I've never made a life plan chart, but I'd like to make an exciting one.

I've made a life plan chart before, but I want to increase my assets in the future.

For those people, I recommend the "Life Plan Chart for Future Reverse Calculation".

Features of the Future-Reverse Life Plan Chart

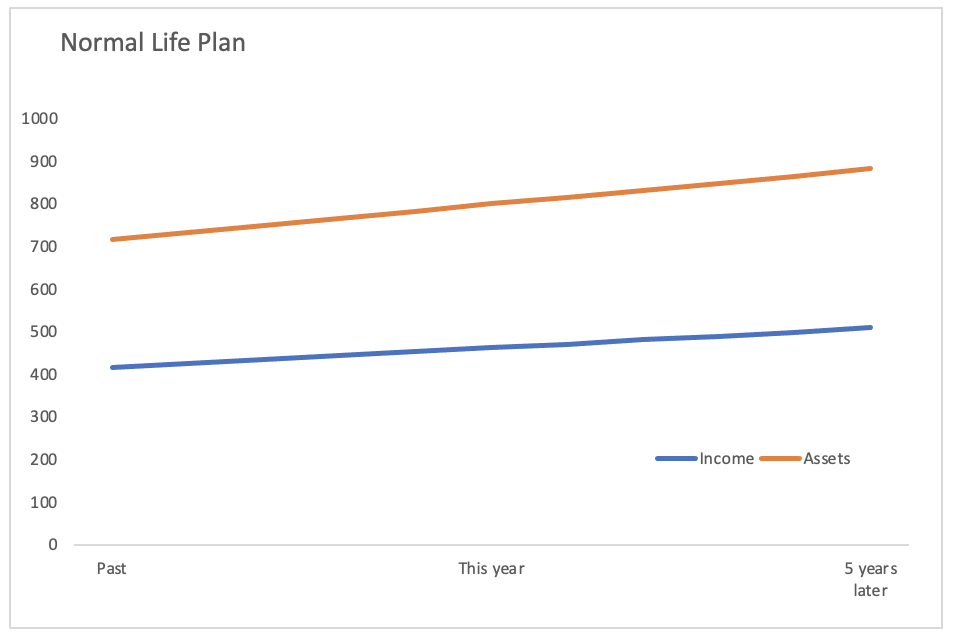

Usually, in a life plan chart, you plan your life events and money plans year by year.

