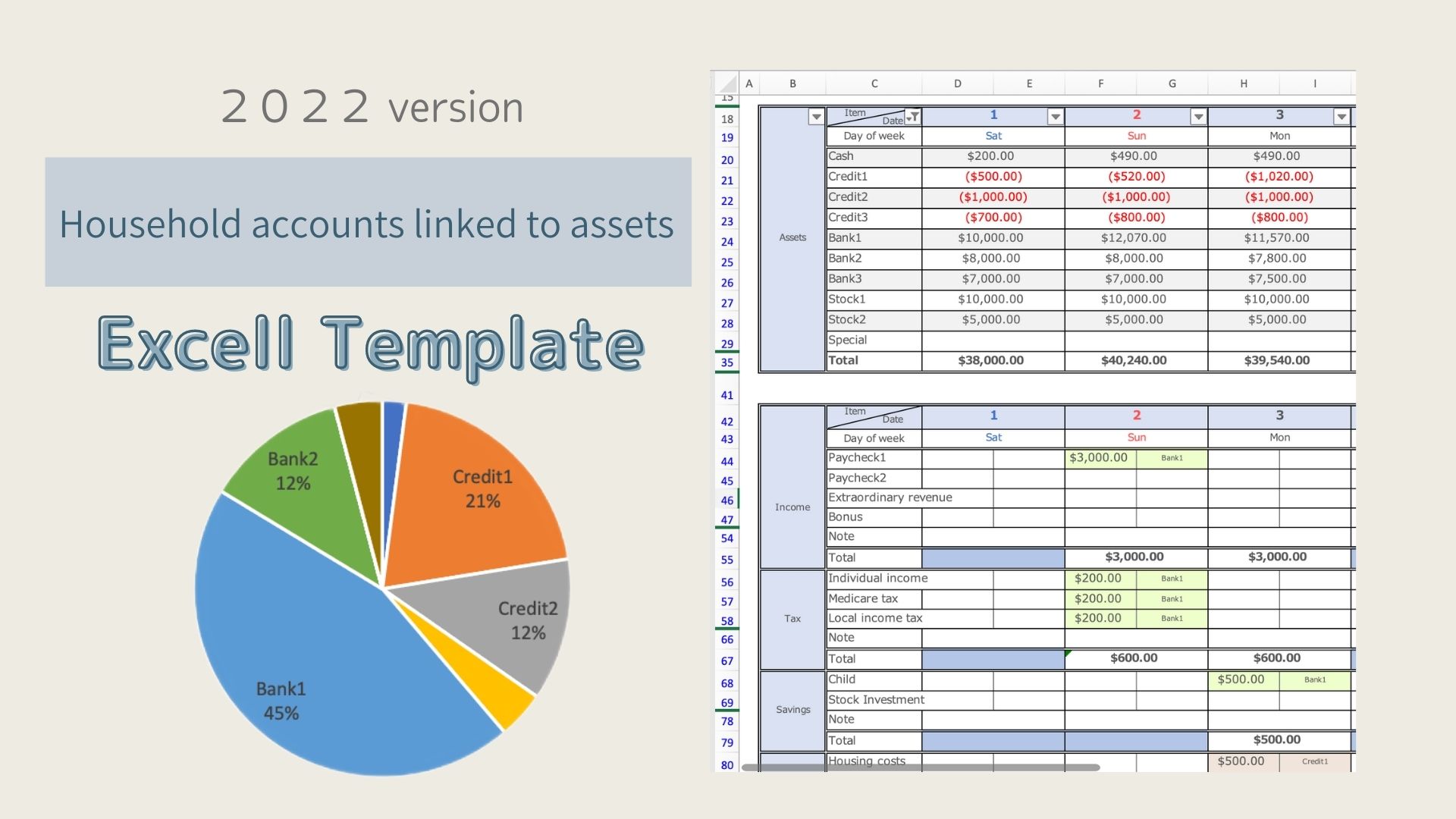

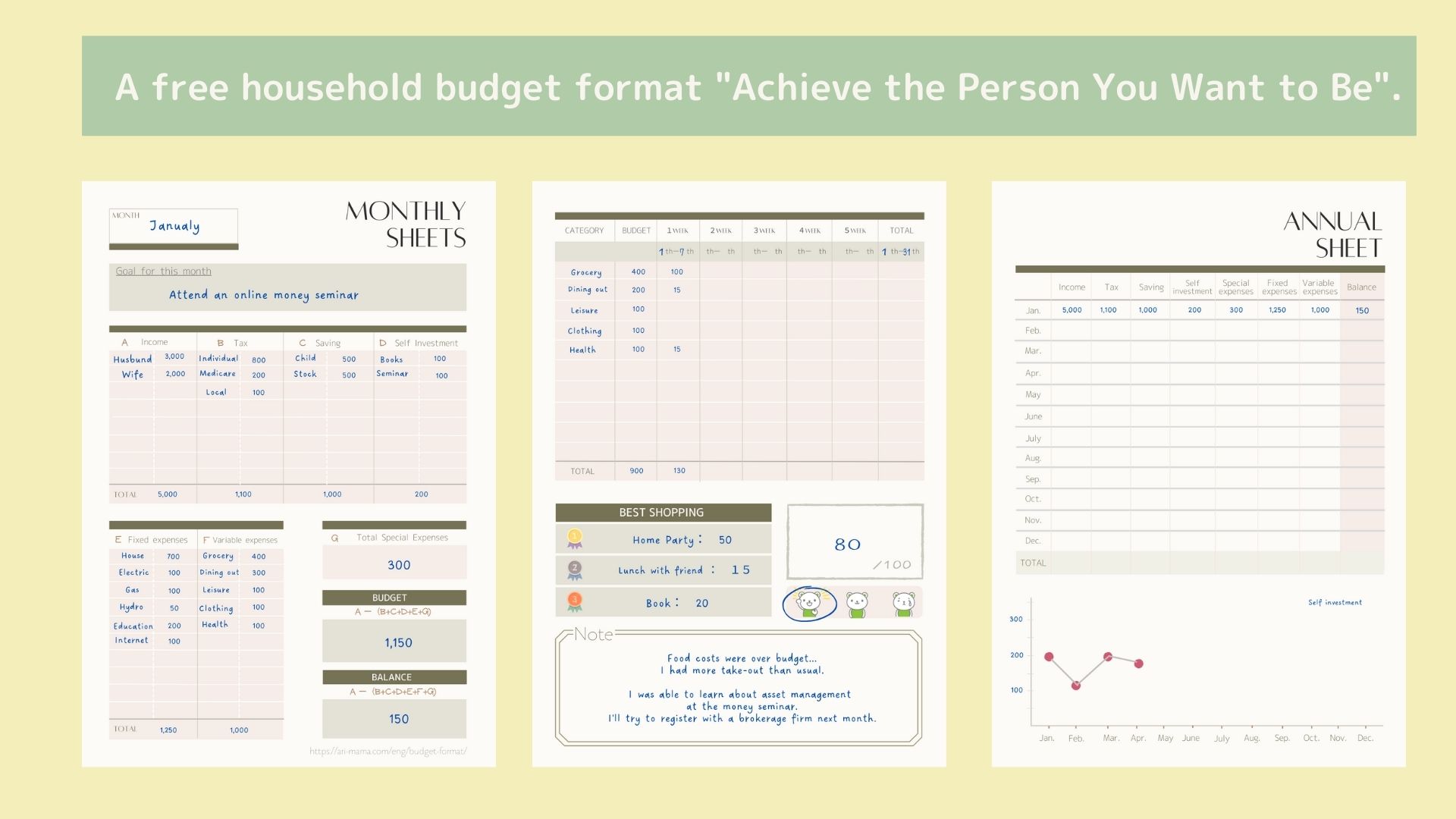

This Excel household account book is an Excel household account book that works in conjunction with the household account book to show daily asset movements.

It is recommended for those who want to manage their money well, as it shows at a glance from which accounts money is used and whether daily assets have decreased or increased.

- I want to record assets at the same time.

- How do I record when I transfer funds?

- How do I record when I use a credit card?

This is why I created a household account book that is linked to the household account book and automatically displays the amount of assets that have been deposited and withdrawn.

The 2025 version can be downloaded from the Downloads section.

Features of Excel Household Budgeting

- You can set up any expenses you want.

- Colors indicate which accounts the money was used from

- Assets are linked every time you record a household account

- Sheets are set up for each month, making it easy to enter information

- A pie chart is displayed for each monthly item, allowing you to see which items you are overspending on

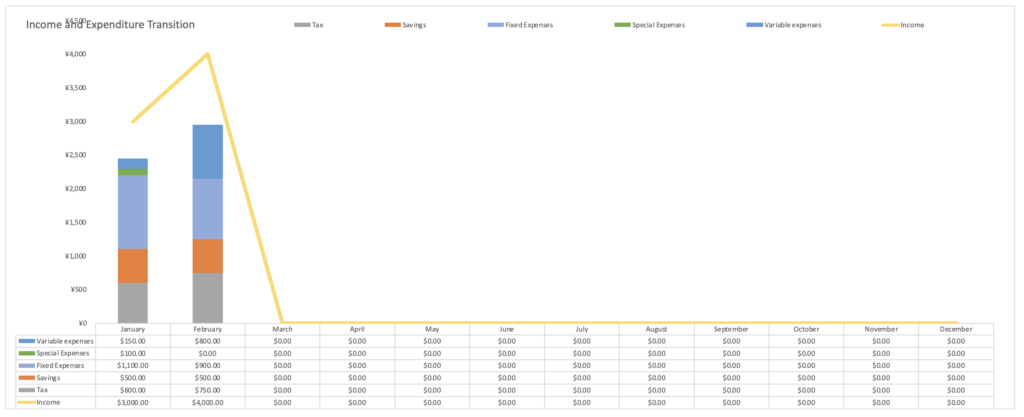

- Monthly income and expenses are displayed in a list and graph, allowing you to see monthly trends at a glance

- Monthly asset transition and percentage of consumption by asset are displayed in a table and graph, allowing you to see the monthly transition at a glance.

