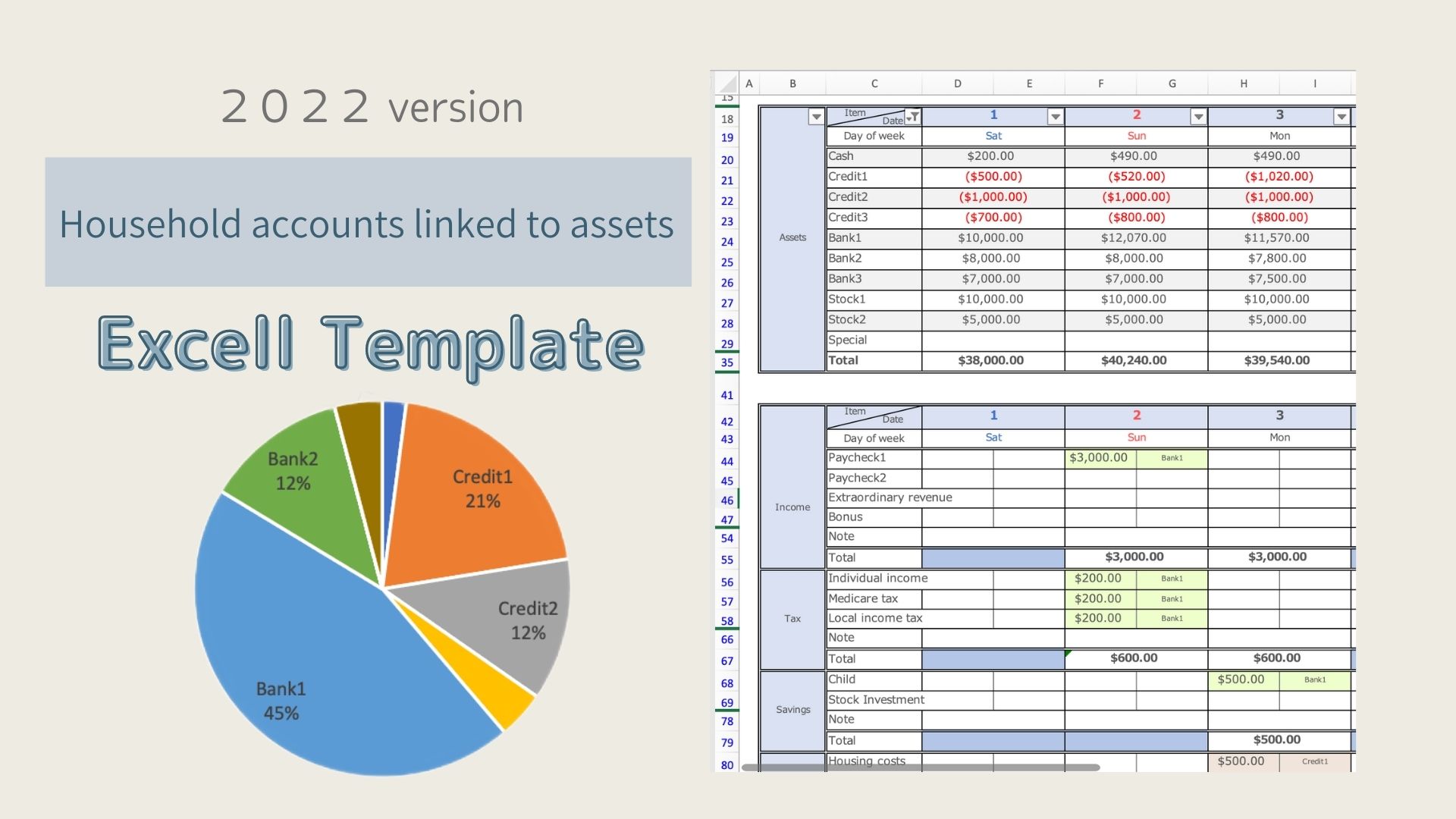

This Excel Kakeibo is the 2023 version of the [2022 version] Excel Family Budget Book (with free templates), which specializes in credit card records.

The [2023 version] has been further improved and is easier to use.

Changes

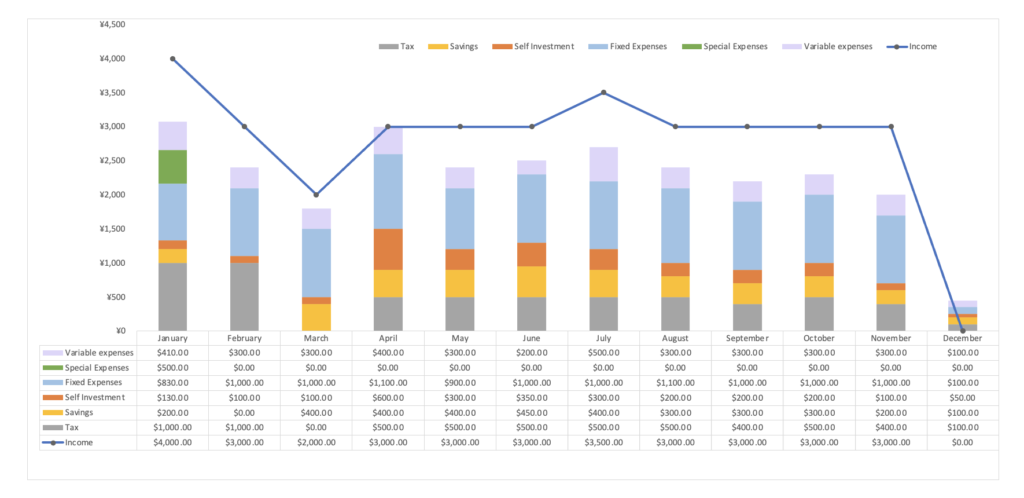

- Added many graphs.

