I always end up failing in the middle.

Do you have such problems?

The first step in managing your finances to achieve what you want is to ask yourself, "What do I want to be?

The first step is to clarify what you want to be.

By establishing yourself as a person who is not swayed by the world around you, and by focusing on your goals, you can make steady progress.

In making an action plan, we will break it down into small steps and explain them, so let's get our finances in order together.

A Roadmap for Getting Your Family Budget in Order

- Set goals

- Understand your monthly income and expenses

- Reduce wasteful spending

- Review how you spend your money

- Increase your money

Clarify what you want to be.

Clarify your vision of the future, your ideals, and what you want.

What kind of life do you want to have in five years?

Isn't it exciting to imagine what kind of house you would like to live in, your possessions, and your ideal family image?

Instead of imagining what it will be like five years from now based on what it is now, try to remove the limiter and set an ideal image for five years from now.

Setting Goals

These are the landmarks that will help you reach your goals.

How much income do you need to achieve what you want? How much money do you need? This will help you find your goal.

If you set as specific a deadline as possible, it will be easier to look back and see if you have achieved your goal.

Example: I want to have $30 million in assets in 5 years.

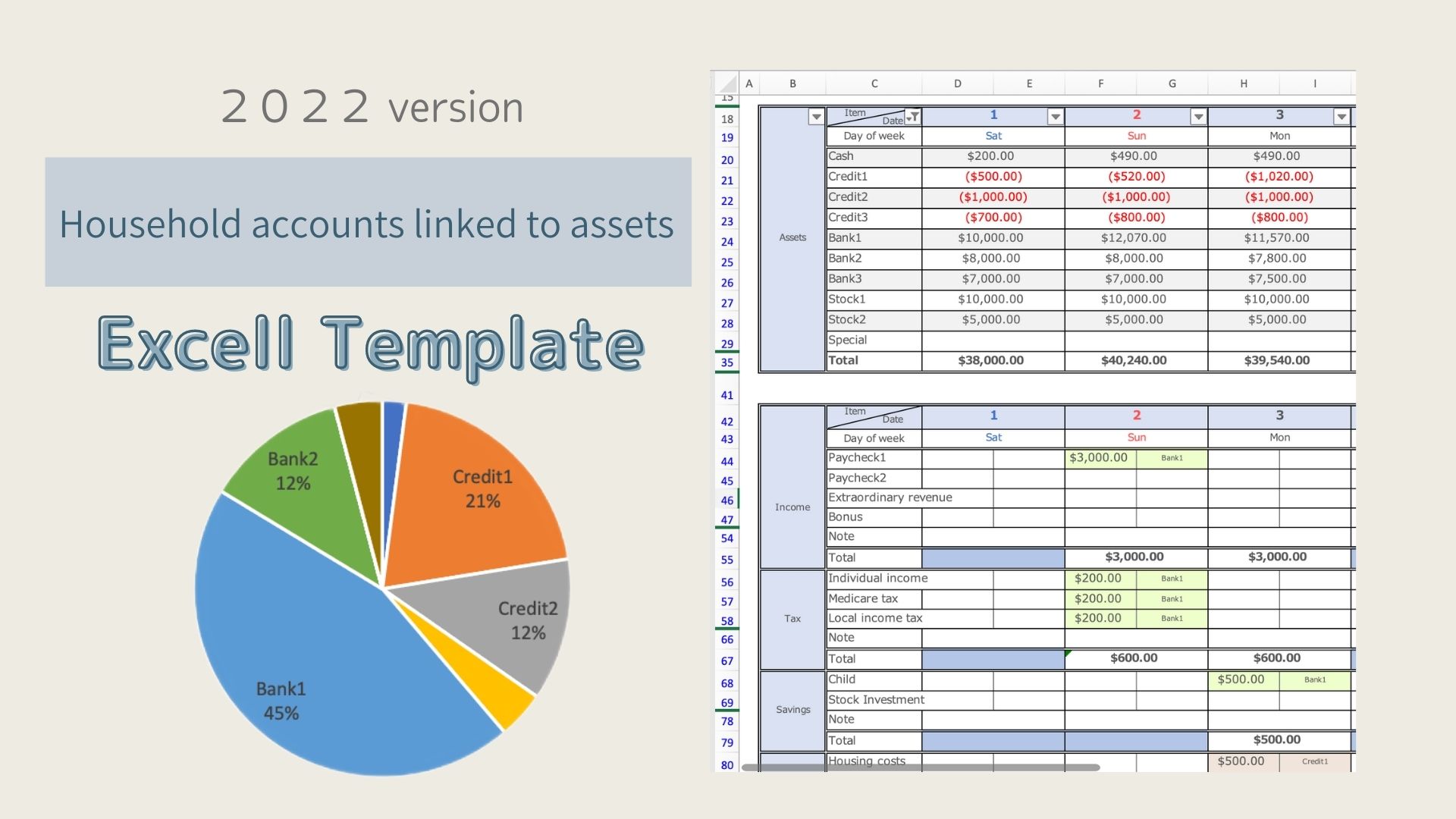

Track your monthly income and expenses.

To understand the gap between your goals and the present, track your monthly income and expenses.

You can get closer to your goal by making and implementing an action plan to close the gap.

Get a rough idea of your monthly income, savings, expenses (fixed and variable), and how much money you have left over.

Reduction of wasteful expenses

Reducing wasteful expenses can be categorized into (1) reducing fixed costs and (2) reducing variable costs.

Reducing fixed expenses that occur every month is difficult due to changes in procedures, but it is recommended because it has a large impact and can be structured.

To reduce variable expenses, keep a record of your waste in a household account book and see how much waste you are incurring each month.

Once you are familiar with the household budget, you can classify the causes of your wasteful spending as stress, habit, vanity, or other.

Recognizing the cause of your overspending is the first step.

Habit ー Stop the habit and adopt a new one.

Stress ー Even if you can't get rid of it easily, it will give you an opportunity to think about how you can alleviate the stress.

Review how you spend your money

Once you have reached a level where you are able to reduce your wasteful spending, you can start to see how you are spending your money. (Percentage of each expense such as food, daily necessities, education, etc.)

The next step is to

Are you using your money in a way that is consistent with your values?

It is important to work backwards from your ideal image and review whether you are spending the money you need now.

Determine what is important to you, and check how much money you are spending on important things each month.

