How do I start getting my finances in order?

We tend to think that household management = money management.

Focusing on saving money can lead to neglect of health care and a decrease in life fulfillment, which can lead to greater losses in the long run.

To manage your finances is to organize your thoughts and take action.

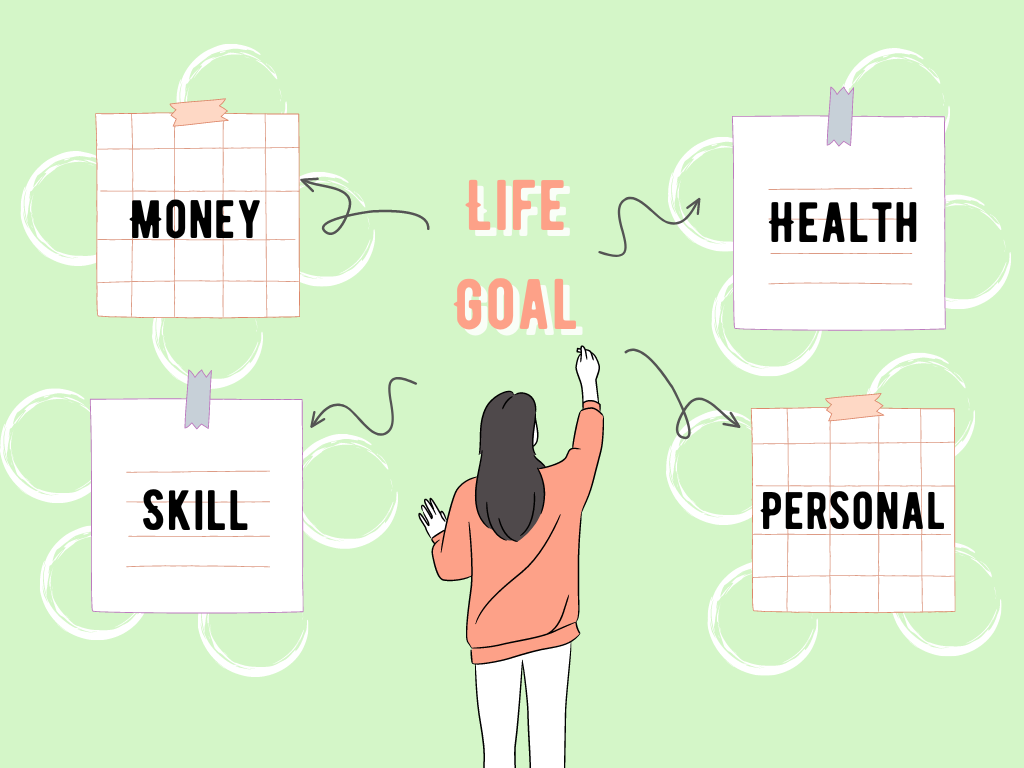

If your goal is to manage your household finances to enrich your life, you should organize your finances one by one along four axes: money management, health management, skills management, and personal life management.

- Money management → savings

- Health management → food, medical care, beauty expenses

- Skill management → personal investment, education expenses

- Personal life management → entertainment and social expenses

The first step is to define your goals for the kind of life you want to lead.

Step 1: Set life goals

I want to be rich.

→ Too abstract to take action.

However, "life goals" may be too grandiose to set a deadline or numerical target.

If you are such a person, first think vaguely about what kind of life you want to lead.

The trick is to set an ideal without assuming that your level is this high.

Step 2: Set goals by category

In Step 1, set your big life goals, and in Step 2, set goals by category.

Goals here should have a deadline and a target number.

Health Goals

We cannot separate health from our life goals.

It is said that we are living in the age of 100 years, and we want to spend as much time as possible in a healthy age.

For example. Assuming my life expectancy to be 100 years, I aim to have a body that can work until I am 80 years old.

What kind of diet and exercise habits should I have in order to have a body that can work until age 80?

It may be too far in advance to imagine, but if so, you may want to consider whether your current lifestyle and eating habits will allow you to build a body that can work until you are 80 years old.