- Changed Gantt chart to weekly.

- Blank lines for variable expenses can be hidden.

- Improved the viewability when printed out.

- Changed the color of credit cards.

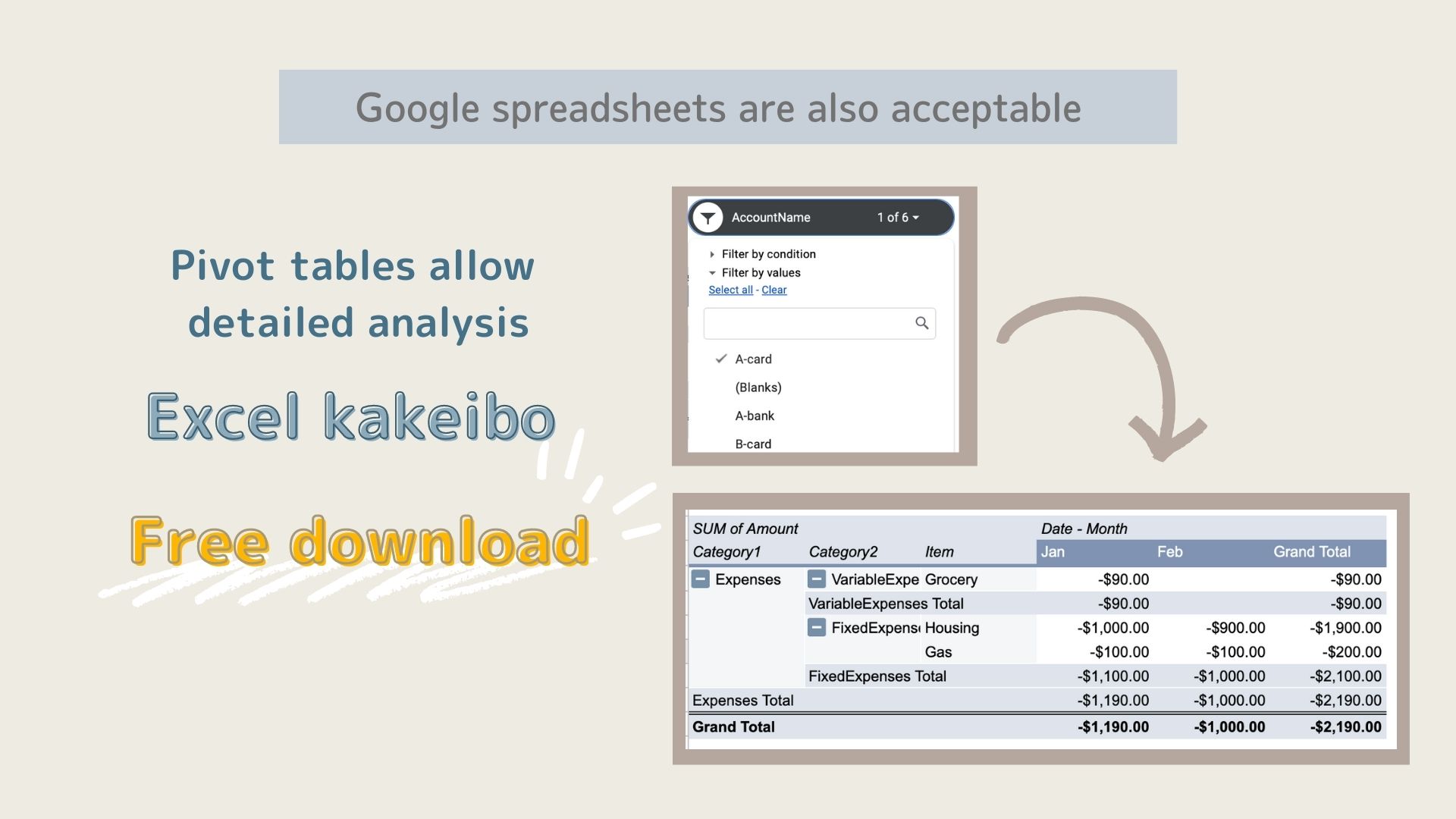

This Excel Kakeibo is a template specifically designed for credit card records.

This template is mainly for people who have high credit card usage and want to keep track of their credit cards in a categorized and yet easy to use manner.

I have created an Excel template that allows you to enter your credit card records without any special effort.

It is recommended for those who want to keep track of their credit cards together, but want to do so as easily as possible, but also want to keep track of their credit cards securely.

Features of Credit Card Family Budget

This credit card Kakeibo is an improved version of the [2023 version] Excel Kakeibo template(free),I recommend it to anyone who couldn't last.

