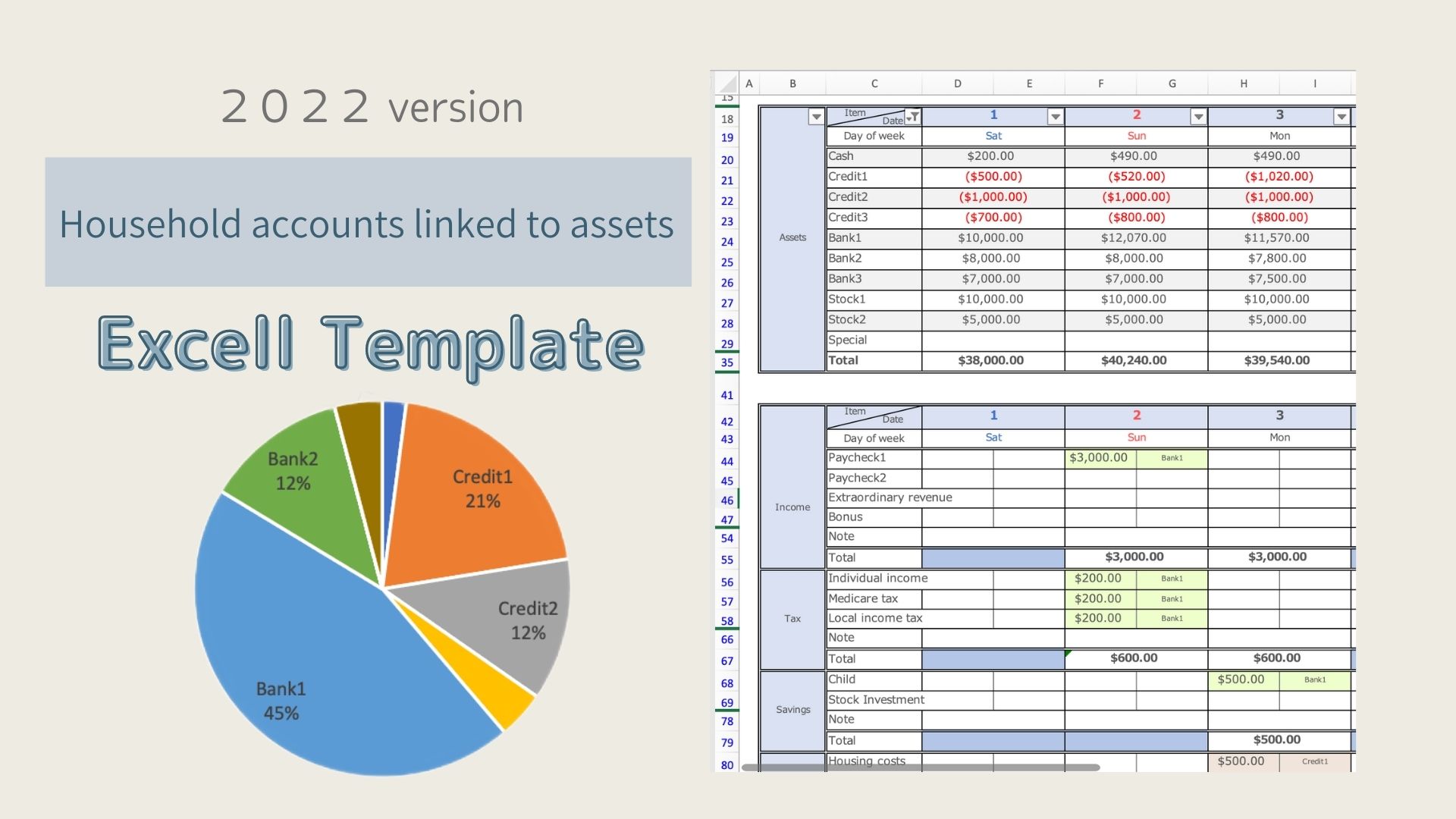

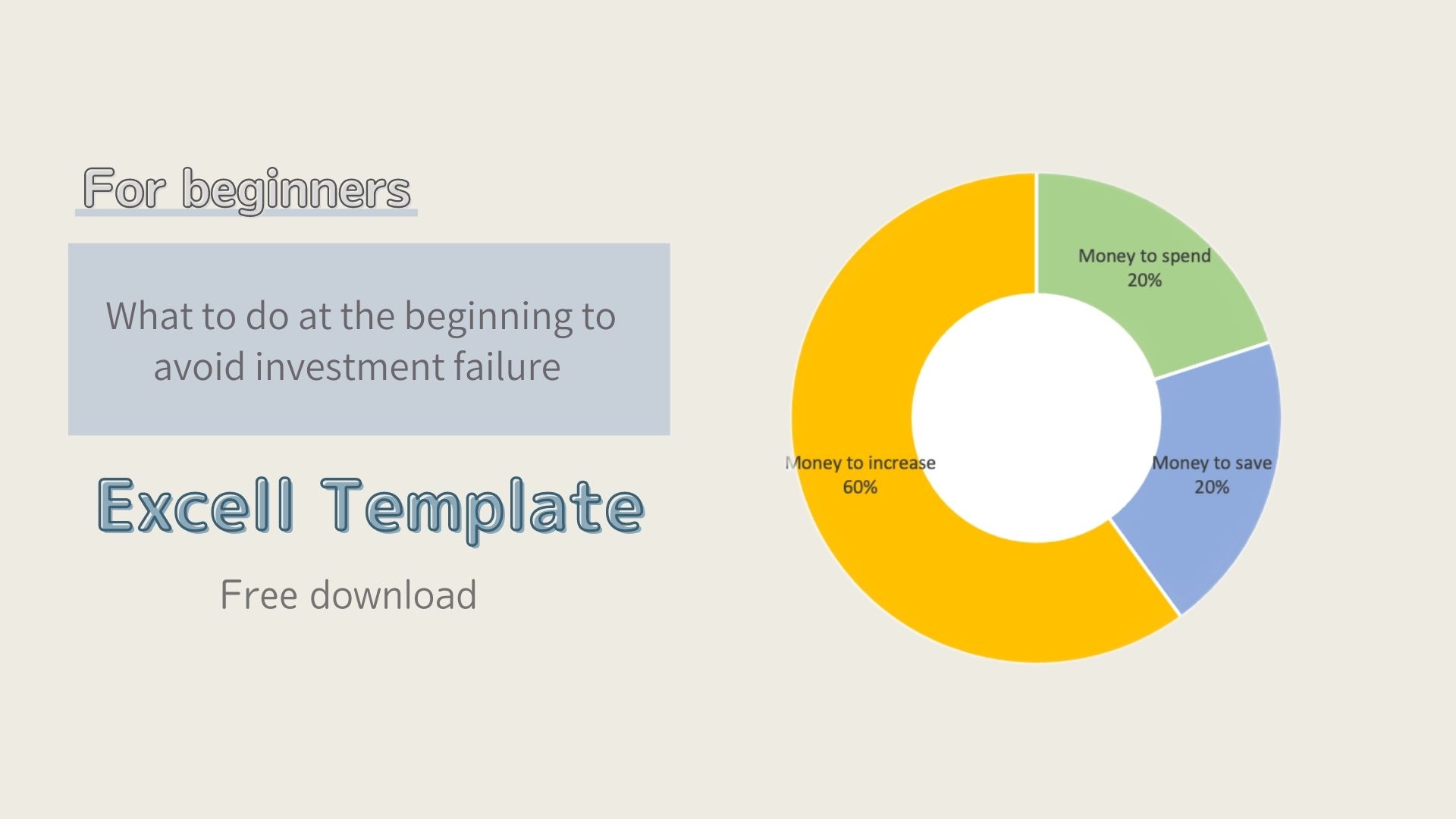

Separating your money by use makes it easier to manage your money.