Personal goals

Your personal goals are directly related to your life goals.

If you are single, are you married or not, what is your family structure?

If you are married, think about what kind of family relationship you want to have and what kind of life you want to lead.

Set goals for your ideals, such as whether you will buy a house, how often you will travel, etc.

Money Goals

Let's go over the money goals you need for your life goals.

After setting your private goals, calculate how much money you will need.

Use the life plan chart to create your personal and financial goals so you know how much you need per year.

-

-

Let's make an exciting "Future Reverse Life Financial Plan Chart! (Free Excel template available)

I've never made a life plan chart, but I'd like to make an exciting one. I've made a life plan chart before, but I want ...

Skill Goals

Skills goals are an essential part of generating income.

After setting your money goals, consider what skill goals you should set.

You should set goals in the following order: health goals, personal, money goals, and skill goals.

If you want your body to be able to work until you are 80 years old, as set by your health goals, you need to shift from a job that requires physical strength to one that allows you to use your brains.

Also, if you set a goal of living while traveling for private purposes, you need an environment where you can work regardless of time and place.

Step 3: Bring it down to a level where it can be acted upon

Step 1: Set Life Goals

Step 2: Set goals by category

Step 3: Subdivide goals by category

Based on the goals by category, we will break them down into proposed solutions and actions to be taken.

