One of the most important things for freelancers is sales management.

By properly grasping your sales and expenses, you can see

- the current state of your business

- your goals for next month and next year

- what you need to do to increase your sales

In reality, however,

I don't know how to start sales management.

It is troublesome to make a management chart, and I end up neglecting it.

I am sure that there are many of you out there who would like to do the same.

For those people, I have prepared a free template that specializes in sales management!

Recommended for

- Those who want to manage their sales

- Individuals who work as handmade artists, creators, consultants, lecturers, etc.

- Those who have started earning income from side jobs

- Those who have experienced sales mess before filing tax returns

- Those who are preparing to start their own business as freelancers

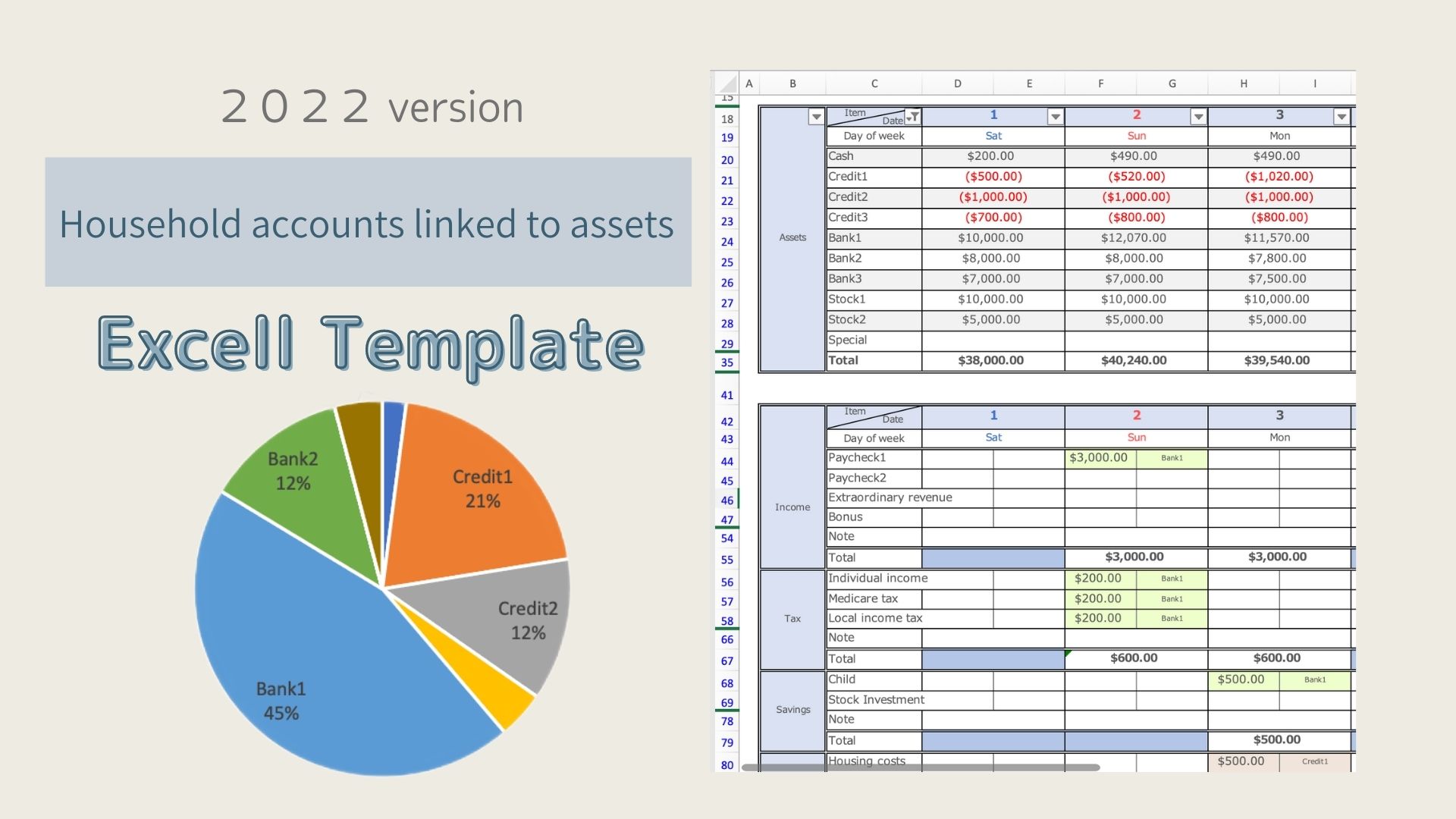

Features of the Sales Management Template

- Sales, expenses, and profits at a glance

With automatic tabulation, monthly and yearly income and expenses can be immediately visualized. - Includes a graph display

You can visually check sales trends and monthly fluctuations. - Input items are simple and easy to understand

Designed to be easy to keep track of, even if you are not good with numbers. - Also useful for tax return preparation.

If you record your daily sales and expenses, you can post them smoothly to your accounting software. - Free to download

Easy to start, zero cost. - Ideal for freelance and side hustle beginners.

No need for complicated knowledge, just follow the templates and enter your information.