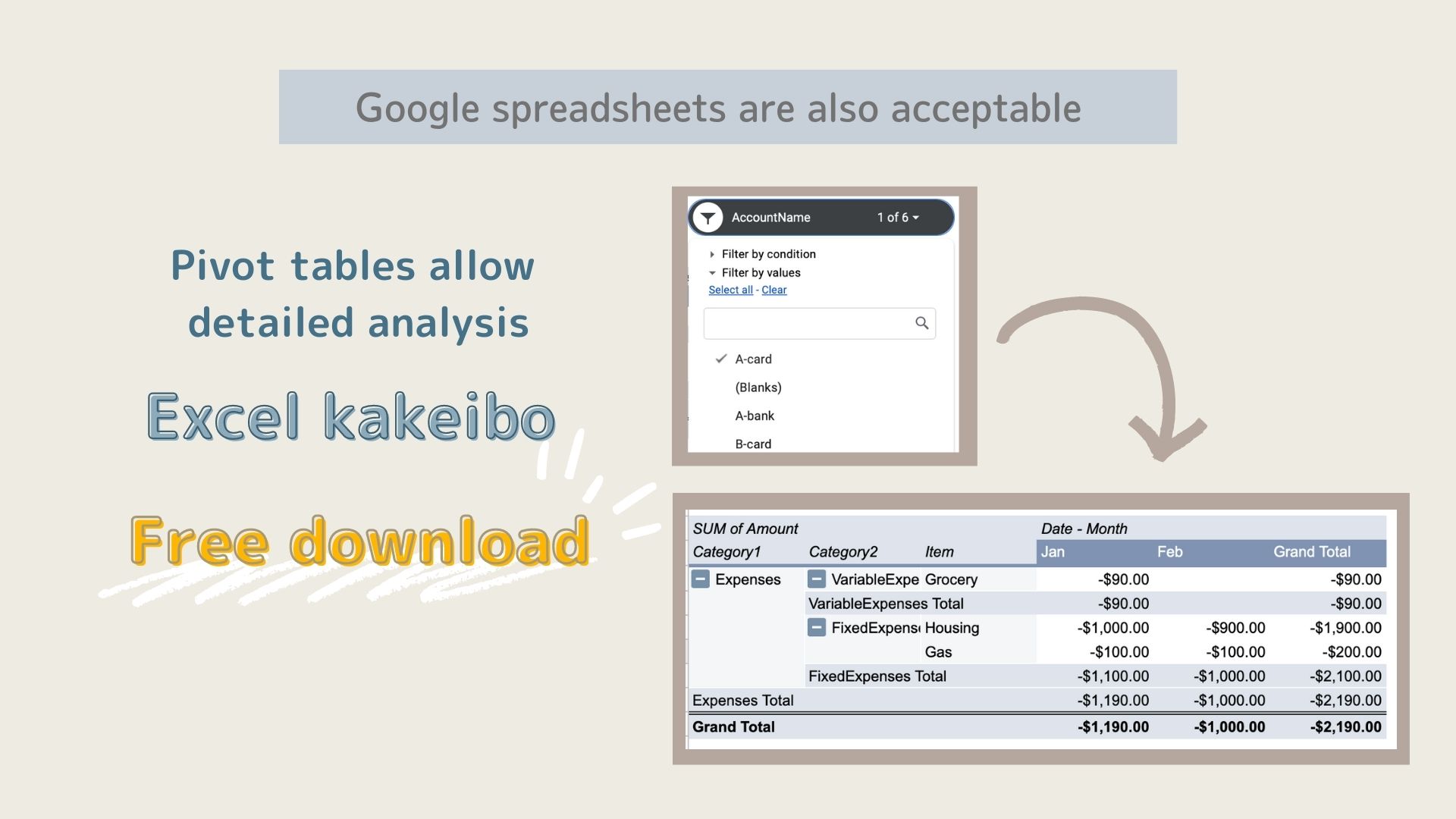

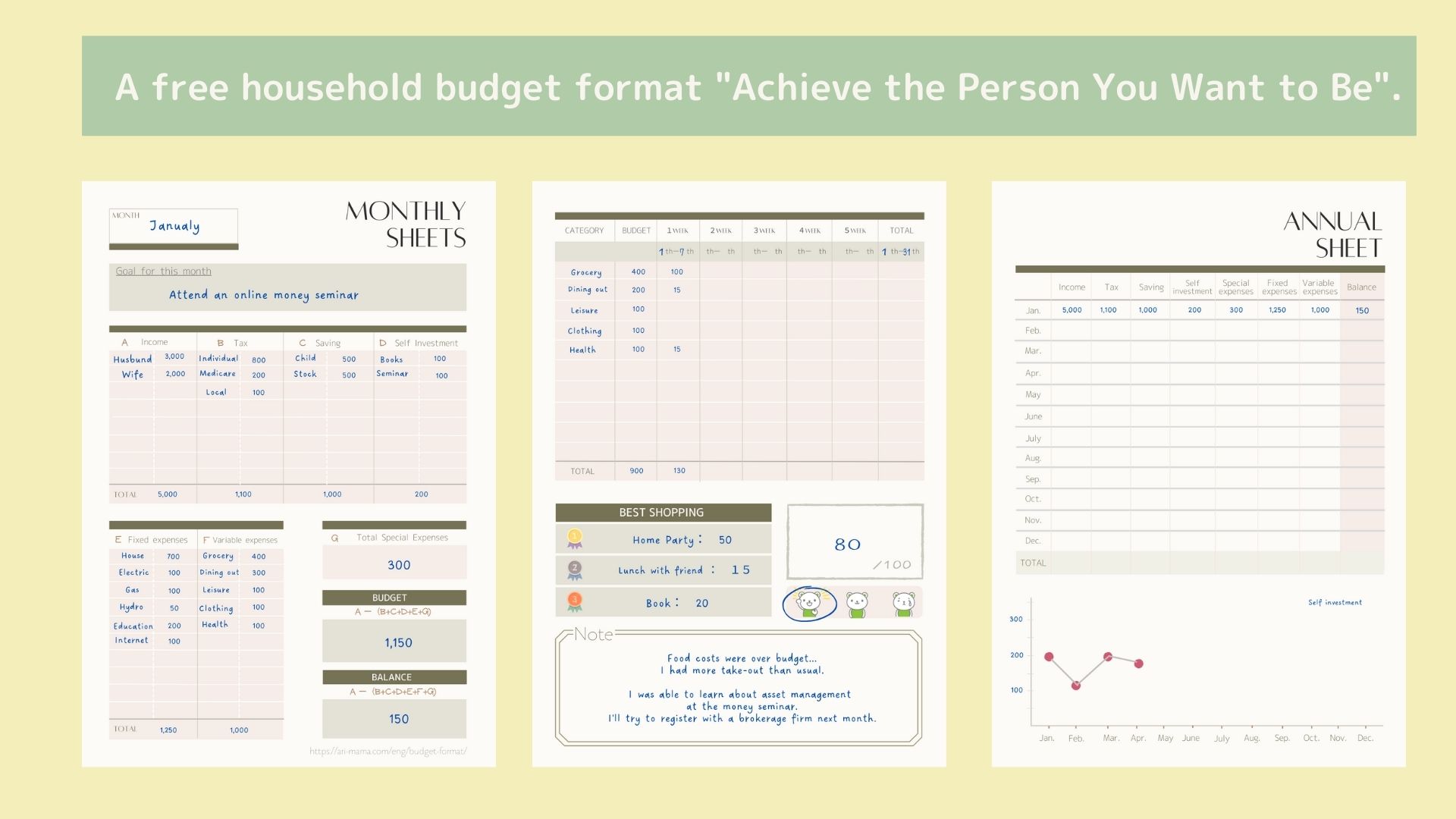

Free download of "Increase Your Happiness in Life" Excel Family Budgeting

Increase your money

There are three ways to increase your money

- Reduce your expenditure

- Increase income

- Asset management

Since the items to reduce spending are set in Reducing Wasteful Spending, here we will focus on Increasing Income and Asset Management to increase our assets.

Increase your income

In order to increase your income, it is essential to improve your skills.

Start by gathering information on what you want to do, whether it is to expand your existing skills and change jobs, or to acquire new skills and use them in a side business.

Asset Management

By developing financial skills, you can run a business that generates income without you being there.

You can make your money work for you, or put your money to work for you.