- The start date can be easily set to coincide with payday, etc.

How to start an Excel household account

step

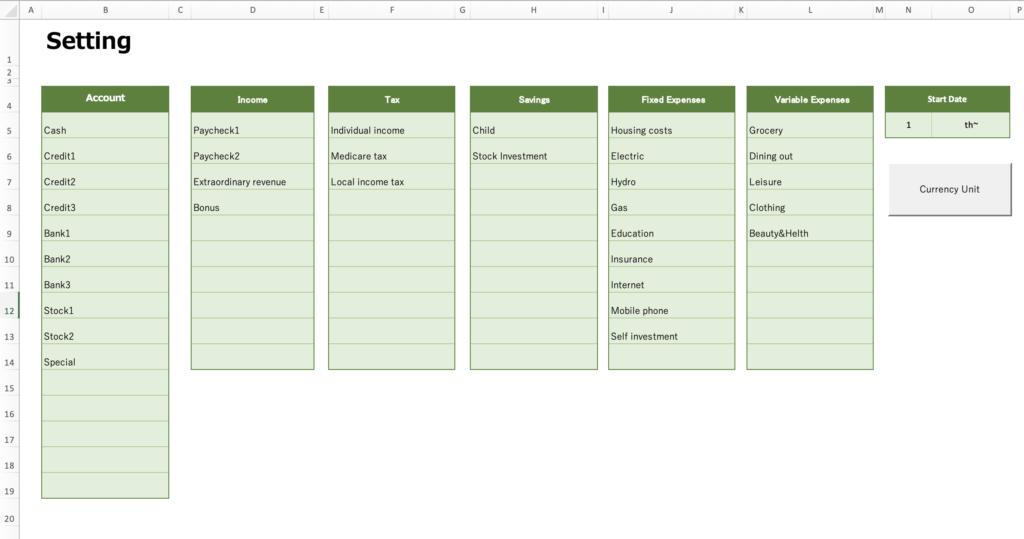

- Setup

Enter expenses (account, income, taxes, savings, fixed expenses, variable expenses, start date) - Enter current asset amounts by account

- Monthly Entry

Enter income, taxes, savings, fixed and variable expenses by day - Check Income and Expenses Chart

Check monthly trends in tables and graphs - Check asset transition

Check monthly changes in assets and the percentage of consumption by asset

setup

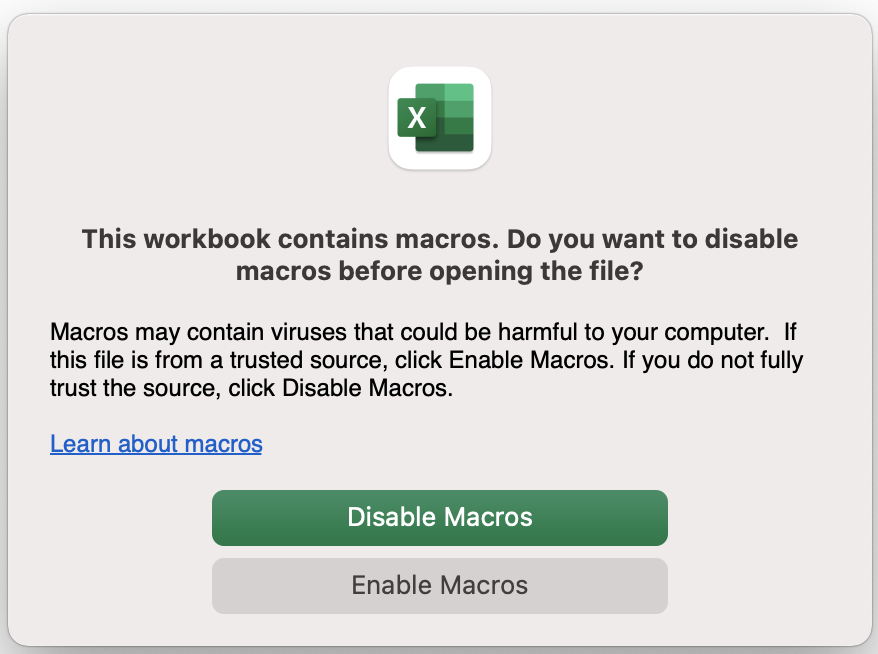

This Excel household budget book uses macros.

Open Excel and click on "Enable Macros".

Enter account name and expense line item

- Account Name (Assets)

- Income

- Social Insurance/Taxes

- Savings

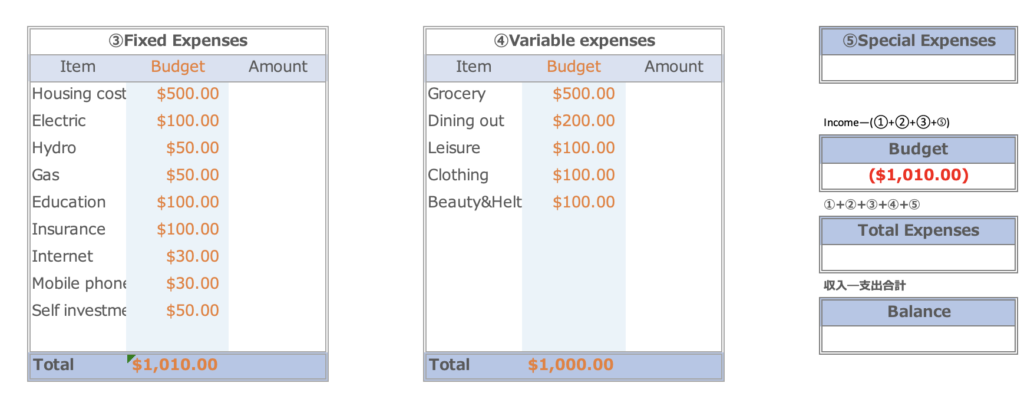

- Fixed expenses

- Variable expenses

Enter a name for each item.

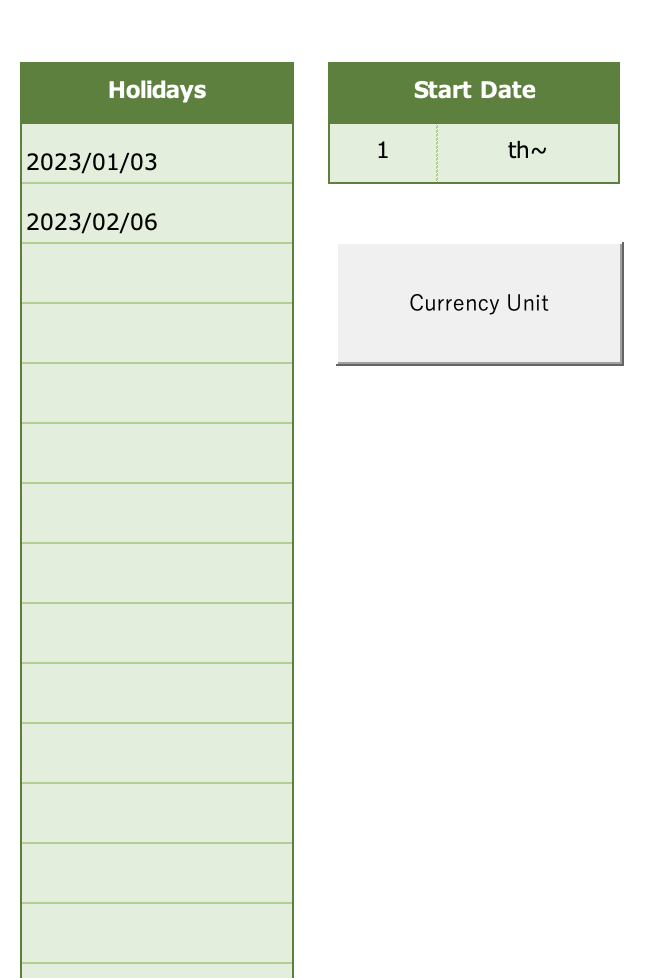

Set start date

You can change the start date to match your payday, etc.

In the Holiday field, enter the national holiday of the country in which you live.(Applicable from version 2023)

Saturdays are shown in blue, and Sundays and Holidays are shown in red.

Select a start date and each month sheet will automatically set the date to match the start date.