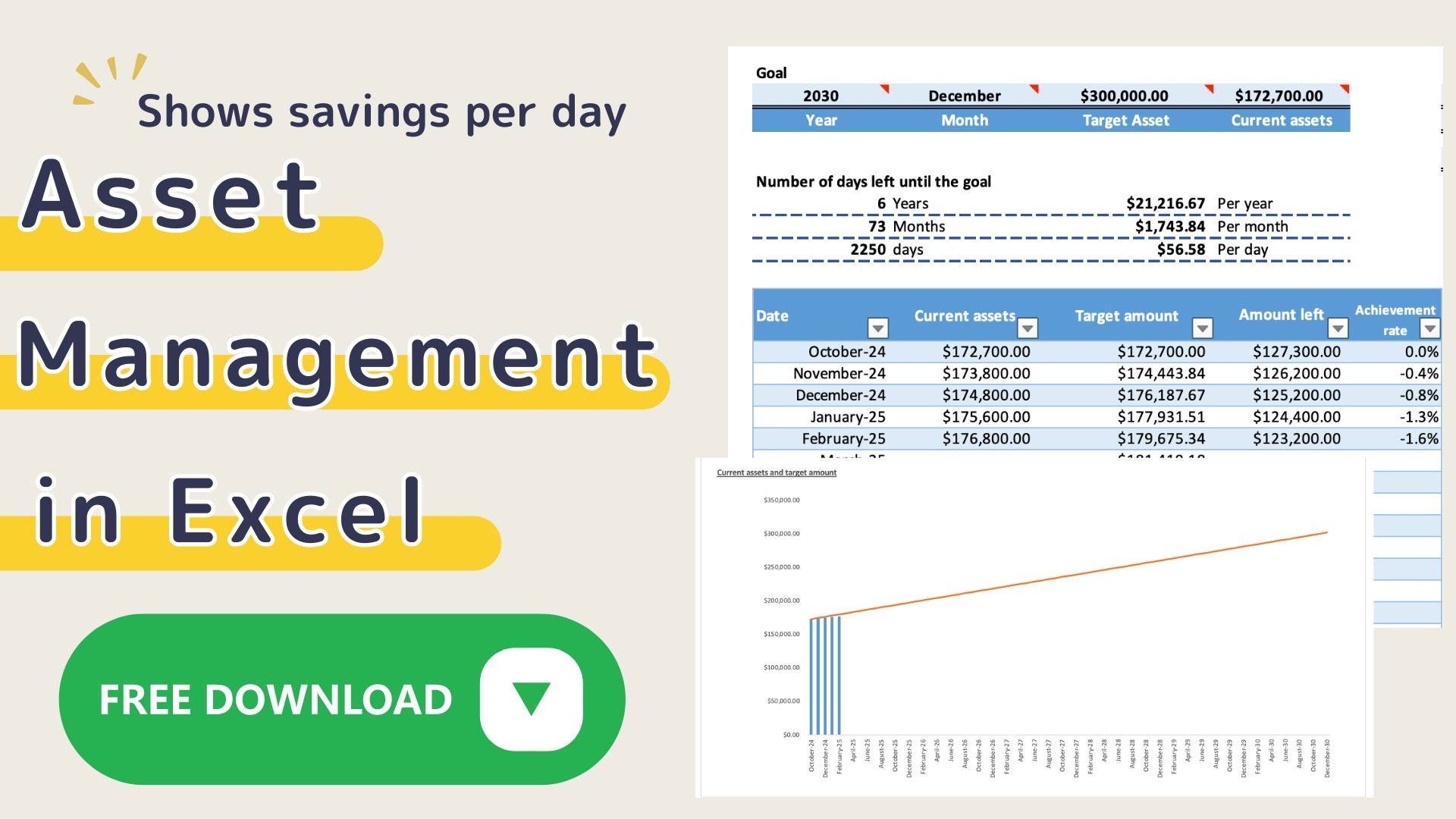

It has the advantage of allowing you to grasp the approximate amount of future events and assets.

