I keep a household account, but I don't know how to improve it.

Do you have such a problem?

This Excel family budget book solves such problems.

Features of Excel Household Budgeting

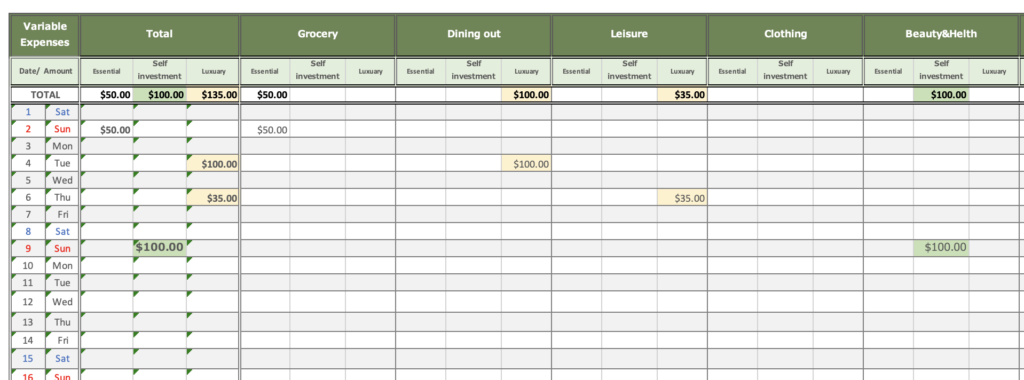

Normally, when recording in a household account book, we categorize by expense category (food, daily necessities, etc.), but by categorizing by money usage separately from expense categories, we can see what is necessary.

