The key to managing household finances is to get in the right mindset and find ways to improve household finances.

I believe that many people manage their money in a self-directed manner without knowing how to properly manage their finances.

I was one of them.

I was living my life with the sole goal of not having a negative monthly balance.

I was not able to spend money according to my values.

The values of "what kind of person I want to be,"

In other words, the way you think and feel about your own life is reflected in your household management.

For example, if you can clearly envision the person you want to be, you will be able to

What will my ideal self be doing with money in five years' time?

This will help you to imagine how your ideal self will be spending money in five years' time, and to check whether the way you are spending your money now is appropriate.

Being able to manage your finances well will change your life.

Household management = controlling money means setting goals, understanding yourself, and then

and then develop habits to achieve your goals.

Stop the poverty mindset

Poor Mindset

- I feel guilty about spending money.

- Lacks emotional control and makes short-range purchases.

- Has low self-esteem and no long-term goals. (Believes he/she is incapable of doing so)

- Chooses products based on price, not quality.

- Negative thinking

Negative thinking tends to lead to conservative thinking.

The thought of having to somehow save money without having a goal prevents us from spending money now for our future selves.

Saving somehow may help you accumulate money in the short term, but you may fall into a negative loop because you are unable to invest in yourself.

To stop the poverty mindset is to change your values about money.

Do you feel guilty about money?

I used to have a fear of money.

I believed that it was better not to spend money as much as possible because of fear and anxiety about losing money.

By focusing on what you can get with the money rather than what you can lose, you can let go of your fear of money.

By imagining what you can do with what you get in exchange for the money, you will be able to use the money in a way that you will not regret later.

Protecting the money you have is important, but being aware of how to spend your money well is important to growing your money!

Know Good and Bad Savings

- Bad Savings.

Things that degrade the quality of life

Things that don't add value - Good Savings

Stopping doing things you don't have to do in order to do the things you want to do

Have you ever tried to save money and the first thing you did was to reduce your food bill?

Cutting back on food costs may seem to be effective at first glance.

However, saving money that results in imbalanced nutrition or even quality of life can be a big risk.

On the other hand, stopping doing things you don't have to do fits into the category of good frugality.