Sales List

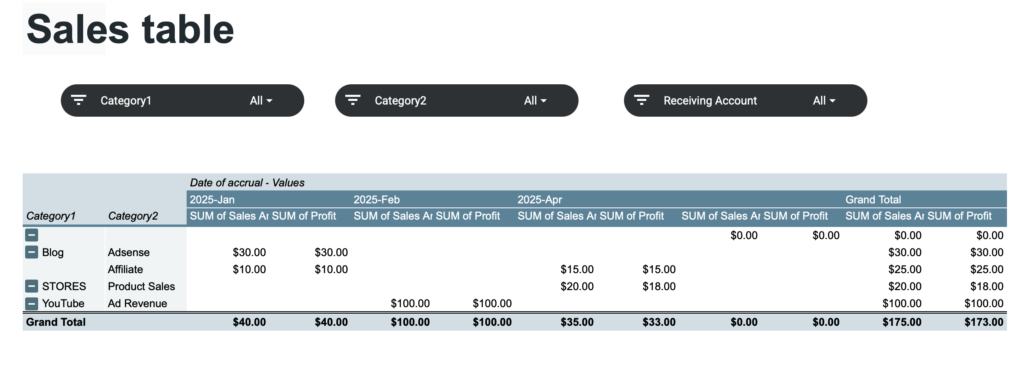

Sales Table

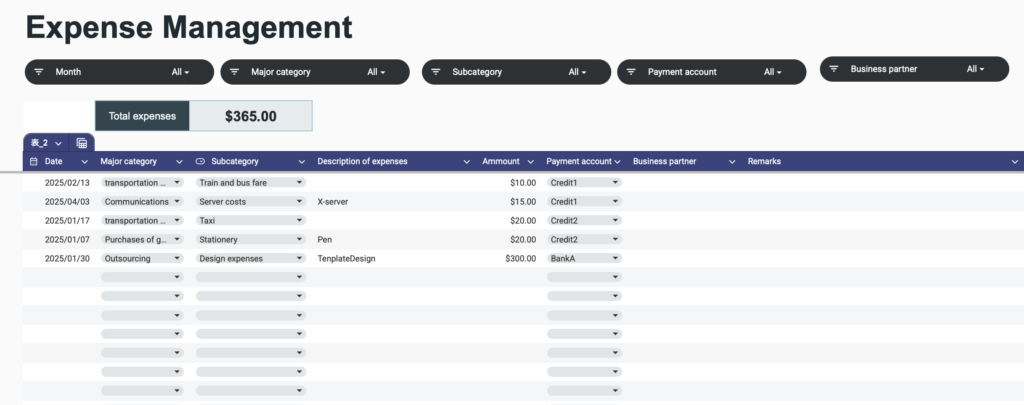

Expense List

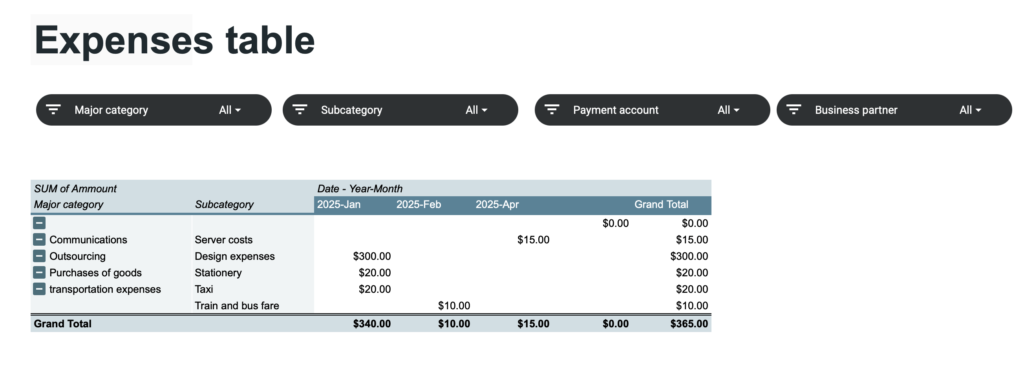

Expense Table

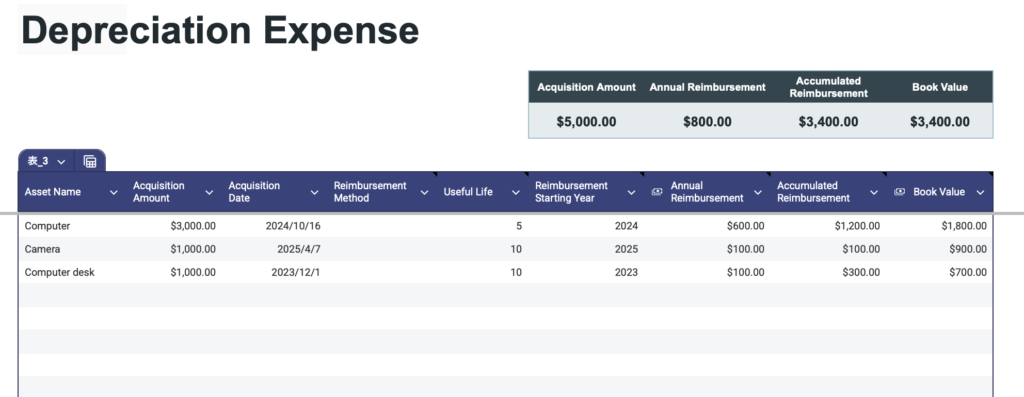

Depreciation Sheet

Annual Sheet

How to use the Sales Management Template

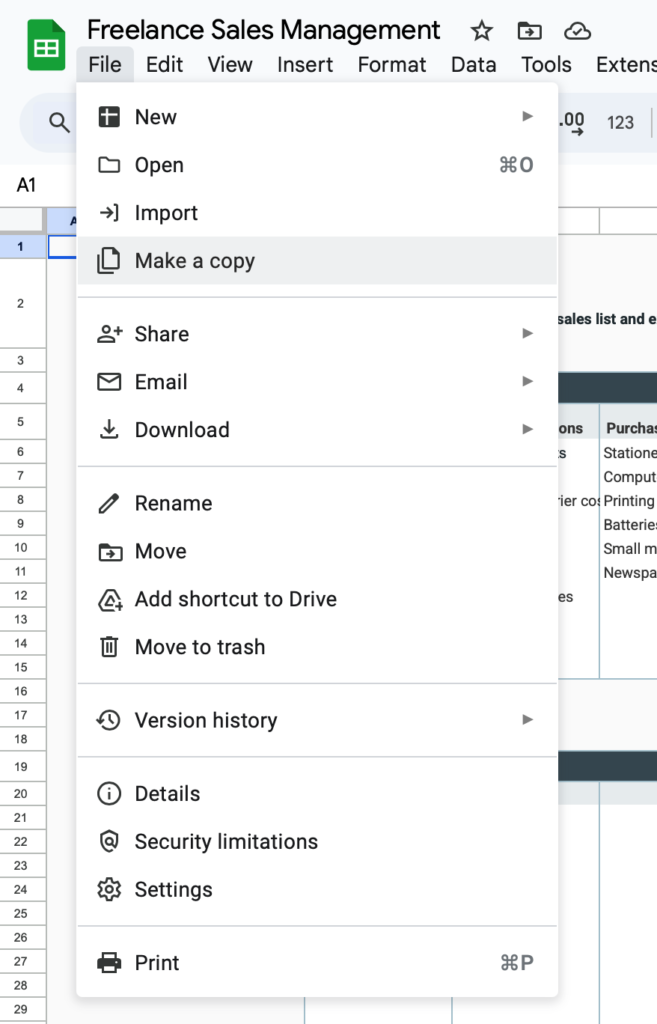

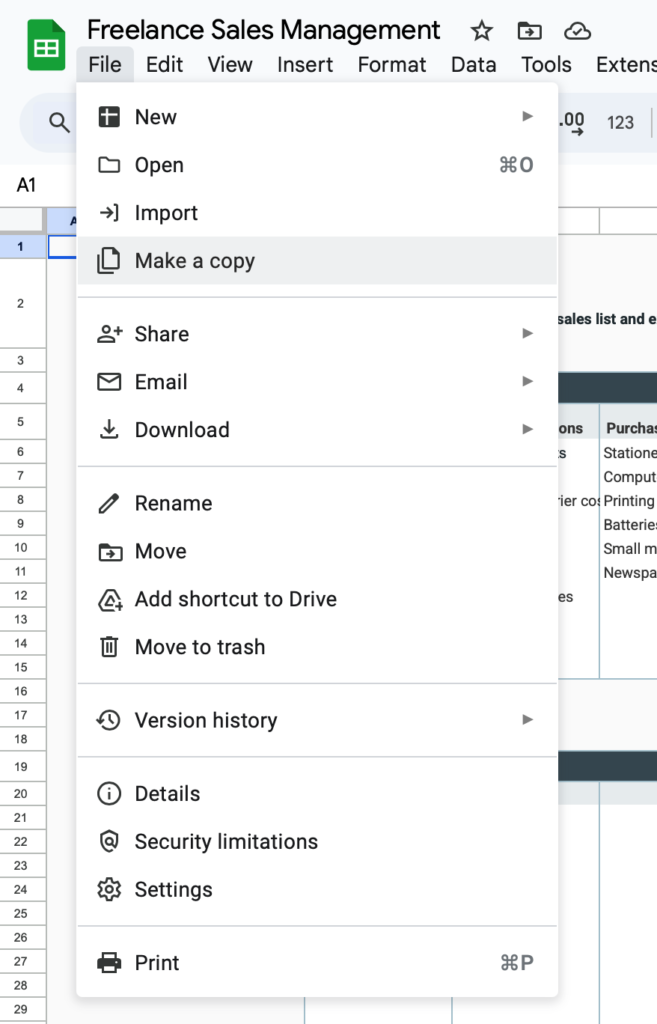

Download and save a copy

This file is for viewing only.