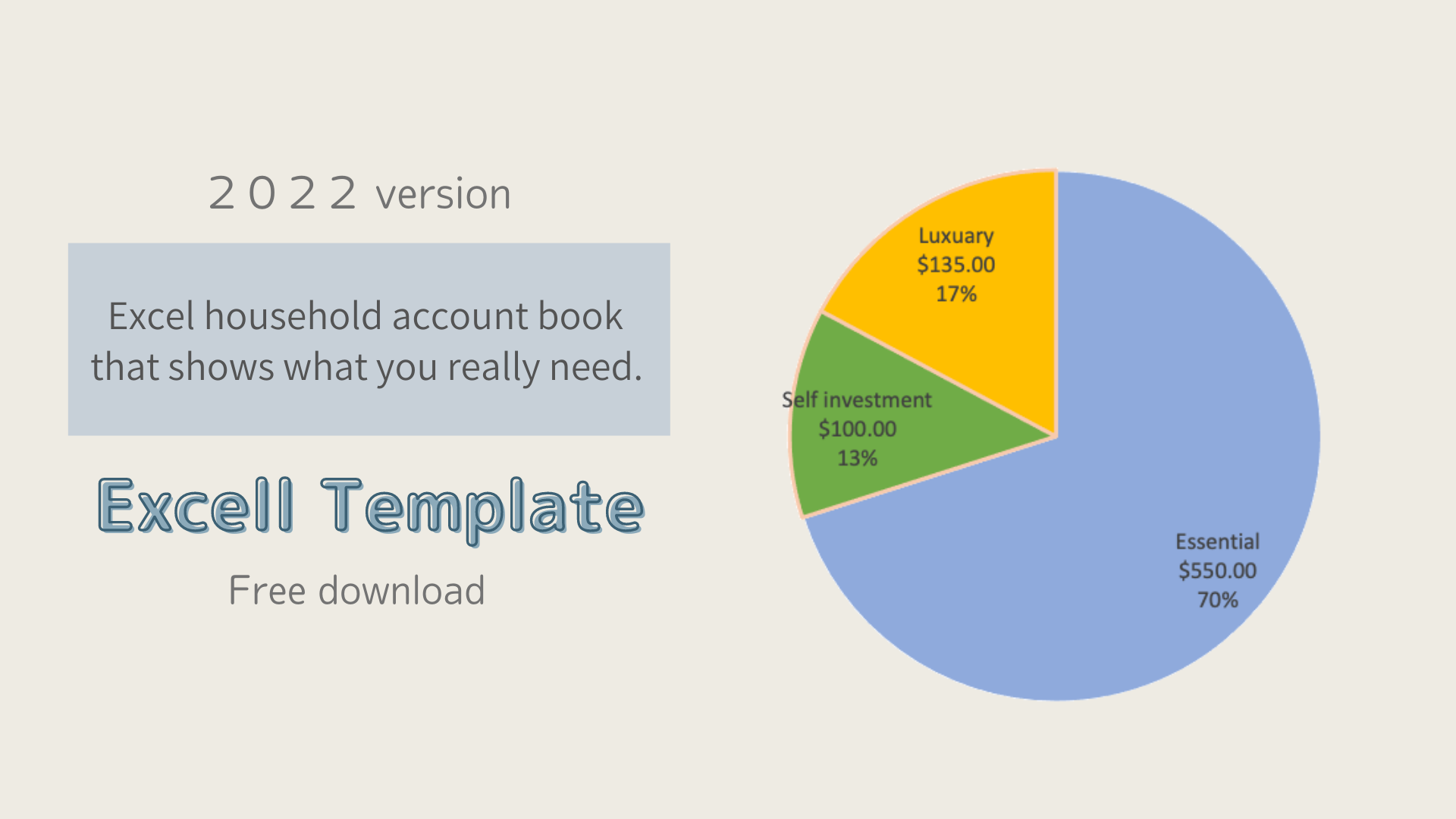

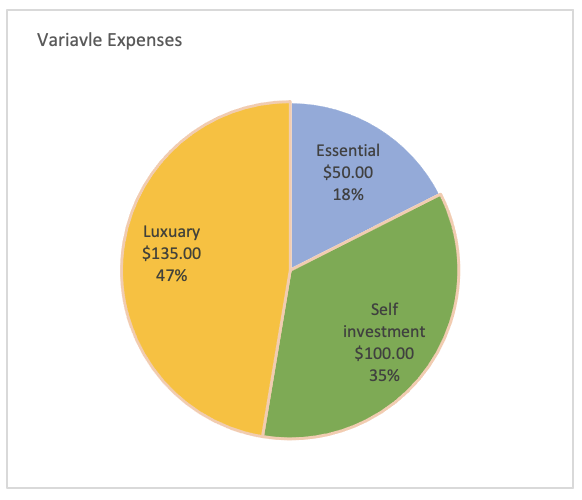

How to categorize the use of money

■Essential Items

Essential items for daily life

■Self-investment

Items not necessarily need but expected to be recouped in the future

■Luxuries

Items that are not necessarily need but enrich our lives and minds

I was previously categorized into consumption, investment, and waste.

The difficulty with this classification method is that different people have different values, so the judgment tends to be ambiguous.

Entertainment expenses or a cup of coffee at a café can be regarded as necessary consumption for refreshment, not wastage.

However, if we classify them as luxuries rather than wastes and essential items rather than consumptions, the criteria are clear and it is easier to make a judgment, isn't it?

Following this classification method, you will not only know the minimum monthly cost, but you will also be able to visualize how you spend your money with certainty, as you will know the percentage spent on luxury items and personal investments.

How to record household accounts

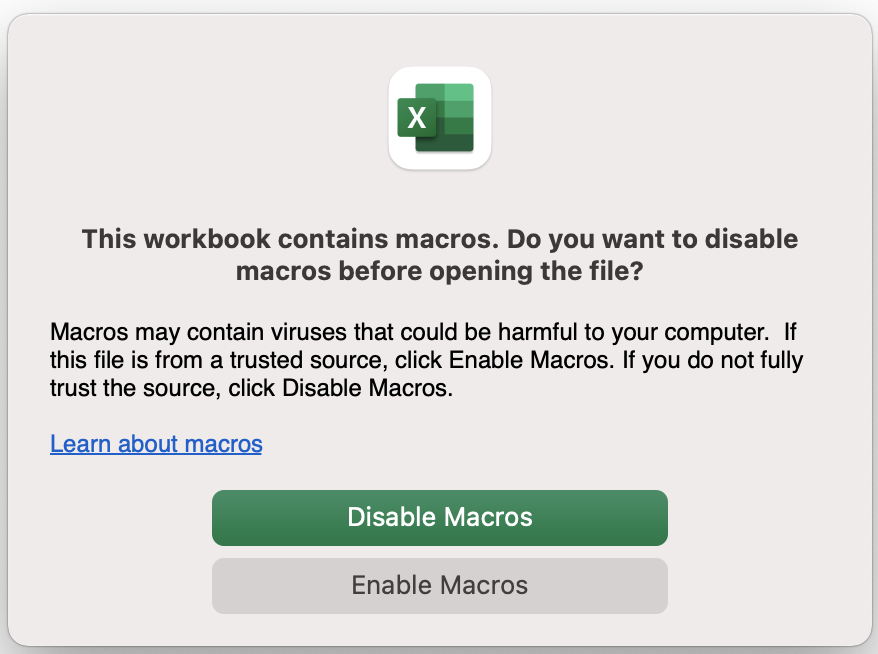

This Excel household budget book uses macros.

Open Excel and click on "Enable Macros".

Setting

First, set up the expenses.

