Do you ever wonder why you spent so much money when you record it in your household budget and look back?

One of the reasons could be due to a large expense that does not normally occur, such as buying a new appliance.

By setting such large expenses as special expenses, you will not only be able to look back on them easily, but you will also be able to keep track of your annual budget.

What are special expenses?

High and special expenses that are not needed every month are called special expenses.

Examples include life insurance premiums paid annually, car inspections, and travel expenses.

How much is too much is up to each individual, so please feel free to set your own limits.

Advantages and disadvantages of setting special expenses

Advantages

- You can keep track of special expenses that occur throughout the year.

- You can know your annual budget in advance.

- If you have a fixed schedule, you can make an annual list and see how much you need to spend per month and per year.

- Household expense items are categorized and easy to understand.

In the past, when I didn't set up special expenses, it was difficult to find where large expenses came from when I reviewed my income and expenses.

When expenses were much higher than in other months, I would find the item with the largest amount, whether it was food or entertainment, and then find the special expense from that item.

And then I could finally figure out, "I bought a new washing machine this month.

By classifying these expenses as special expenses and graphing them, it becomes much easier to understand.

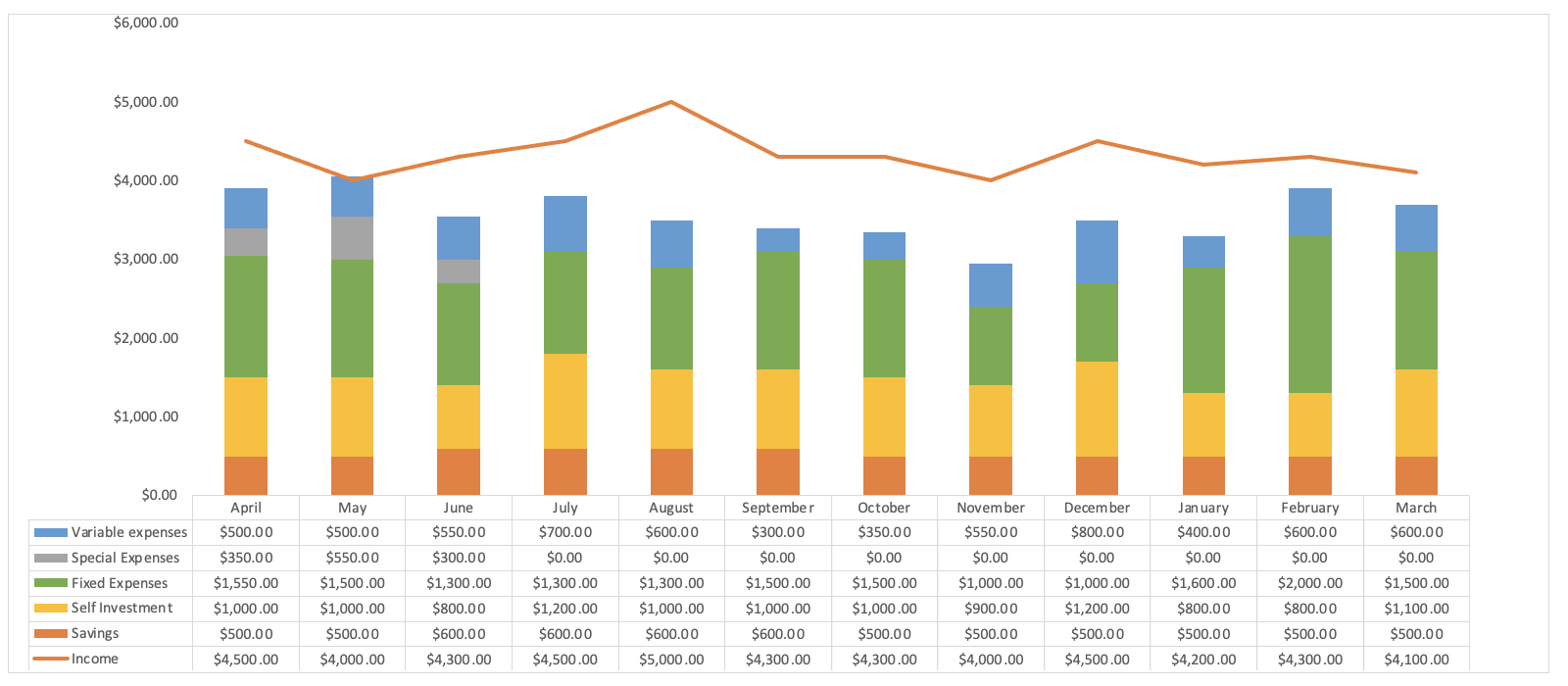

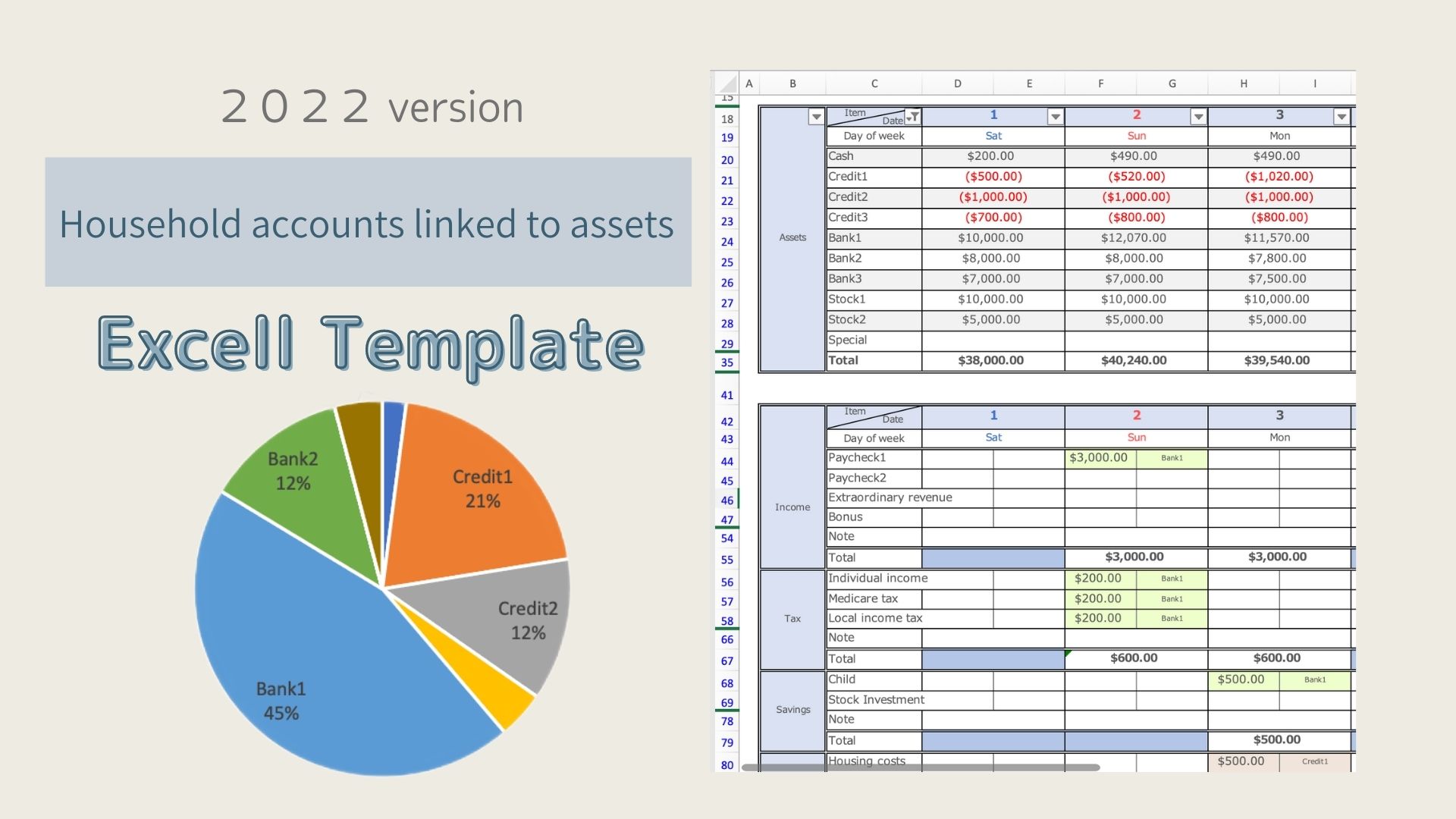

This is a sample of a "household budget sheet," but by categorizing normal expenses and special expenses, you can easily review your spending and see at a glance the changes in special expenses.