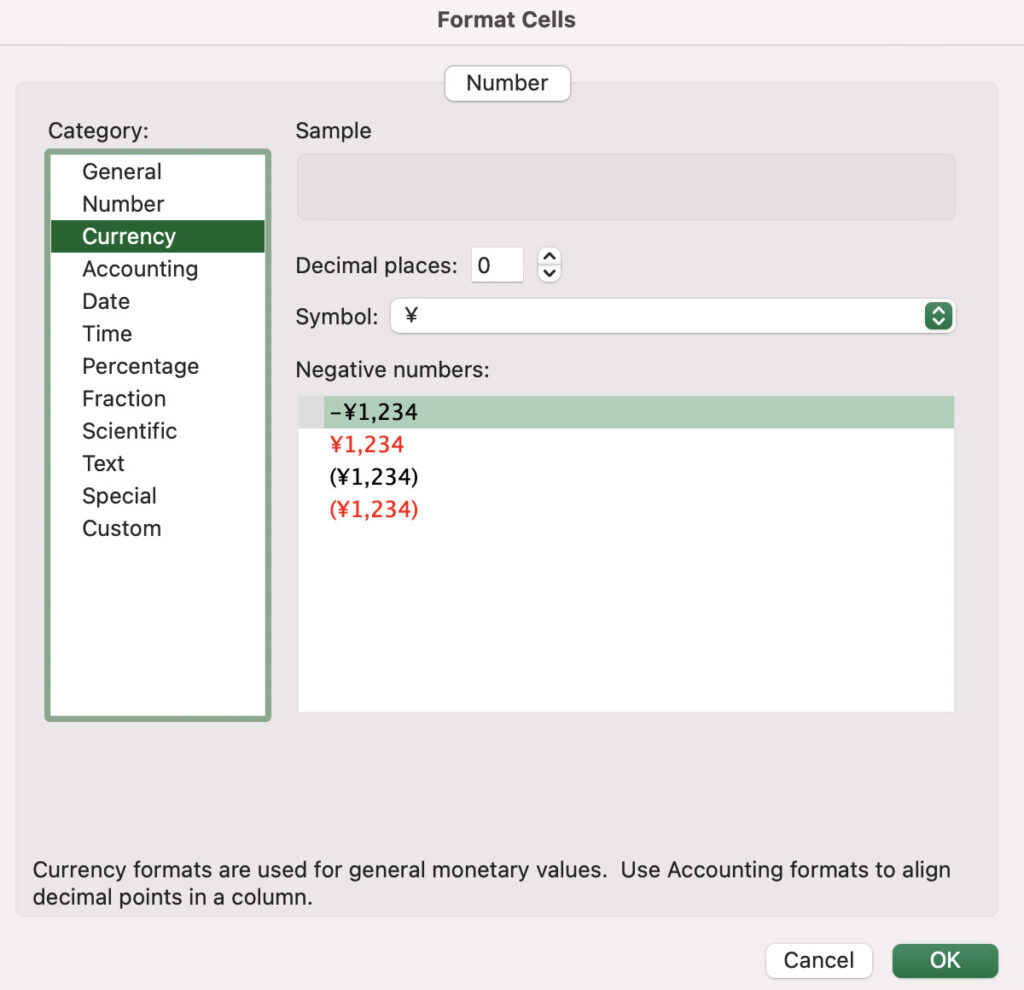

Change the currency unit

Press the "Currency Unit" to select a range of currencies.

Select the currency unit for each sheet.

The January-December sheets can be changed in units at the same time.

Please change the units of the other sheets after changing the month sheet first.

After clicking on Currency Unit, right-click and click on Format Cell.

Select the currency in the category and click on the currency unit of your country.

The default setting is in dollars.

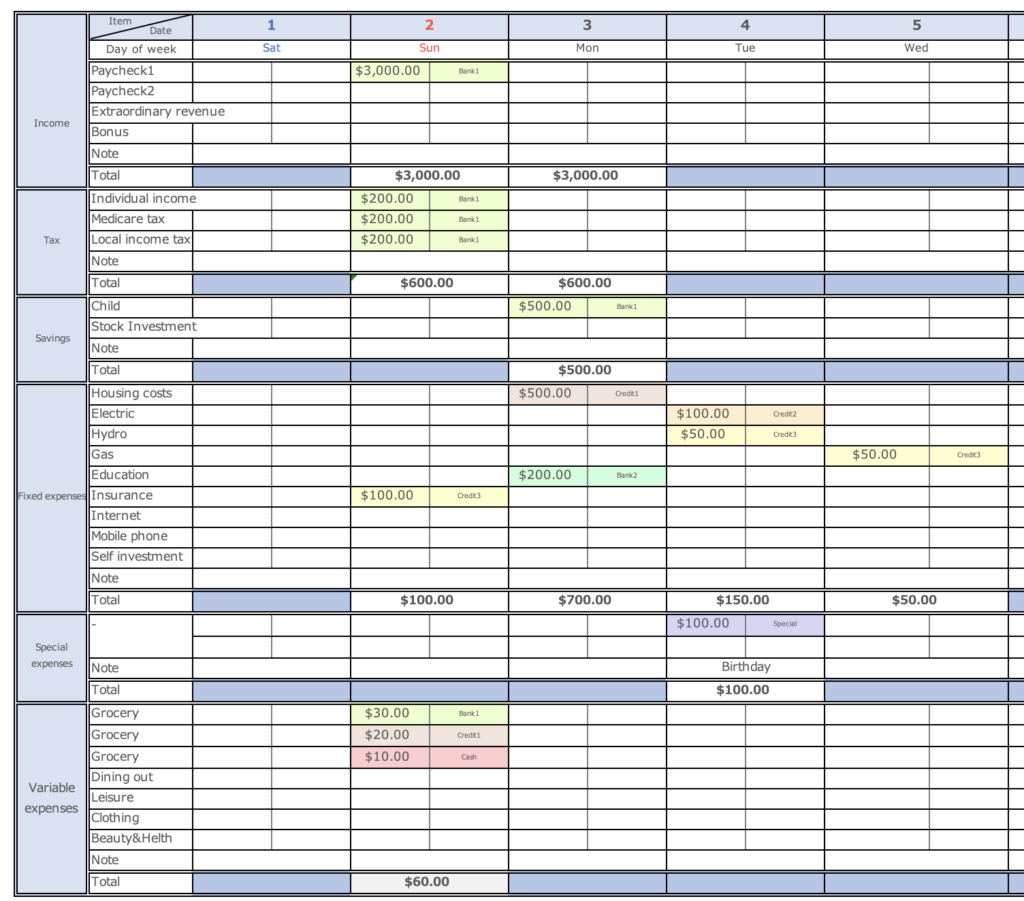

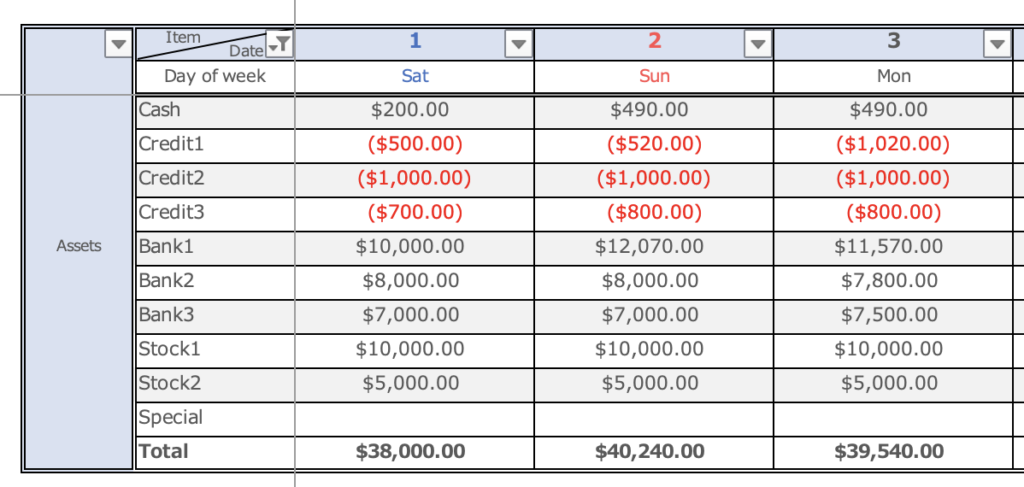

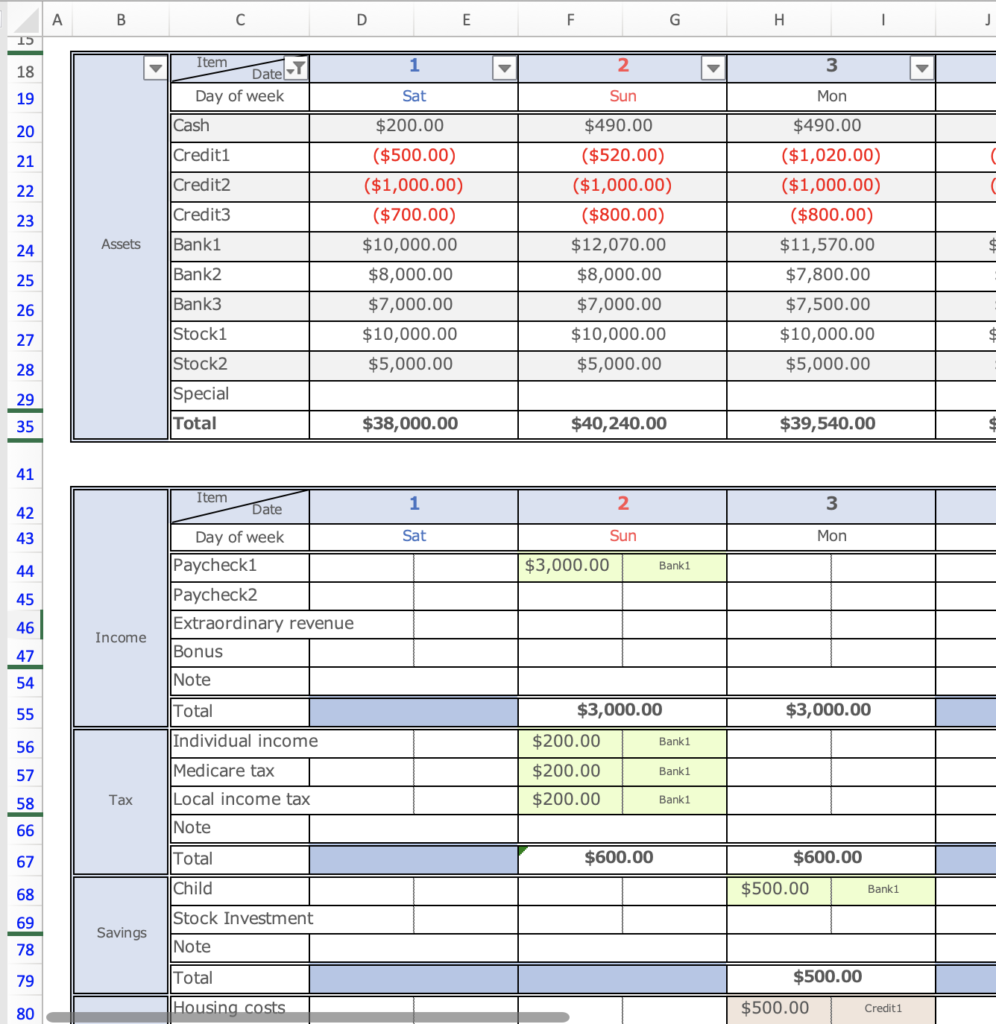

Set asset amount

Enter the amount of assets in the column for the day before the date on which the household account is to begin.