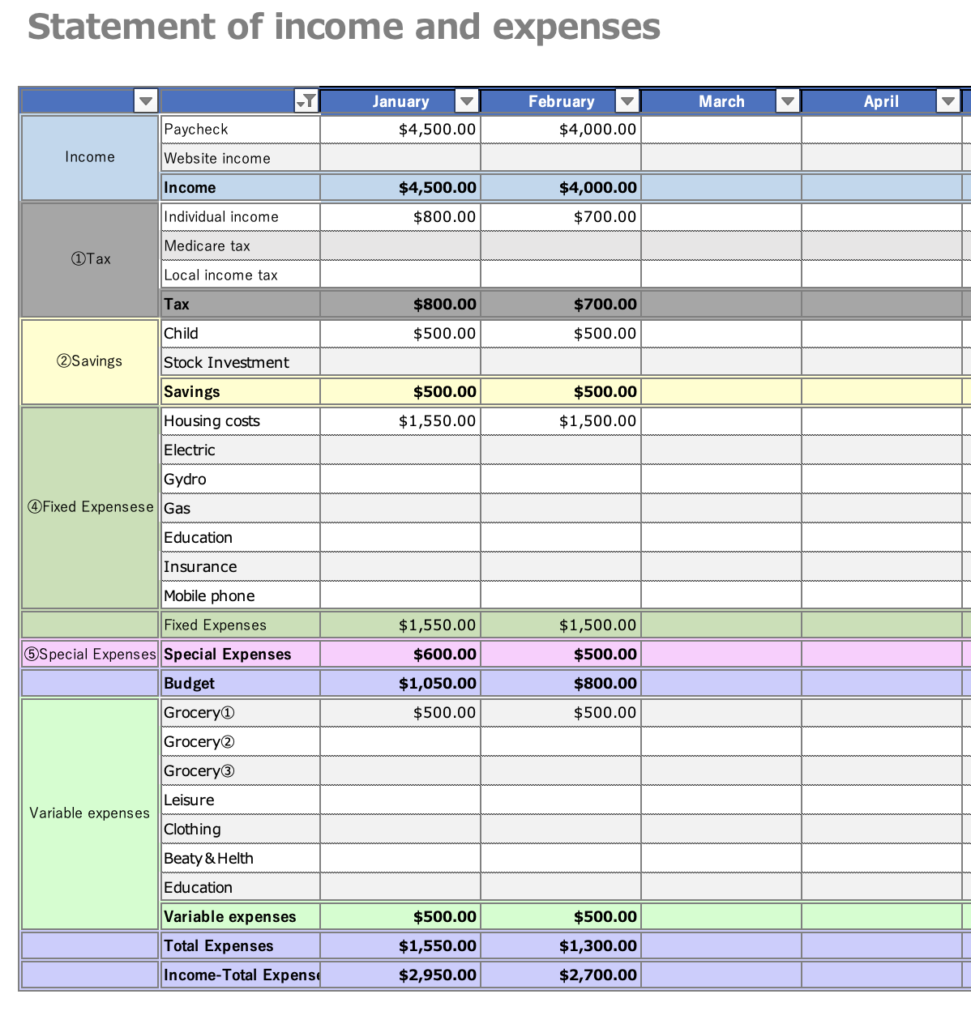

- Income

- Tax

- Savings

- Fixed expenditure

- Variable expenses

- Start Date

- Select Currency

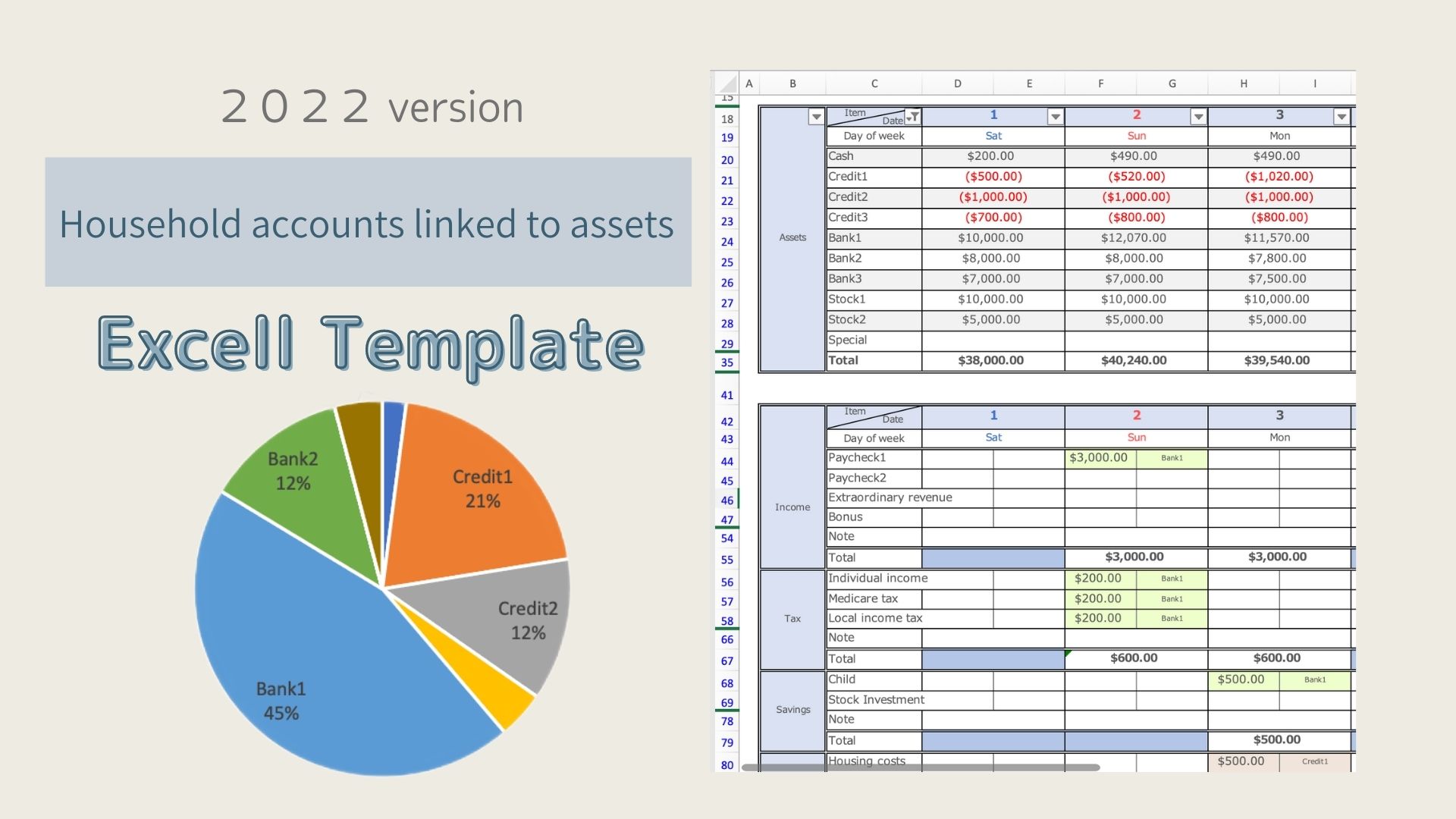

Set up the expense items

Enter the item names for income, taxes, savings, fixed expenses, and variable expenses.

The item names you enter will be reflected on the respective sheets.

Select the start date

The date will be set to match the start date in each month sheet.

you can change the start date to match your payday, etc.

Saturdays are shown in blue, and Sundays are shown in red.