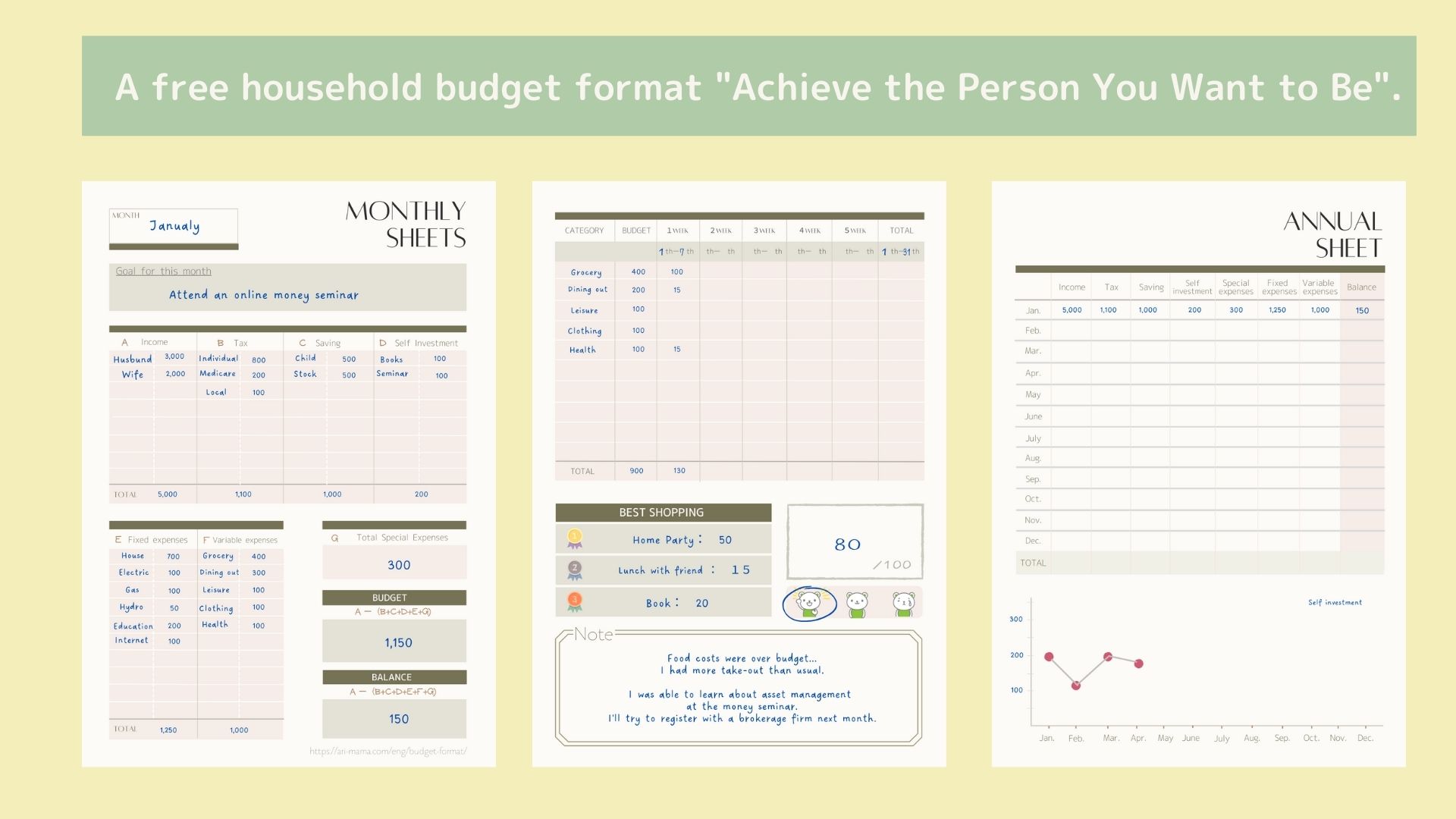

This kakeibo that allows you to make the anticipatory personal investments necessary to increase your income.

