What is a kakeibo book?

A household account book (kakeibo) is an account book in which the income and expenses of a family are entered. Since there are no firm standards, there are many different forms. It is similar to a statement of cash flows, as it mainly records income and expenditures of cash and cash equivalents. The general purpose is to avoid spending more than one's income and to keep one's finances sound.

Invented by Motoko Hani in 1904.

Source:Wikipedia

Similar to a company financial statement, it records monthly income and expenses (taxes, rent, vehicle expenses, living expenses).

By recording this information, it is possible to determine how much surplus money was generated and how much was not.

Many kakeibo books are sold in bookstores in Japan every year.

It usually begins in January or April and is recorded throughout the year.

Since there are no clear rules for household accounting, a variety of recording methods exist.

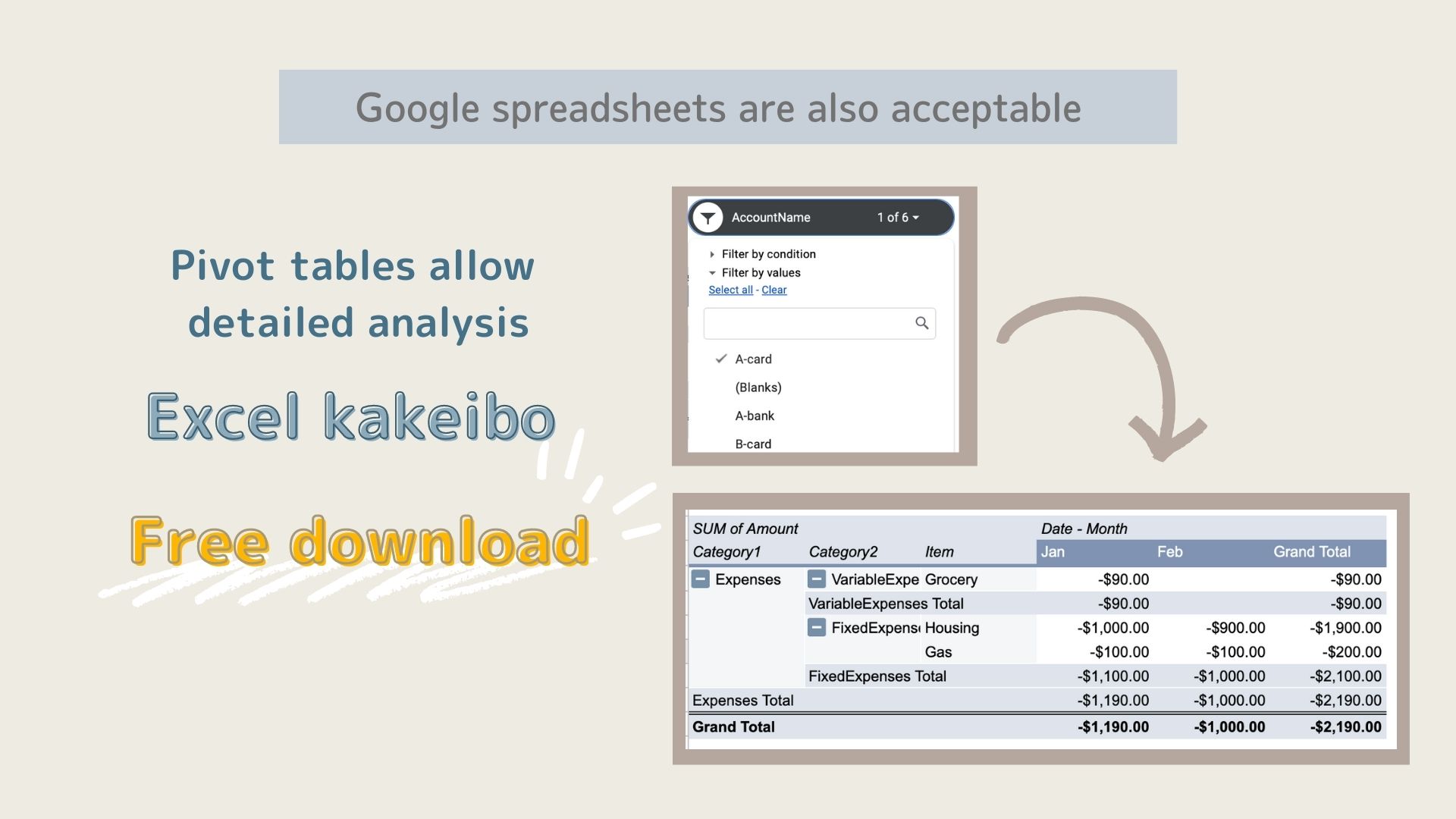

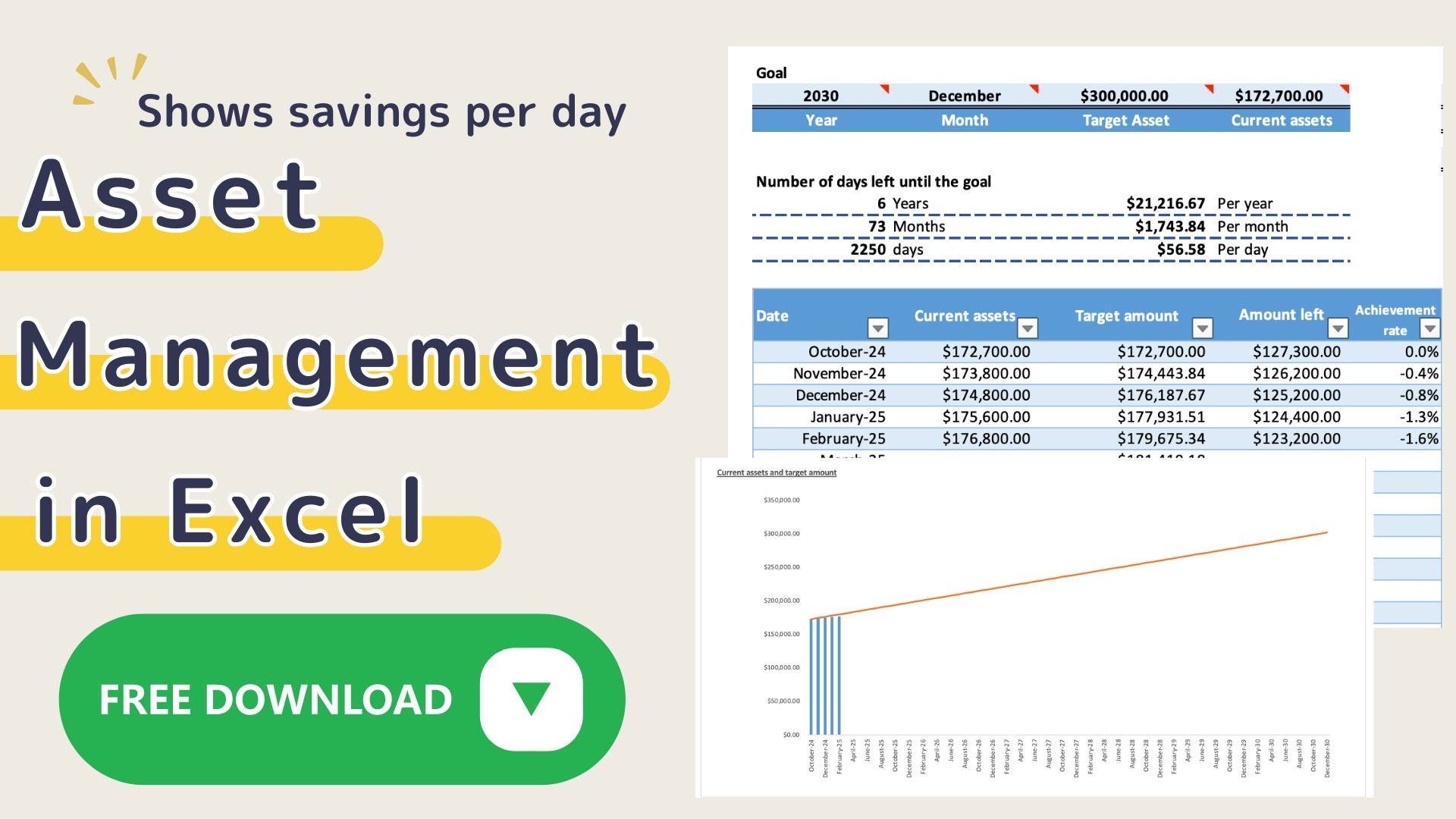

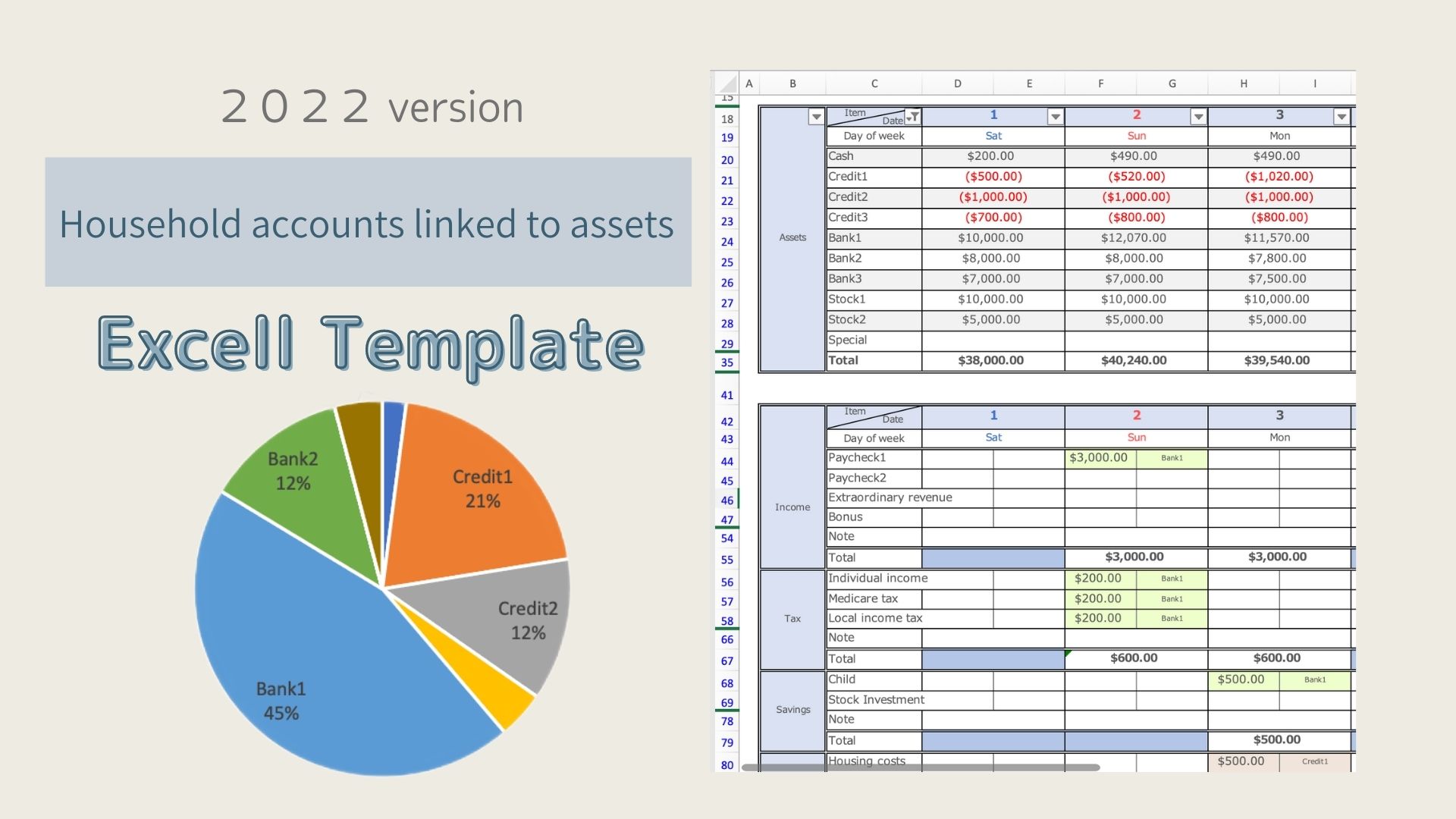

In addition to kakeibo books, there are also ways to record in Excel, and uses of software and apps to manage them.

Benefits of Keeping a kakeibo

It can correctly measure how much you have spent.

You can record exactly what you spent and how much you spent, by category.