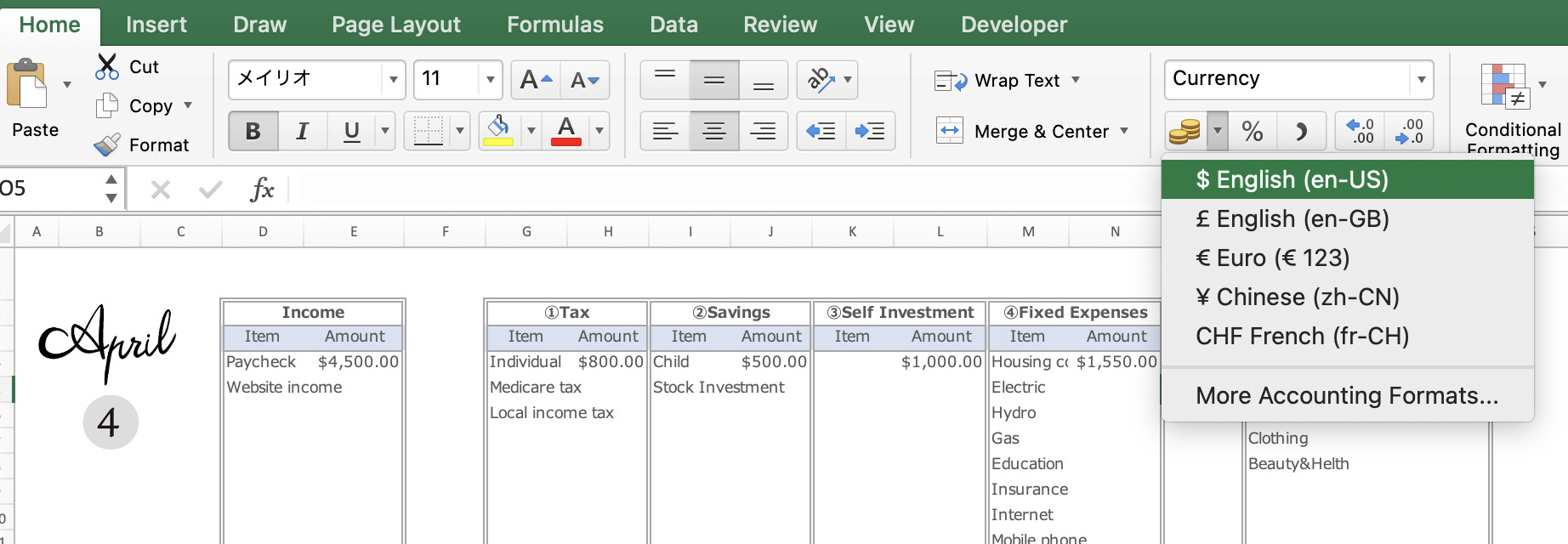

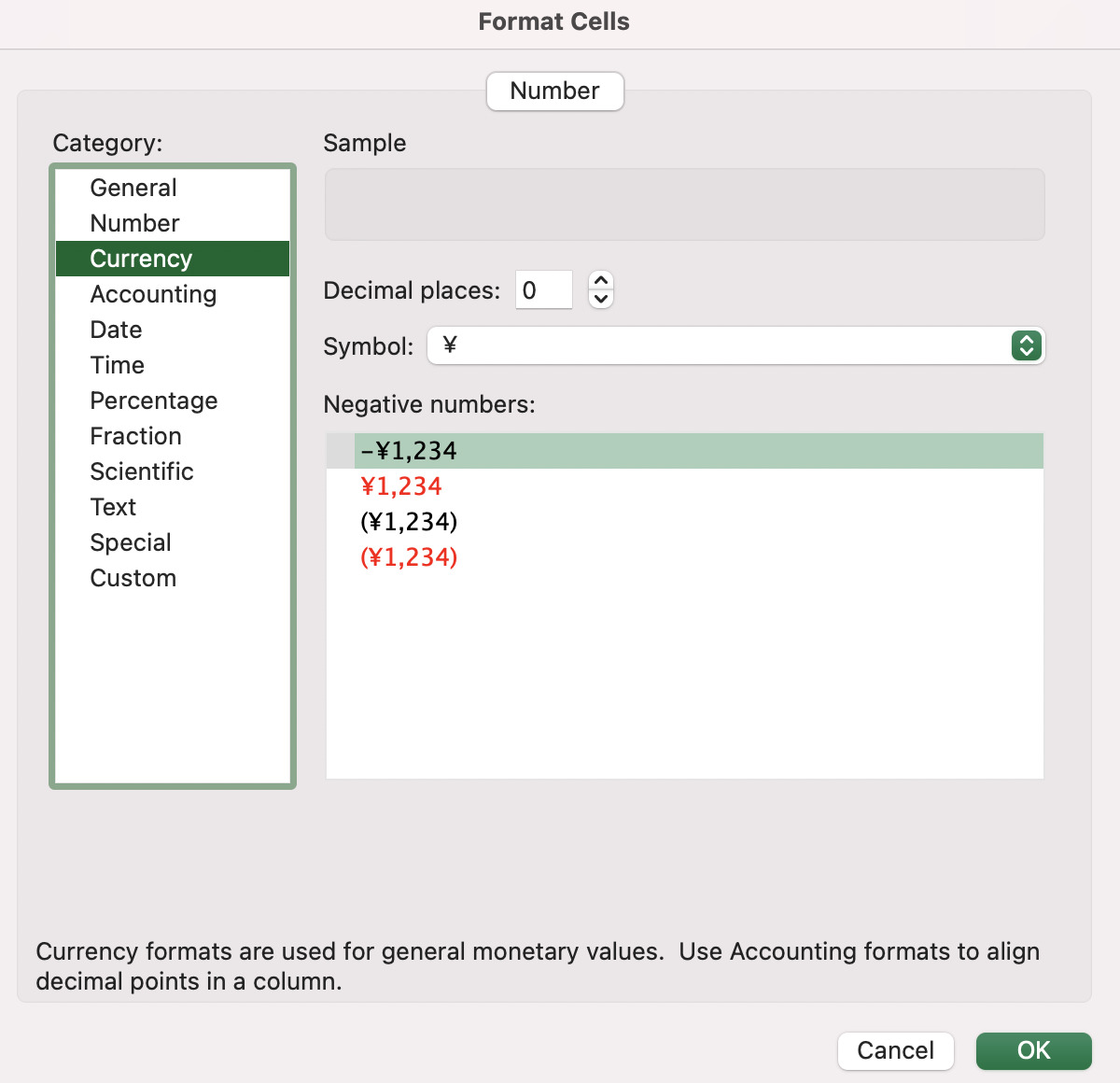

Change the currency unit

Press the "Select Currency" to select a range of currencies.