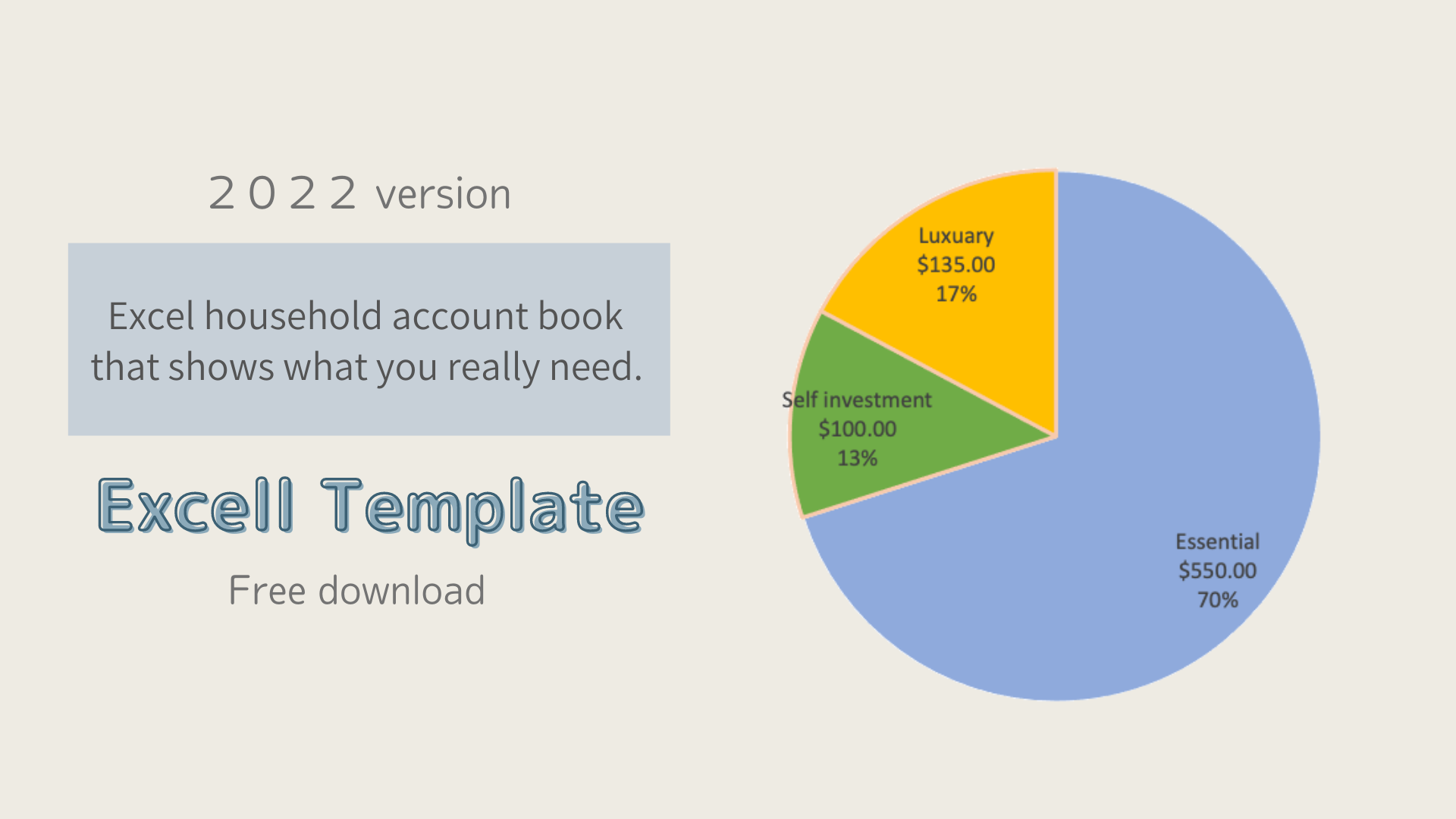

There is a difference between extravagant spending and wasteful spending.

For example, a cup of coffee at a café to relax is a luxury expense, and

A purchase that you regret after you buy it (candy to relieve stress) is a wasteful expense.

Raising luxury expenses and lowering wasteful expenses will lead to a higher level of life satisfaction.

Let's first figure out how much you spend on luxuries and how much you waste per month.