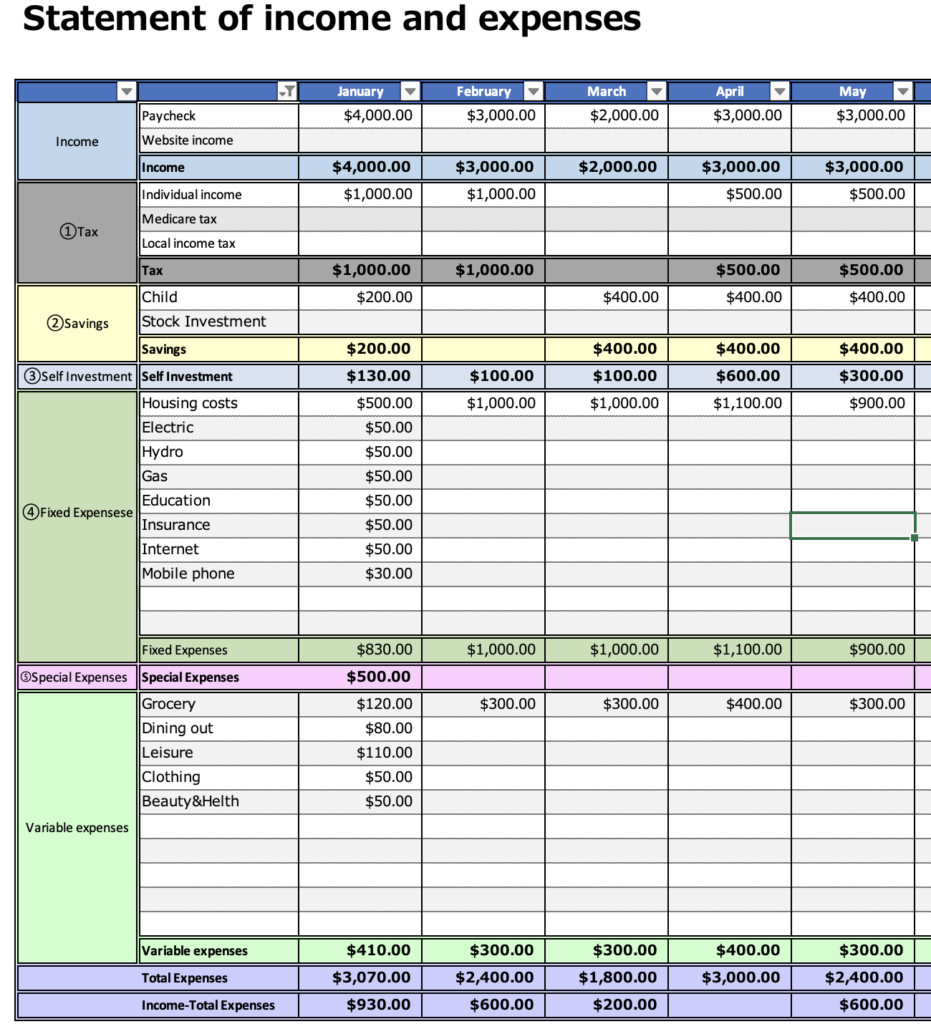

Prioritize your money and figure out how much you can spend each month.

Income - (Taxes + Savings + Personal Investments + Fixed Expenses) = Variable Expense Budget

Credit card record entries have been added.

When you specify the name of the credit card and enter the amount, it will be color-coded.

You can manage each month on a single sheet, saving you the trouble of entering each credit card separately.

The colored entries make it easy to see which credit cards are used most frequently.