- Money to spend

- Money to save

- Money to increase

-

-

Great for beginners! 4 Steps to Start Building Assets

I don't know how to start asset building.I don't know how to allocate my money. Do you have such a problem? By categorizing your money, ...

The savings sheet manages the money to be saved.

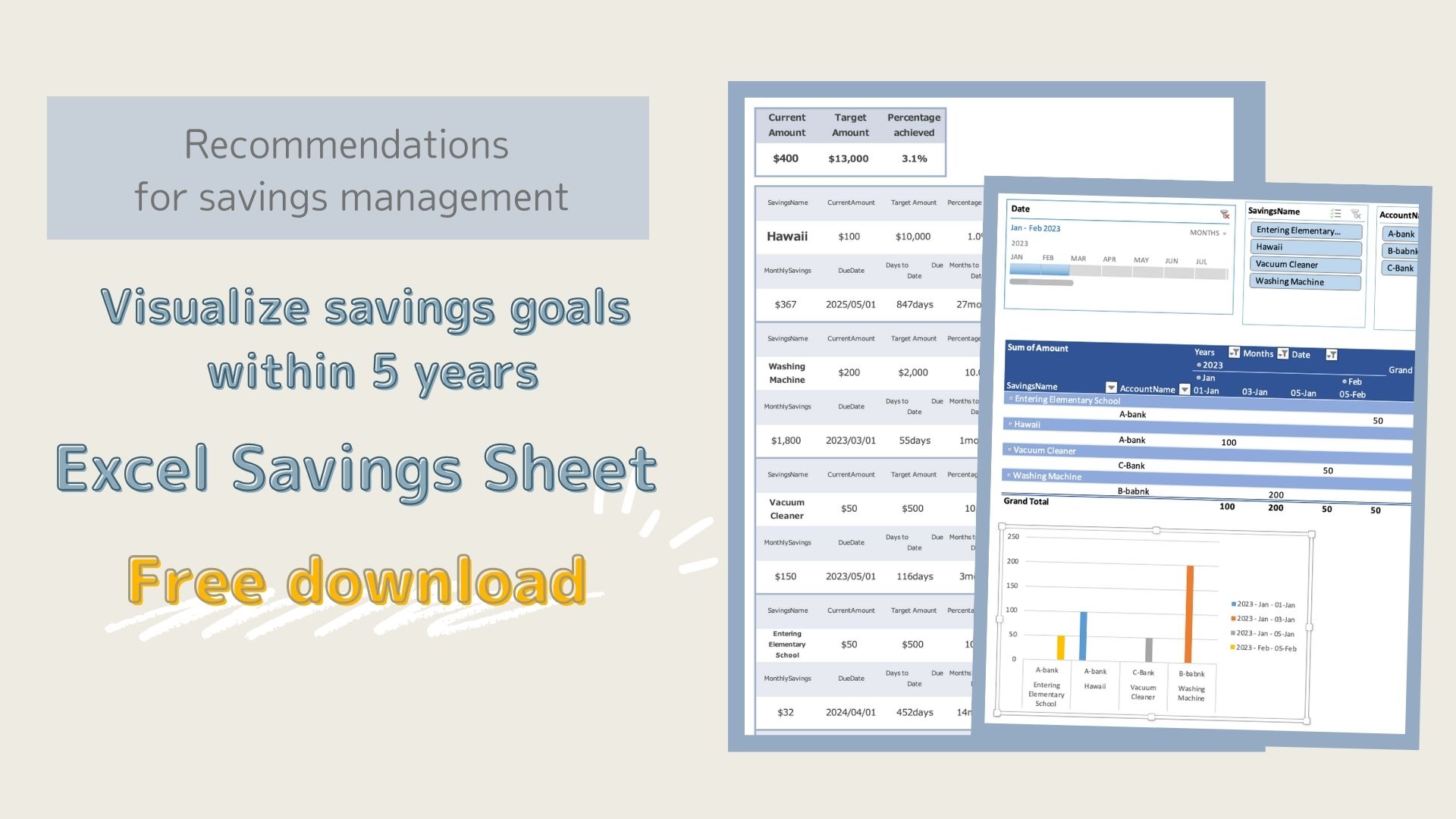

Savings Sheet Features

For "money to spend," it is generally recommended that three months' worth of necessary monthly expenses be set aside.

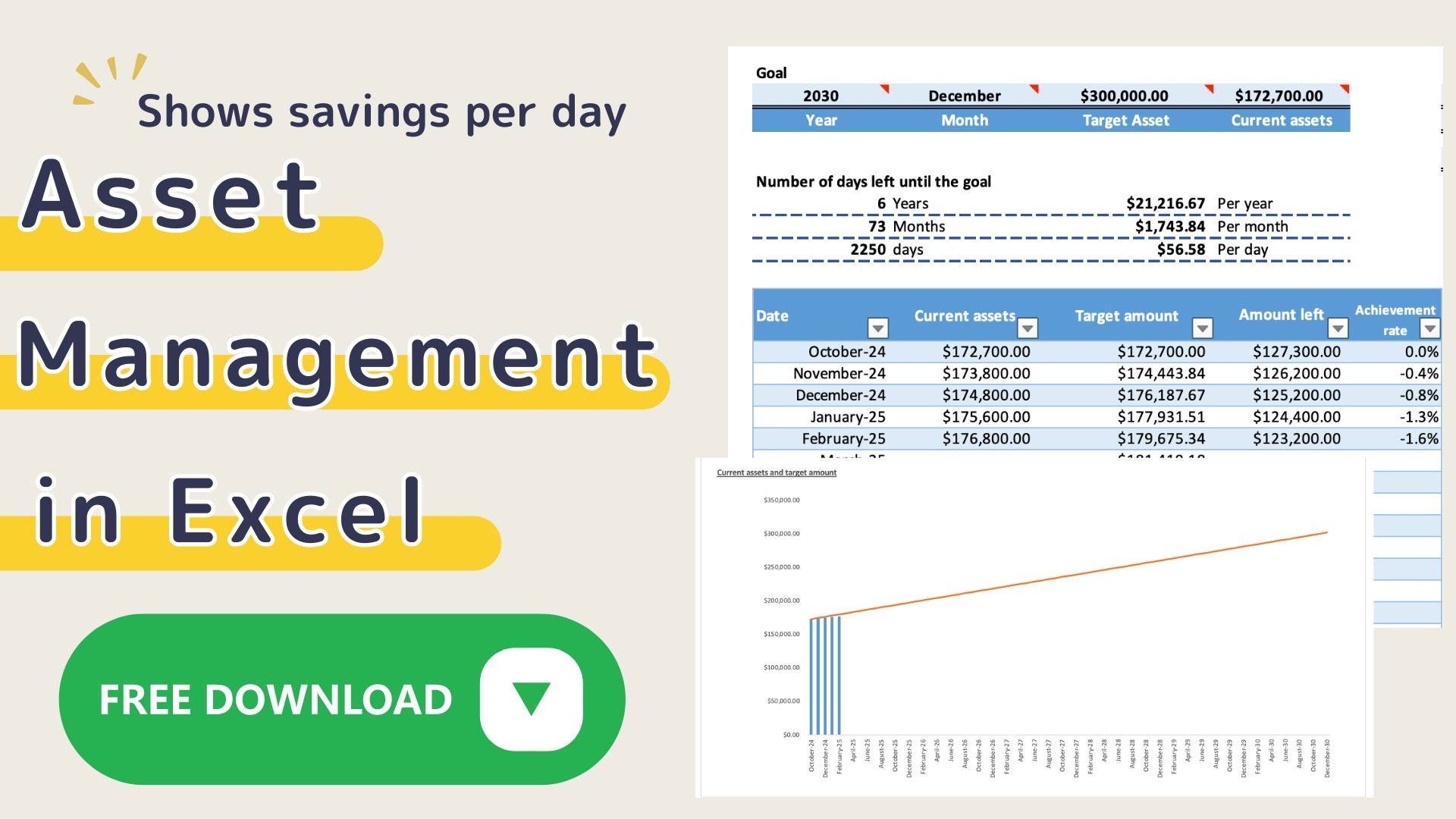

On the other hand, "money to save" is intended for expenses such as a down payment for a car purchase, a house purchase, and education funds that will be needed within 3-5 years.