Select the currency unit for each sheet.

The January-December sheets can be changed in units at the same time.

Please change the units of the other sheets after changing the month sheet first.

Click on the money symbol to select the currency unit.

Click on the ”More Accounting Format” to see more unit information.

The default setting is in dollars.

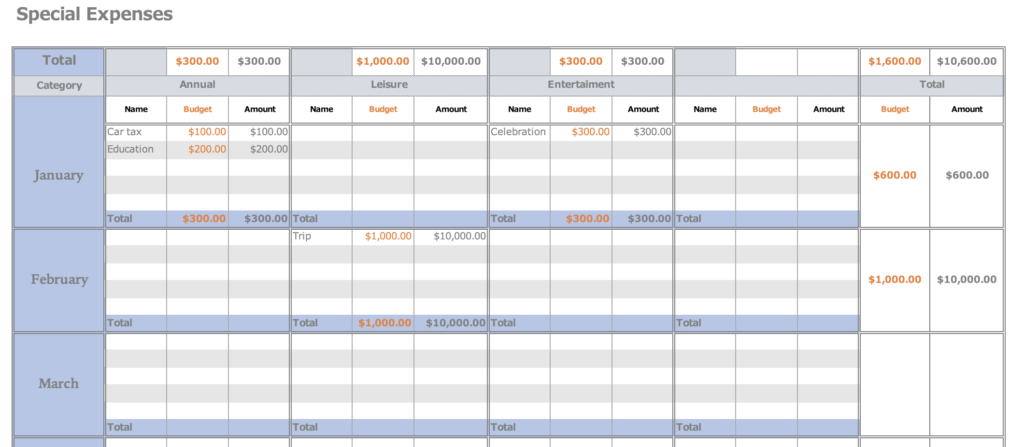

Special expenses are managed in a separate sheet.

Special Expenses

Special expenses are those that do not occur every month but are special expenses and should be set to a large amount, such as event expenses or annual payments.

You can set them up by month and by expense category, so it is easy to look back.