Please make a copy first before use.

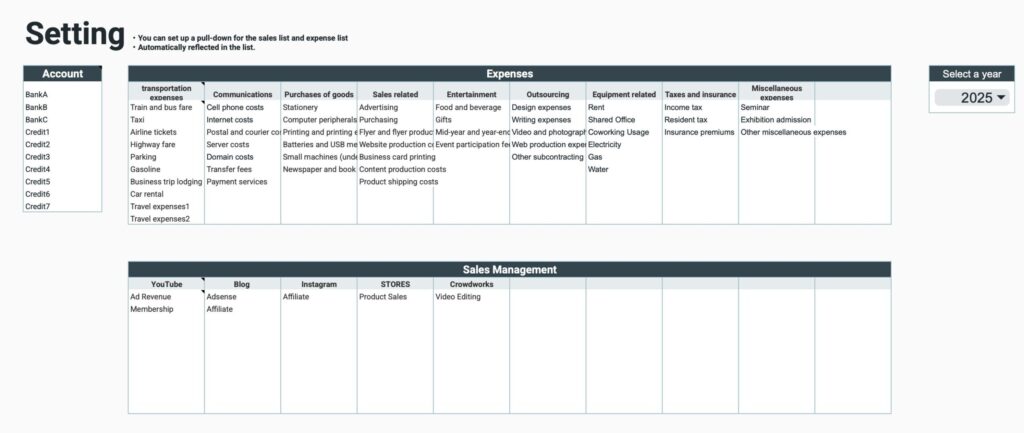

Setup sheet

Setup

- Account Name

Enter the account for withdrawals and deposits - Expense Categories

Categorize into large and small categories - Sales Management

Categorize into large and small categories - Select the year

Select the year from the tab

Sales Management should be arranged by platform, client, product, etc.

Use one file per year.

Please select the year to be used.

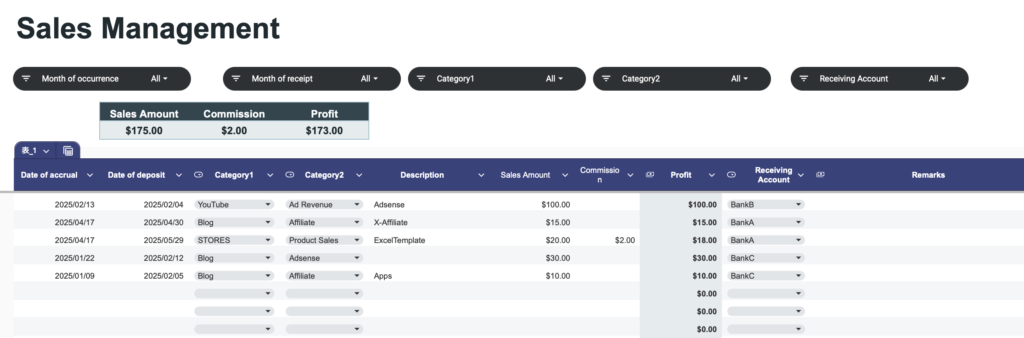

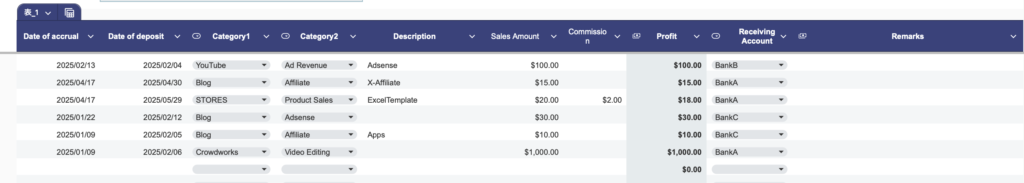

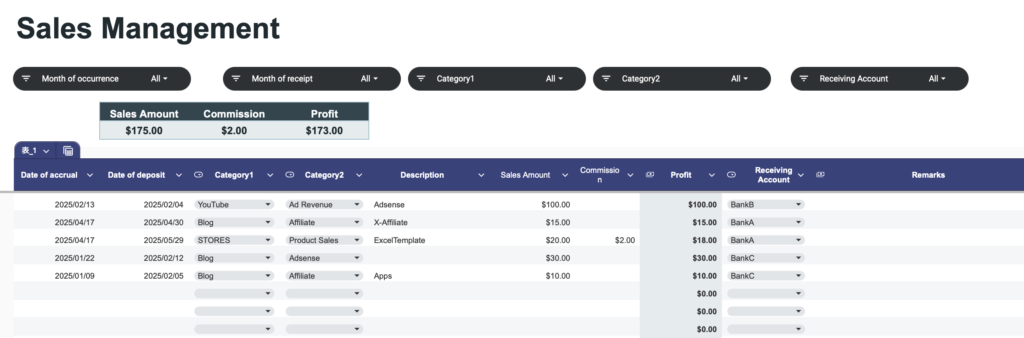

Sales list

In the Sales List, enter the sales amount by date.

Input items

- Date of Occurrence - select from calendar

- Date of Deposit - select from calendar

- Large Category-Select from tab

- Small Category-Select from tab

- Description

- Sales Amount

- Commission (blank if not generated)

- Receiving Account-Select from tab

- Notes

Profit is an automatically calculated item.

Profit = Sales amount - Commission

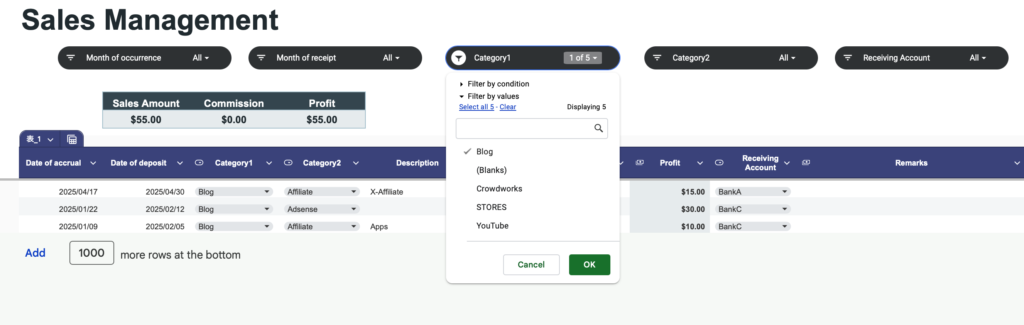

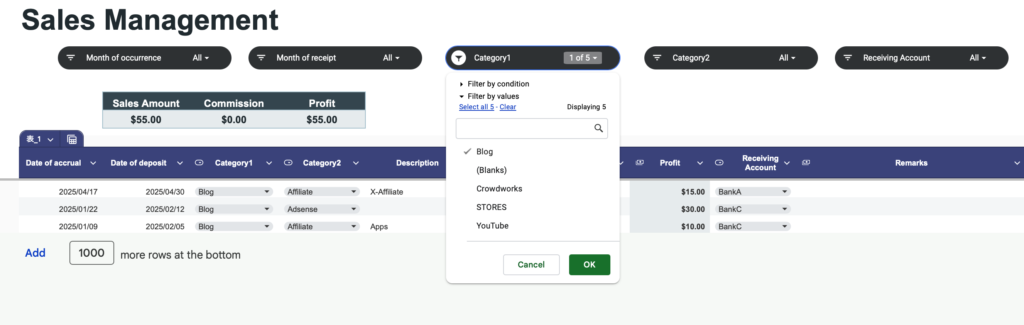

Slicer

You can use the slicer function to display specific items.