Education and retirement funds that will not be used within 5 years can be invested as "money to increase," but can be managed on a savings sheet along with the savings needed within 5 years.

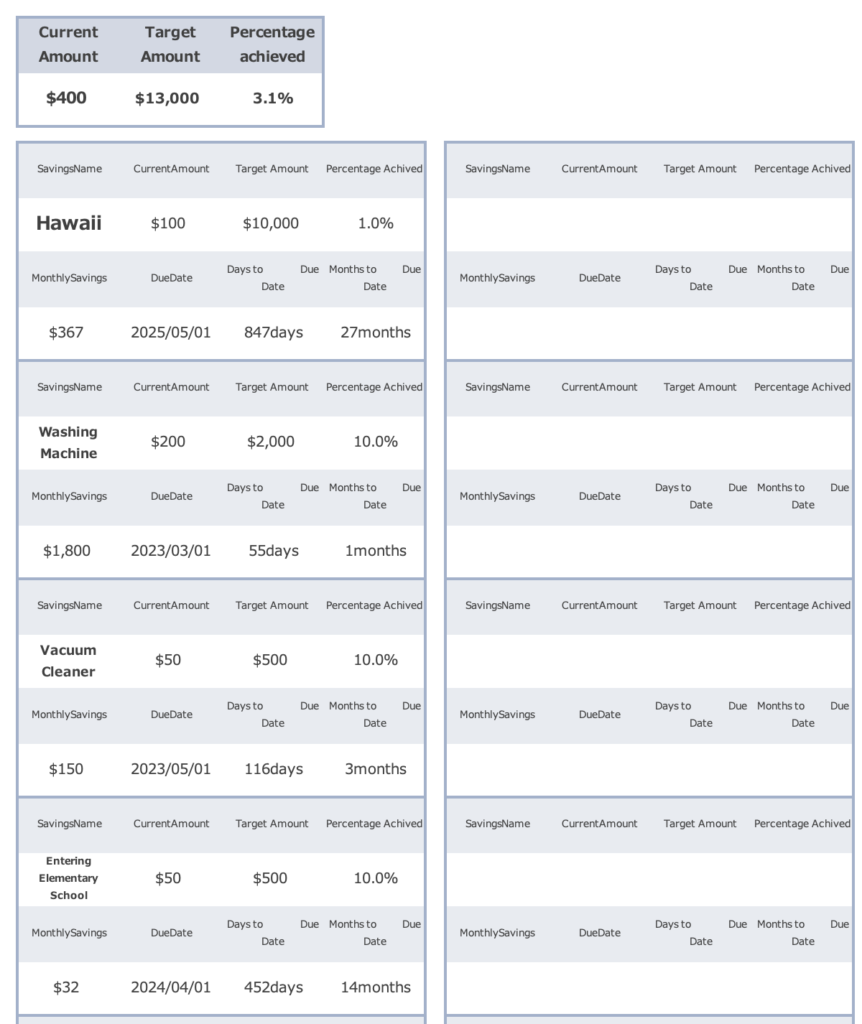

- Lists savings goal, target amount, current amount, and due date.

- Displays due dates according to the date you open Excel.

- Displays current percentage achieved by savings name.

- Manage savings by account.

- Displays savings deposits by month in a table and a graph.

- Slicer function allows you to check the deposit information for a specific account or a specific savings name in a table and a graph.