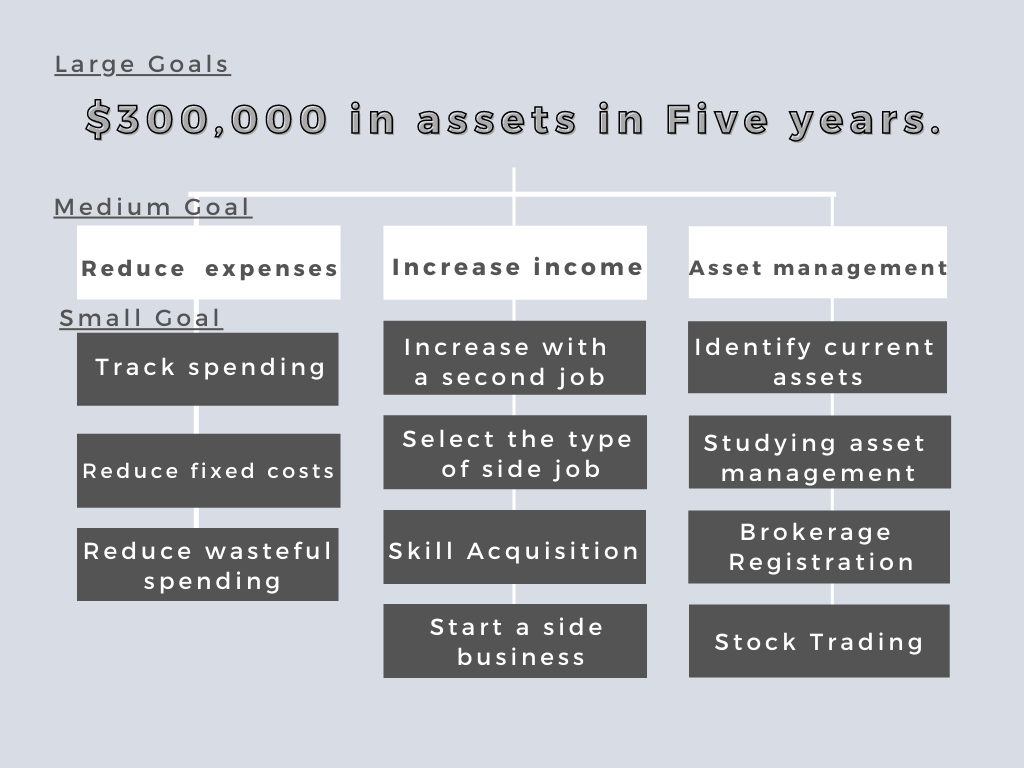

How to make an action plan

The bigger your goal is, the more anxious you become about whether you can really achieve it, and the harder it is to take the first step.

In such cases, make an action plan and think about how you can achieve it.