Slicer items

- Months of origination

- Months of deposit

- Large categories

- Small categories

- Receiving accounts

Show total number and total amount

Show totals at the top of the list

Display items

- Sales amount

- Commission

- Profit

When a particular item is displayed in the slicer, the total of the displayed items is shown.

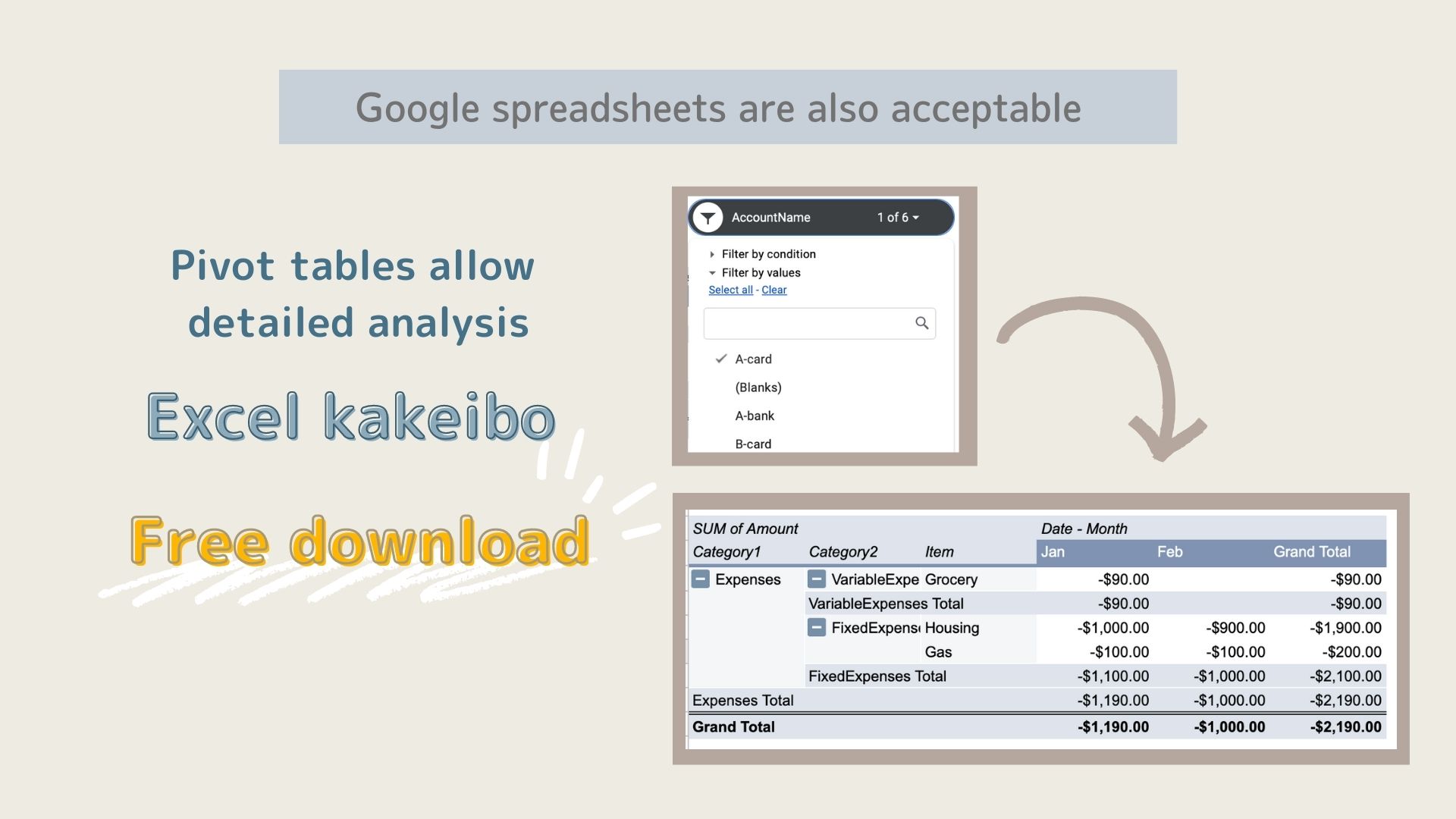

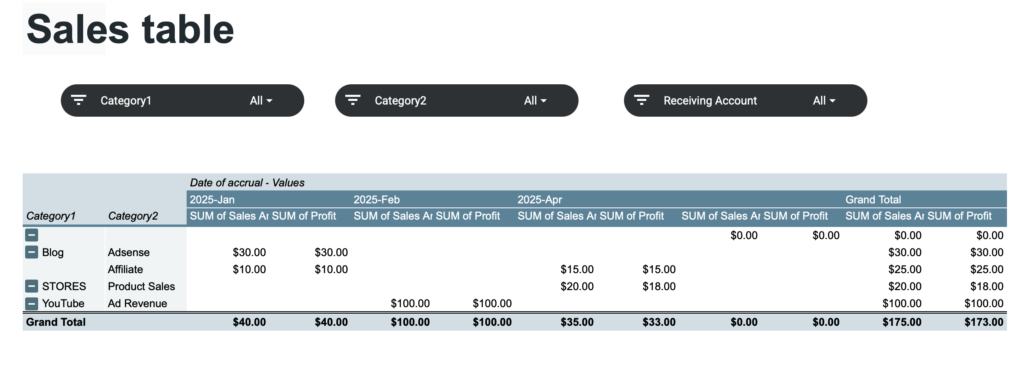

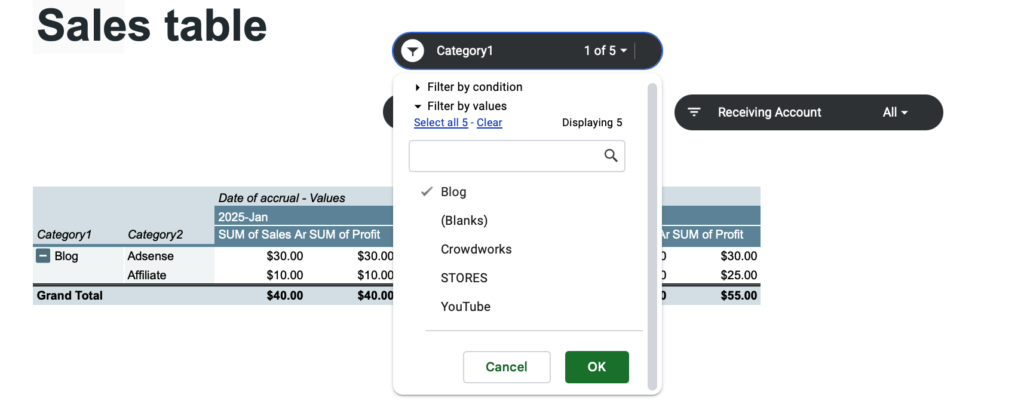

Sales table

Displays sales and profits by month and category based on sales list data.

The slicer function can also be used to display only specific items.