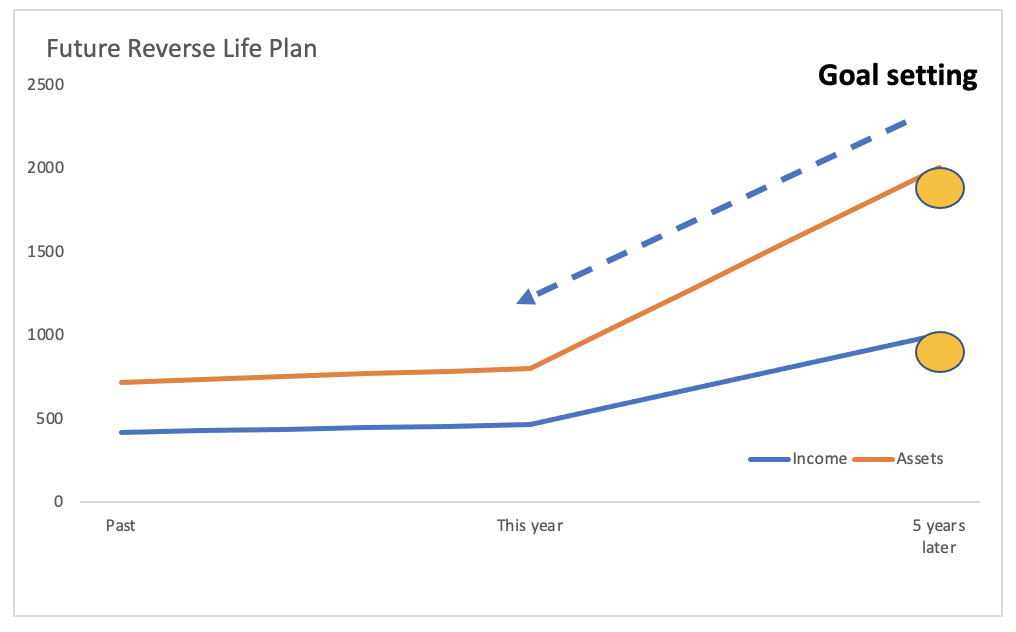

By setting the ideal amount of income and assets five years from now, you can count backwards and grasp the changes in income and assets from one year to five years from now in the Future Reverse Calculation Life Plan Chart.

Normal Life Plan

Future Reverse Life Plan

By setting an ideal future, rather than a future that is an extension of the past to present, you will be able to see what you need to do now.

Procedure for Creating a Life Plan Chart

Create a life plan table in two ways: a normal life plan and a future-reverse life plan table.

- Create a normal life plan tableEnter your age, life plan, this year's income, expenses, and amount of assets, and it will be created almost automatically.

- Take off the limiter and think carefully about your ideal life plan.(If you are married, please discuss it with your spouse.)

- Create a life event and expenses for future reverse calculation.

- Set an ideal annual income and amount of assets in 5 years.

- Set up your income and asset composition from 1 year to 5 years from now.

Set an ideal life plan

The ideal life plan is easier to set up if you imagine what kind of life you want to have in five years.