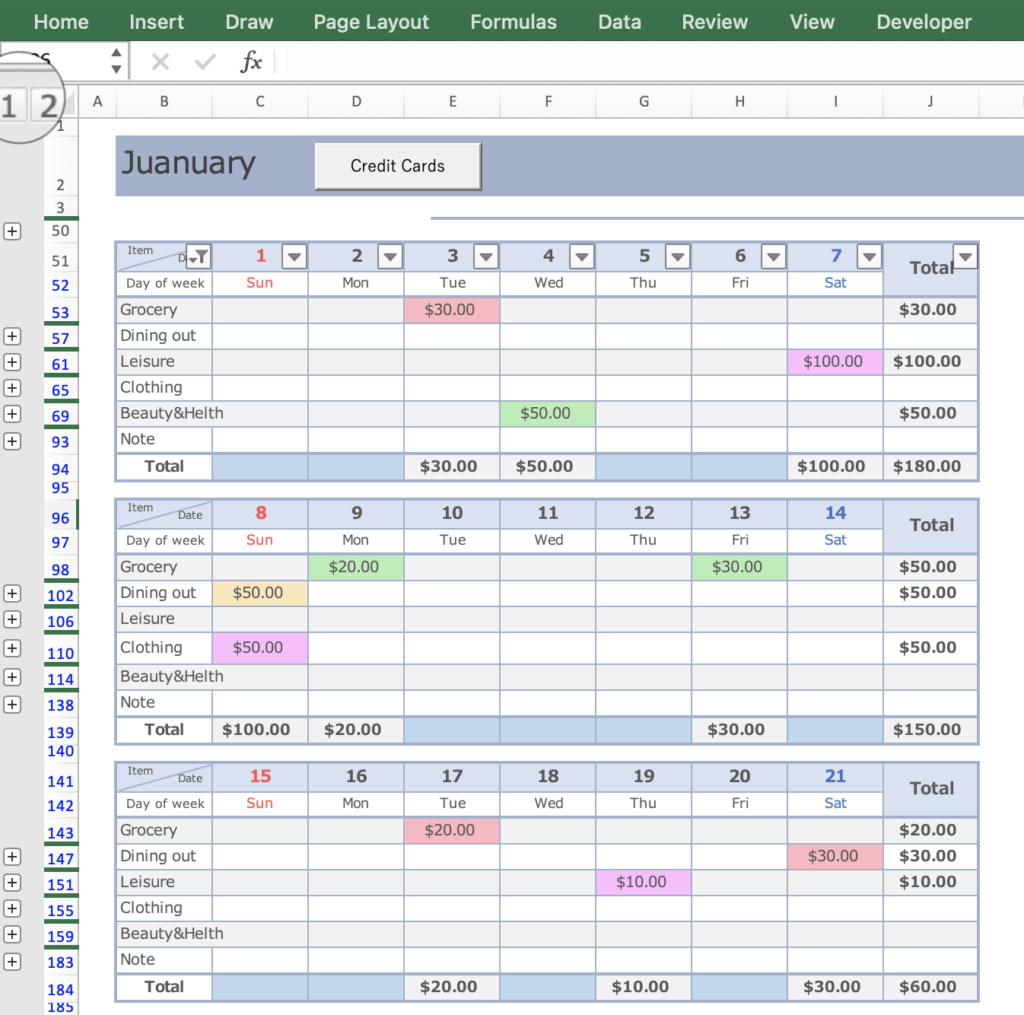

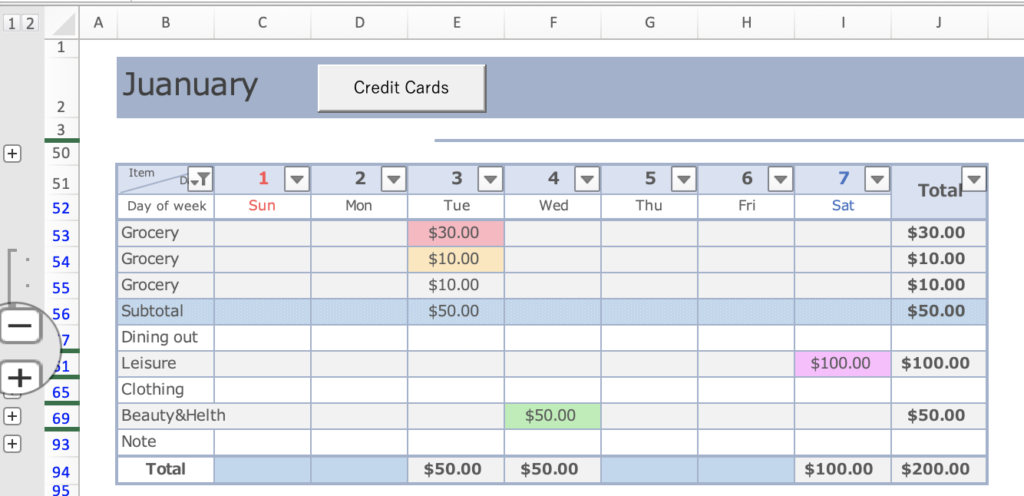

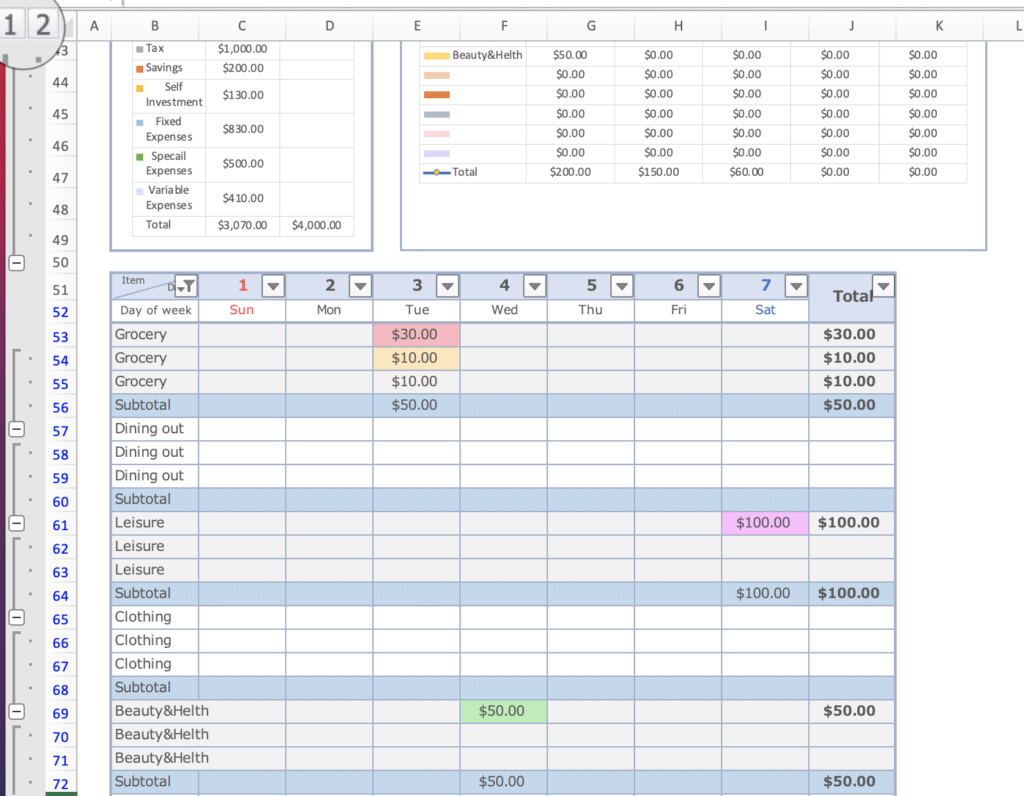

Variable expenses are entered into a weekly Gantt chart.

- Expenses can be set freely.

- Monthly sheets are set up for easy entry.

- Money priorities can be identified.

- Weekly totals are automatically entered, making it easy to revise your budget.

- Days when you didn't spend any money are colored.

- Weekly trends of variable expenses are displayed in a graph, making it easy to revise the budget.

- A pie chart is displayed for each monthly item, showing which items are overspent.

- Special expenses for the year can be entered by expense category.

- Monthly income and expenses are displayed in a list and graph, allowing you to see monthly trends at a glance.

- Credit card records can be kept.

- Easily set a start date

- Assets list shows changes in assets

Steps to create a household budget

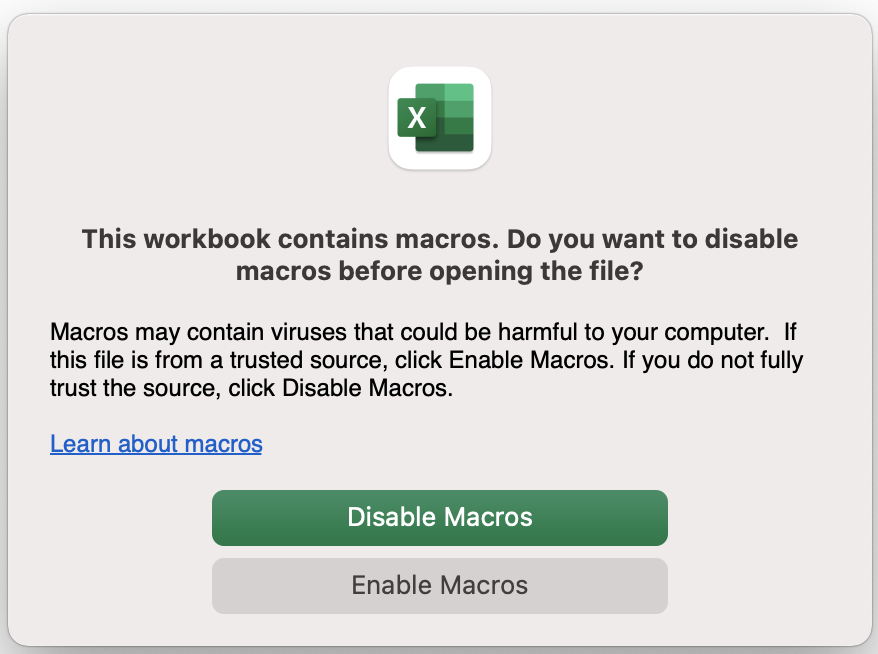

This Excel household budget book uses macros.