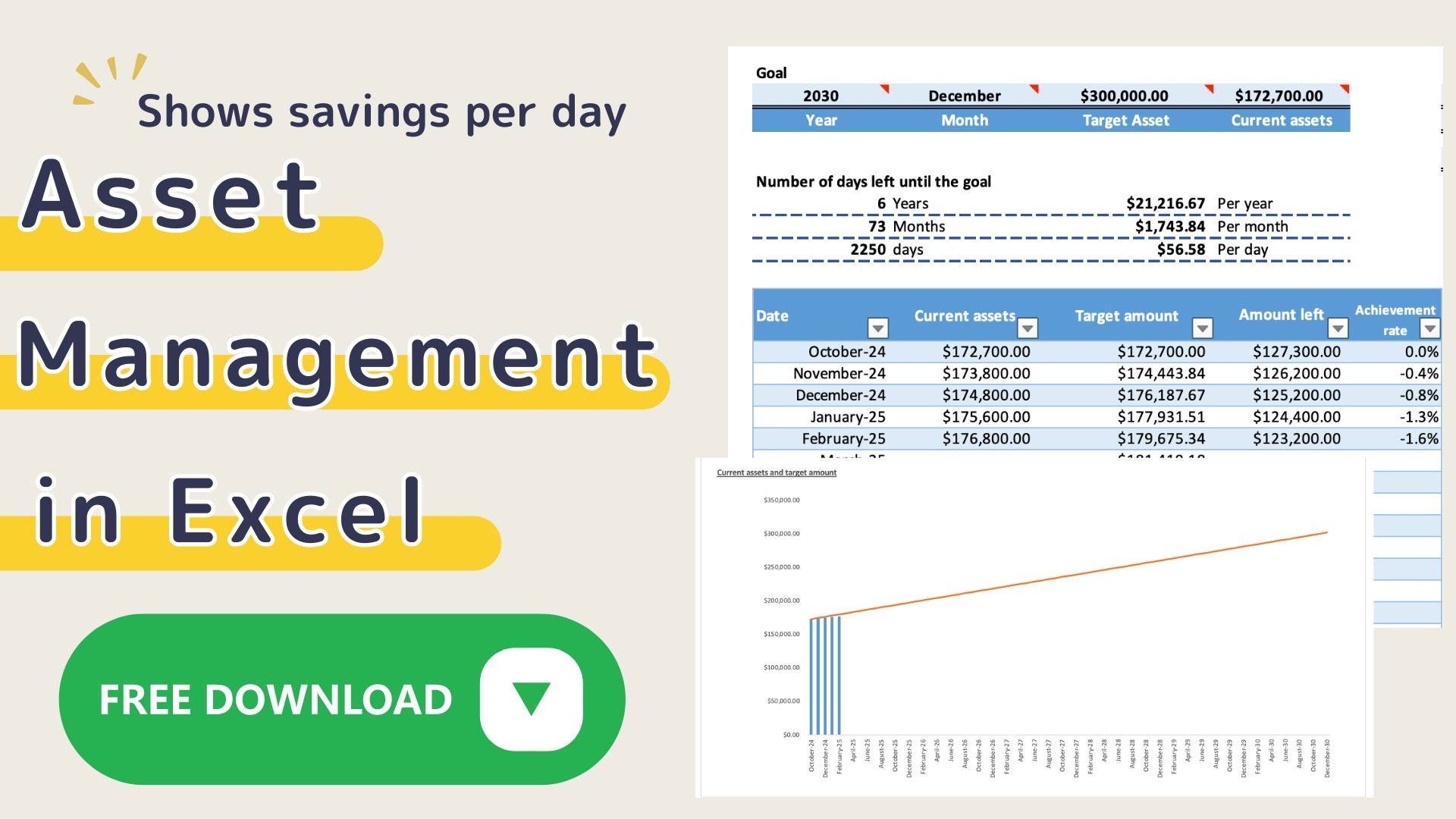

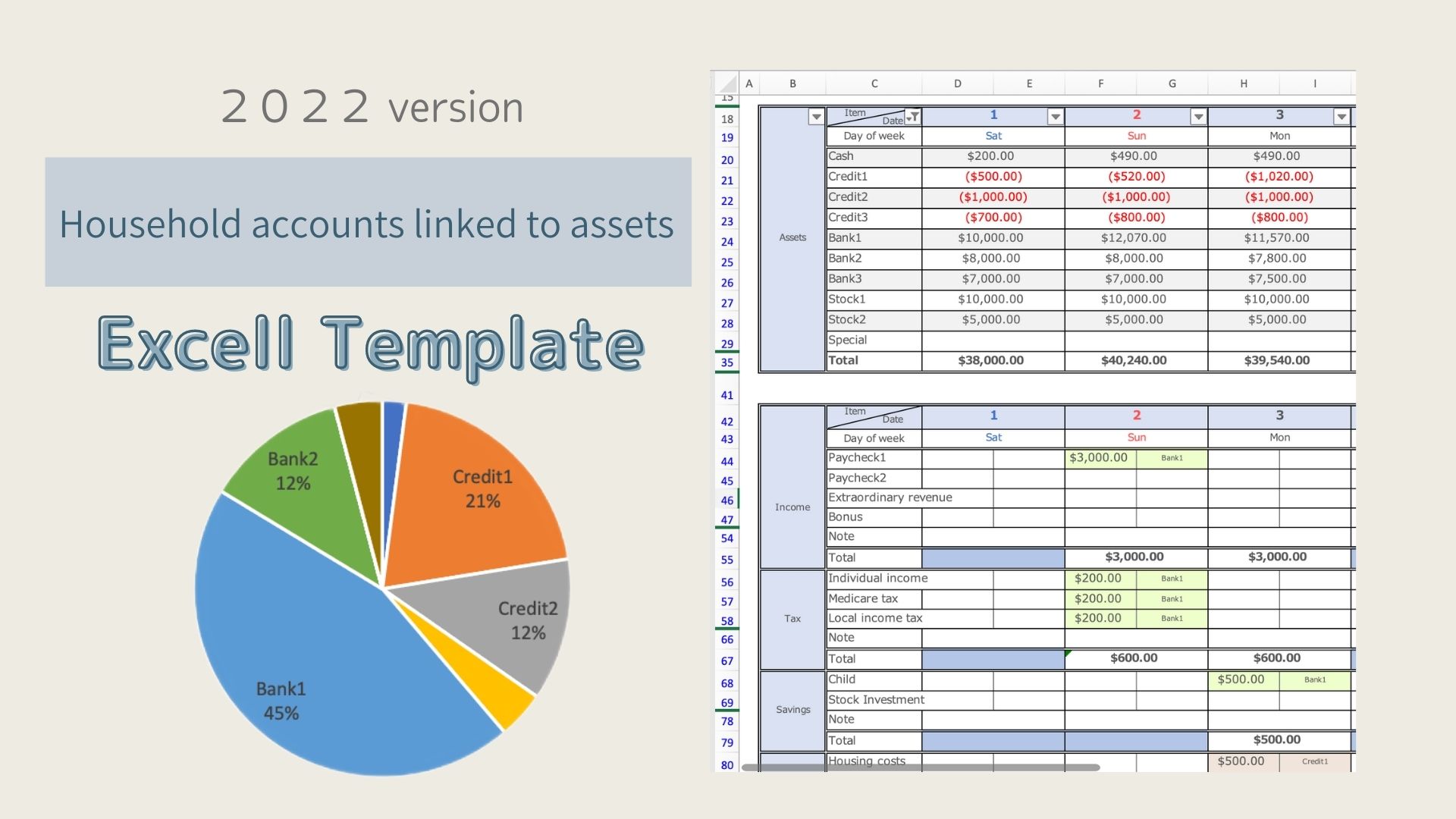

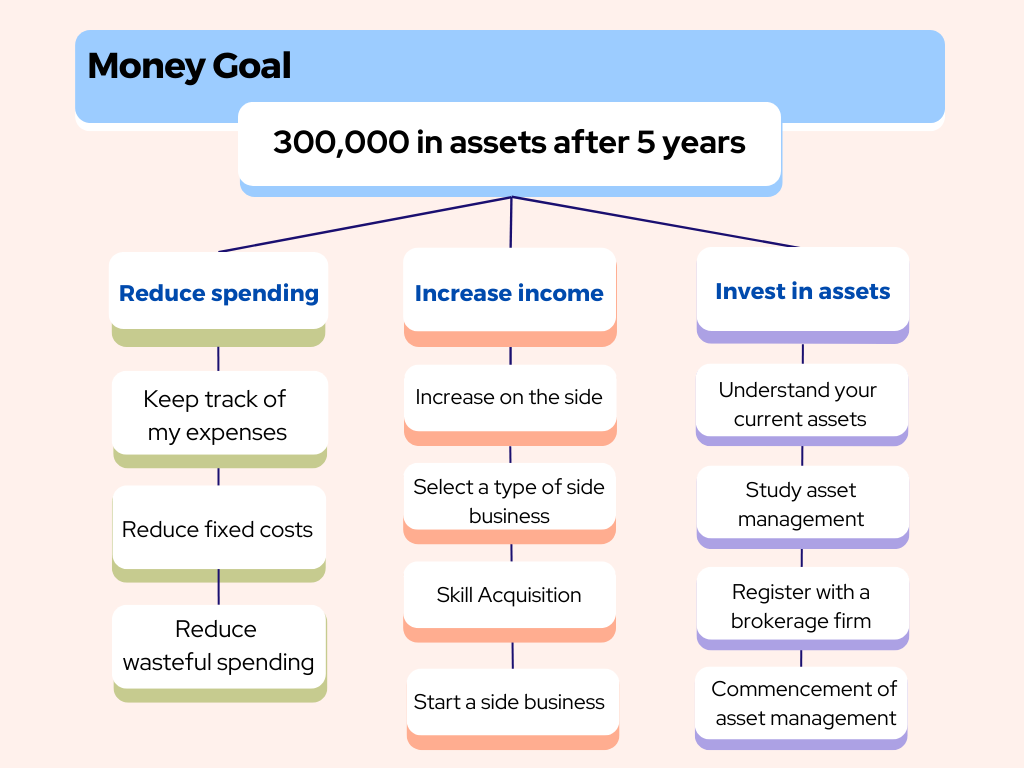

Using money as an example, if you set a goal of $300,000 in assets in 5 years, the solution can be divided into three categories: reducing expenses, increasing income, and managing assets.

In addition, we will identify what we will do for each of the proposed solutions.

It can be further subdivided into.