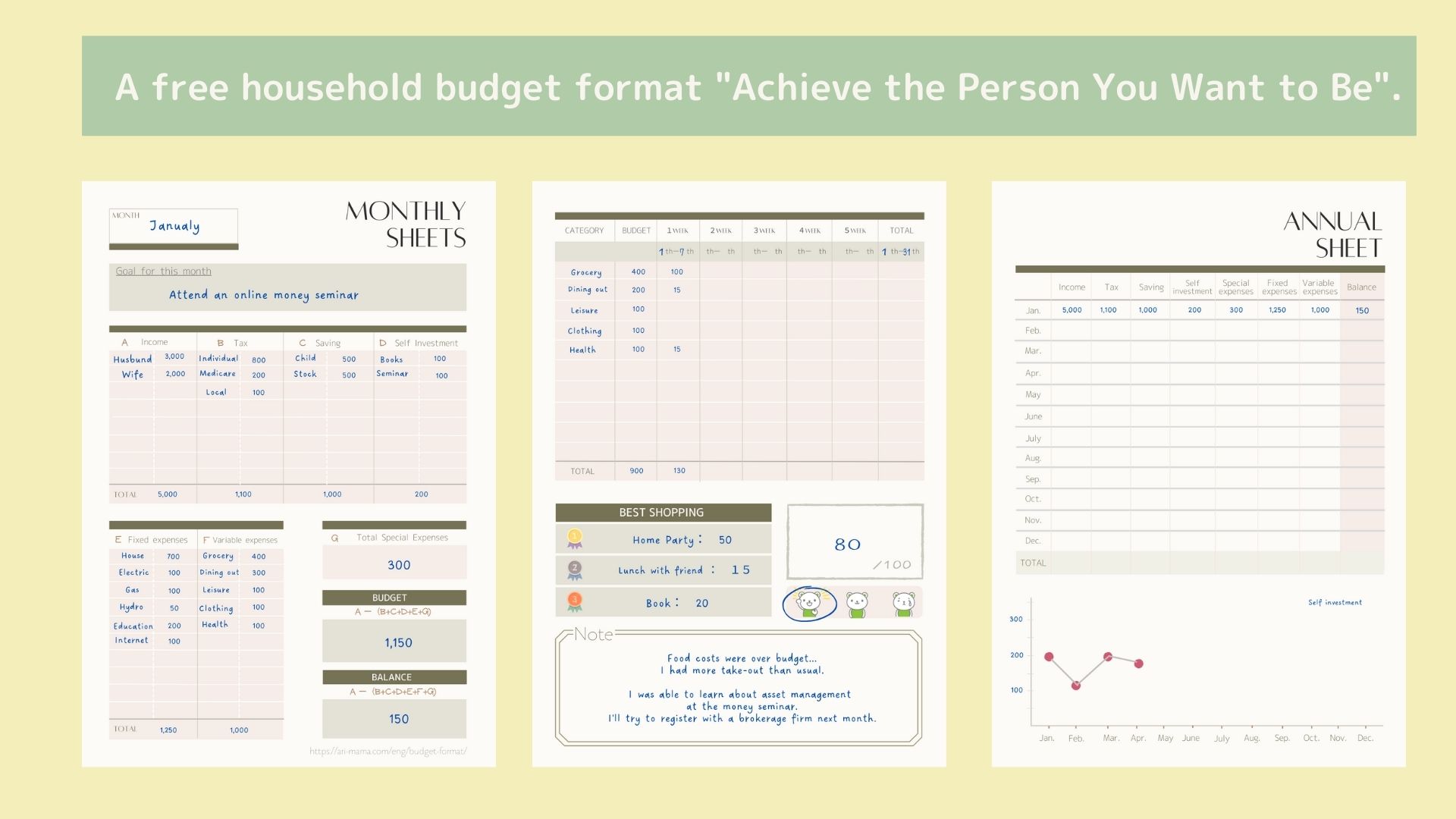

I have prepared a sample in Excel format for you to use as a reference.