How to use the Savings Sheet

Creation Steps

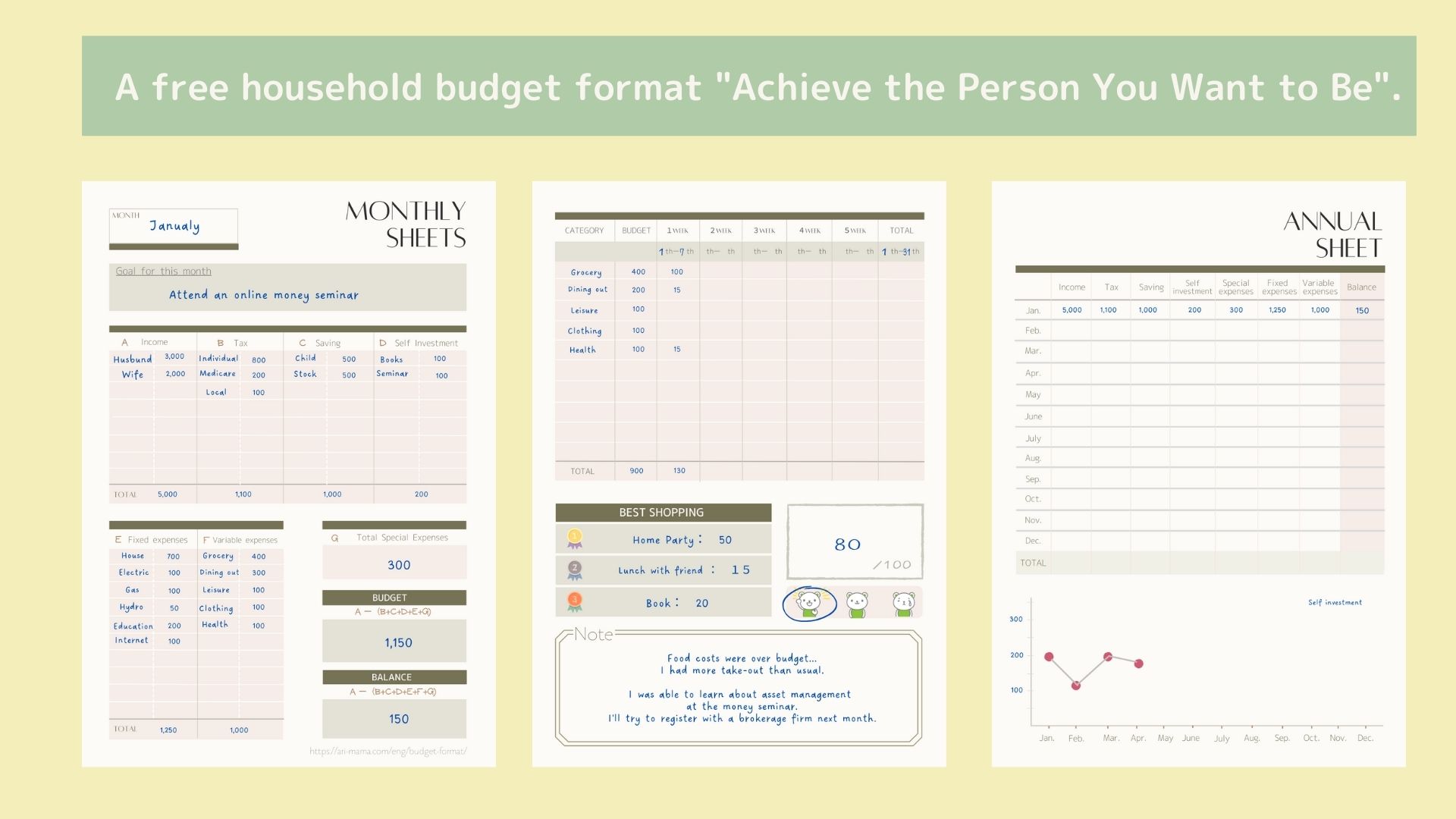

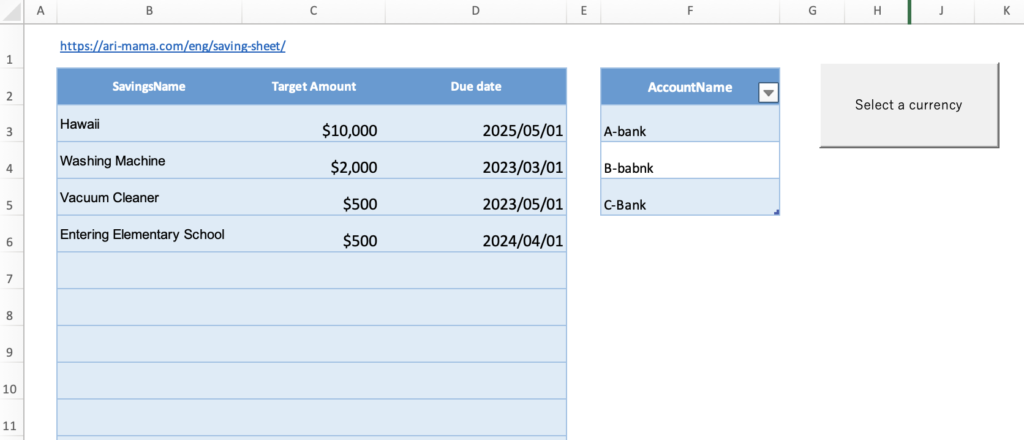

- Setup sheet:Enter savings goal, target amount, and due date.

Set account name. - Input sheet: Select the date, savings name, amount, and account to be credited to the account.

- Savings sheet: Check savings name, current amount, achievement rate, and monthly savings amount (no entry fields).

- Graph Sheet: View the current amount by savings in a table and graph. (No entry fields are required.)

Setup Sheet

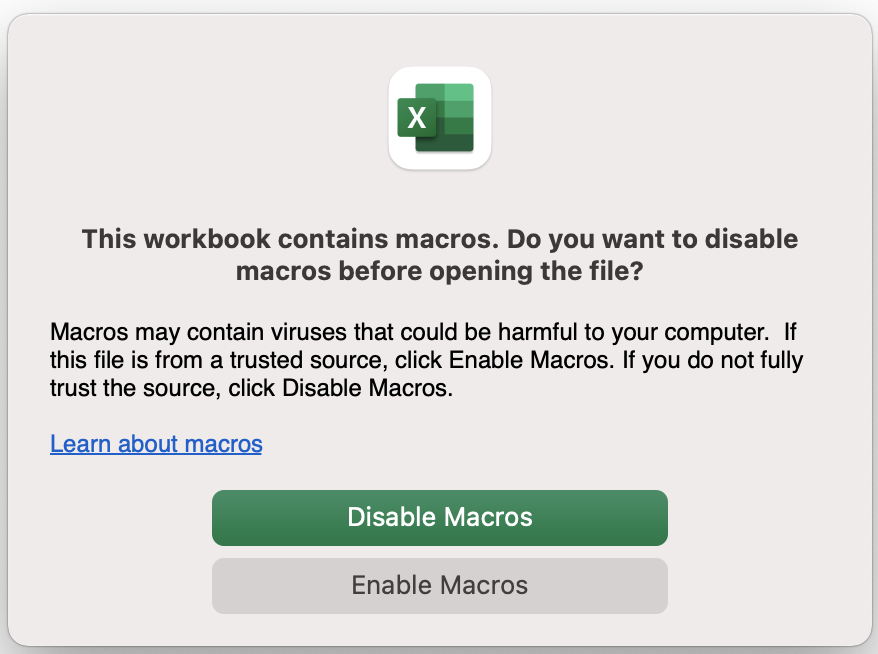

This Excel household budget book uses macros.

Open Excel and click on "Enable Macros".

Setting

Enter savings name, target amount, and due date.

Up to 20 items can be entered in the Savings Name field.

In the Account Name field, enter the name of the account for which you are managing your savings.

A table will be automatically added when the account name is entered.