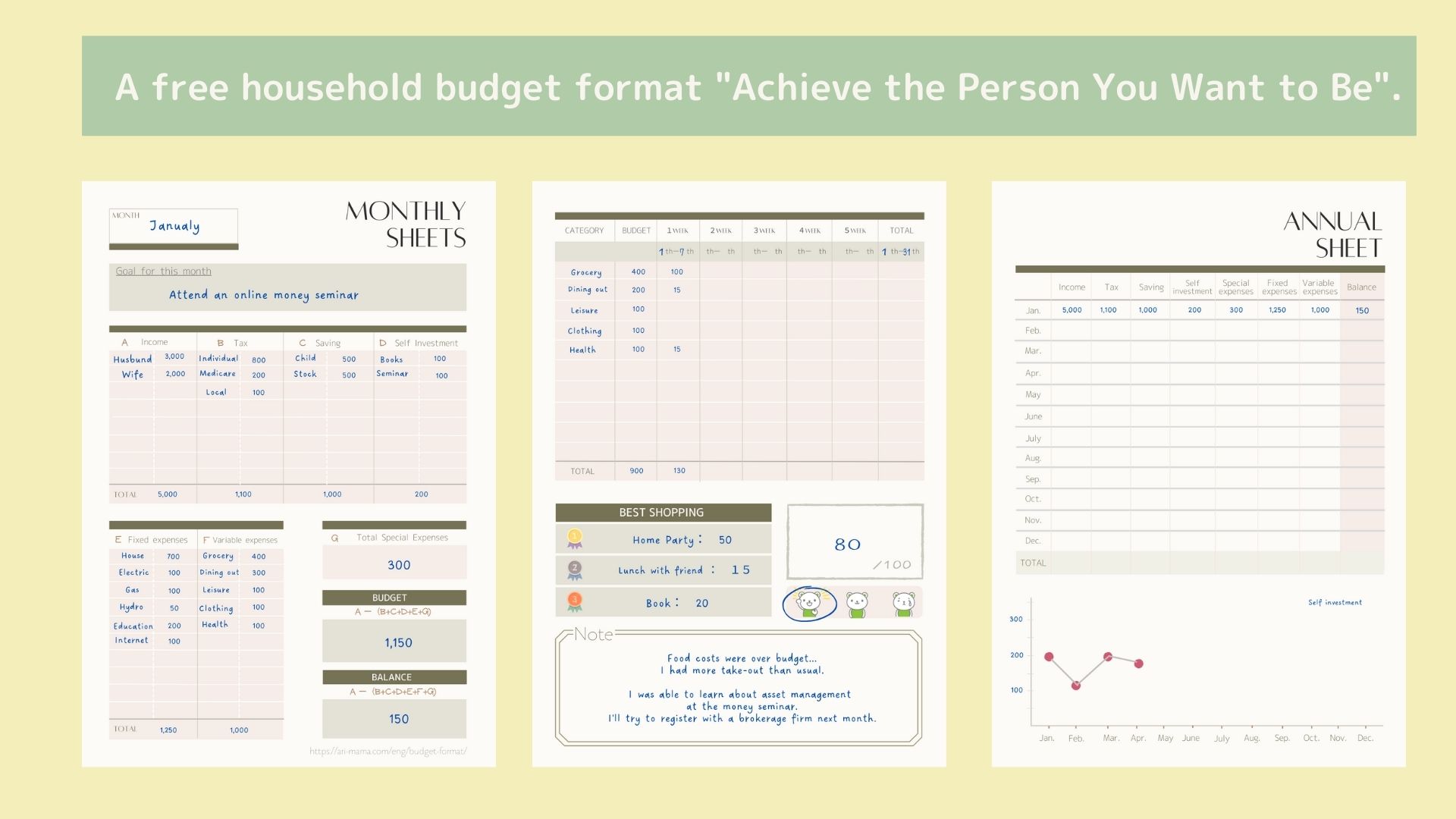

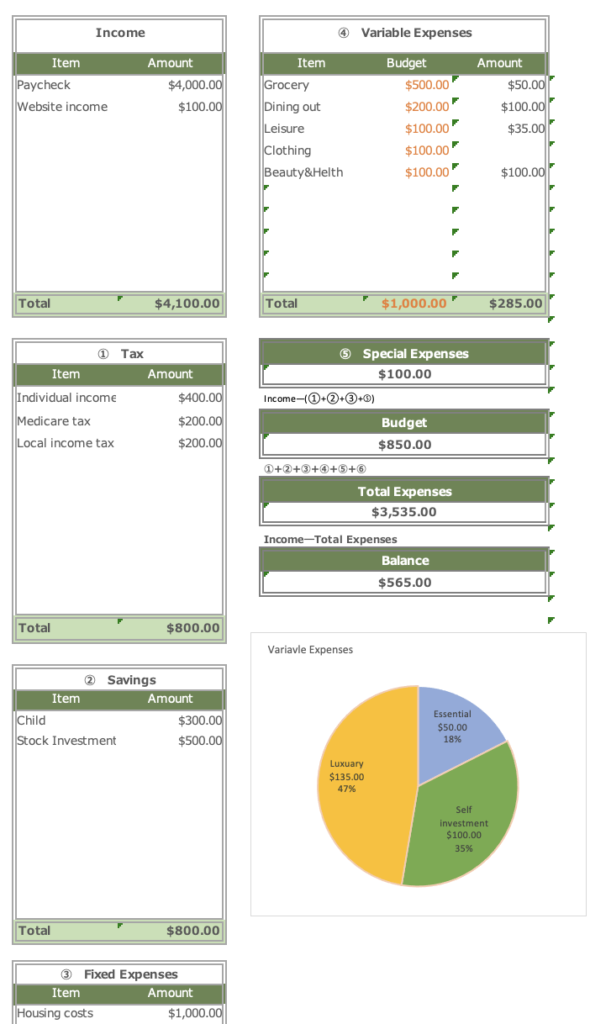

Monthly Sheet

The expense items set in the settings are set on the monthly sheet (Jan-Dec).

Enter the actual expenses for Income,Tax, Savings, and Fixed Expenses, and the budget for Variable Expenses.

The amount entered in Special Expenses is automatically entered in the Total Special Expenses column.

How to Enter Variable Expenses

Variable expenses are categorized into essential, self-investment, and luxury for each expense category.

Entering the amount in the Self-investment and Luxury columns will automatically color them green and yellow, respectively.

When you enter a variable expense, a pie chart will be displayed showing the amount and percentage of each category (essential, personal investment, and extravagance).