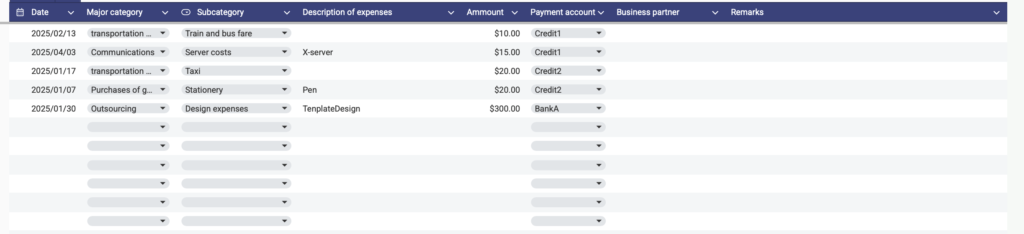

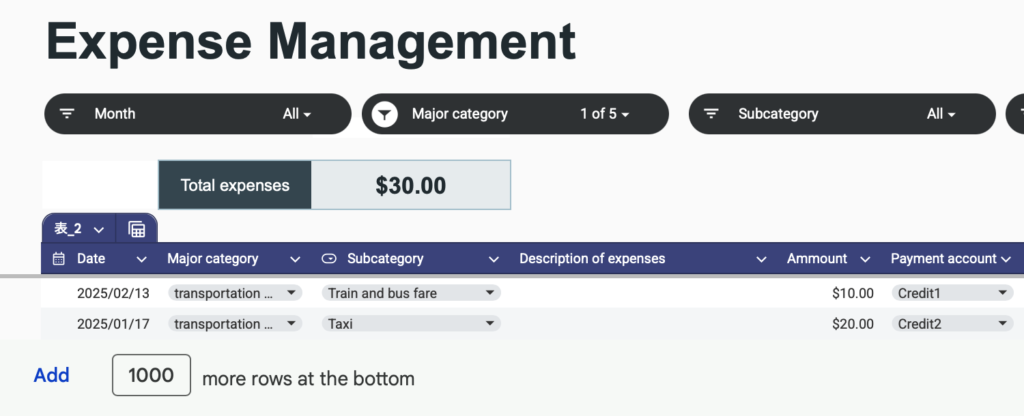

Expense list

In the expense list, enter expense amounts by date.

Input items

- Date - select from calendar

- Large category-Select from tab

- Small category-Select from tab

- Expense description

- Expense amount

- Payment account-Select from tab

- Business partner

- Notes

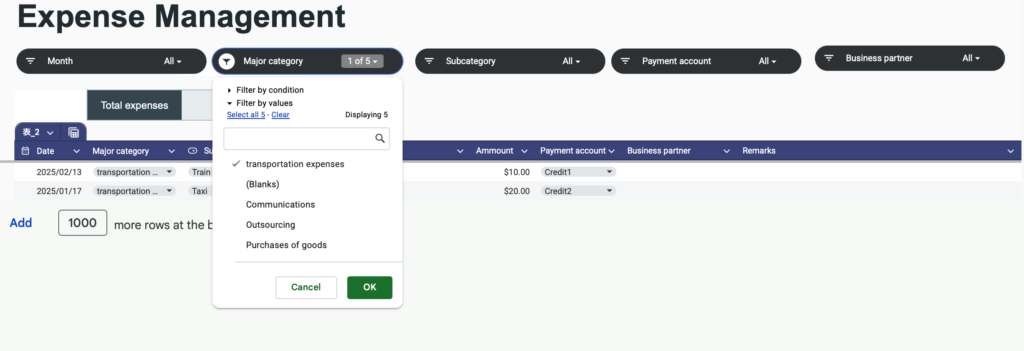

Slicer

You can use the slicer function to display specific items.

Slicer items

- Month

- Large category

- Small category

- Receiving account

Show total amount

Total expenses are displayed at the top of the list.

When a particular item is displayed in the slicer, the total of the displayed items is shown.

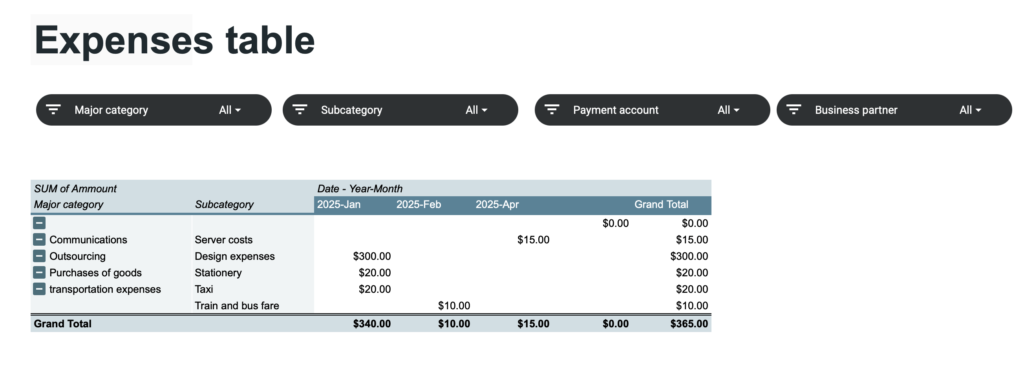

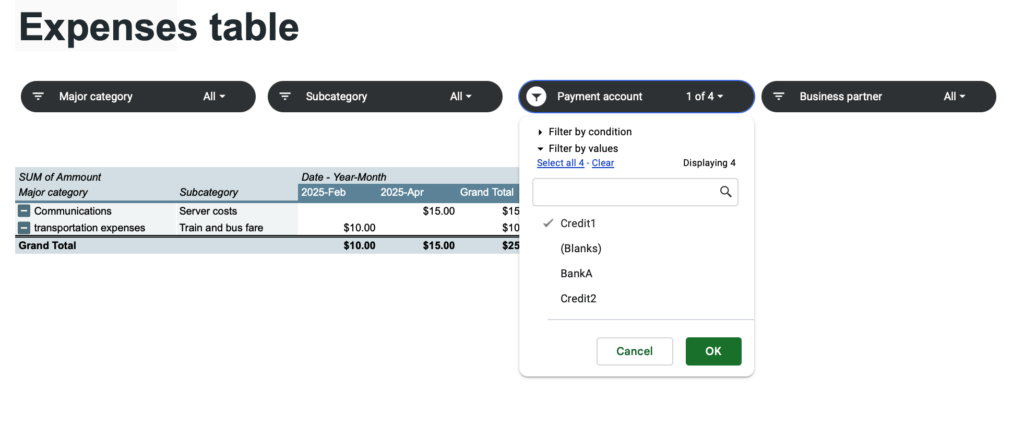

Expense table

Displays expense amounts by month and category based on expense list data.

The slicer function can also be used to display only specific items.