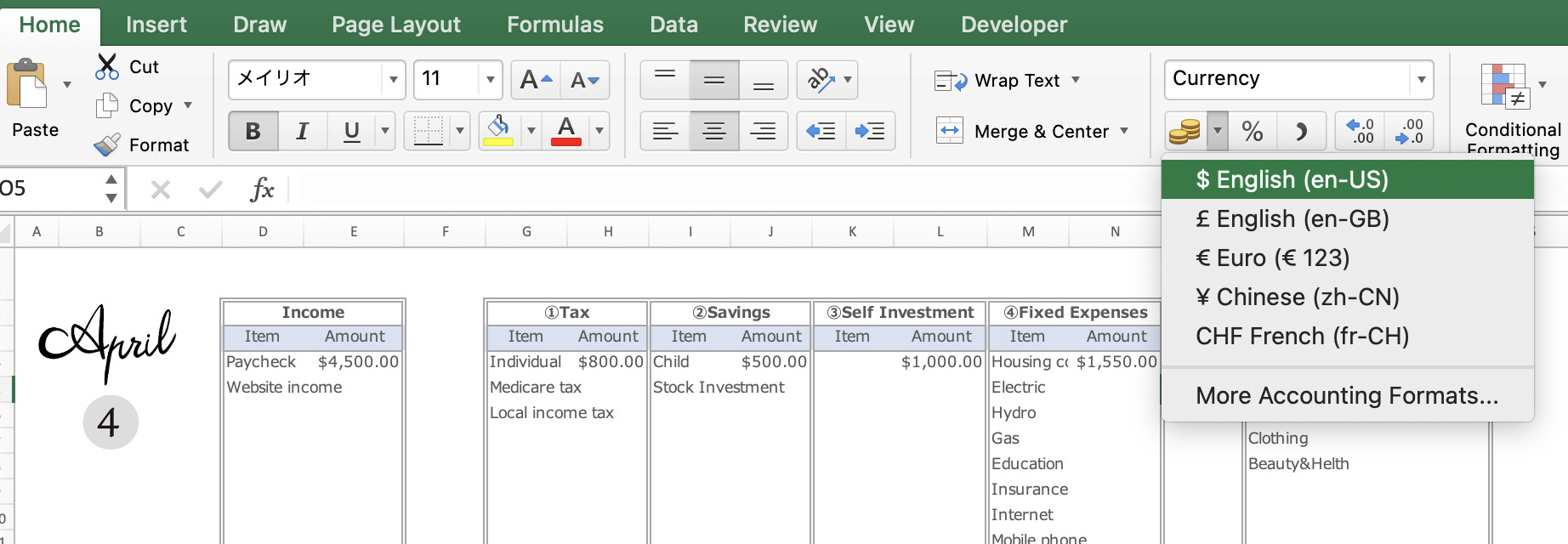

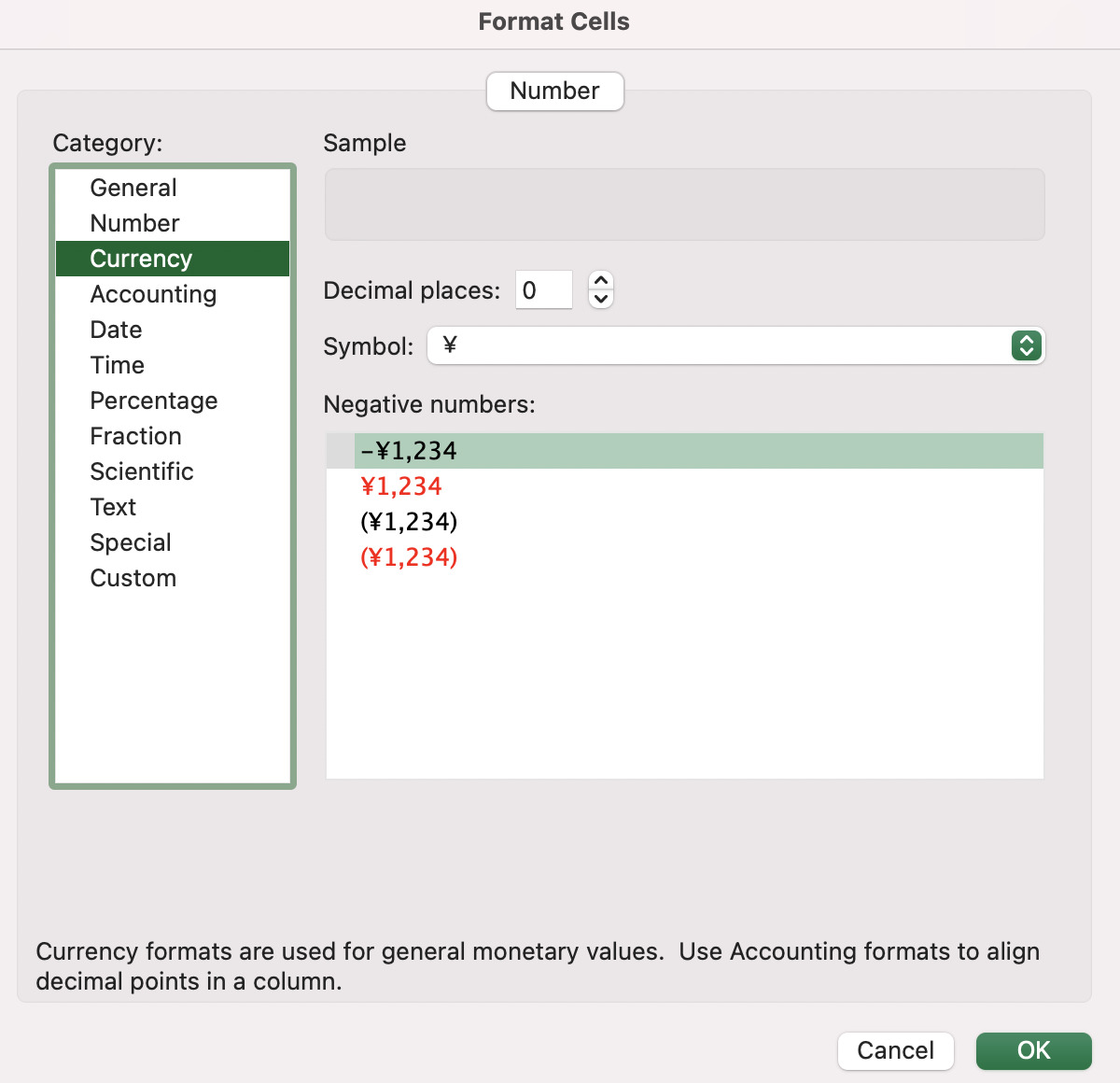

Change the currency unit

Press the "Select Currency" to select a range of currencies.

Select the currency unit for each sheet.

Click on the money symbol to select the currency unit.

(Home-Currency-Money symbol)

Click on the ”More Accounting Format” to see more unit information.

Or right-click and select Format Cell.

The default setting is in dollars.

Input Sheet

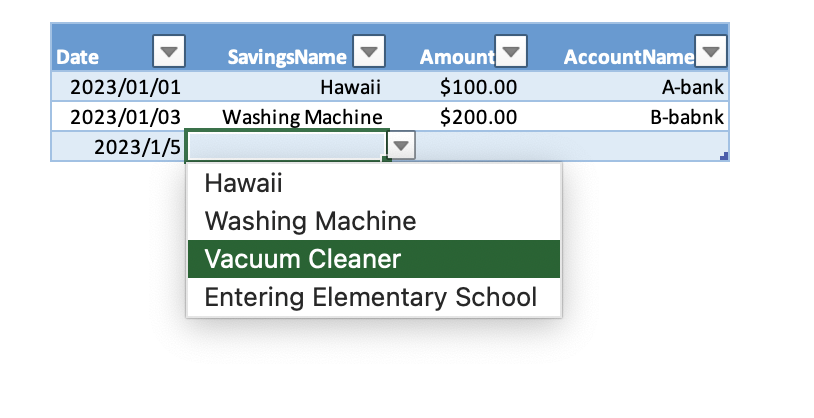

After entering the information on the setup sheet, click on the input sheet.

Enter the date, savings name, amount, and account name.

As you enter the date, the table frame will automatically increase.

To withdraw money from the account, enter the amount in minus sign.

Select the Savings Name and Account Name by clicking on the tabs.

The information entered in the settings will be reflected.

Savings sheet

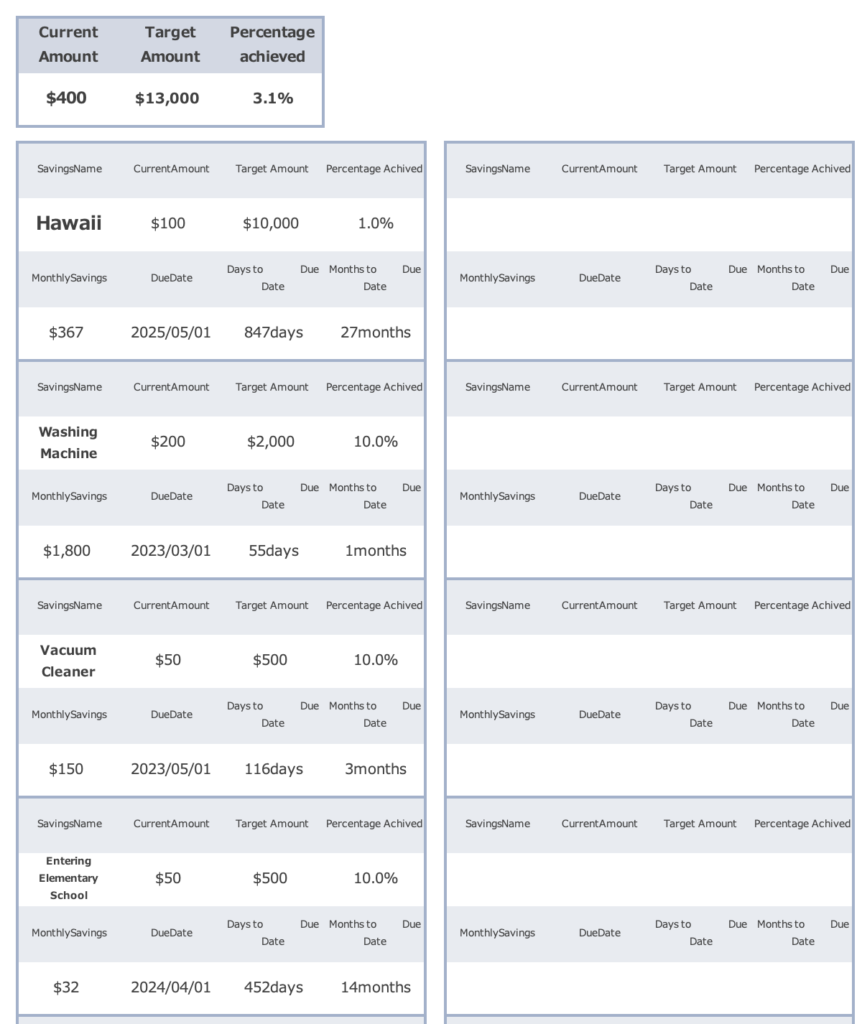

The information entered on the setup sheet and the input sheet will be reflected.