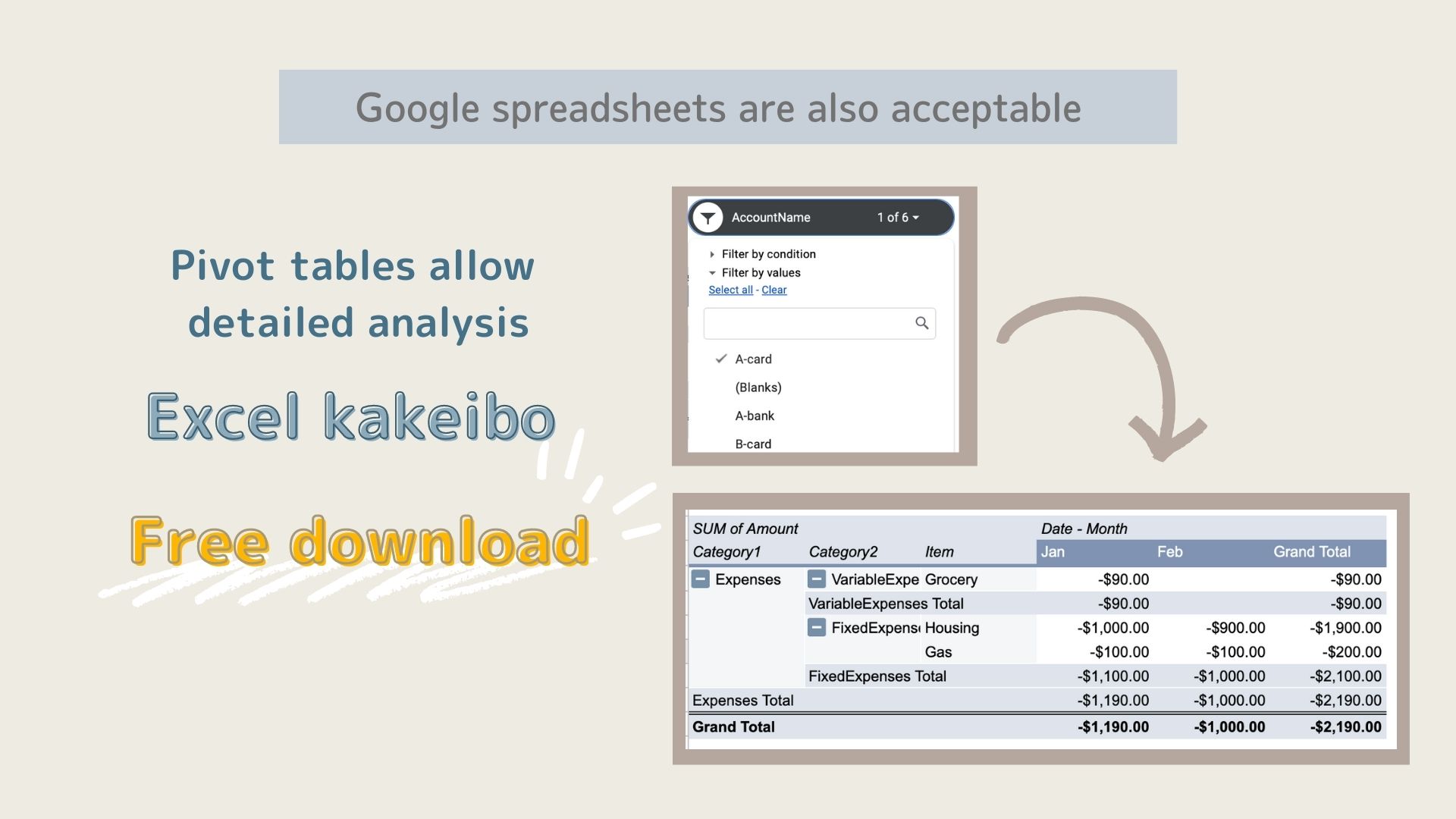

Figure out your expenses → keep a household account book → buy a household account book on __ days.

and by bringing it down to an actionable level, it becomes easier to put it into action.