-

-

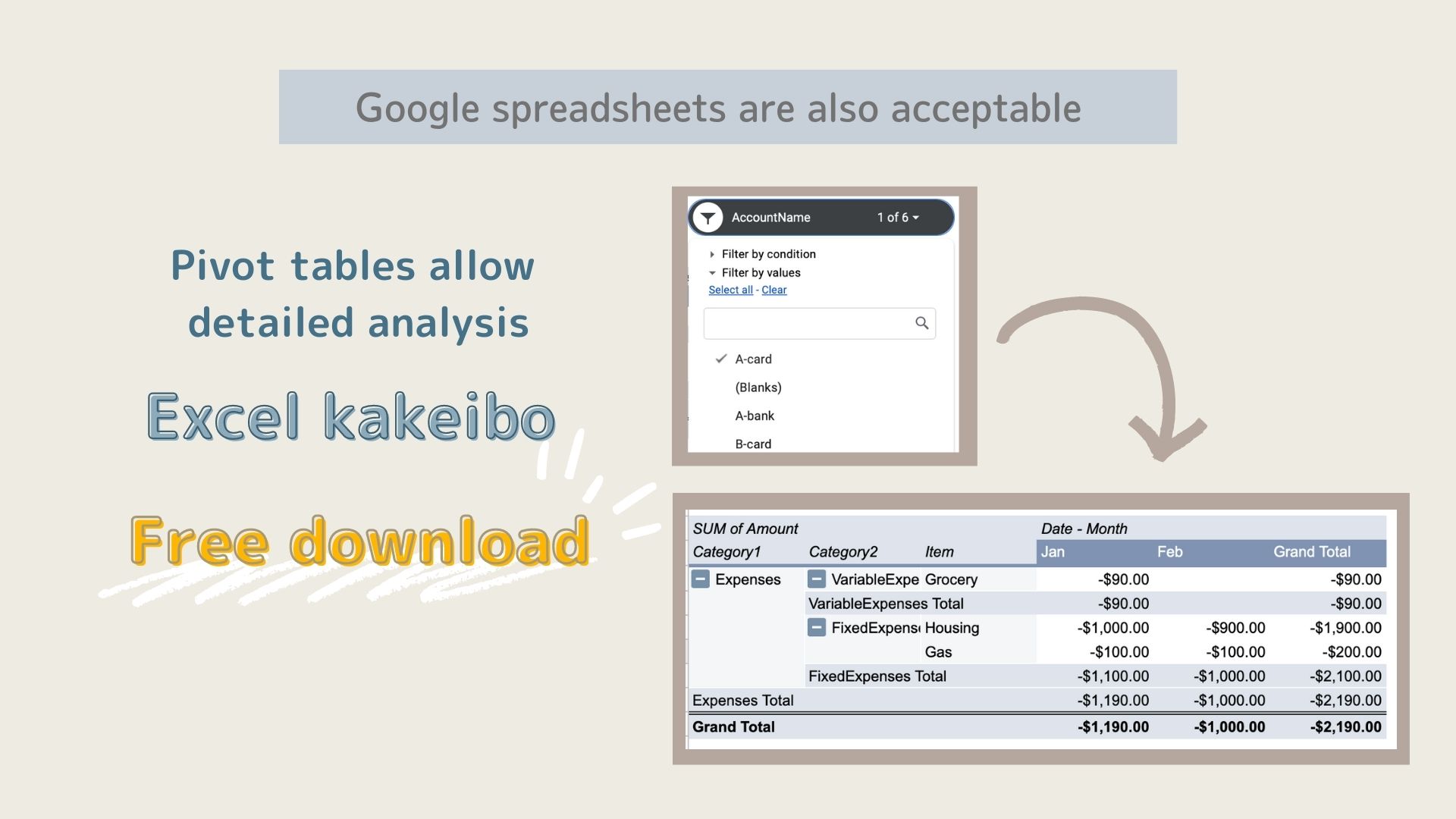

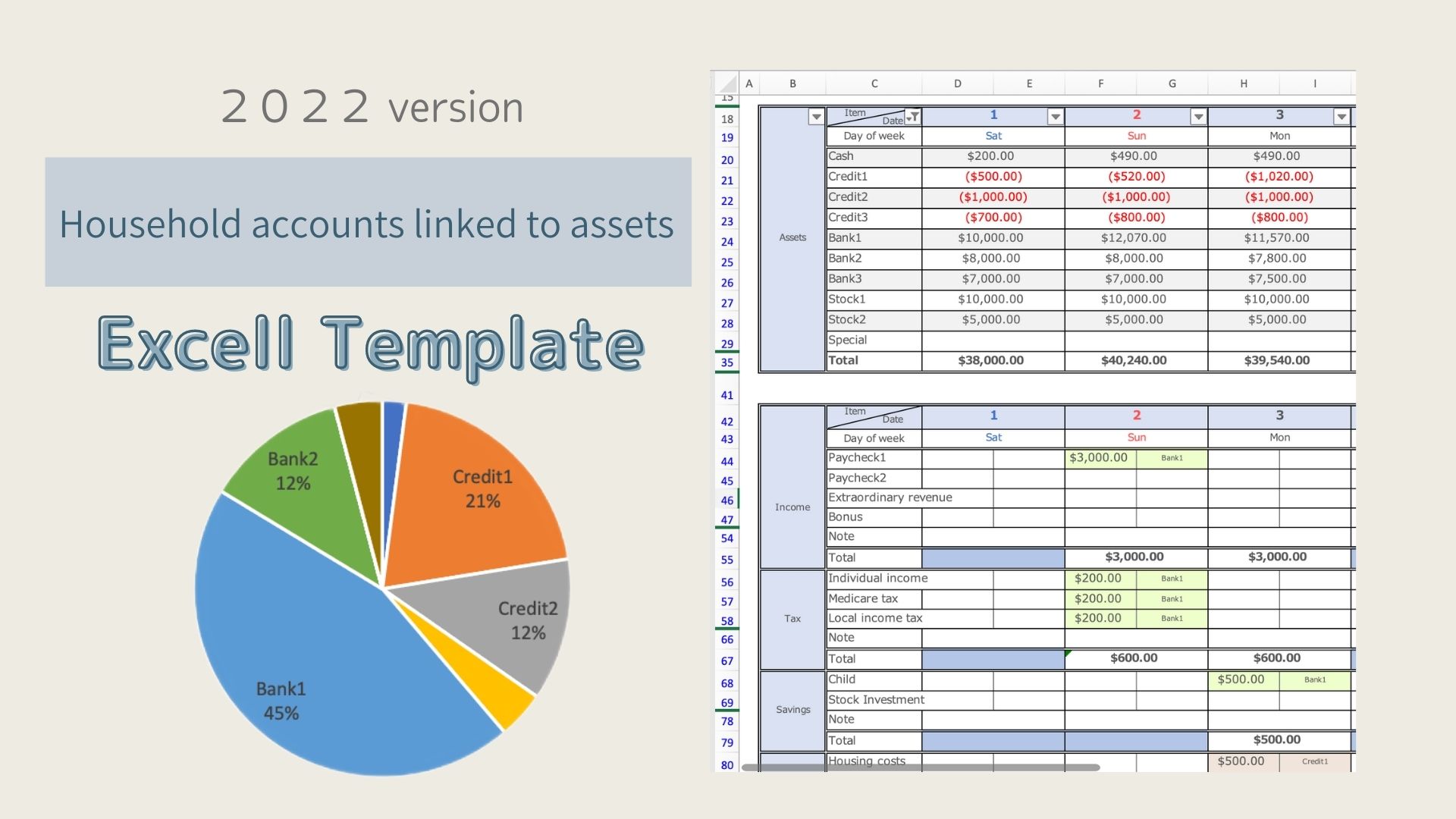

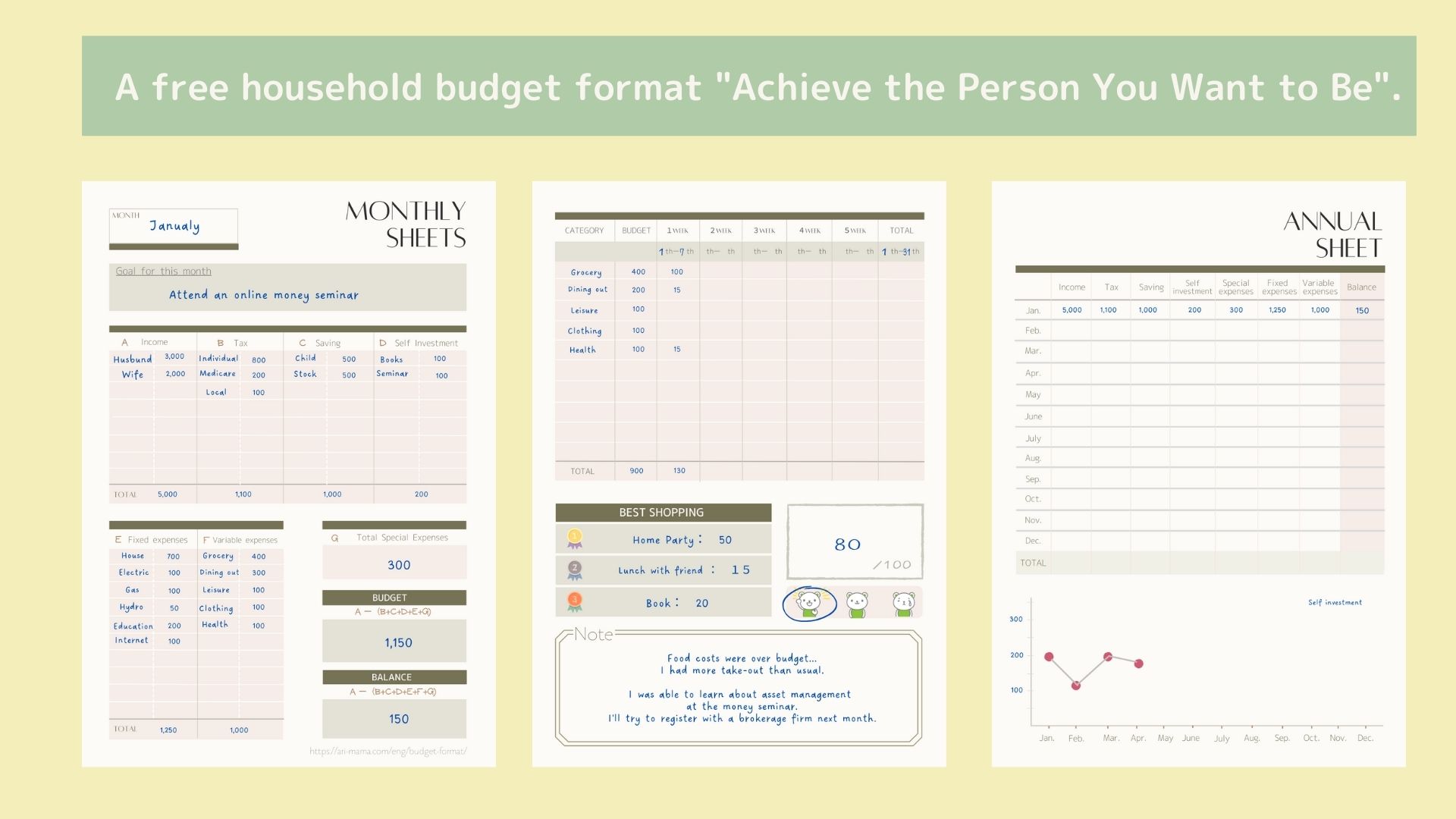

Excel household account book that shows what you really need (free template available for download)

I keep a household account, but I don't know how to improve it. Do you have such a problem? This Excel family budget book solves ...

What it takes to control your money

- Goal Setting

- Money knowledge

- Analytical Skills

Goal Setting

It is no exaggeration to say that your life will change from the day you set your goals.

Clarify your vision of the future, your ideals, and what you want.