There are no items to be entered on this sheet.

- Savings name: Details entered in setting

- Current amount: Total amount entered in the input sheet

- Target amount: entered in settings

- Percentage achieved: Current amount ÷ target amount × 100

- Monthly savings amount: (target amount - total amount) / Number of months to the due date

- Expiration date: Enter in the settings

- Days to go: Number of days until the due date

- Months to go: Number of months to the due date

*The number of days and months to the due date is the number of days from the date you open the Excel.

The top of the table shows the current amount, the total target amount and the percentage achieved.

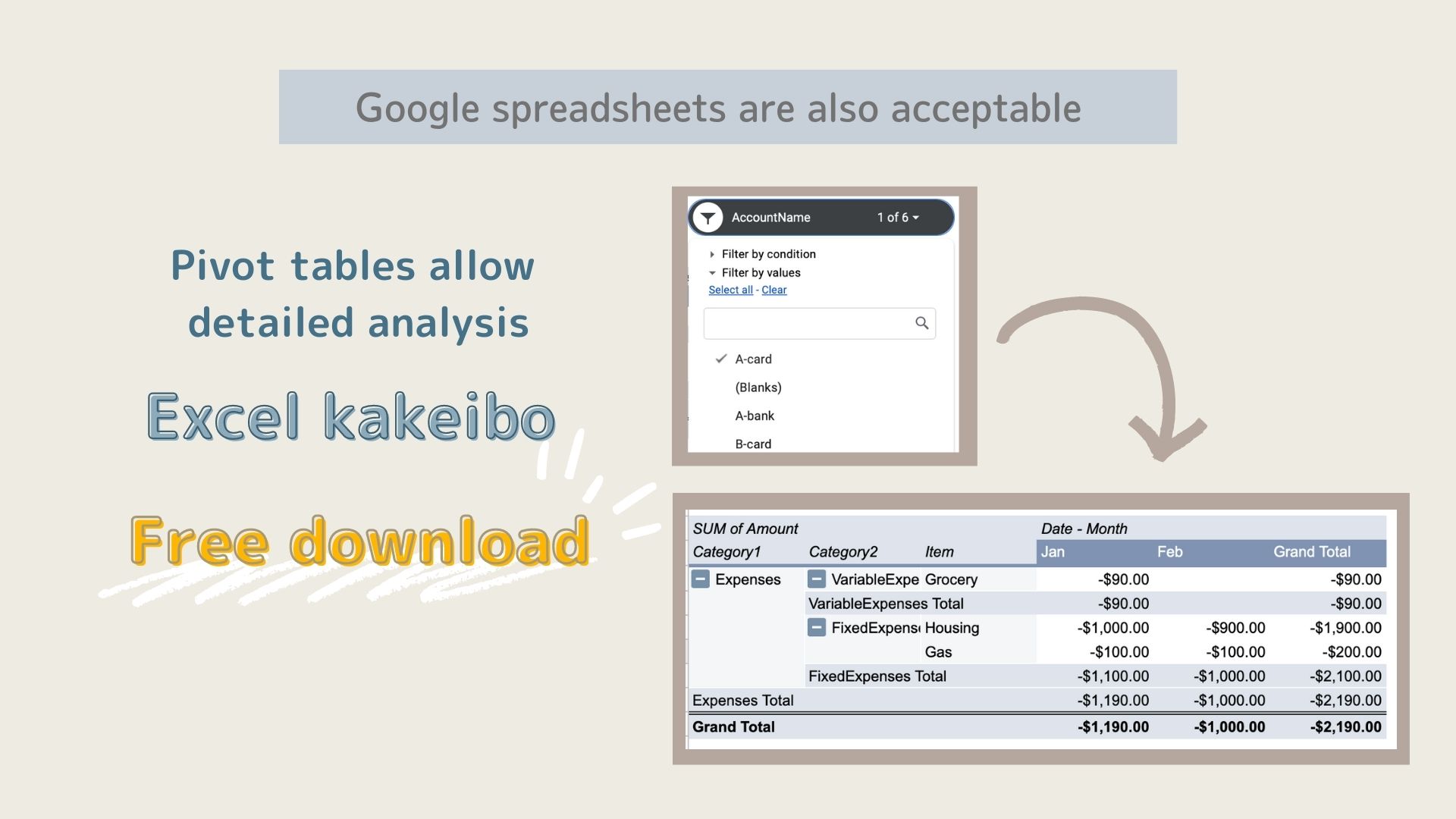

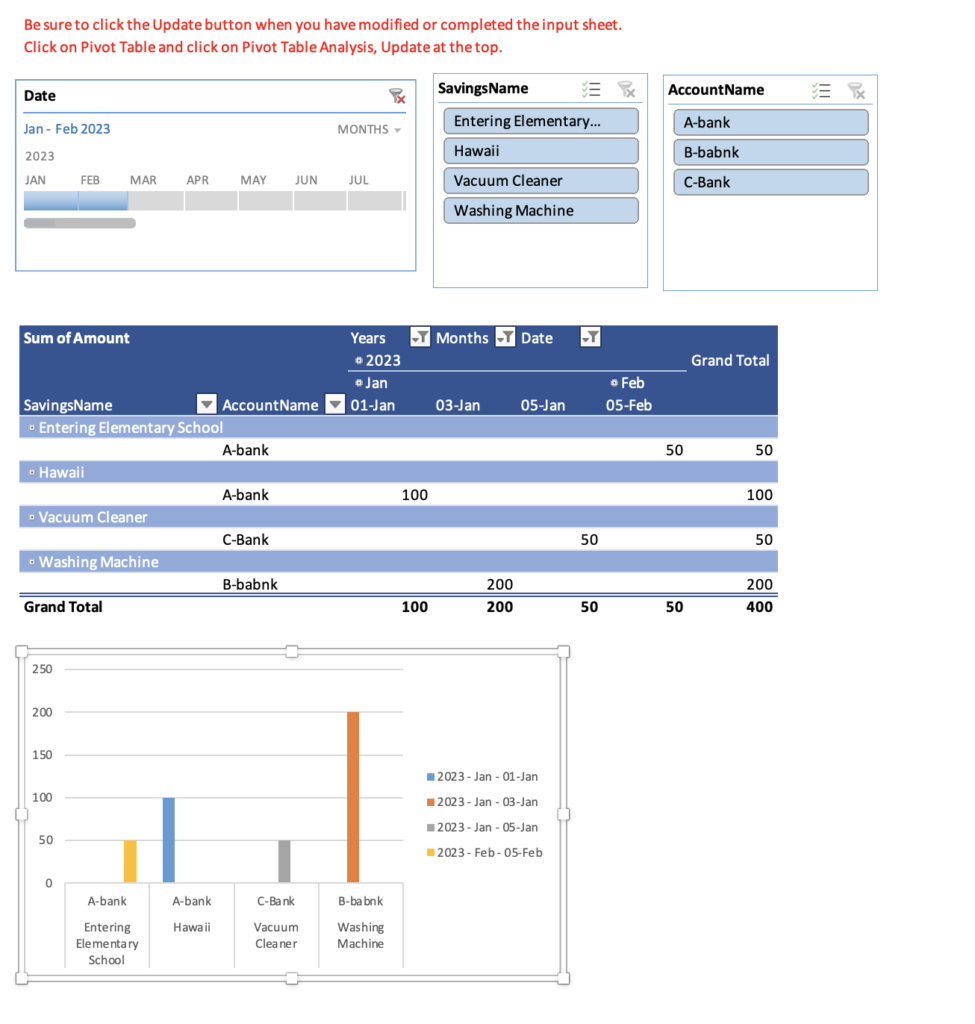

Graph sheet

The entries you have made on the input sheet are reflected in the tables and graphs.