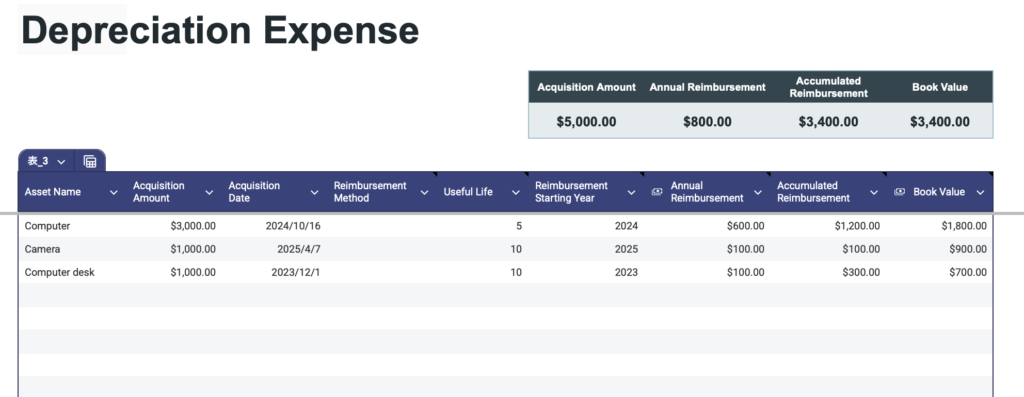

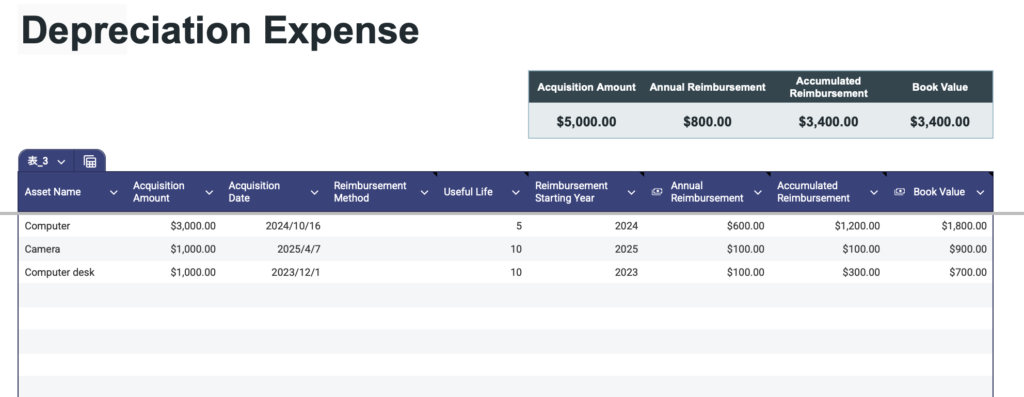

Depreciation sheet

Input items

- Depreciation is the process of allocating the cost of a tangible asset over its useful life.

- Asset name

- Acquisition amount

- Acquisition Date

- Depreciation Method: The method used to depreciate the asset (e.g., Straight-Line, Declining Balance).

- Useful Life: The number of years over which the asset will be depreciated.

- Depreciation Start Year :The fiscal year when depreciation begins.

- Annual Depreciation: Expense The amount of depreciation recorded each year.

- Accumulated Depreciation: The total depreciation recorded to date.

- Book Value :The remaining value of the asset after depreciation has been subtracted.