If you start on January 2, enter the asset amount on the first day of the month in the asset column on the January sheet (you cannot enter amounts for future dates).

For credit cards, please enter the next debit amount in minus sign.

Monthly Setup

The expense items set in the settings are set in the monthly sheets (Jan-Dec).

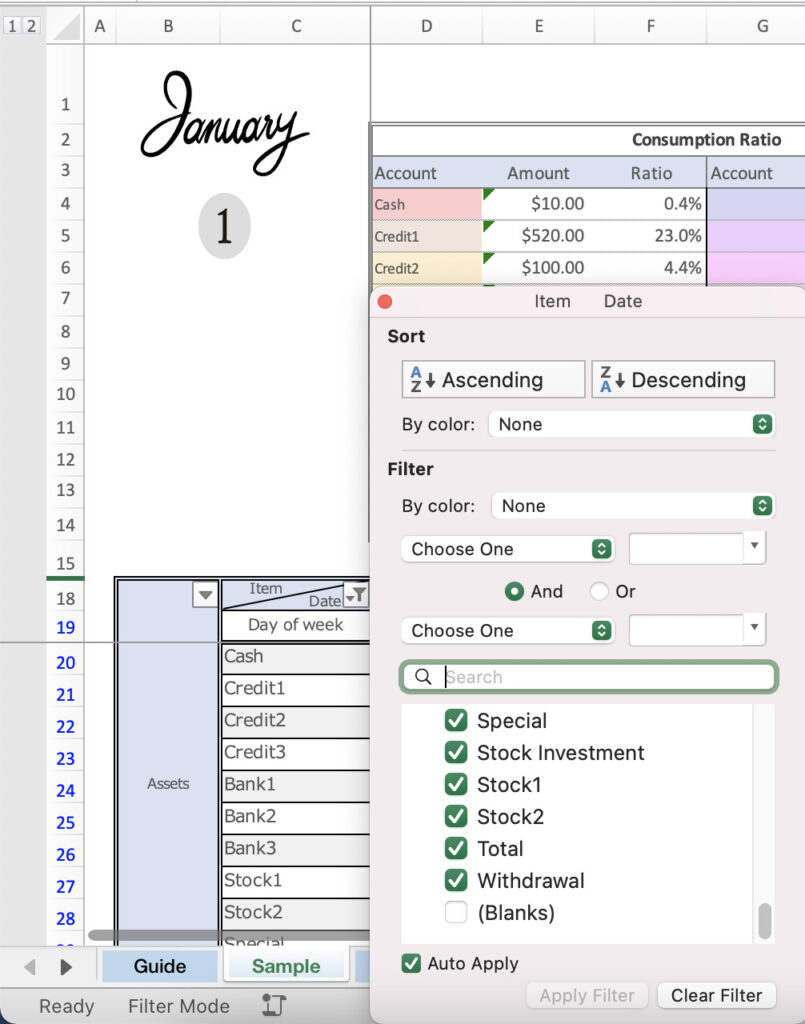

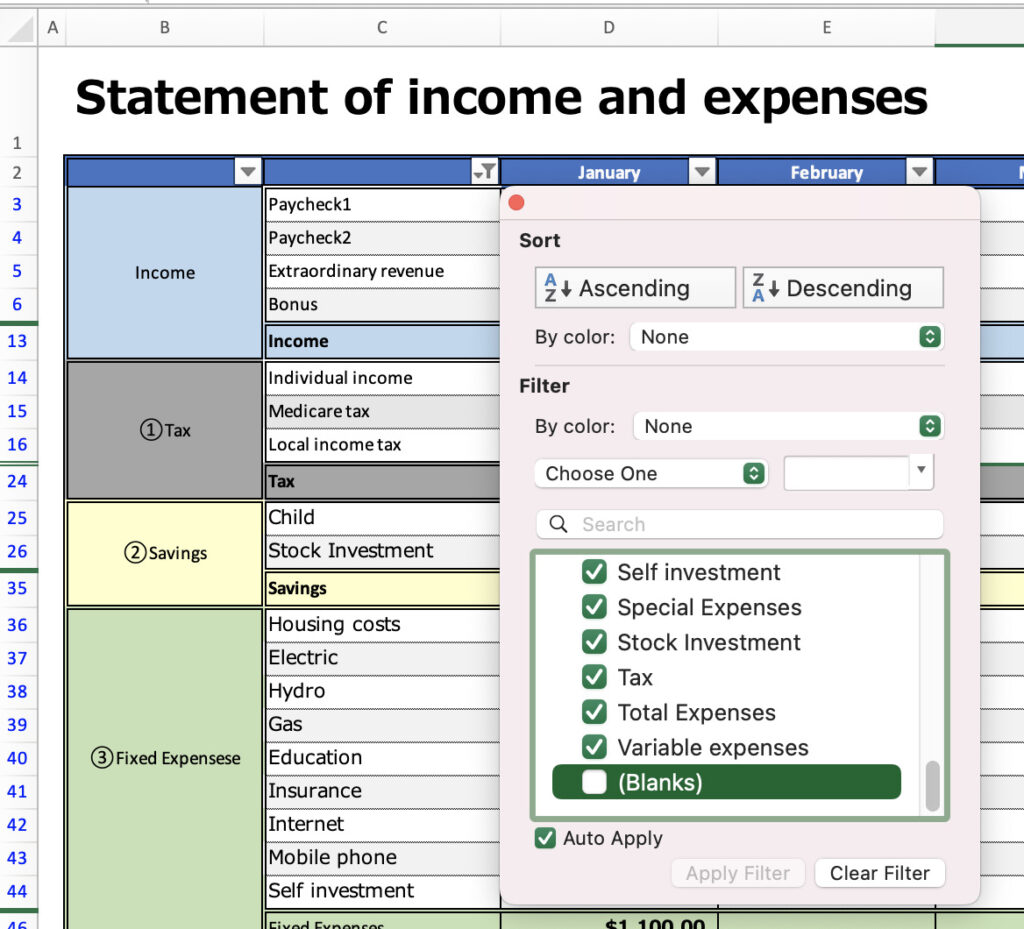

Hide blank lines in filters

Click on the button in cell C18 to uncheck blanks or zeros.

Click button 1 in the upper left corner

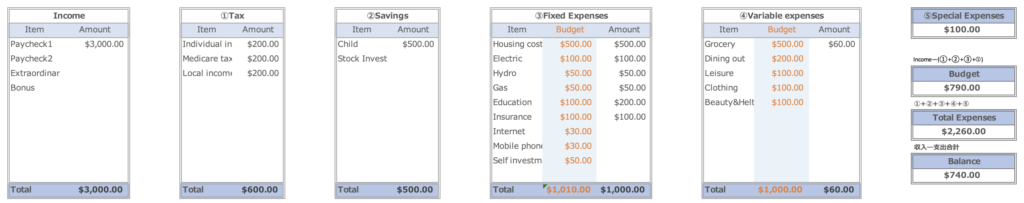

Setting a budget

Set a budget for fixed and variable expenses

Budget = Income - (Taxes + Savings + Special Expenses + Fixed Expense Budget)

Income, taxes, savings, and special expenses are tentatively entered into the Gantt chart table below to show the budget.