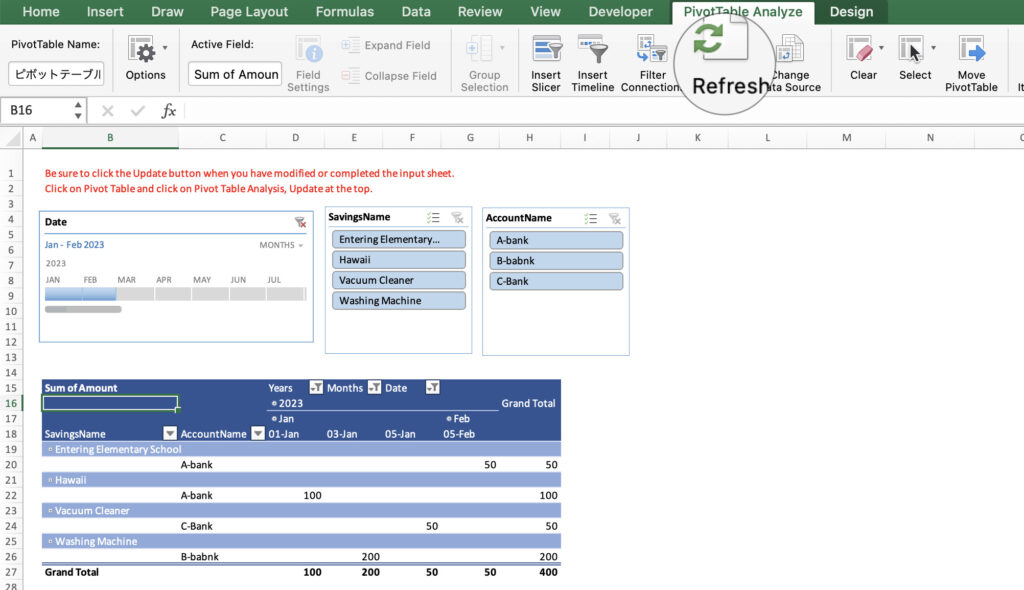

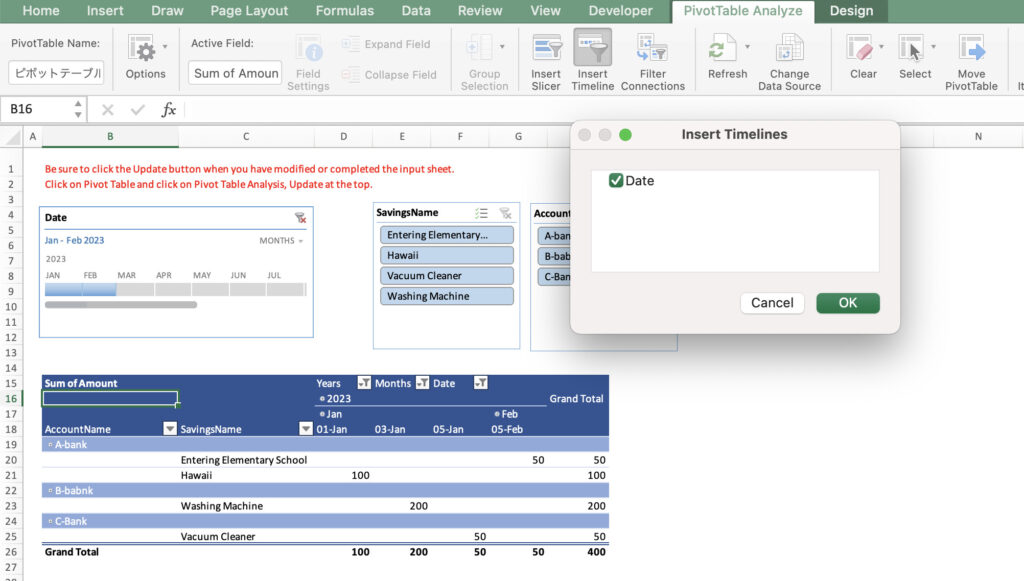

Be sure to click the Refresh button each time you modify or enter information on the input sheet.

It will not be reflected automatically.

If you click on a part of the table (anywhere), you will see a Pivot Table Analysis at the top.

Select Pivot Table Analysis and click the Refresh button.