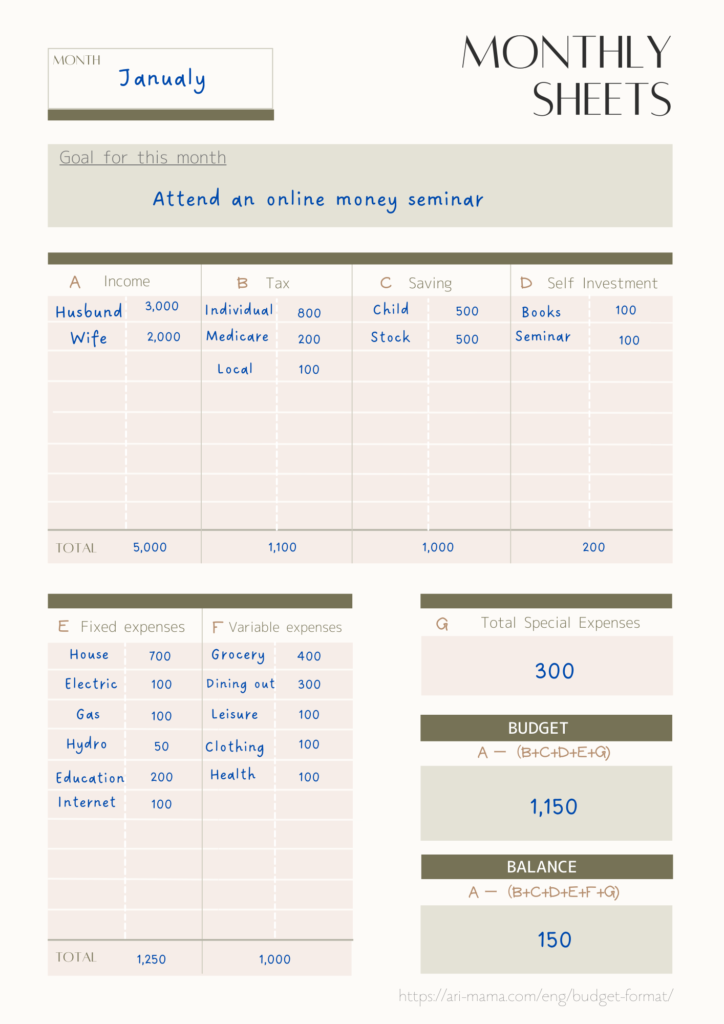

Categories generally fall into the following categories: taxes, savings, fixed costs, and variable costs.

Know your monthly money balance.

Income - expenses shows how much surplus or deficit was generated.

Know your monthly budget.

You know the approximate amount of your income, taxes, savings, and fixed expenses (rent, vehicle, education, etc.).

Income - (Taxes + Savings + Fixed Expenses) = Budget

You will know how much you can spend each month on variable expenses (food, daily necessities, entertainment, etc.).