Income and Expenditure Entry

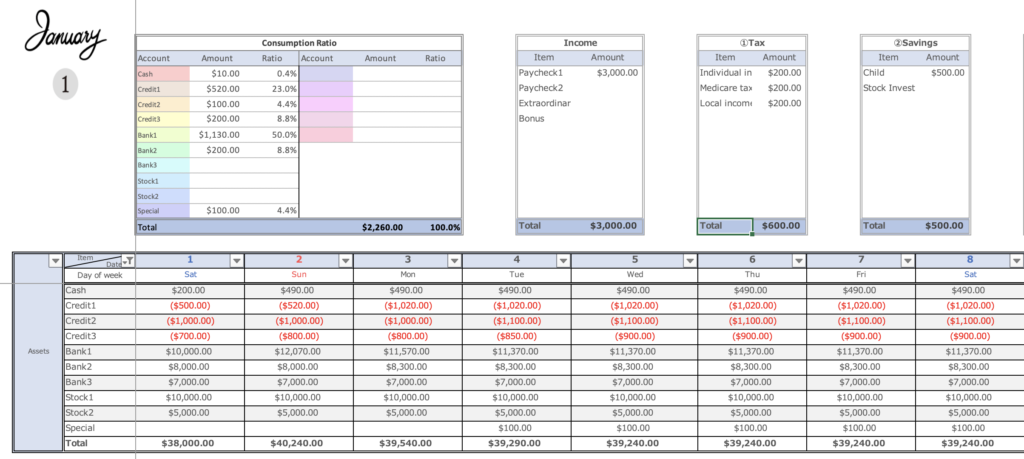

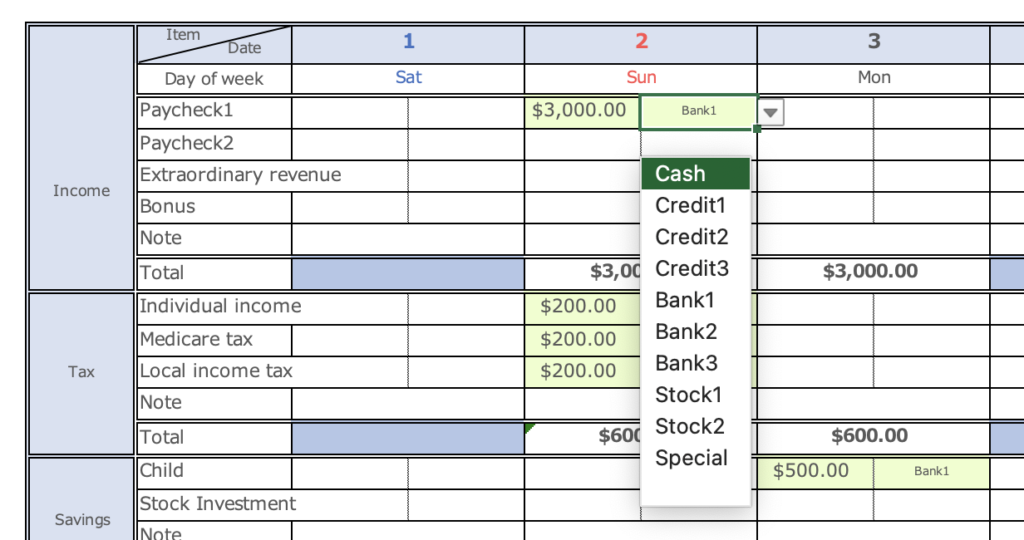

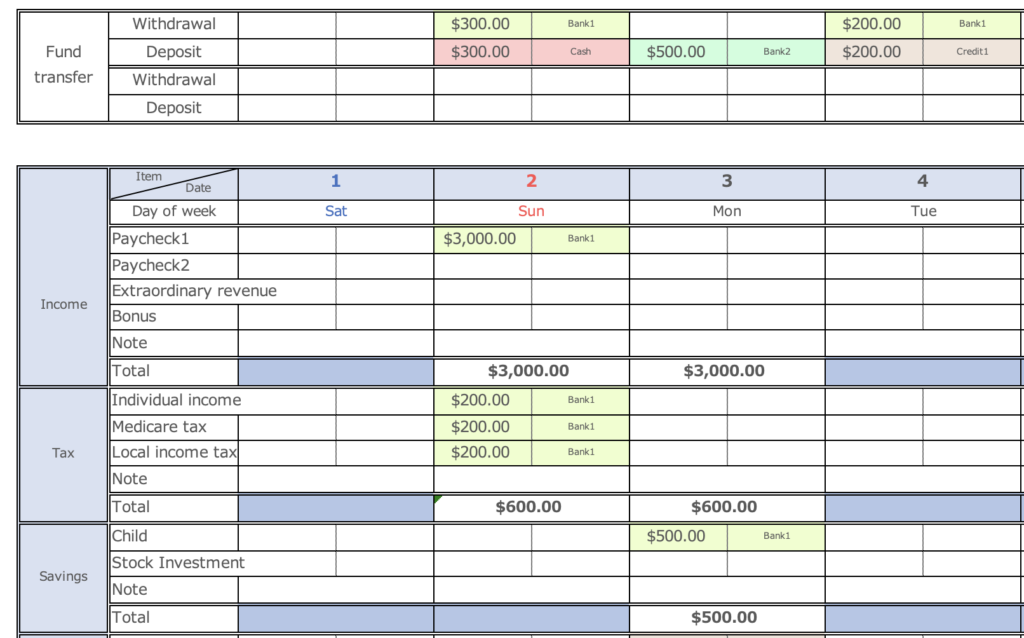

Enter amounts spent and accounts used for income, taxes, savings, fixed expenses, special expenses, and variable expenses items on the Gantt chart

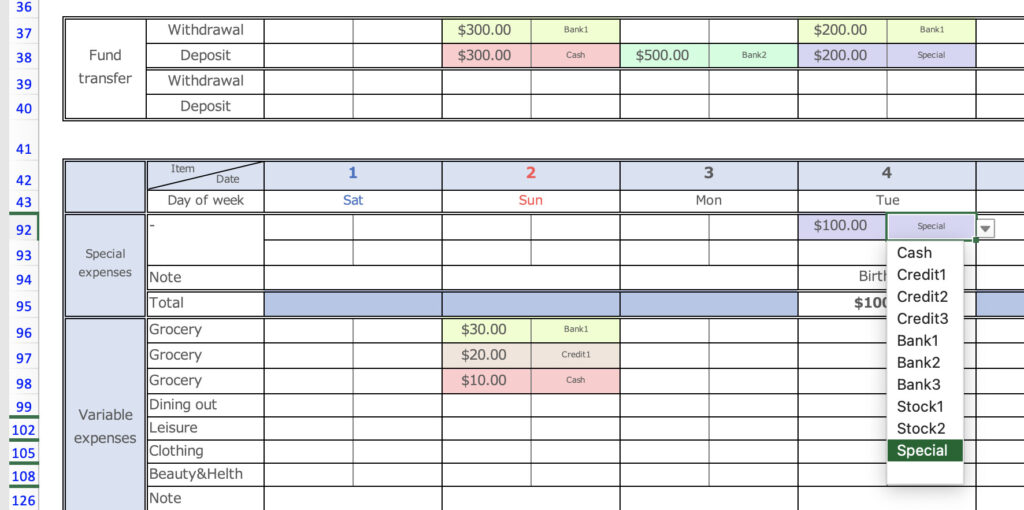

Enter the amount to the left of the Date Spent column and select the account in the pull-down on the right.

Credit cards should be entered on the day they are used, not the day they are debited.

Clicking on the pull-down will display the account name entered in the setup.

Color coding is provided for each account.

As you enter household income or expenses, the amount of assets changes in conjunction with the amount of assets you set up at the beginning.

The amount entered in the income column will increase the account assets and the amount entered in the other fields will be subtracted from the account assets.

At the top of the month sheet, the total amount entered in the Gantt chart is displayed by expense category.

When transferring assets

- Withdraw cash from the bank

- Transfer funds for savings

- Make credit card payments

The funds transfer item is used primarily in these situations.

The information entered in the Funds Transfer field is not included in the consumption as funds are transferred between accounts.

Withdrawing cash from the bank (transferring money between accounts)

Enter the amount to be withdrawn in the Withdrawal item of the Funds Transfer and select the account name from the pull-down menu on the right.

In the Deposit field, enter the amount to be deposited and select the account name.

When transferring funds for savings

For example, if you want to transfer funds from Bank 1 to Bank 2, in the Savings field, enter the amount of savings and select Bank 1 in the right-hand column.

In the Transfer of Funds section, enter the savings amount only in the Deposit section and select Bank 2 in the adjacent column.

Only the deposit item is entered in the funds transfer because the savings amount is deducted from the Bank 1 account in the Savings section of the Gantt chart.

To make a credit card payment

On the date of the credit card payment, transfer funds from the account from which the payment was made to the credit card account.

Be sure to enter the credit card amount to be charged in the Fixed, Special, and Variable Expenses section of the transfer of funds, as entering the amount in the Fixed, Special, and Variable Expenses section will result in double spending.

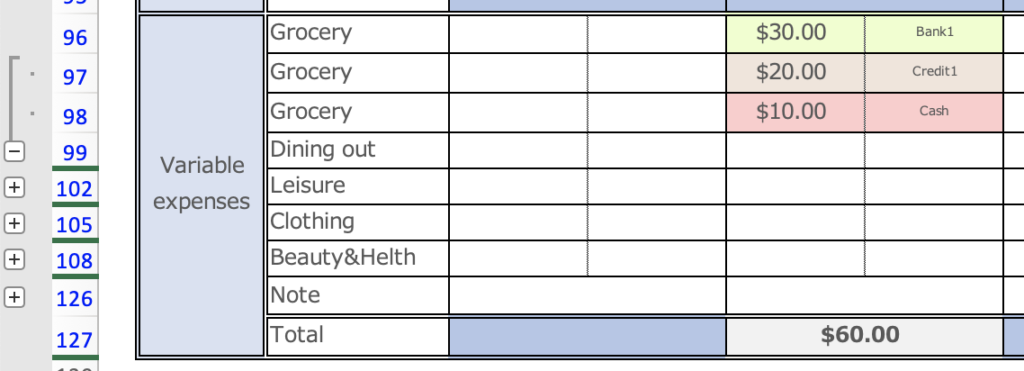

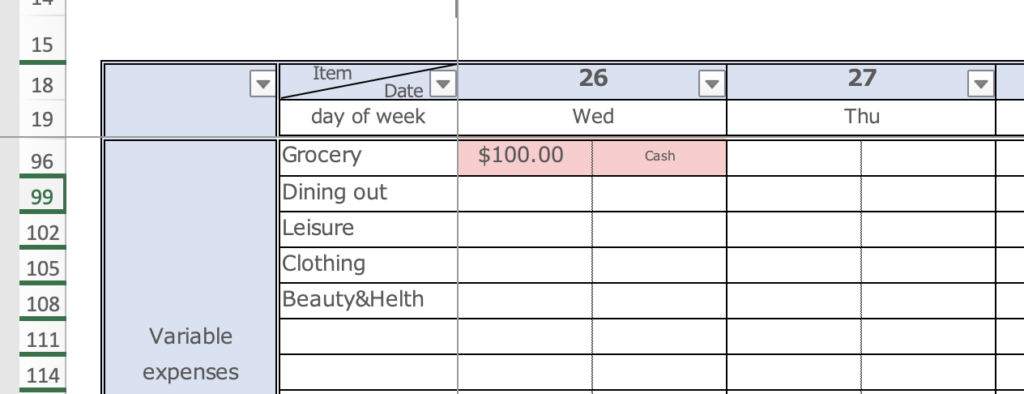

When entering multiple accounts in the same field on the same date

How do I enter if I split my food expenses into multiple accounts on the same day?

This is limited to variable expense items, but you can enter up to three of the same item on the same day.