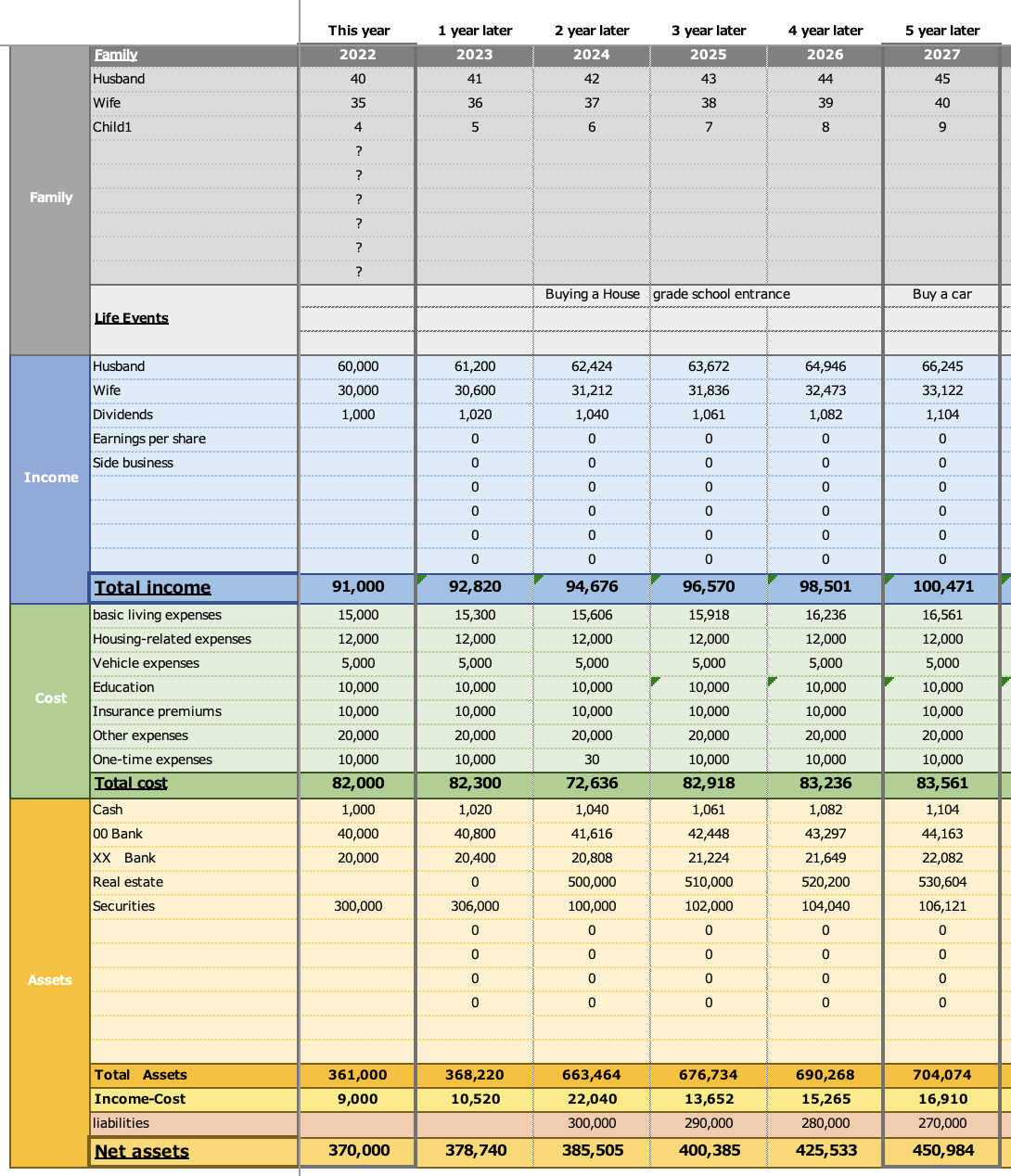

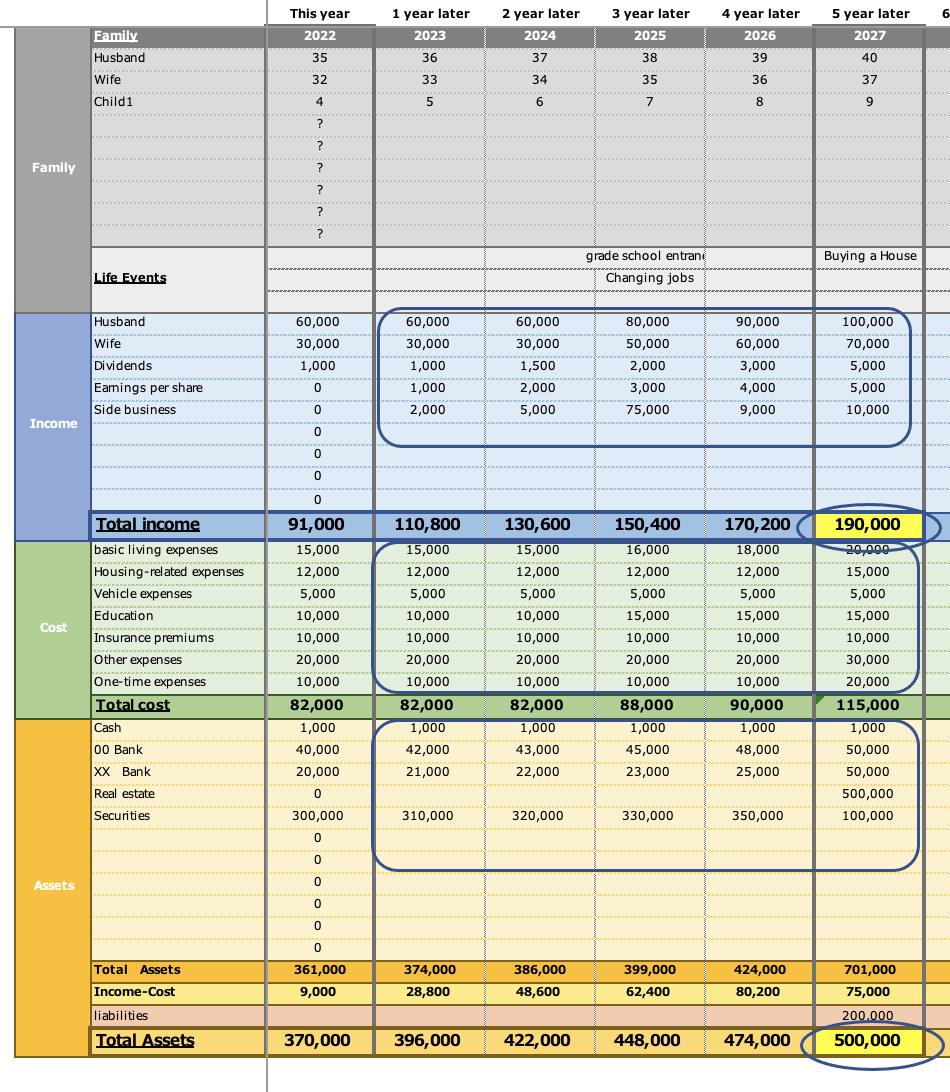

Sample Settings

- Wife, husband, and child live together

- Annual household income: $9 million (take-home pay)

- She is planning to buy a house in 2 years ($30 million) and a car in 5 years ($2 million).

- Current assets: $30million

So we postponed the purchase of the house until 5 years from now, and set our income at $20 million (take-home pay) and assets at $50 million in 5 years.

Try to imagine it like this.