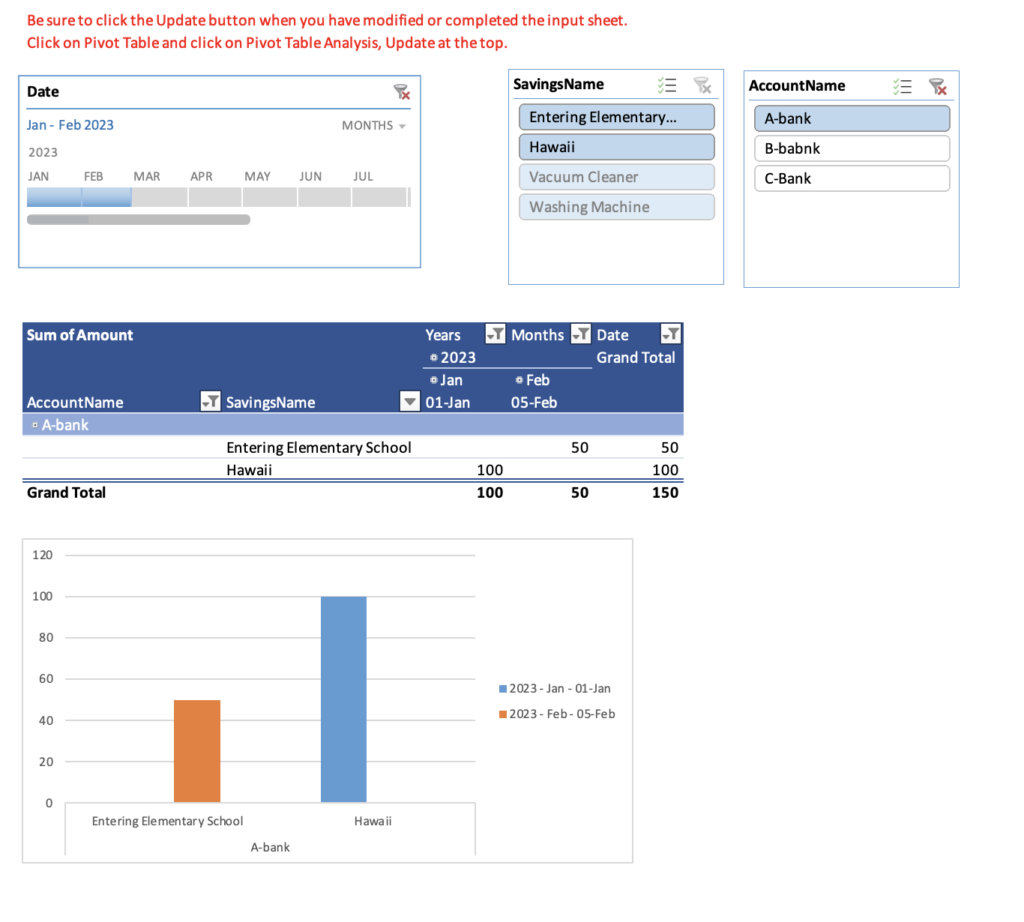

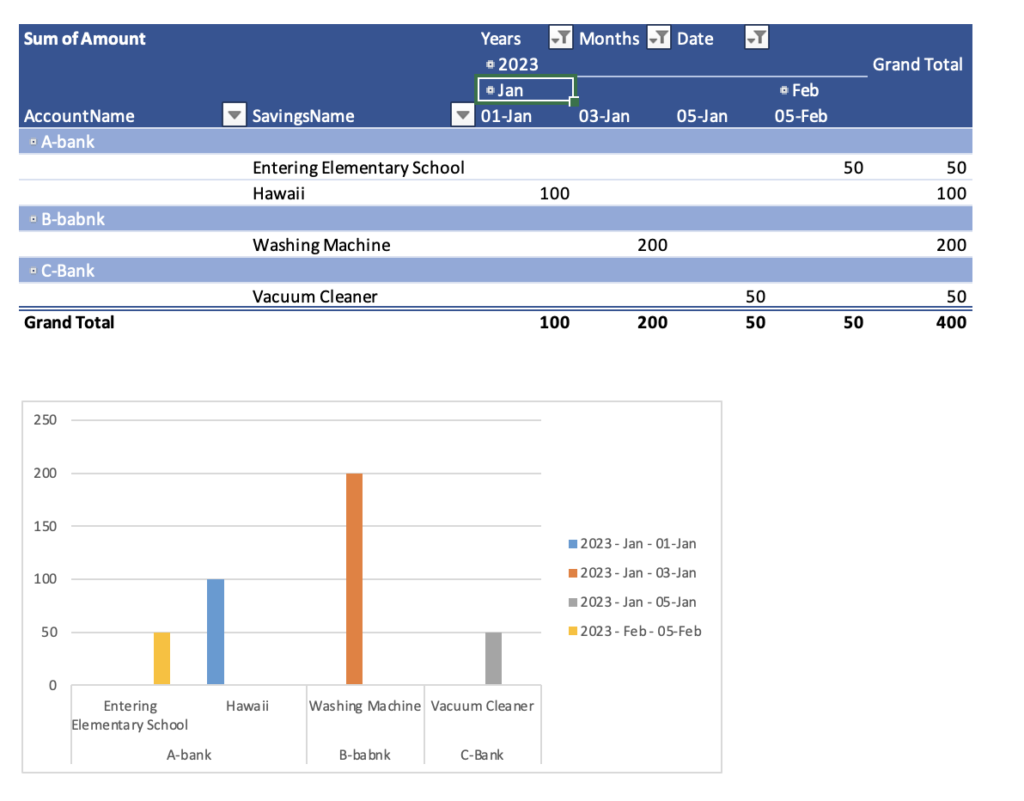

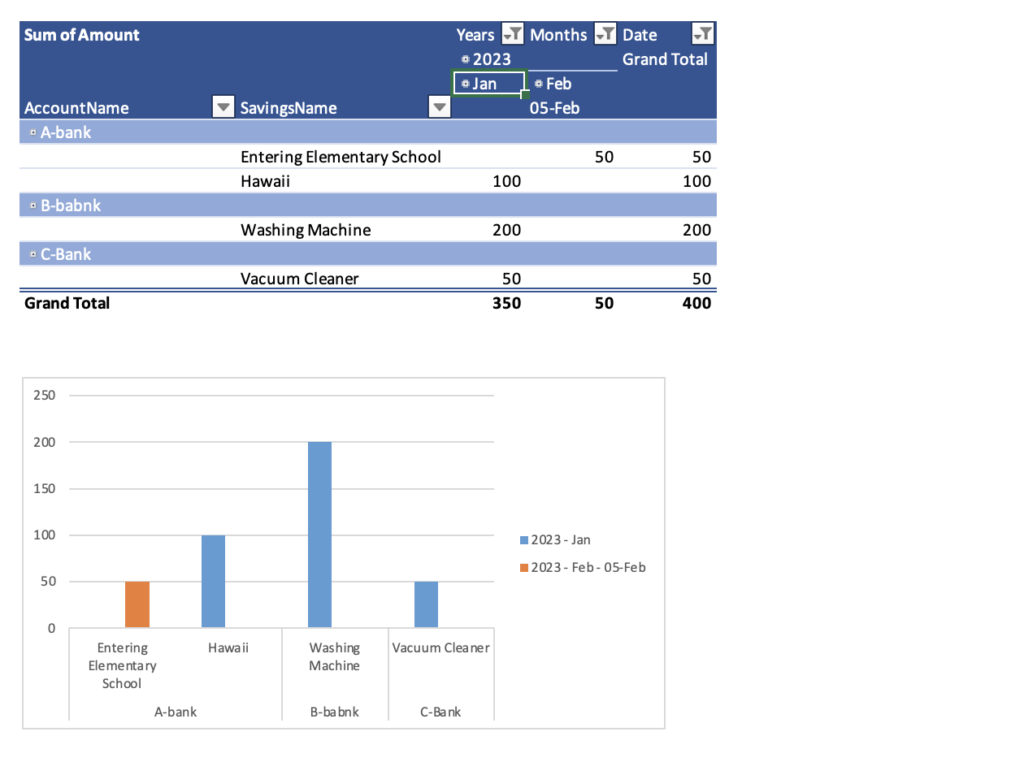

The date timeline allows you to select only a specific month or year.

The slicer displays account and savings names.

You can select a specific account name or savings name to see it in a table or graph.

To undo a selection, click on the cross in the upper right corner of the slicer.

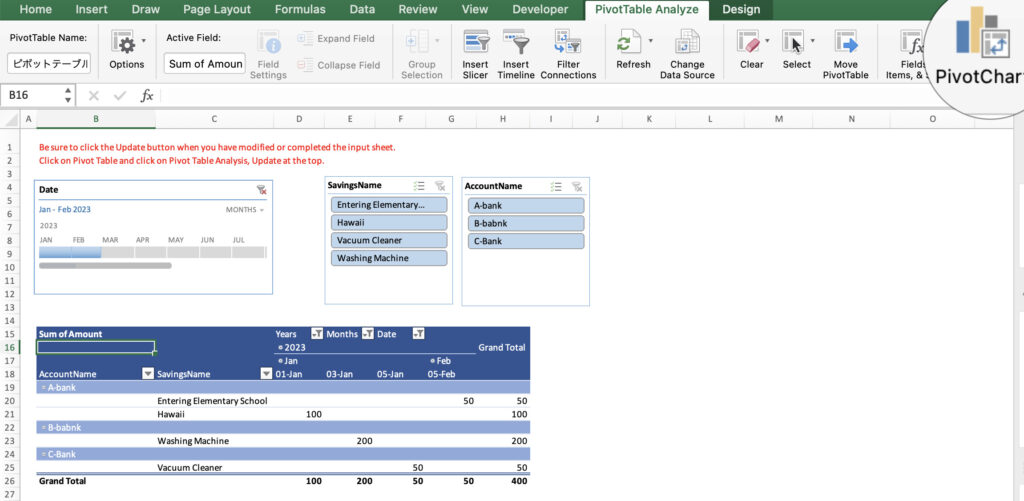

Click on the plus sign to the left of the month (Jan and Feb) in the table to view the table by day.

Likewise, clicking on the minus sign to the left of the year (2023) will show the total amounts for 2023 only.

Settings for first time use

When entering the input sheet and displaying the tables and graphs for the first time, the date timeline and graphs will not be displayed.

For the very first setup, please add a timeline and graph.

After the second time, this setting is not necessary.

Click on a part of the table, check Pivot Table Analysis, Insert Timeline, and Date, and click the OK button.

Click on a portion of the table, then click on Pivot Table Analysis, Pivot Chart.

Free download

Click on the download button to download the file for free.

The file is downloaded in Zip format, so please unzip it before use.