Open Excel and click on "Enable Macros".

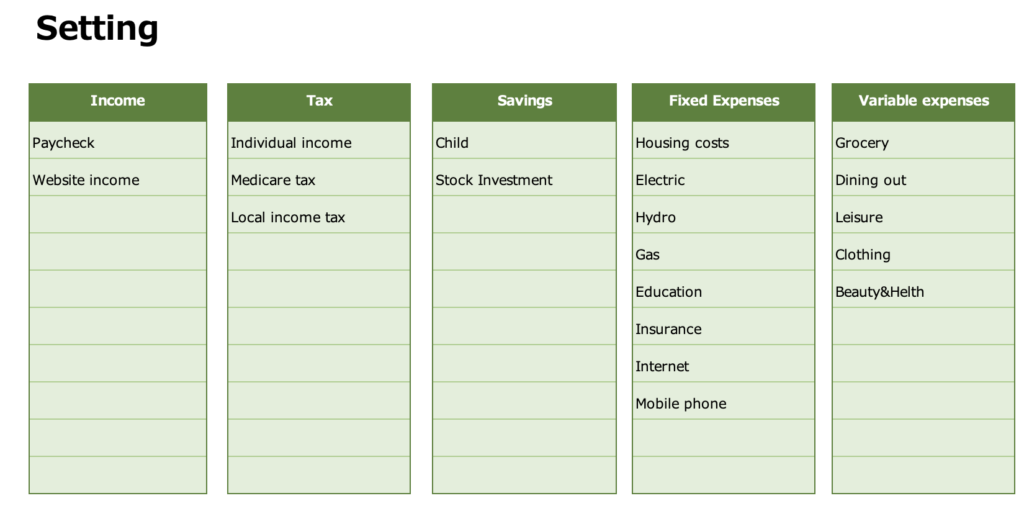

Set up the expense items

Enter the item names for income, taxes, savings, fixed expenses, and variable expenses.

The item names you enter will be reflected on the respective sheets.

Self-investment items are set up on the monthly sheet and special expenses are set up on the special expenses sheet.

- Income

- Taxes

- Savings

- Fixed Expenditure

- Variable Expense

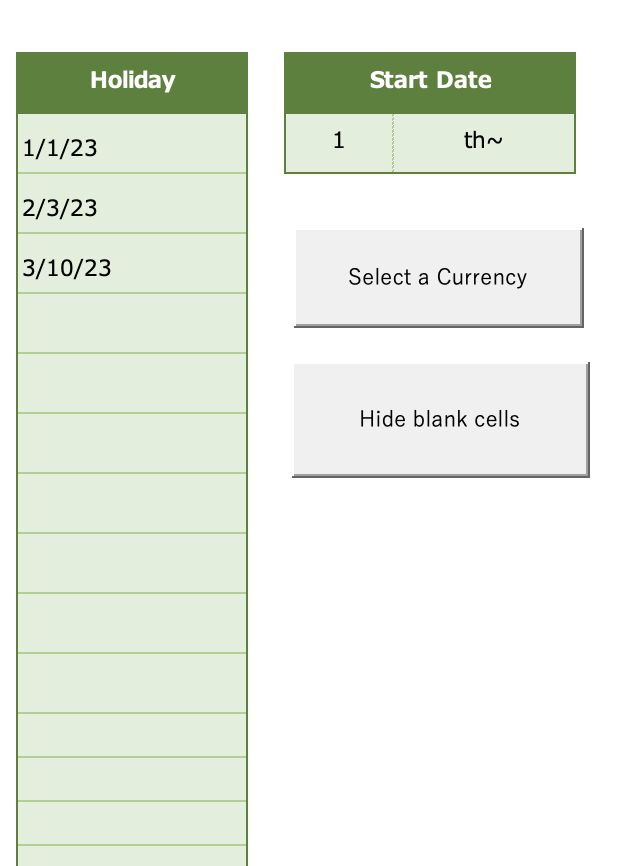

Select the start date

The date will be set to match the start date in each month sheet.

you can change the start date to match your payday, etc.

In the Holiday field, enter the national holiday of the country in which you live.

Saturdays are shown in blue, and Sundays and Holidays are shown in red.

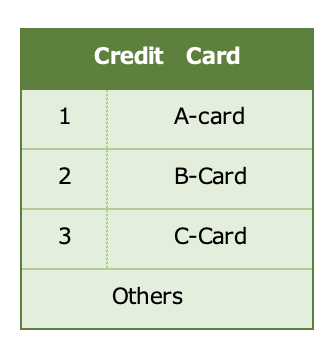

Register up to credit card names

You can register up to three credit card names.