Disadvantages

- It is difficult to identify annual events and annual expenses.

- You are not sure if you should record it as a regular item or a special expense.

You need to know the events and set up the items to be purchased in advance, which makes the work more difficult.

You may be wondering whether it is better to set this item as a special expense or a regular expense.

A birthday party for a family member or a small gift for a friend is not something that occurs every month, but it is not expensive.

In such cases, Record as a special expense anything that does not occur every month but is over $100.

This can be solved by setting up criteria for special expenses.

How do you come up with a budget for special expenses?

Once you know your annual budget for special expenses, the next step is to figure out how to come up with that budget.

There are two ways to budget for special expenses

Make up for it from the bonus

This is a way to save the bonus amount and set aside it as a special expense.

In our family, we use the bonus to cover special expenses.

Set aside from monthly income for special expenses

You can allocate the total budget for the year in 12 months, or if your monthly income varies, you can change the amount to be paid each month.

This accumulation is different from savings.

It has a specific purpose of use, so keep it separate from your savings.

If you still can't make a budget

If you do not receive a bonus or are unable to set aside money every month, you must first work on improving your household budget.

There are two ways to improve your finances: increase your income or decrease your expenses.

Figure out your monthly income and expenses, and if your expenses are higher, improve your household budget.

The steps to improve your household budget

- Keep a household account book to keep track of your monthly income and expenses.

- Classify your expenses into fixed costs and variable costs.

- Check to see if the ratio of fixed expenses is too high, and consider whether fixed expenses can be reduced.

- Check if there are any unnecessary expenses in variable expenses.

Fixed expenses include rent, mortgage, utilities, communication costs, and life insurance premiums.

Variable expenses include food, daily necessities, clothing, entertainment, and transportation.

After making the above improvements to your household budget, you can set up special expenses.

If you want to increase your income, you need to change the amount of money you spend on consumption and waste to investment.