Steps to create an action plan

- Set a major goal

- Understand your monthly income and expenses and current assets

- Identify the gap between your goal and the current situation

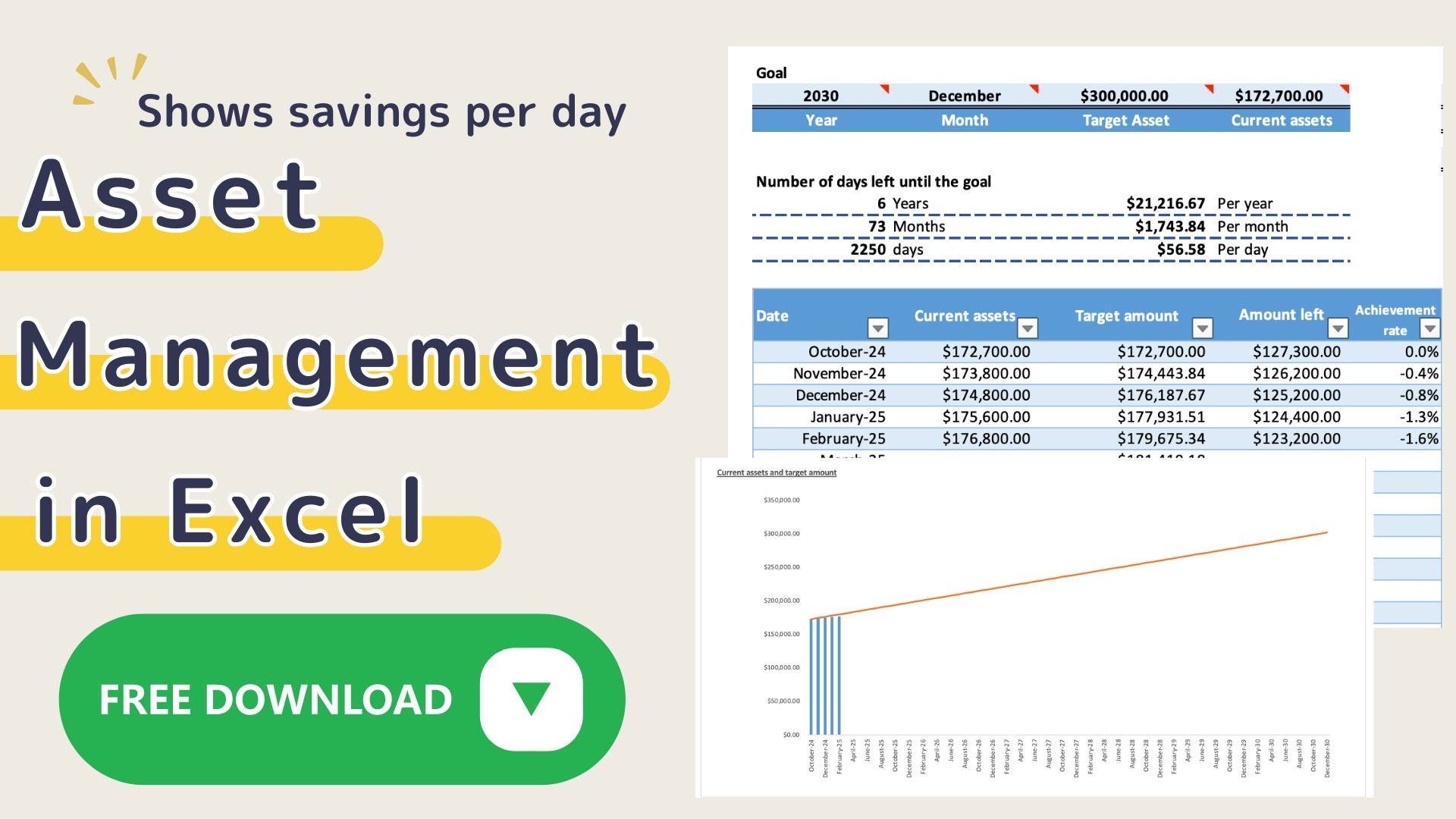

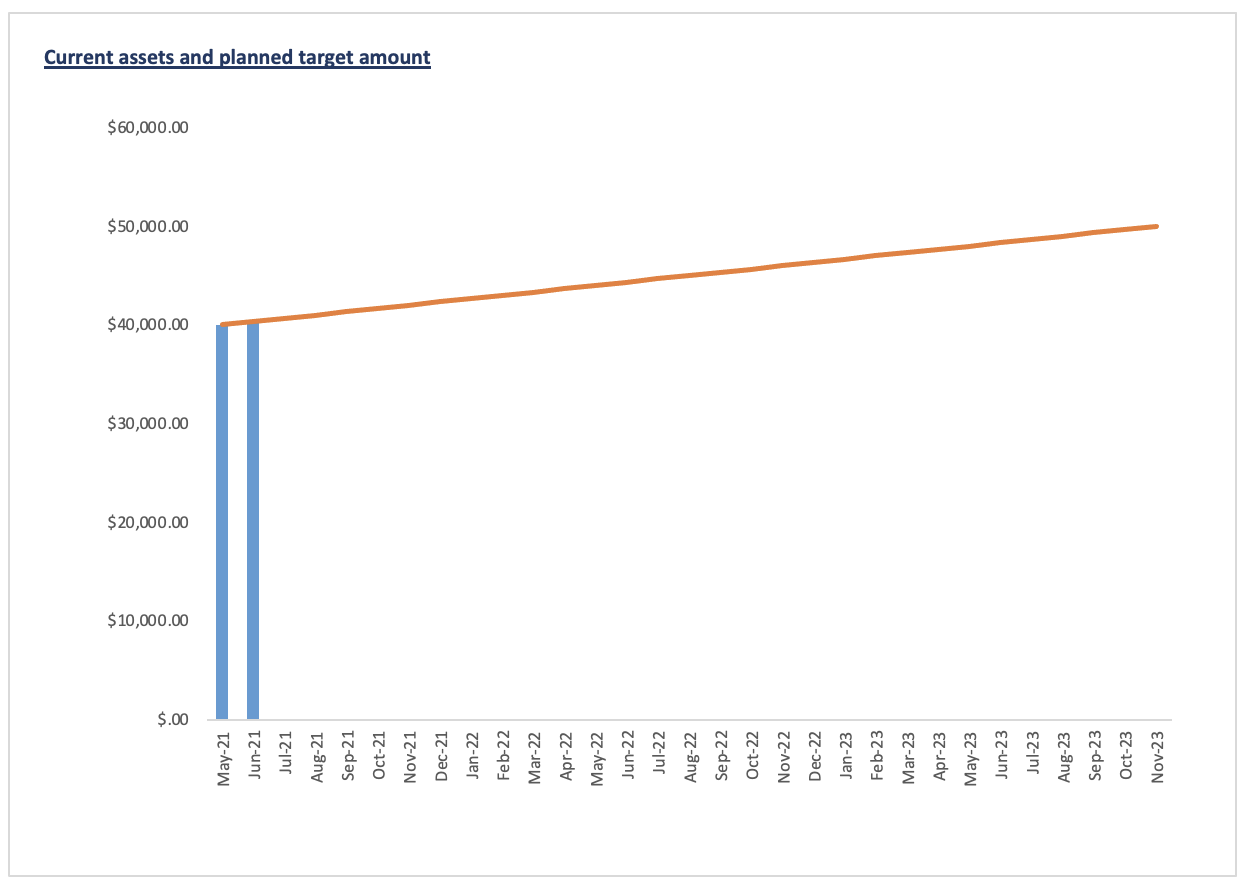

In the template for visualizing the path to achieving your goal, you can set your current assets, the amount of money you plan to spend, and a deadline, and then you can visualize how much you need to increase each month and the monthly achievement rate in a graph. You can re-set your target assets as many times as you want, so you can easily visualize how much you need to increase each month to reach your goal.

- Subdivide the goal

Since the initial goal is a major goal, set medium and small goals.

Example: Major goal

$30 million in assets in 5 years

Medium goal

- Reduce expenditure. (Increase savings)

- Increase income.

- Asset management.

Small goals: (Reduce expenditures)

- Understand your monthly expenses.

- Reduce fixed expenses.

- Reduce wasteful spending.

Setting deadlines and numerical values not only for major goals but also for medium and small goals will make them easier to achieve.

For small goals, if you have decided to increase your income through side jobs, do some preliminary research on which side jobs you can use to increase your income.

→I'm going to stop by a bookstore on my way home from work this evening.

It will be easier to achieve this goal if you break down the steps to a level where you can take action.