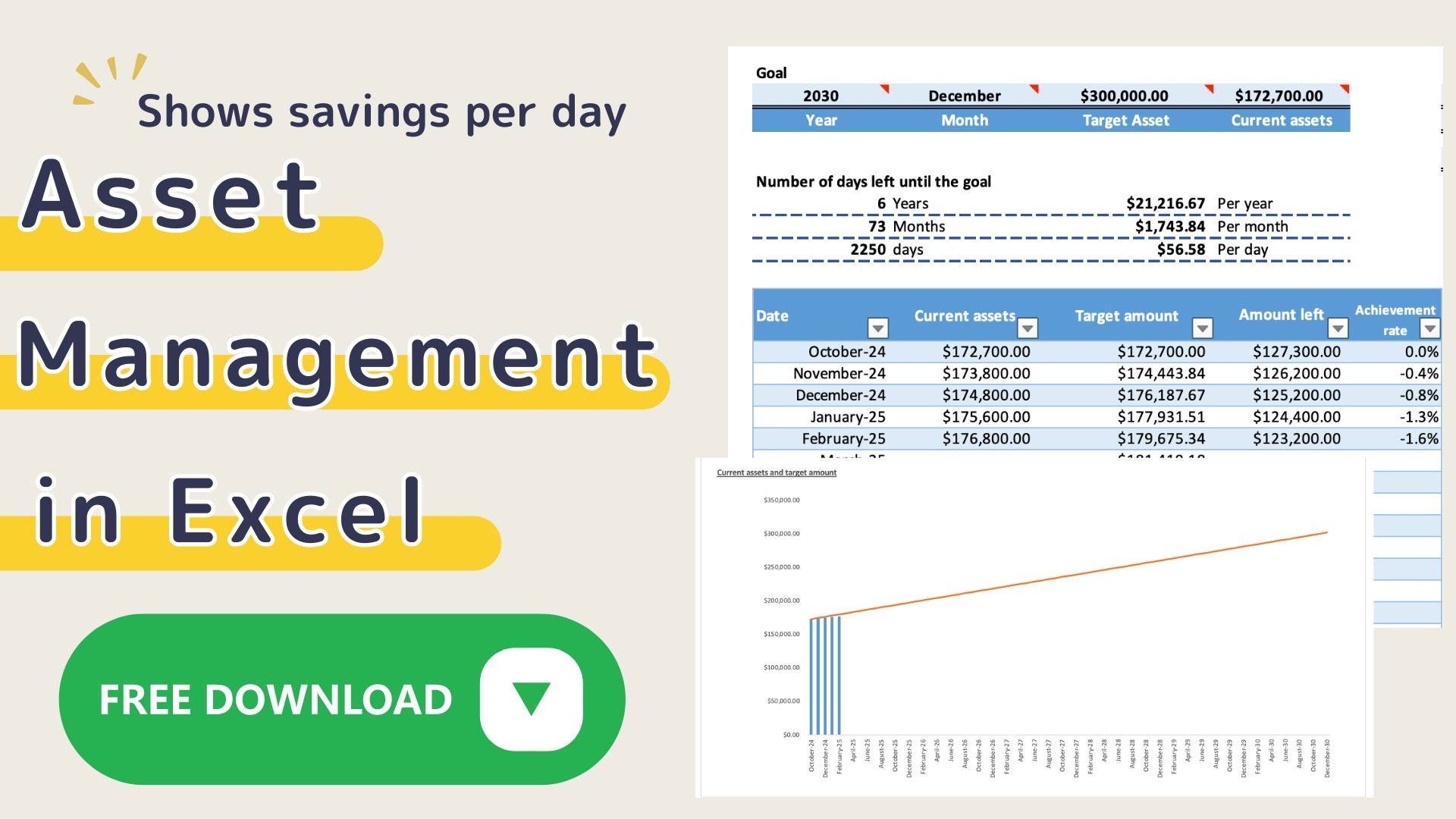

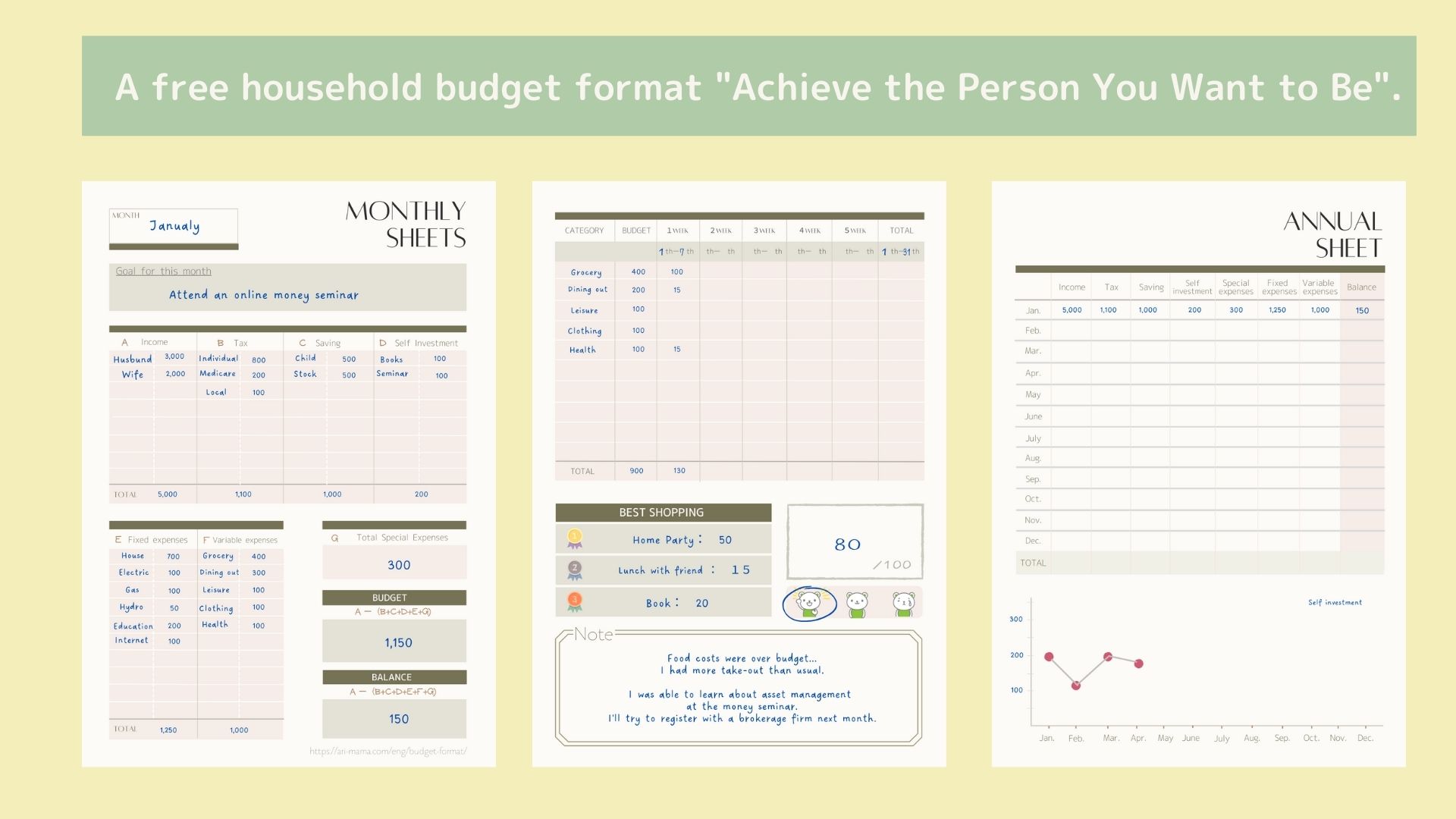

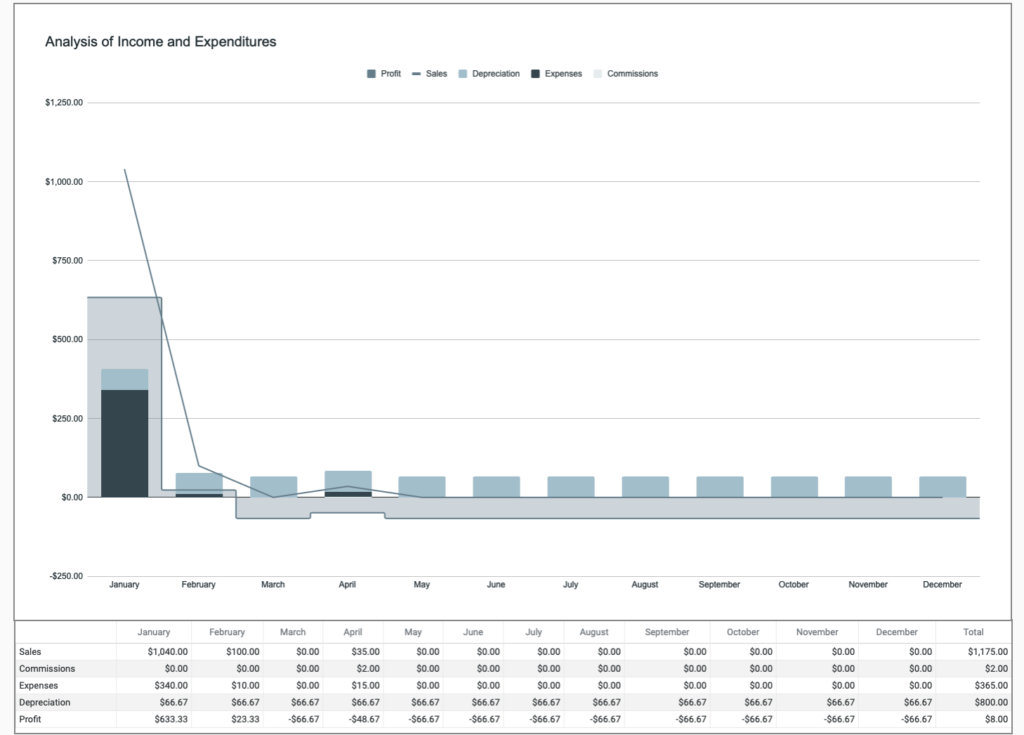

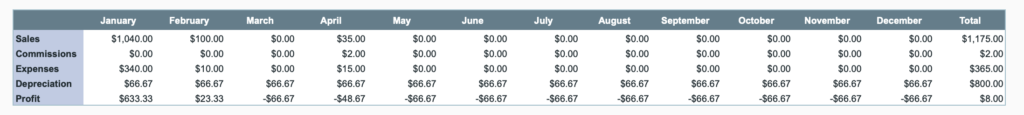

Annual sheet

Annual transition table

Data from the Sales List, Expense List, and Depreciation sheet are displayed by month.

Depreciation is calculated by dividing the total annual depreciation expense on the Depreciation sheet into 12 equal parts.

Profit = Sales - (Commission + Expenses + Depreciation)