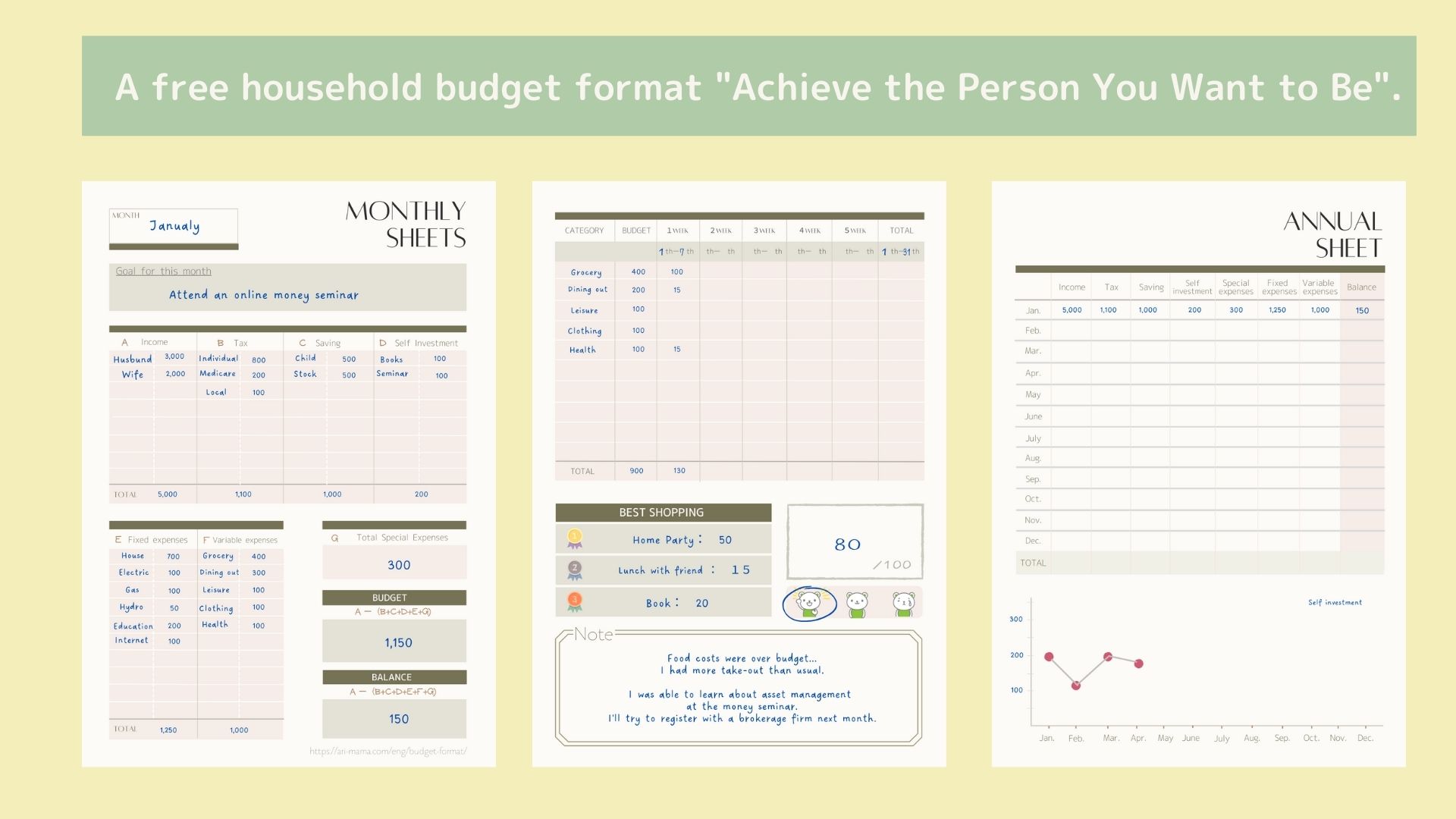

How to use the format

Set a budget

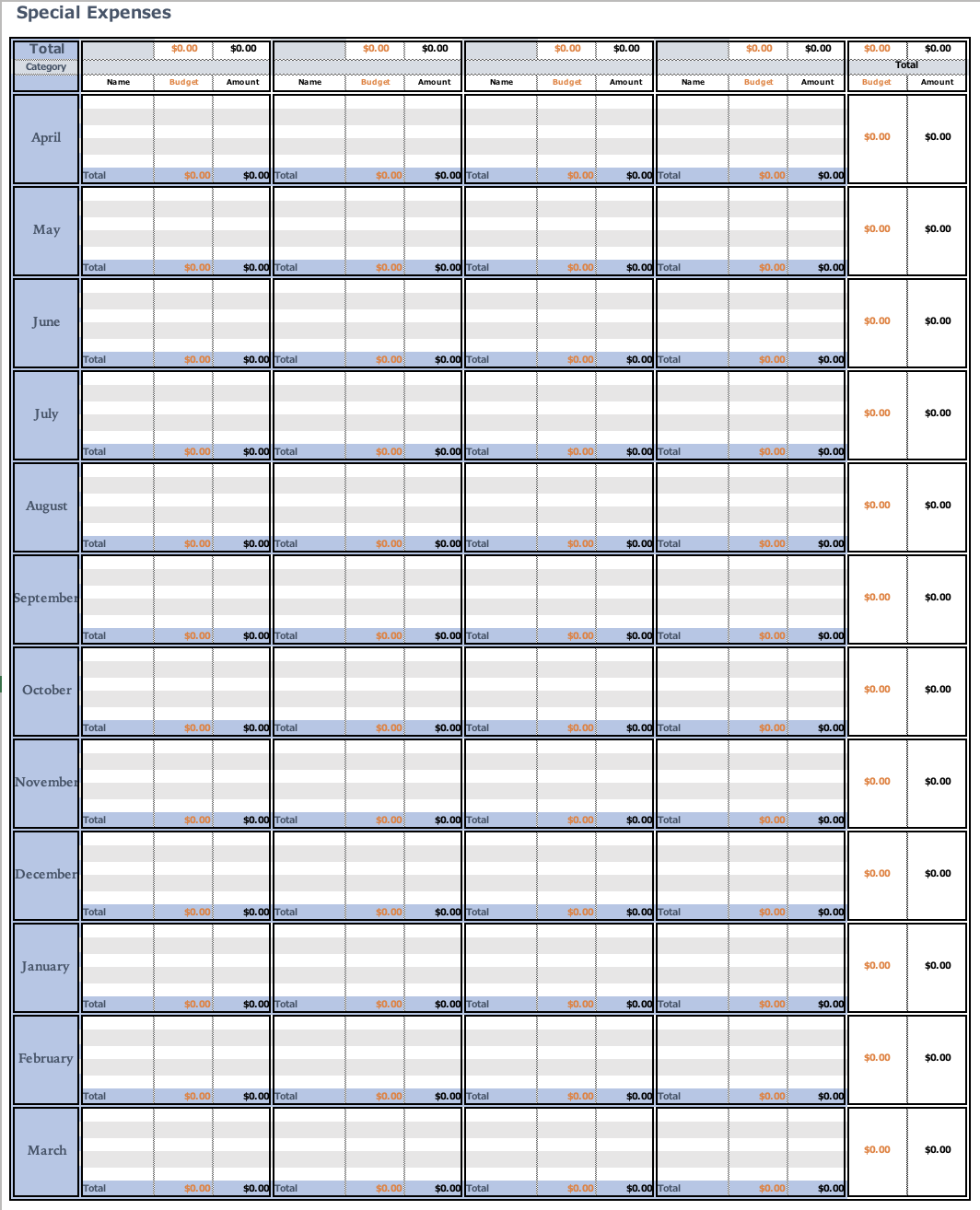

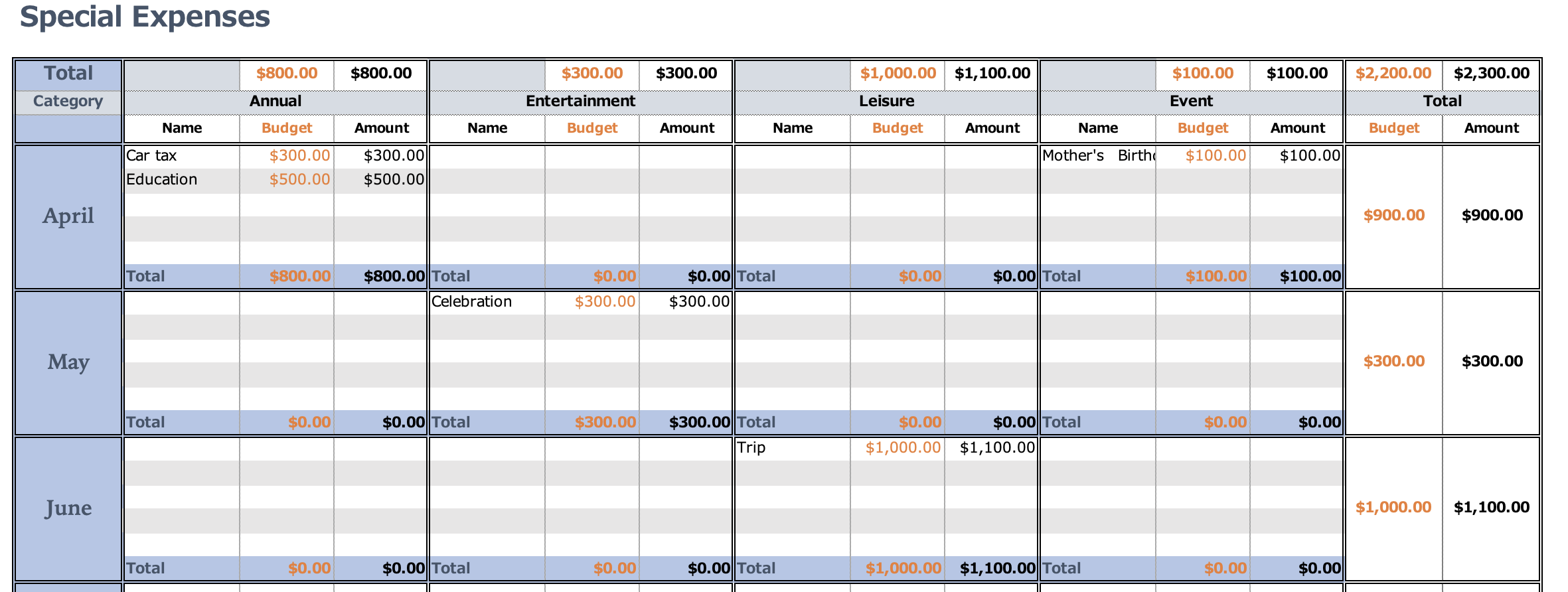

You can record special expenses by month and by category.

Please fill in the category name first.

Next, enter the special expense name and budget.

By entering your predetermined expenses, you can get a rough idea of your annual budget.

In the Amount column, enter the amount of the expense when it is actually incurred.

Change the currency unit

The default setting for the currency unit is dollars.