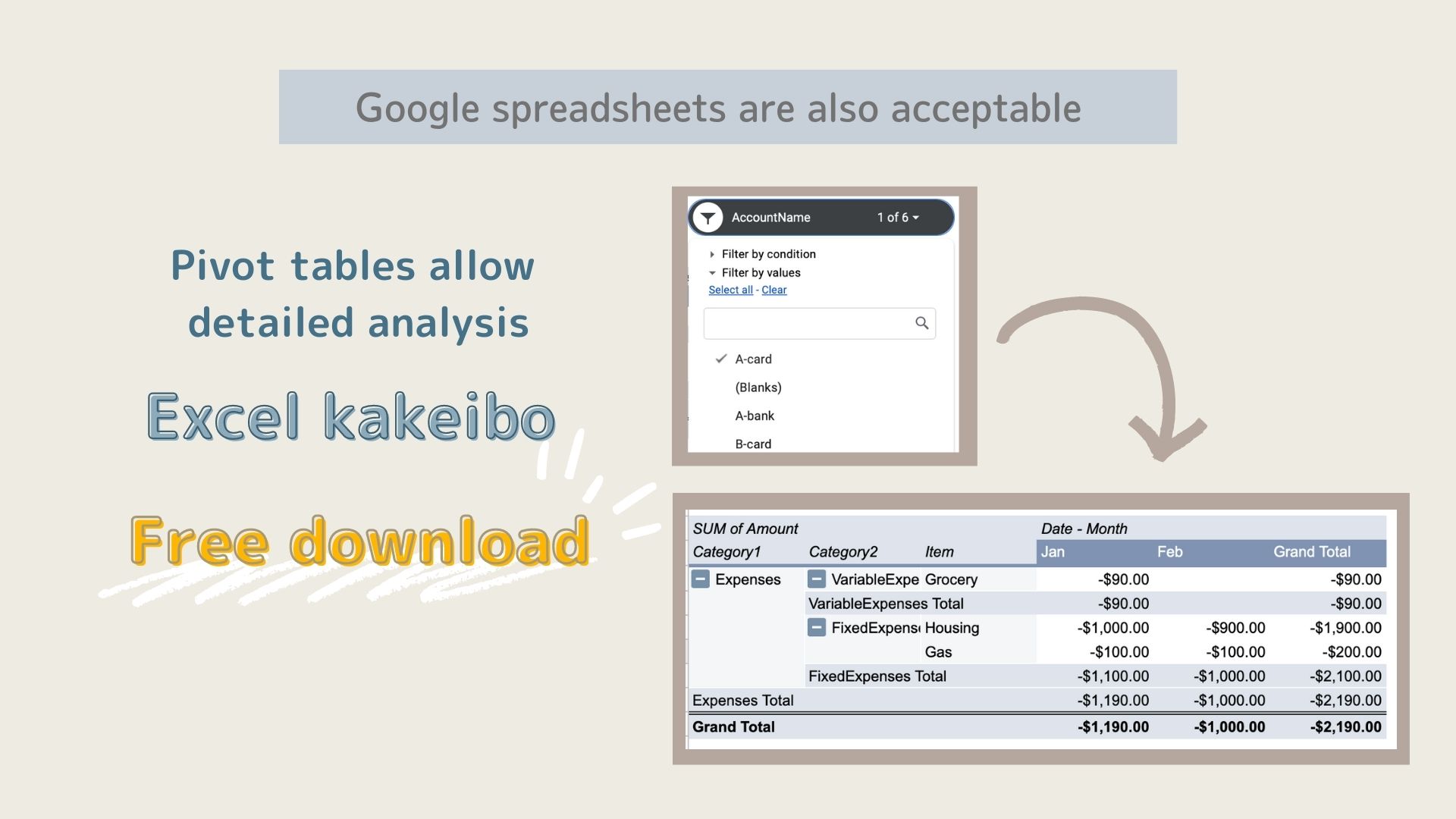

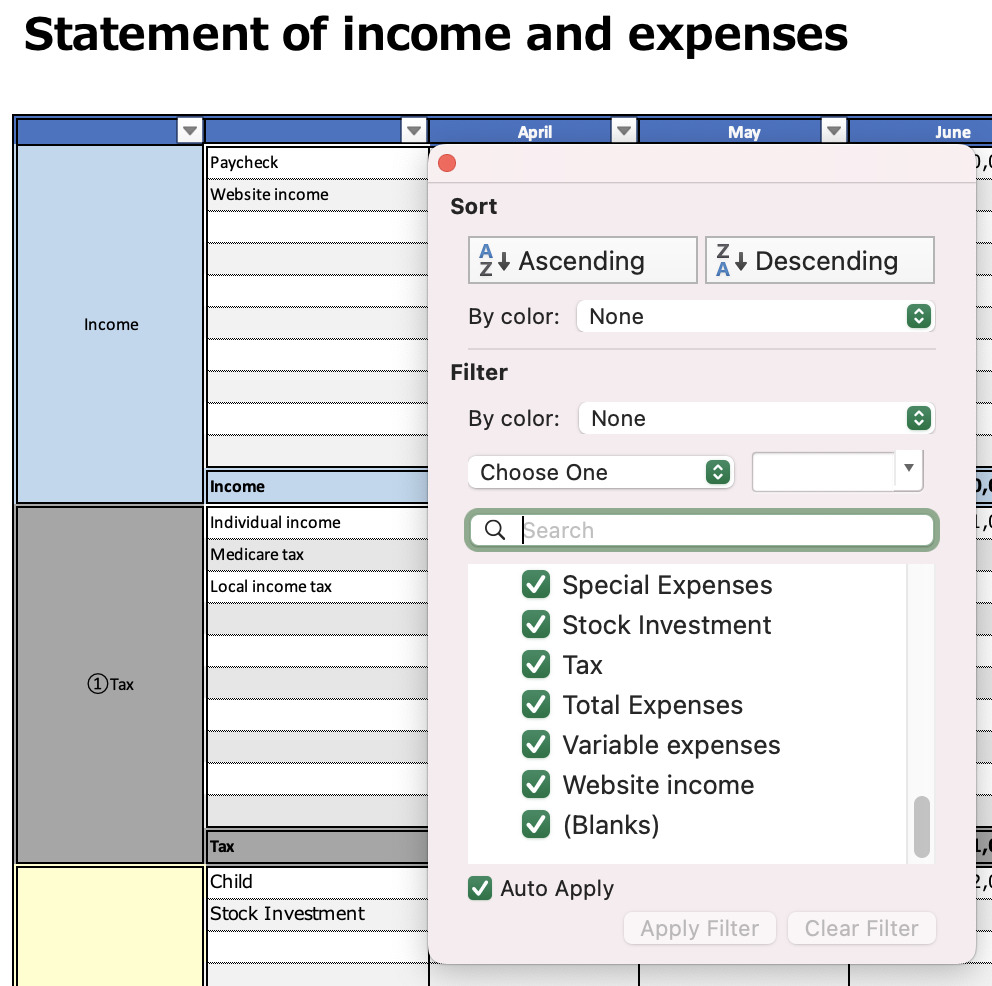

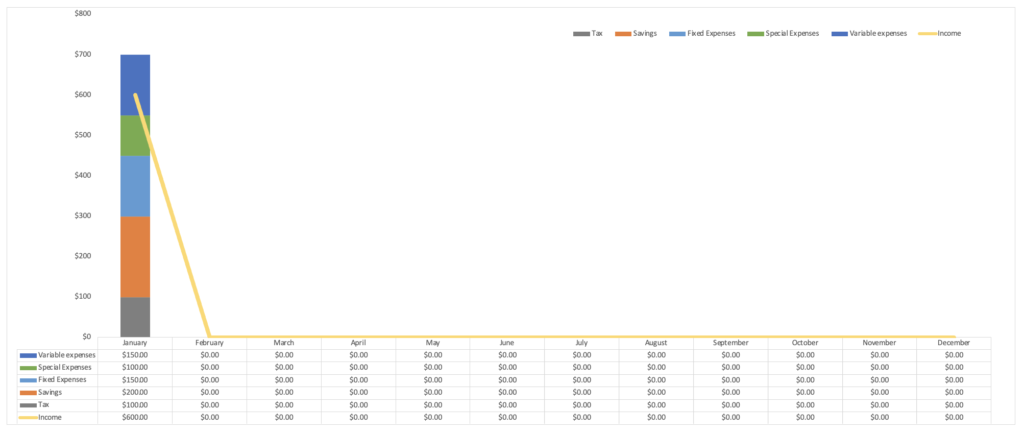

Annual Sheet

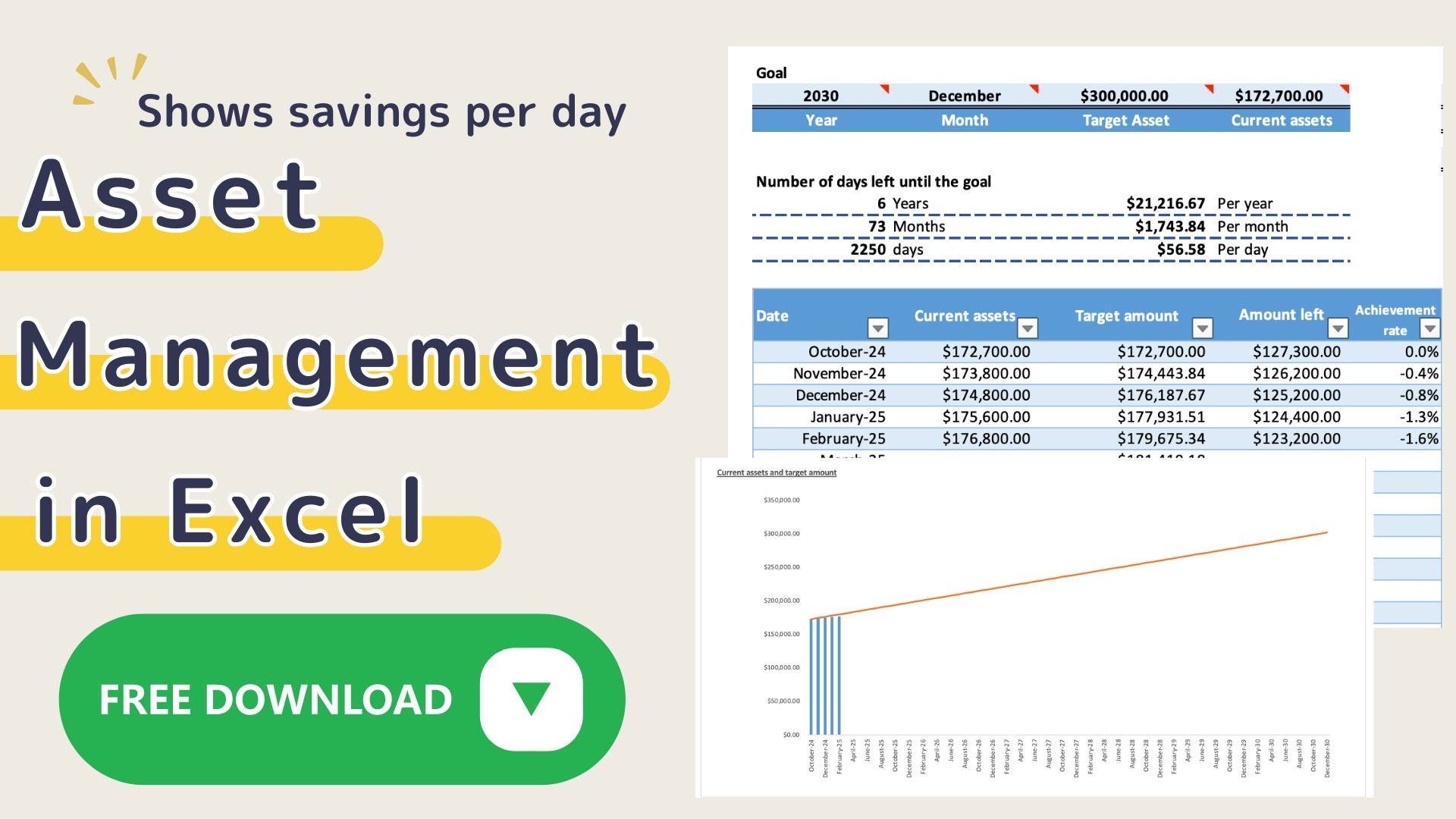

There is a column to fill in the target and set the asset target.

Select the filter in cell C4 and uncheck the blank cell or 0.

The monthly entries are reflected in the monthly items and the annual trend can be viewed in a graph.

To budget for variable expenses, please refer to this month's budget (income - (savings + fixed expenses + special expenses)) in this month's summary.

Points to improve household finances

Basically, it is important that monthly income - expenses not be negative.

If they are negative, check to see if income -essential expenses is negative.

If it is negative for necessary expenses, reviewing fixed expenses and essential items may help.

These methods depend on how much you have saved.

If you have some savings, you can put some money aside for personal investment, even if it is a bit overwhelming.

Of course, luxury is also essential to enriching your life, so first check the ratios and find out how well balanced you are both financially and mentally.

Free download

This "Credit Excel Household Budget" uses macros.

I know that some people are reluctant to use macros.

Here's what I can do

I make the macros visible.

The default setting of Excel is to disable macros.

Click on the Develop tag and take a look at Visual Basic.

To download, click the download button below.

Press the download button below.

Sample sheets are included in the Excel Household Budget.

A ZIP file will be downloaded, and you can use it by unzipping it.