Click the + button to the left of the variable expense item you wish to enter.

Two lines will be added, use this if you use more than one account.

To accumulate special expenses

If you want to set aside a certain amount each month for special expenses and use that account for special expenses,

- Add a special expense account to the fund item in the initial setup.

- Transfer funds to the special expense account each month via fund transfers.

- Select the special expense account when using the special expense.

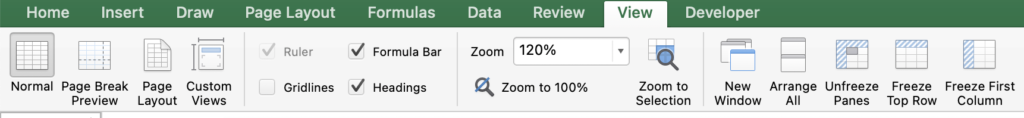

Unfasten the window frame.

To facilitate daily input, the window frame is fixed.

To remove the fixed window frame, click on "Unfreeze Panes" in the display.

To fix the window frame again, click on cell DE20 and click on "Freeze Panes”.

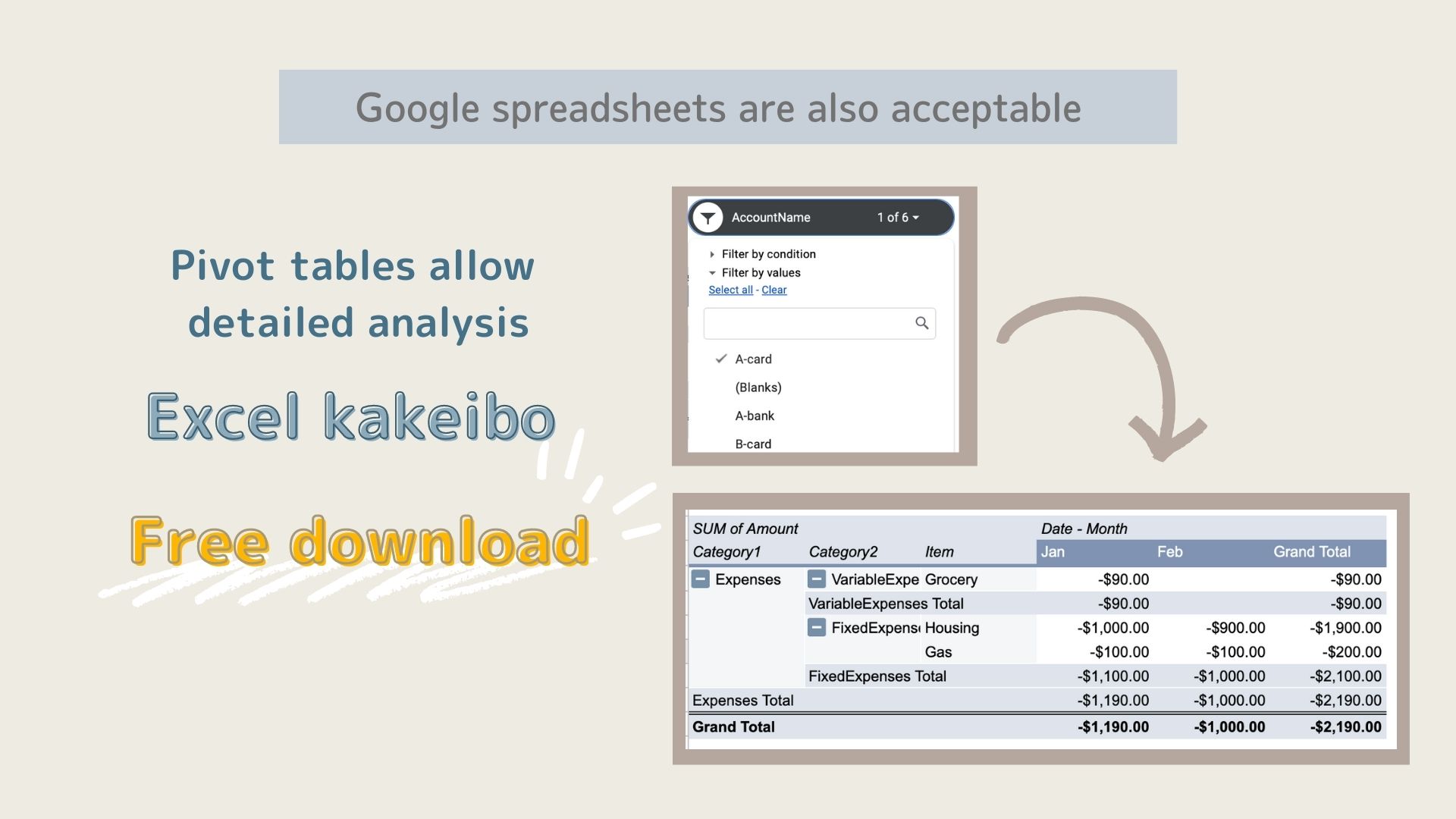

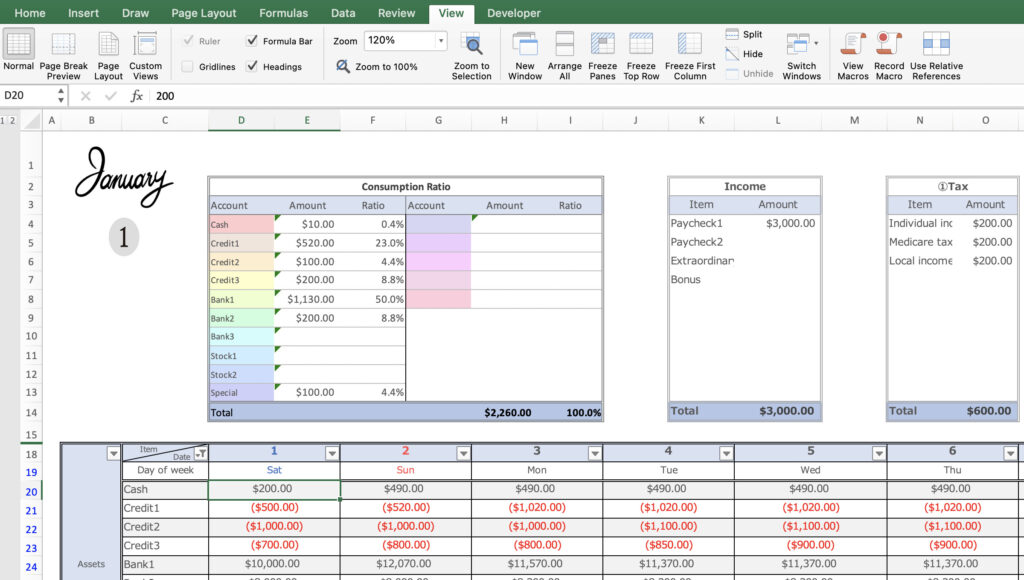

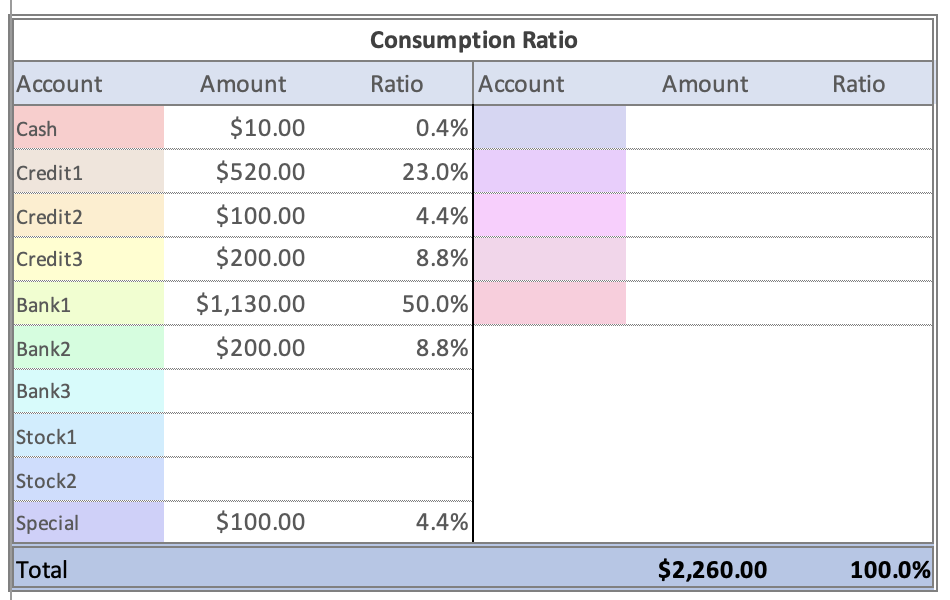

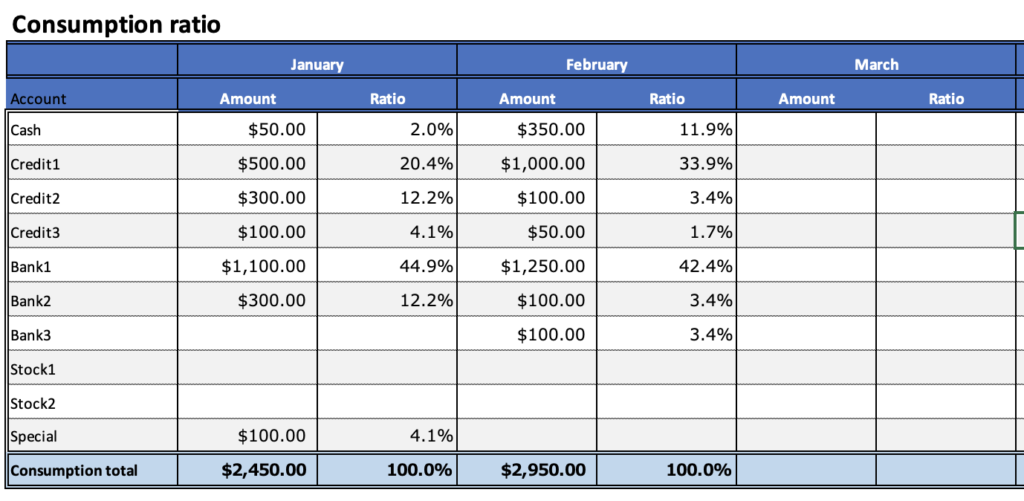

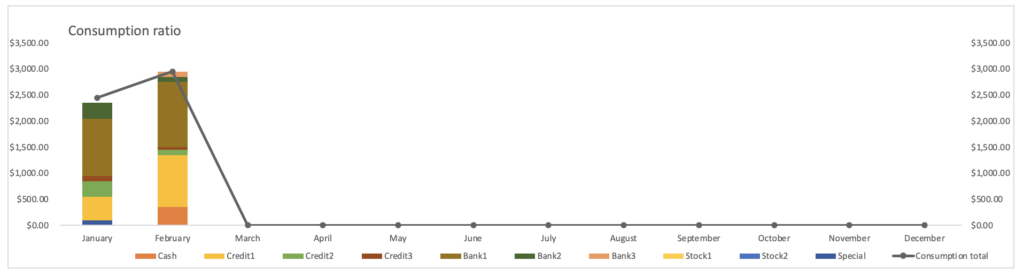

Check consumption percentages by account.