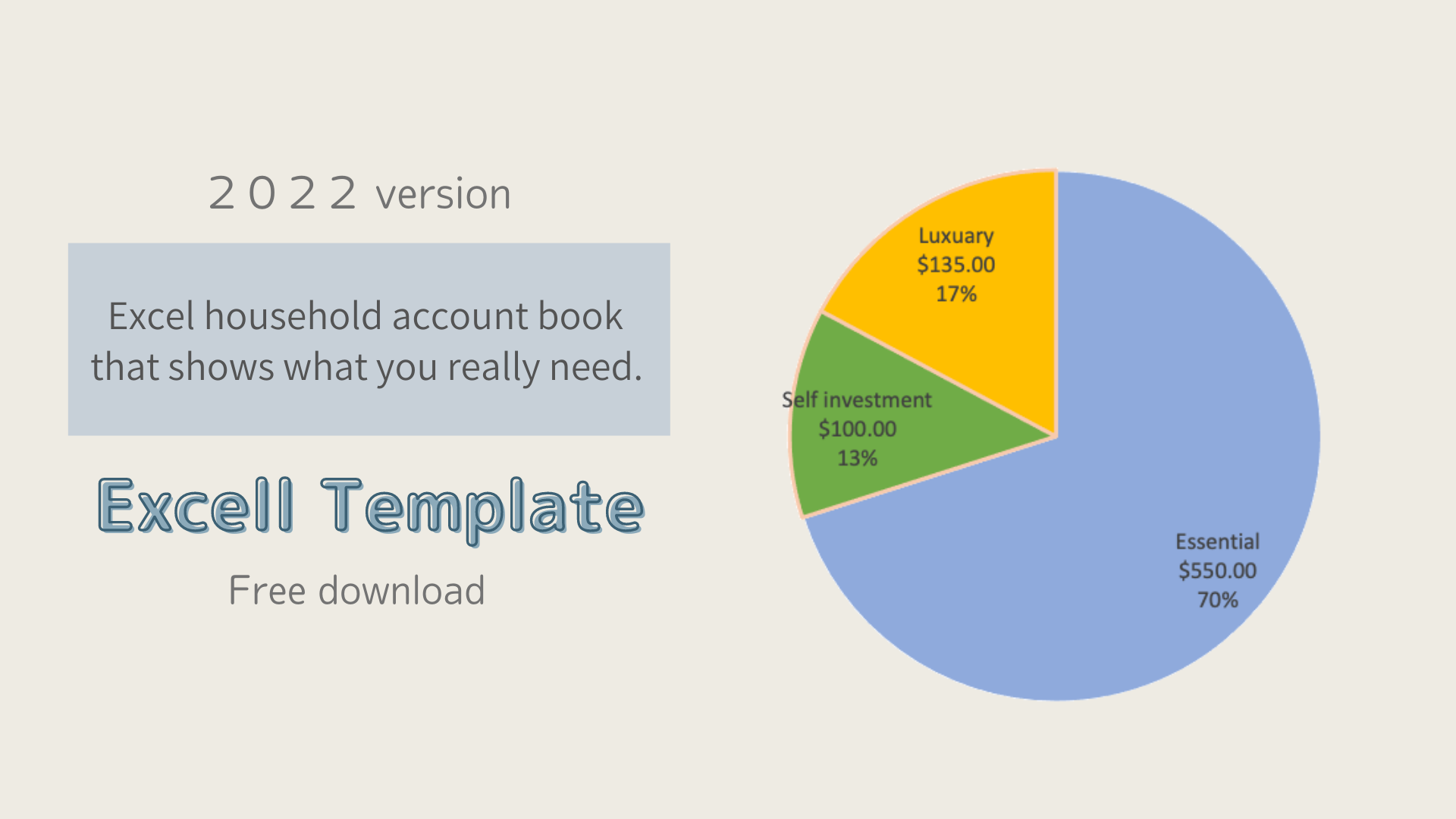

Can visualize how money is spent.

You can visualize what kind of money you spend and what you buy by category.

In addition, by recording detailed information such as food expenses, you can identify behavior patterns that have become habitual.

Identify the causes of the pressure on your household budget.

It calculates the percentage of each of taxes, savings, fixed costs, and variable costs, so you can see which expenses account for the most.

For example, if fixed costs account for a large percentage, you will know which items, such as rent, utilities, and education costs, are putting pressure on your household budget and which items you should cut.

Know your money priorities.

You will know which items you should prioritize to spend your money on.

If you want to increase your savings, instead of saving the monthly surplus, you can set aside an amount for savings at the beginning and work with the rest of your budget.

If you want to spend more on education, you can also look at your past monthly household budget to see if there are other items you can cut back on.

How to record effective kakeibo

Clarify your purpose

The most effective way to use a household account book is to be clear about the purpose for which you are recording your finances.

I want to increase my income.

a household budget that allows me to pre-budget my personal investments each month.