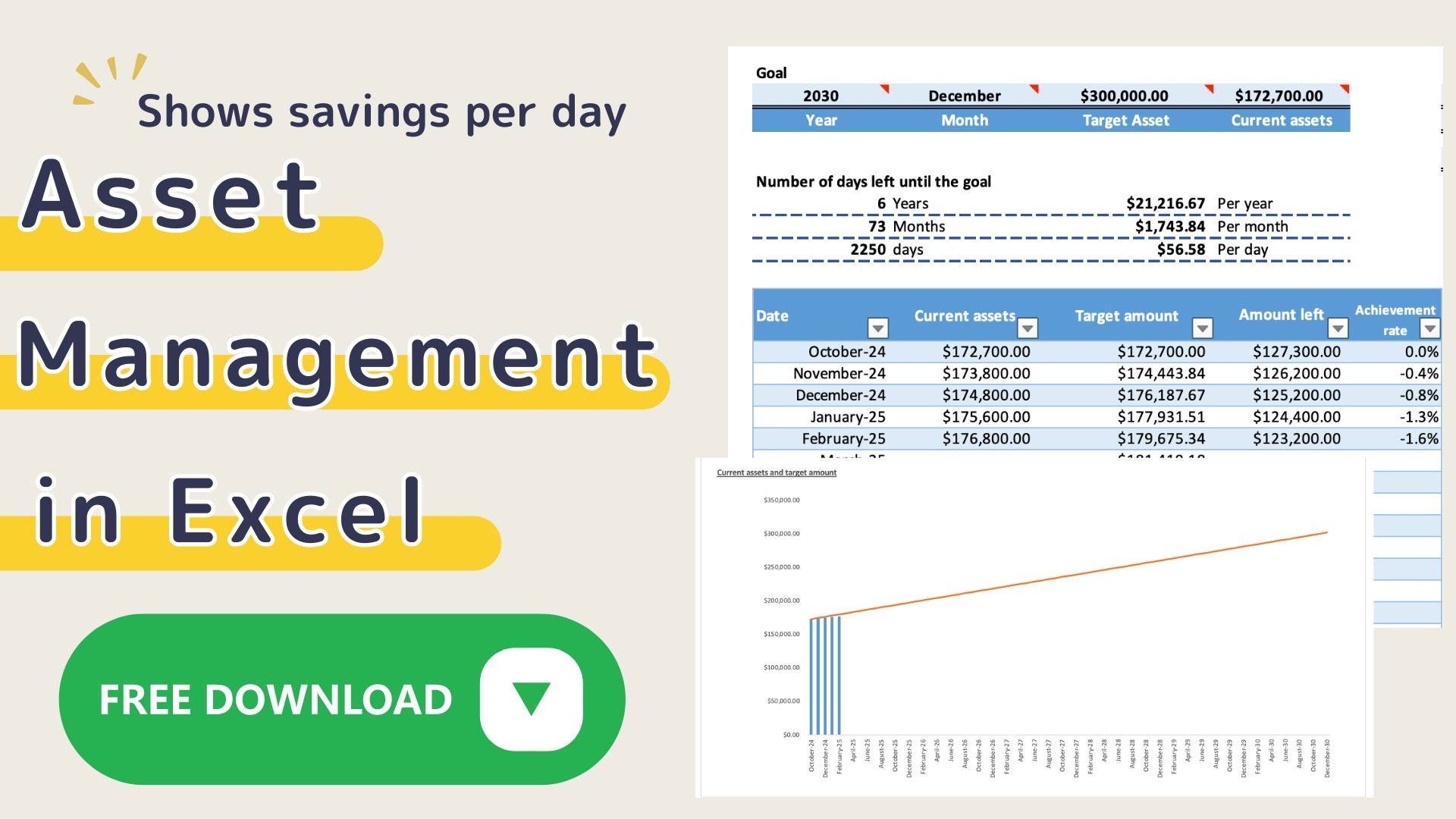

Set specific numerical goals for how much income and how much assets you need in order to achieve those ideals.

Example: Goal: $100,000 in assets in 5 years

Creating a life plan chart will give you a concrete image.

-

-

Let's make an exciting "Future Reverse Life Financial Plan Chart! (Free Excel template available)

I've never made a life plan chart, but I'd like to make an exciting one. I've made a life plan chart before, but I want ...

Money knowledge

The best solution to money anxiety is to acquire the right knowledge about money.

With knowledge, you will not only have more options, but also reduce the risks you face in life.

- Acquire basic money knowledge.

- Understand the difference between assets and liabilities.

- Understand how money flows.

Predict the direction of the future by understanding how the world works and its structure.

Learn how to protect your money and how to allocate the risk of financial assets on your own.

Analytical Skills

Review and improve the way you spend your money so you can take control of your money.

Review how you spend your money each month.

You need to be able to determine if the way you are spending your money is getting you closer to your ideal self or if you need to change course.

You may say, "I'm saving money, but my savings aren't increasing." In this case,

Are you spending more on other things to make up for the savings?

Is there a more efficient way to save money? It is important to examine the situation.

Review of assets

You can change your asset allocation to suit your situation according to your own risk tolerance, rather than the products recommended by gaining knowledge of money.

Conclusion

Steps

- Remove money mind blocks.

- Set goals.

- Learn about money.

- Know good and bad savings.

- Analyze and correct them.

Removing the money mind block, i.e., stopping the poverty mindset, makes it easier to take action.

Set life goals.

→Understand yourself and develop habits to achieve your goals.

→Be able to spend money according to one's own axis.

→You can control your life.