How to Make a Life Plan Chart

How to make a regular life plan chart

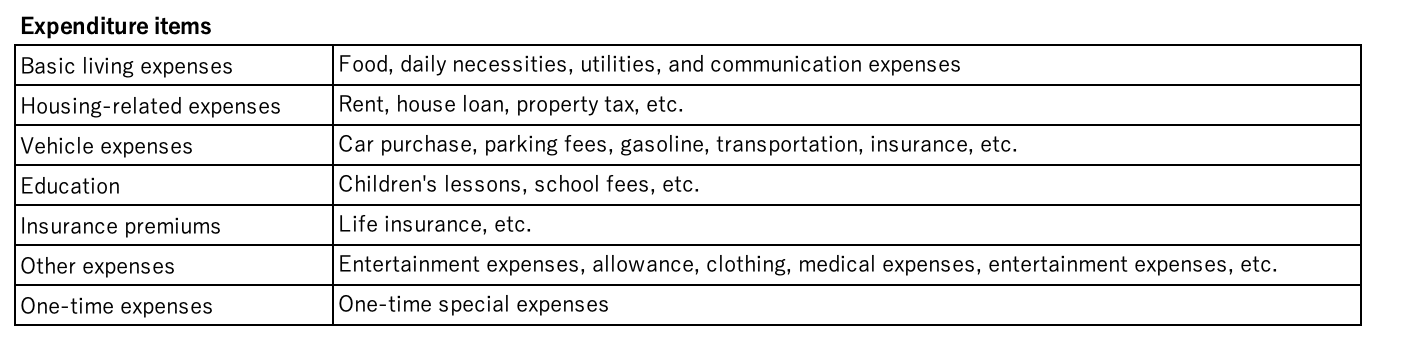

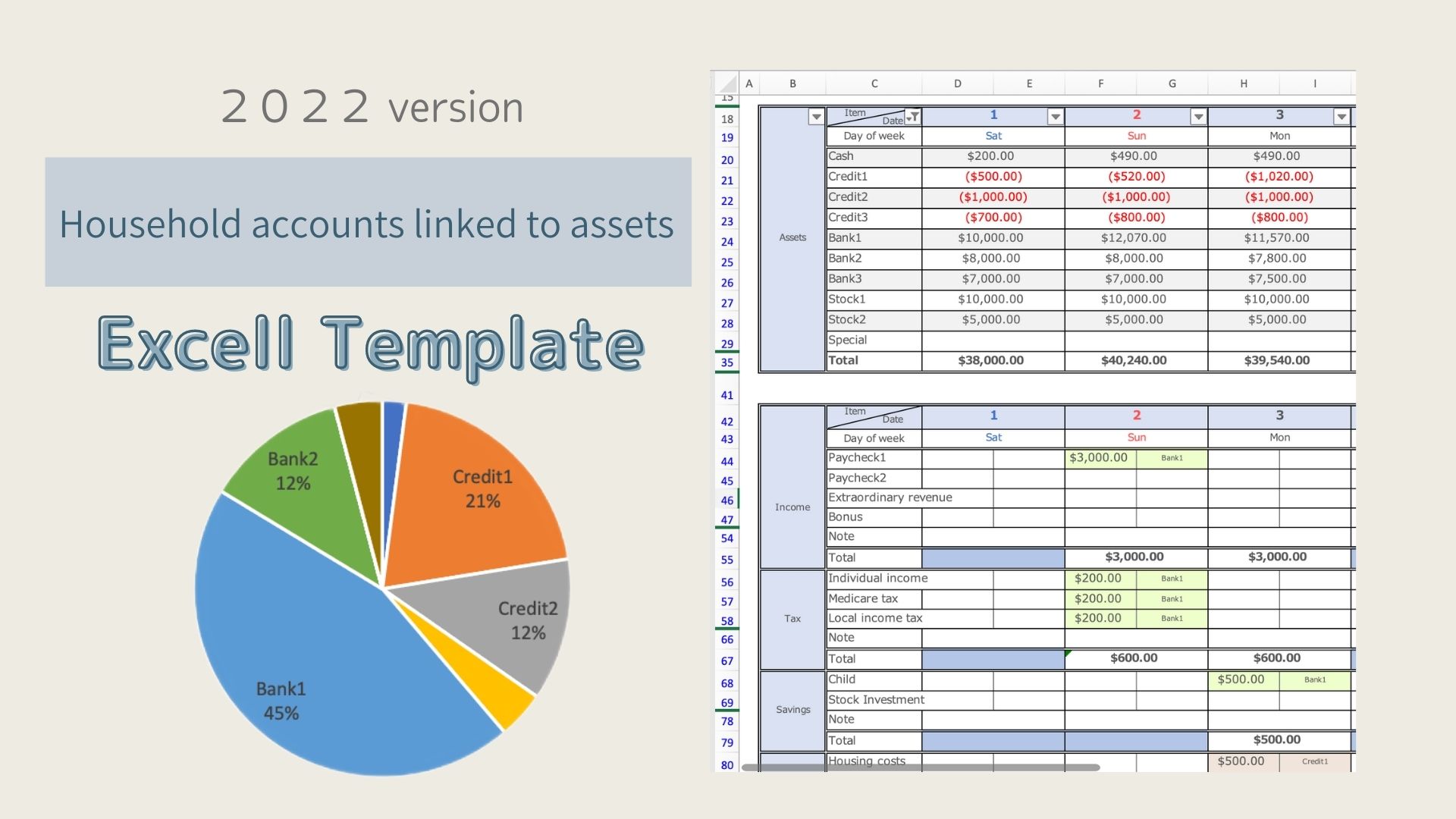

- Enter the family structure, life events, income items, and financial assets items.

- Enter the amount of income, expenses, assets, and liabilities in this year's column.

- Based on this year's amount, the table will be automatically filled in for the next 20 years.

- If there are any corrections to be made in the amount of liabilities or expenditure items, please overwrite it.

- Income, basic living expenses, and financial assets are set to increase by 2% per year.

How to Create a Life Plan Chart for Future Reverse Calculation

- Once you have determined your ideal life plan, enter your life events and expense items.

- Enter the ideal amount in the Total Income and Total Assets columns for five years from now.

- The amounts will be automatically entered in the Total Income and Total Assets columns from one year to four years from now.

- As you modify the income and asset items, enter the amounts in the respective item fields so that they match the total amount.

Normal life plan

Future Reverse life plan

Normal life plans are almost automatically filled in, but with Future Reverse Calculator you have to fill in the information yourself.

This life plan chart goes up to 20 years from now, but you can add more by dragging the 20 years row to the right.

I am currently working on a life plan chart for future reverse calculation, and we are seriously discussing how to increase our income.

By comparing the two ways of life planning, we can see the gap between the normal and future-reversal plans in numbers.

Let's take a hard look at what we need to do now to achieve our ideal future.

Note: This life plan chart is only a guide. We do not guarantee its accuracy or completeness.

How to Download

This life plan table is available for free.