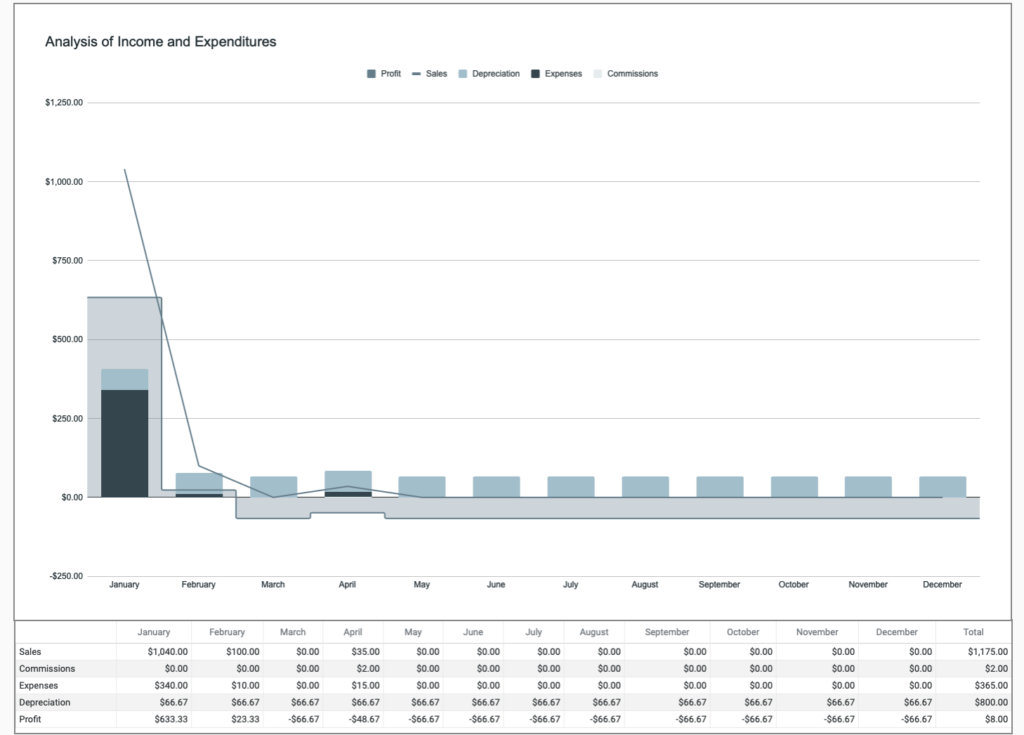

Annual graph

Annual tables are displayed graphically.

Sales are shown as line graphs, profits as staircase surfaces, and all other items are shown as reserve graphs.

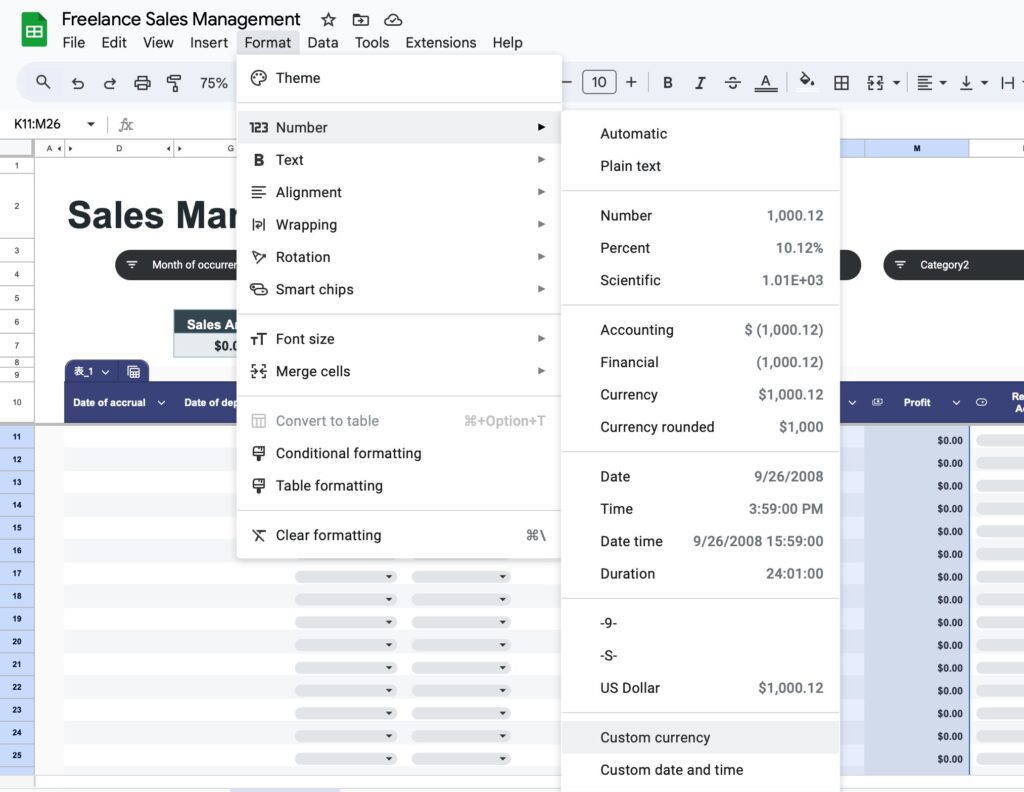

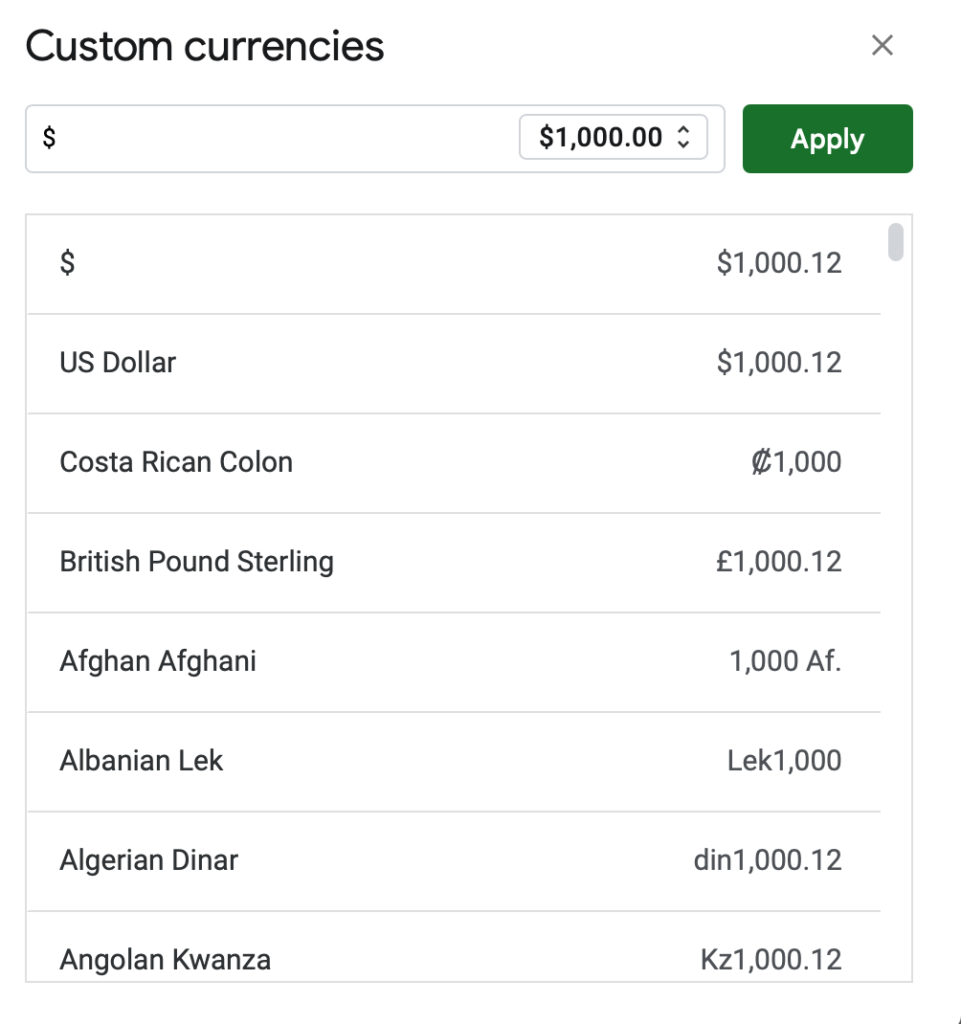

How to change currency units

The default currency unit is the dollar.

To change the currency unit, specify a range, and click Format,Number,Custom currency.

Free Download

Click the button below to download a free sales management template.

Download files are for viewing only.

Please “Make a copy and save” before use.