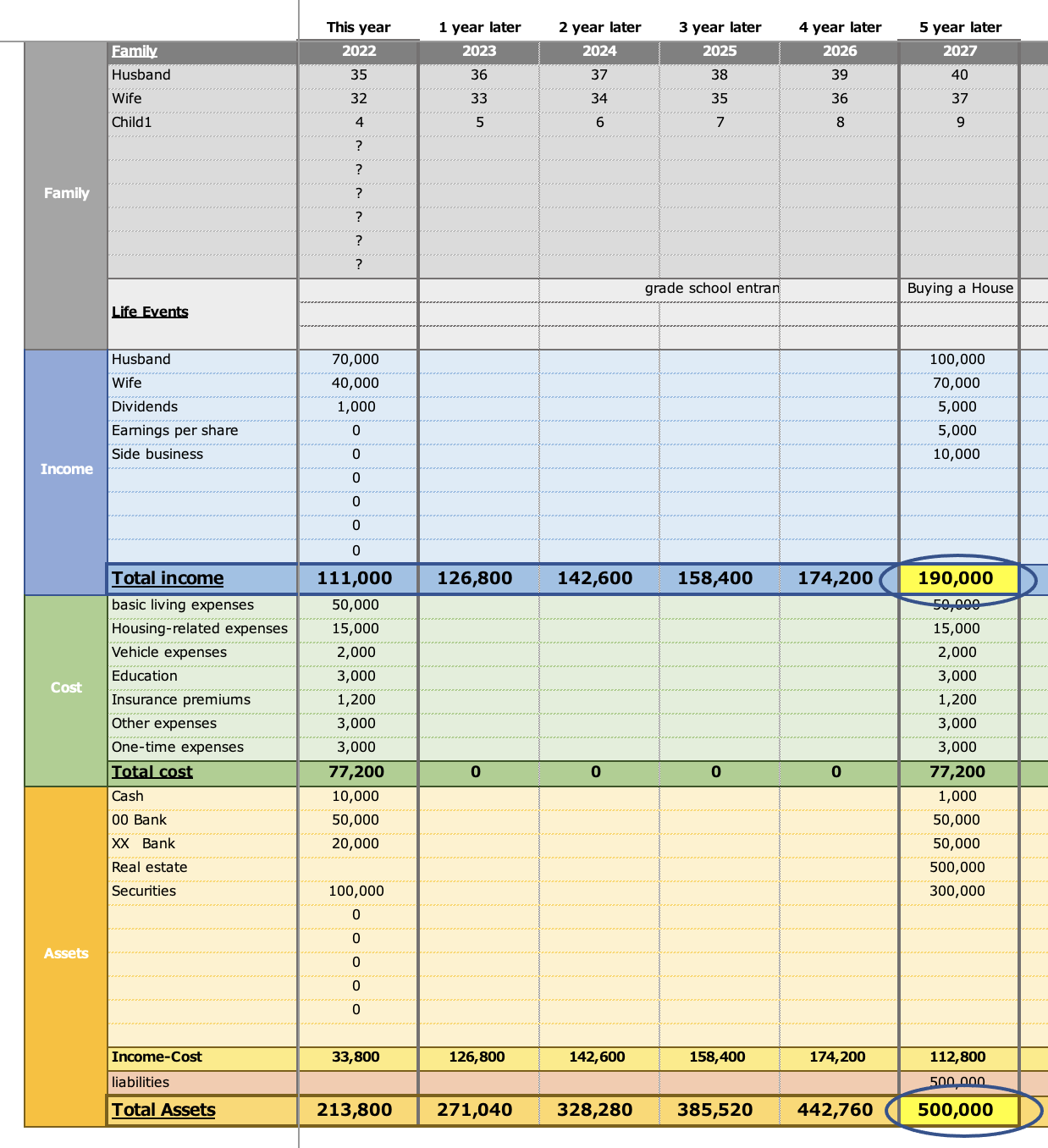

Create a life plan chart.

In implementing these, some of the effects will be seen immediately and others will take time.

- Reduce your expenses: You can cut back rather quickly.

- Increase your income: It will take time to increase your income, especially if you choose a second job.

- Asset management: It takes time to get started and may reduce your assets.

Considering these characteristics, instead of saving the same amount every year, you need to increase your savings after one year or two years.

A life plan chart is useful for this purpose.

Set your target assets on the five-year yearly chart, and fill in your income, expenditure, and asset goals for one year and two years from now.

By detailing your income and expenses for each year, it will be easier to visualize.

Conclusion

This is how to make a household budget roadmap and action plan to achieve what you want to be.

Household budgeting roadmap

- Clarify what you want to be

- Set goals

- Understand your monthly income and expenses

- Reduce wasteful spending

- Review how you spend your money

- Increase your money

Steps to create an action plan

- Set a big goal

- Understand your monthly income and expenses and your current assets

- Identify the gap between your goals and your current situation

- Subdivide your goals into smaller ones

Create a life plan chart

Set goals and work backwards from the future to set annual income and expenses.

Above all, it is of utmost importance to clarify what you want to be and to set goals.

If you can take the time to think about what you want and what goals you need to set, and then set firm goals, you will naturally know what you need to do.