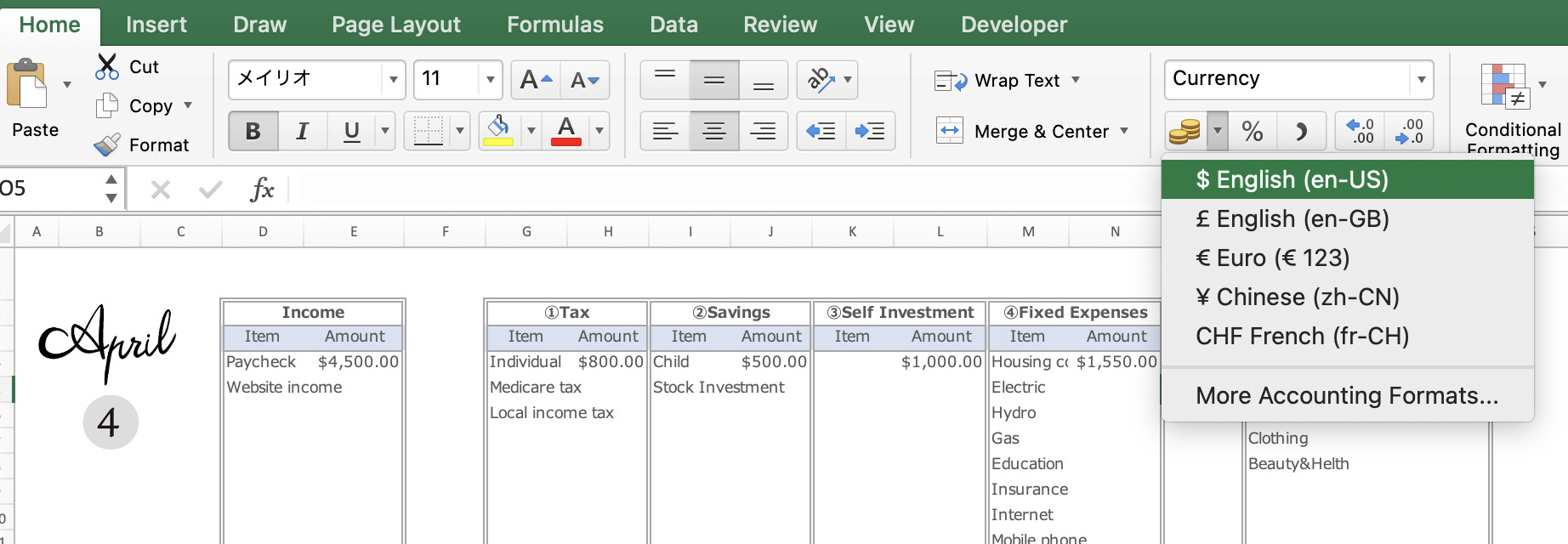

Change the currency unit

Press the "Select Currency" to select a range of currencies.

Select the currency unit for each sheet.

The January-December sheets can be changed in units at the same time.

Please change the units of the other sheets after changing the month sheet first.