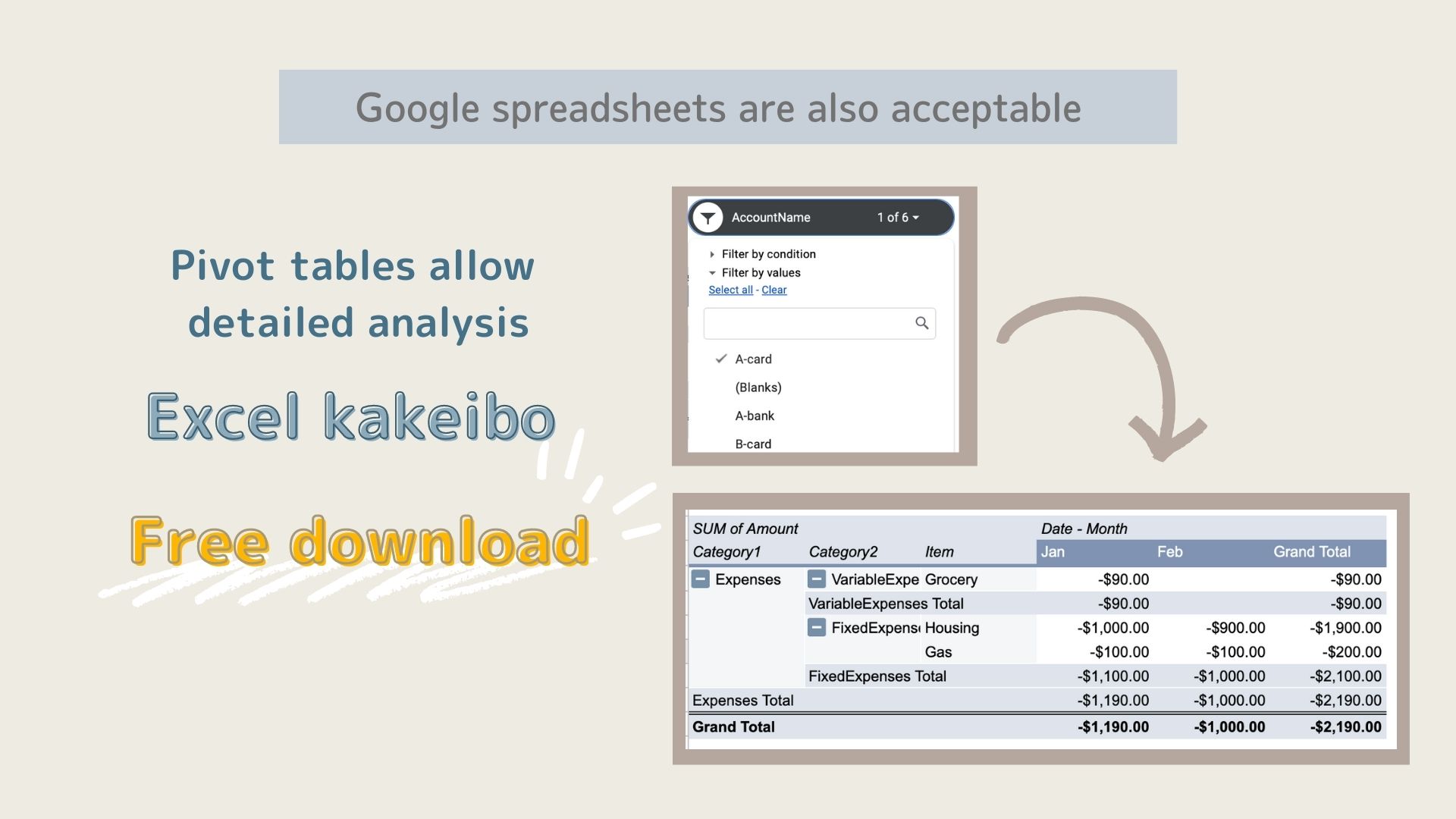

The Excel file contains sample sheets, guides, a regular life plan table, and a future-reverse life plan table.

Click on the download button to use it.