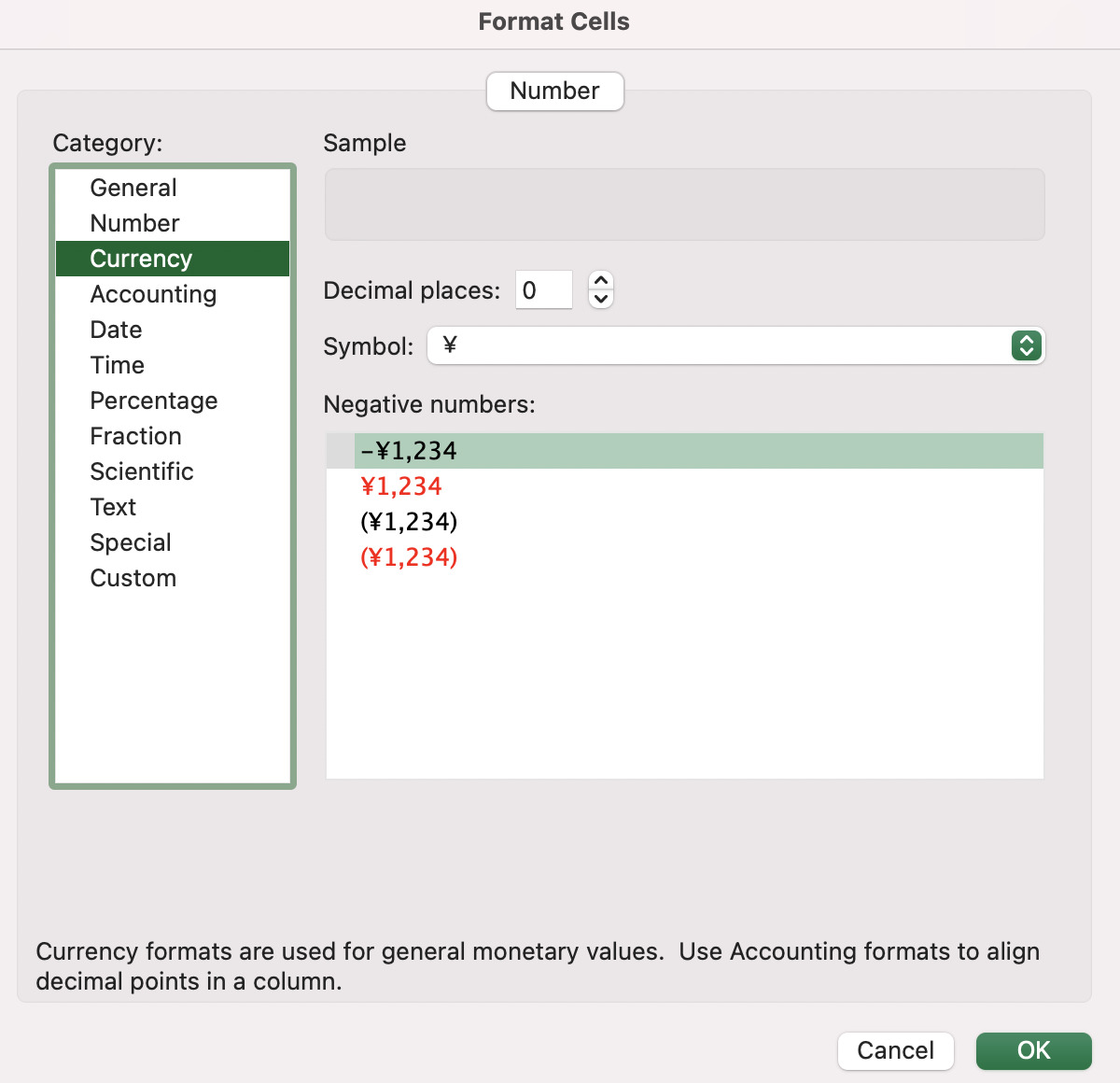

Press the "Select Currency" to select a range of currencies.

Select the currency unit for each sheet.

Click on the money symbol to select the currency unit.

(Home-Currency-Money symbol)

Click on the ”More Accounting Format” to see more unit information.

A sample sheet is included in this format.

Download Special Expenses Format

You can download the "Special Expenses Excel Format" for free.

The paper size is A4.

The download is in zip format, so please unzip it before use.

If you want to print and handwrite, please download the PDF file.

The PDF file does not contain the sample sheets.