Displays amounts and percentages of expenditures entered in Taxes, Savings, Fixed Expenses, Special Expenses, and Variable Expenses by account (does not include amounts transferred from one fund to another).

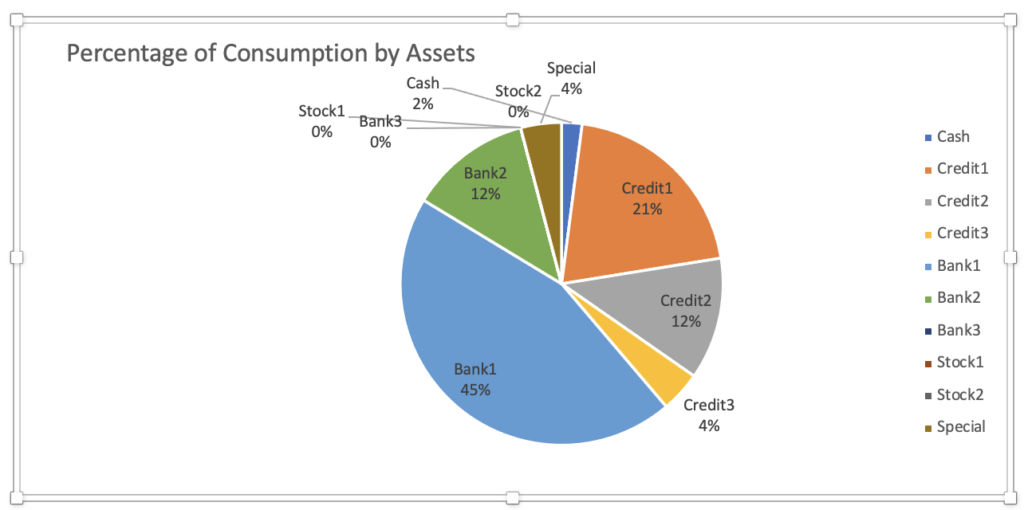

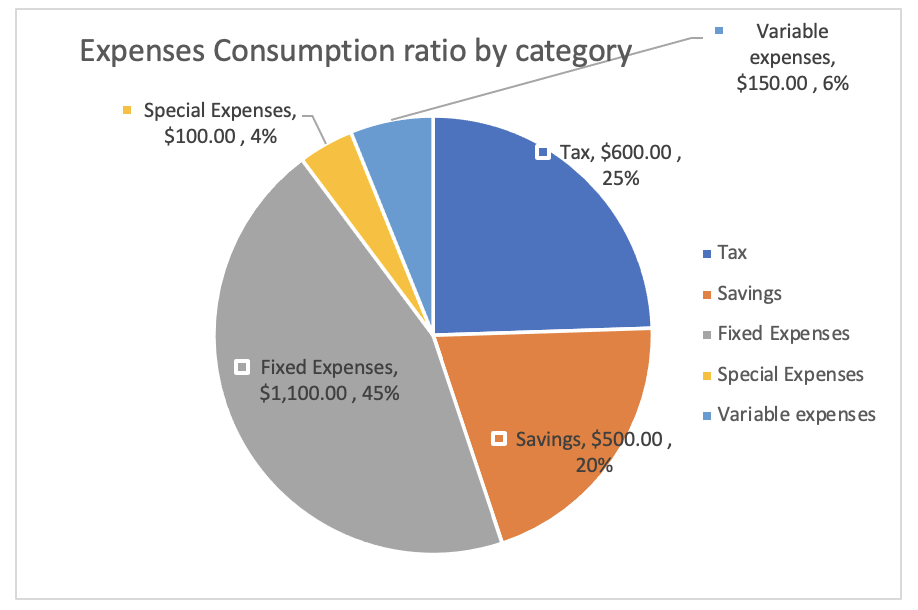

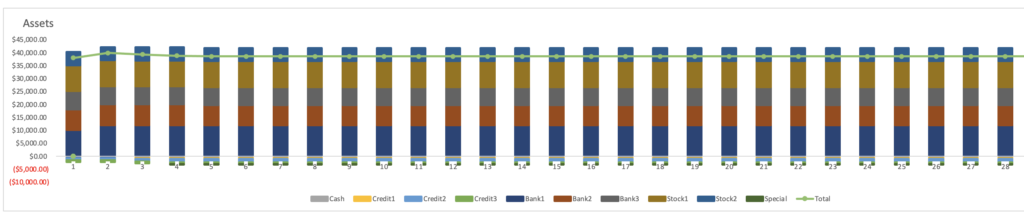

Check the graph

Percentage of consumption by account

Consumption Ratio by Expenses

Assets

Annual Changes

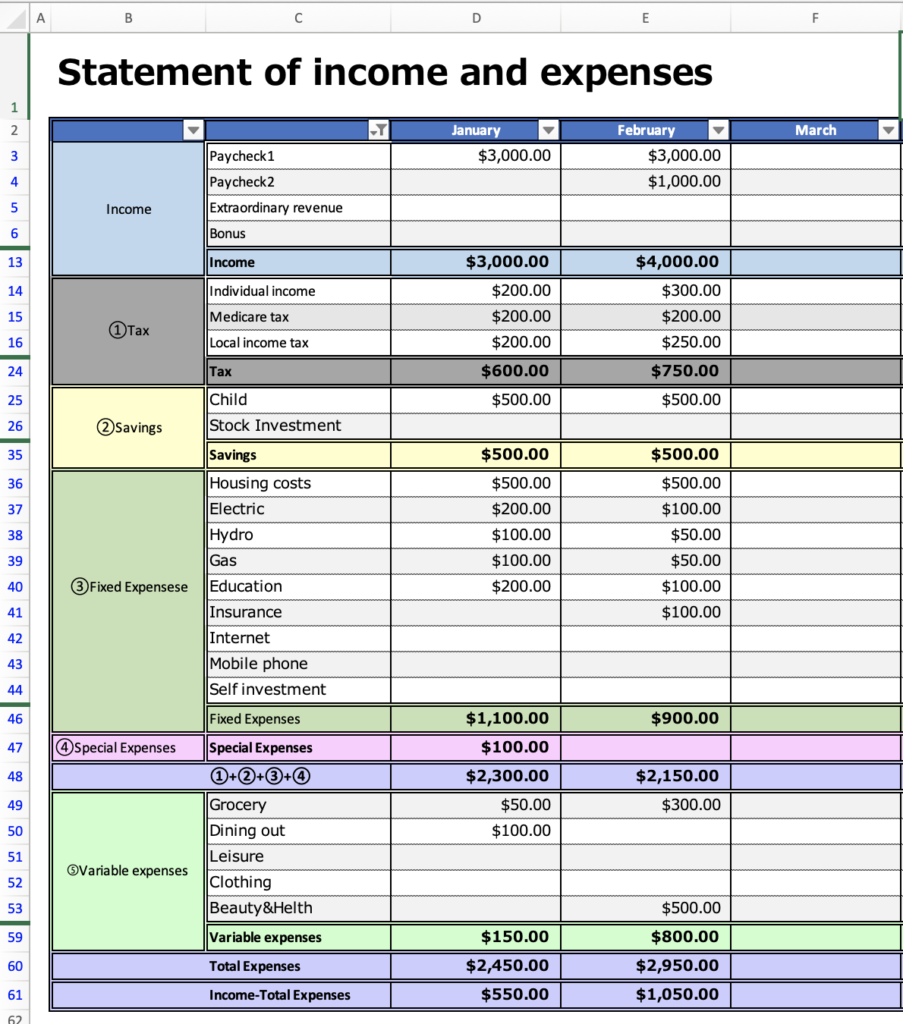

Check annual income and expenses

Balance sheet

Click on the C2 mark to uncheck 0 or (blank cell).

Check annual income and expenses.

A graph appears below the table.