-

-

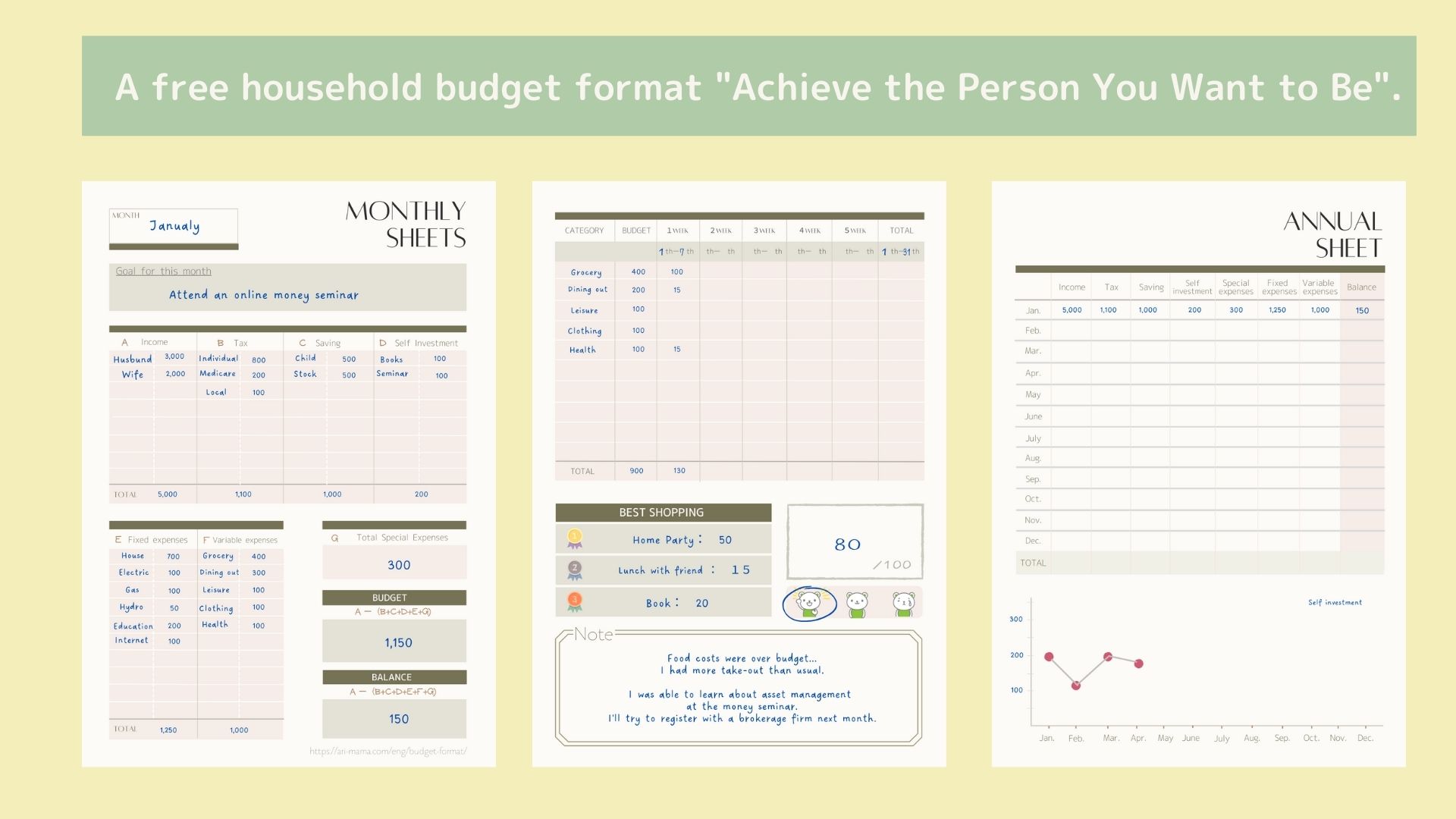

[2023 version] Excel Kakeibo template(free),I recommend it to anyone who couldn't last.

This Excel Household Budget is the 2023 version of the [2022] Excel Household Budget recommended for those who couldn't last. The [2023 version] has been ...

Record in a household account book by classifying consumption, waste, and investment.

-

-

Excel household account book that shows what you really need (free template available for download)

I keep a household account, but I don't know how to improve it. Do you have such a problem? This Excel family budget book solves ...

Categorize costs into fixed and variable costs

Fixed expenses: expenses that must be incurred every month (e.g., housing and education expenses)

Variable expenses: Expenses that are incurred every month but vary in amount.

By categorizing fixed and variable expenses, it is possible to determine whether it is fixed expenses, variable expenses, or both that are causing pressure on the household budget.

Variable expenses can also be budgeted to make it easier to meet monthly goals.

Analyze how you spend your money.

Recording household finances will help you understand the flow of money.

See how much you spend each month on taxes, fixed and variable expenses, and review where you need to cut back or spend more.

It is important to prioritize your money in relation to your life goals and how you should spend your money.

By carefully analyzing and improving your household finances, you can spend money in a way that is consistent with your values.

summary

Many who have kept track of their household finances have been successful in reducing wasteful spending and increasing savings.

However, the reality is that many people become frustrated with household budgeting.

It is important to find a household account book that meets your goals.

And first, try to keep it for three months.

By keeping a record, you will be able to confront how you spend your money.

-

-

How to choose the right Kakeibo for you.

I want to keep a household account book, but I can't seem to keep it up. I don't know which one to choose among the ...

- Define your goals.

- Find a kakeibo that works for you.

- Keep a kakeibo for 3 month.

- Review how you spend your money.

- Spend money with an awareness of your financial priorities.