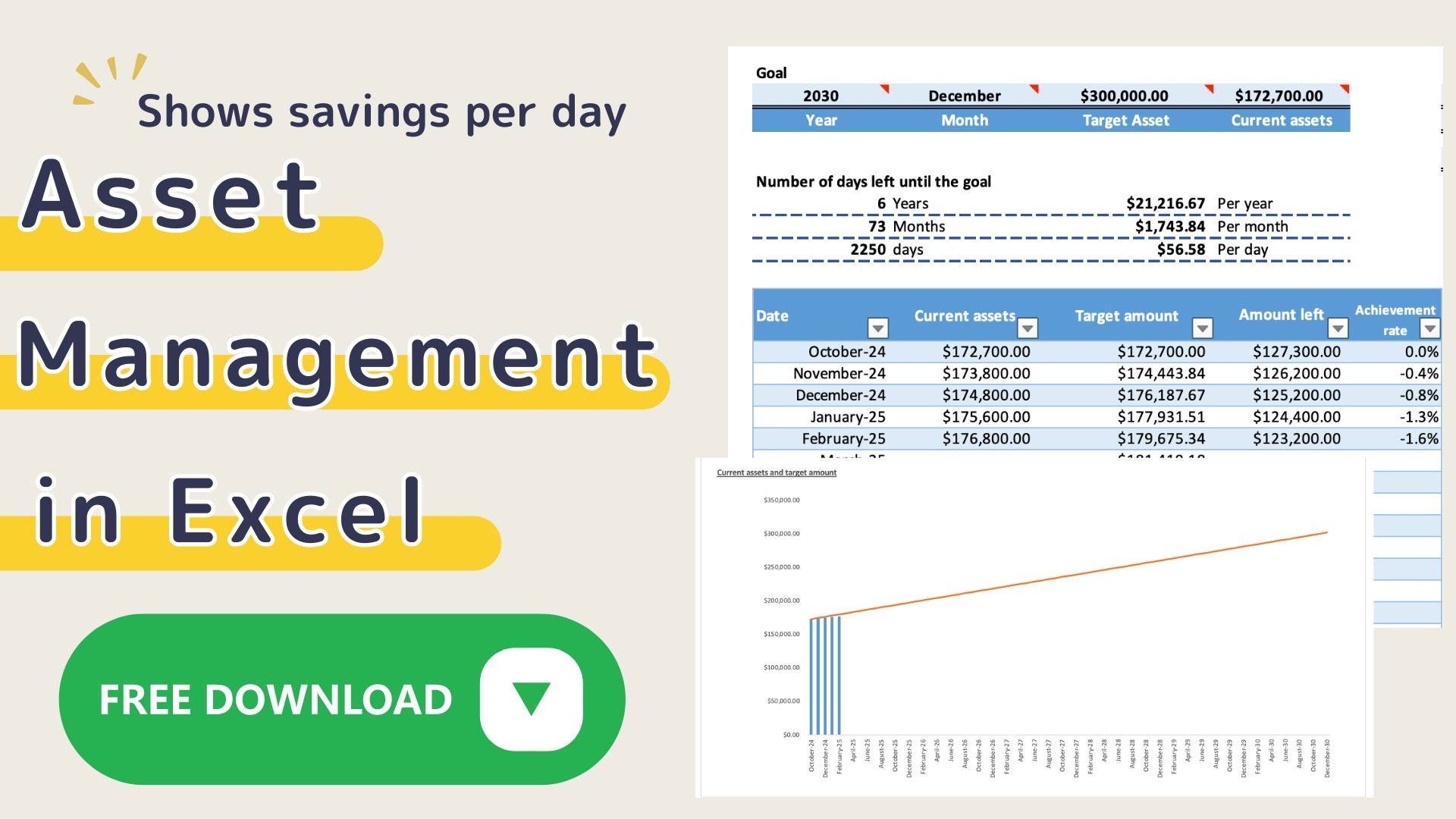

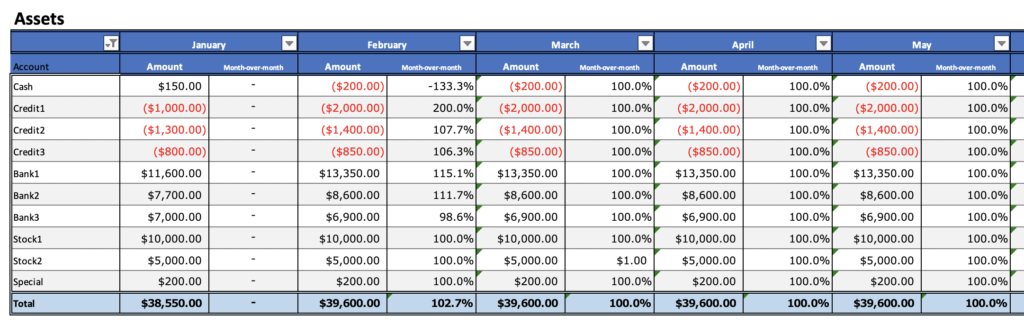

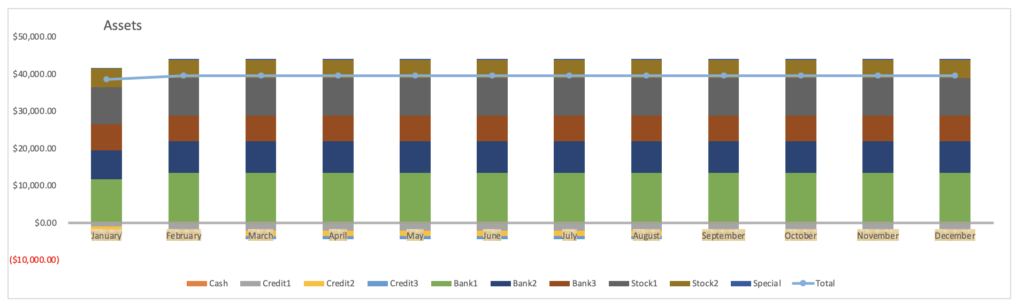

Check annual asset trends.

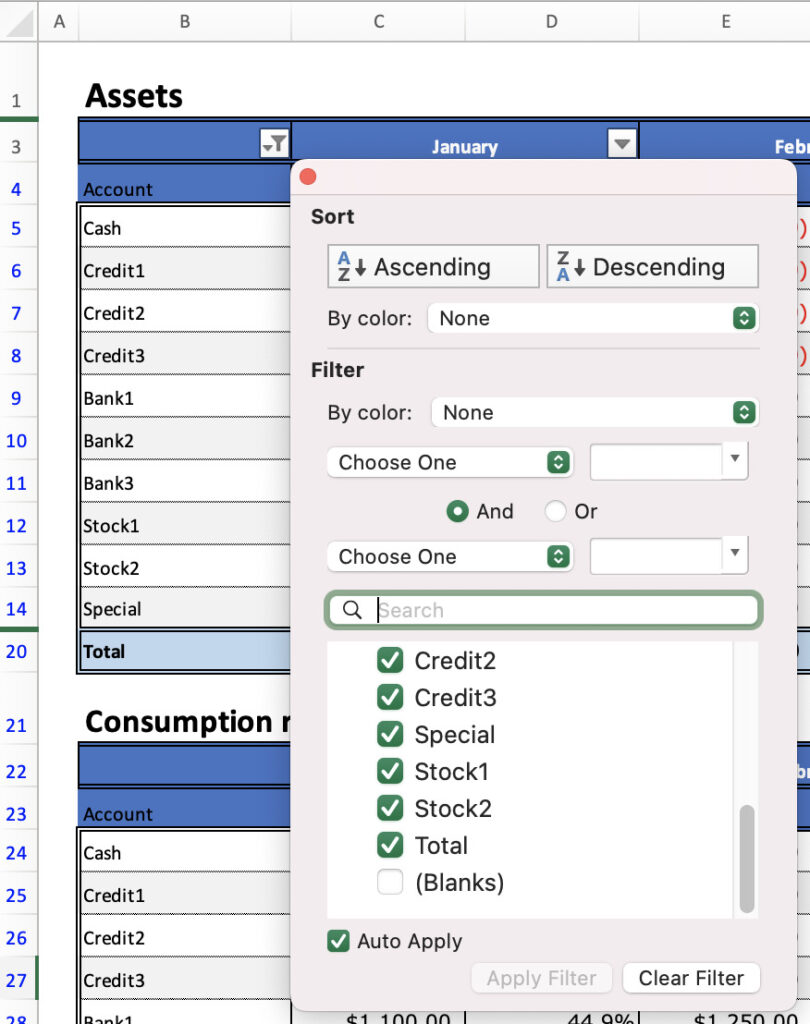

asset sheet

Click on the B3 symbol to uncheck the 0 or blank cell.

Assets

The amount of assets on the last day of each month and the comparison to the previous month are displayed.

Changes in brokerage assets are not supported.

If you want to keep good records, enter daily brokerage assets on the monthly sheet.

If you have difficulty entering daily, please correct the amount of brokerage assets on the asset sheet once a month.

Consumption Ratio

The amount and percentage of consumption by account will be displayed.

Advantages and disadvantages

Advantages

- Daily asset transition can be viewed at a glance.

- Color-coded by account used, so you can see which accounts are used most frequently.

- All expense items are entered in the Gantt chart, making it easy to enter fixed expenses.

Many household budget books allow detailed entry of only variable expenses, while fixed expenses and other items are entered as totals.

In this Excel household account book, all items are entered in a Gantt chart, so even if fixed expenses such as education and vehicle expenses are used on multiple days, you can enter the amount in the column for the day of the expense, saving you the trouble of adding up the total yourself.

Disadvantages

- If you enter an approximate value, it will not match the actual amount of assets.

- If you hoard receipts and enter them all together, you must remember the account you used.

I am this type of person, but when I enter an approximate consumption amount, it does not match the actual asset amount.

If the amounts are too far apart, please adjust them by re-entering the actual asset amount once a month.

If you are entering all your money at once, you will have to remember which account you used the money from, which increases the amount of time and effort required.

I recommend that you double use an Asset management application and an Excel household account , as they will not only tell you the amount spent and the name of the account, but will also give you an accurate asset amount.

Free Download

Sample sheets are included in the Excel Household Budget.

Click the download button to download the ZIP file and unzip it for your use.

This Excel Household Budget is based on the calendar year 2025.

Click here for the 2025 version.

Click here for the 2026 version.