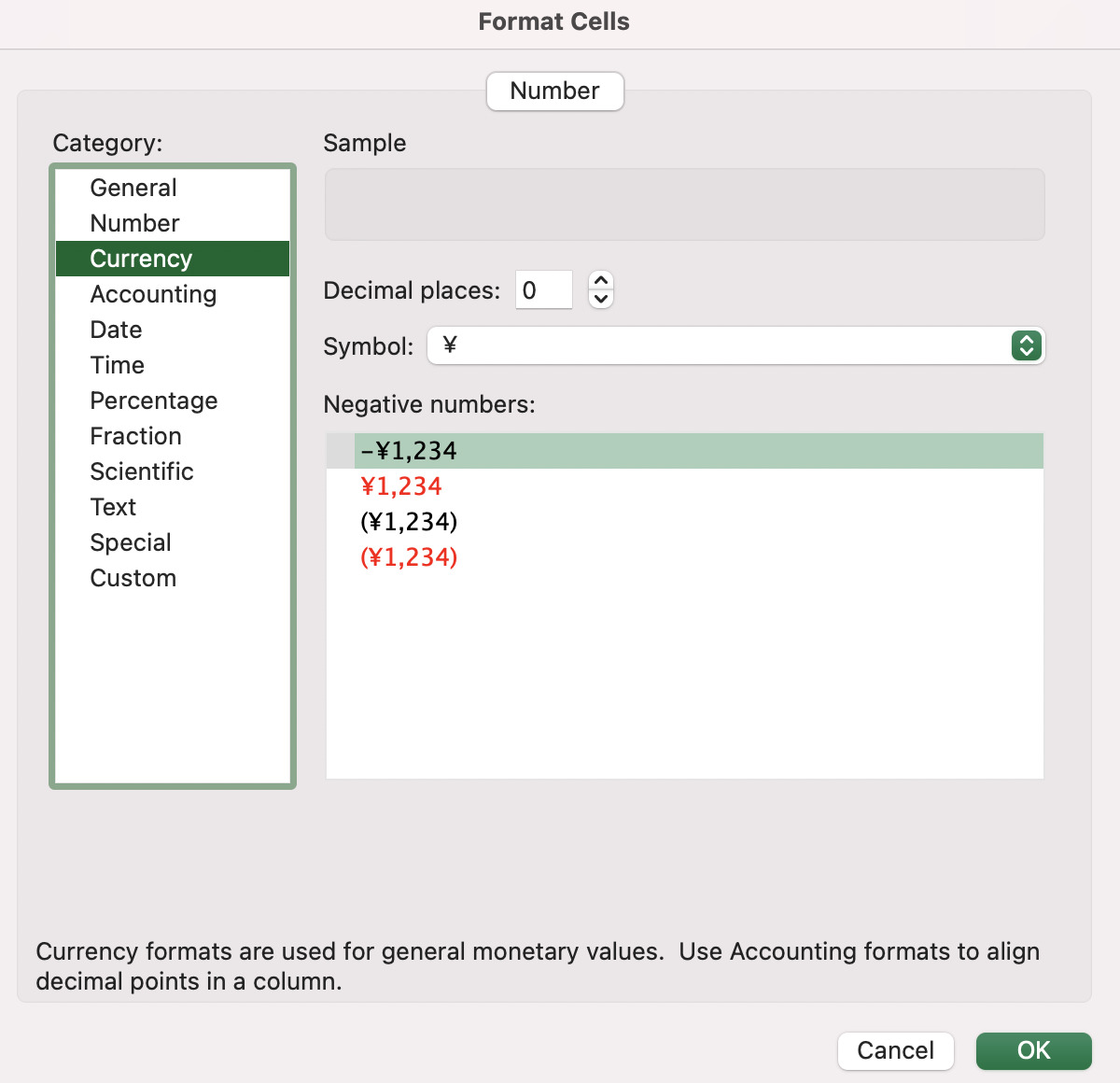

Click on the money symbol to select the currency unit.

(Home-Currency-Money symbol)

Click on the ”More Accounting Format” to see more unit information.

Or right-click and select Format Cell.

The default setting is in dollars.

Finally, click the ”Hide blank cells" to hide the blank cells in the monthly and yearly sheets.

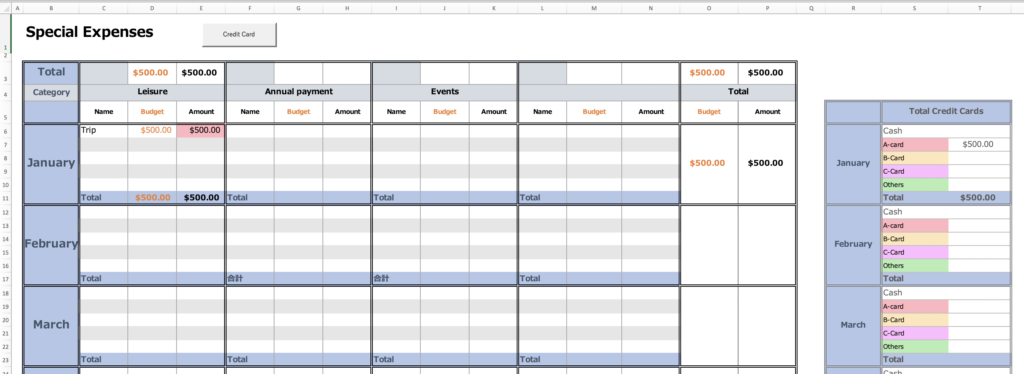

Special Expenses

Special expenses are expenses that don't occur every month but are special, such as event expenses or annual payments.

You can set up special expenses by month or by expense category, so it is easy to look back.

How to enter each credit card is explained in the month sheet section.

Monthly Settings

The expense items entered in the setup are set on the monthly sheets (Jan-Dec).

The system is divided into two parts: a table and graph section and a variable cost input section.

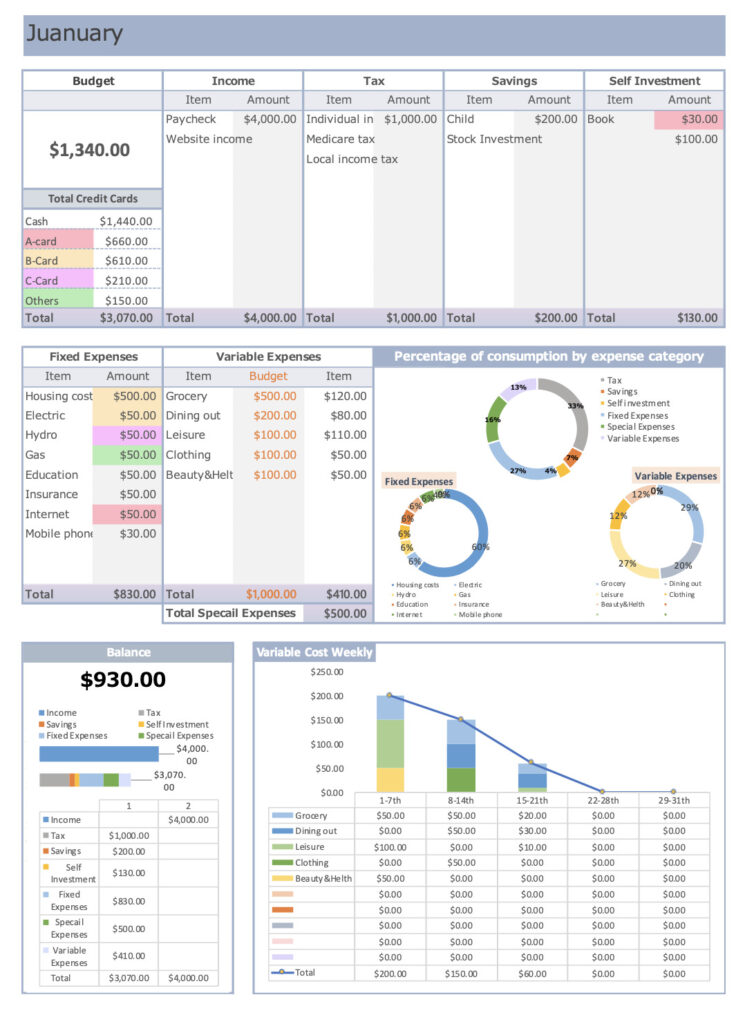

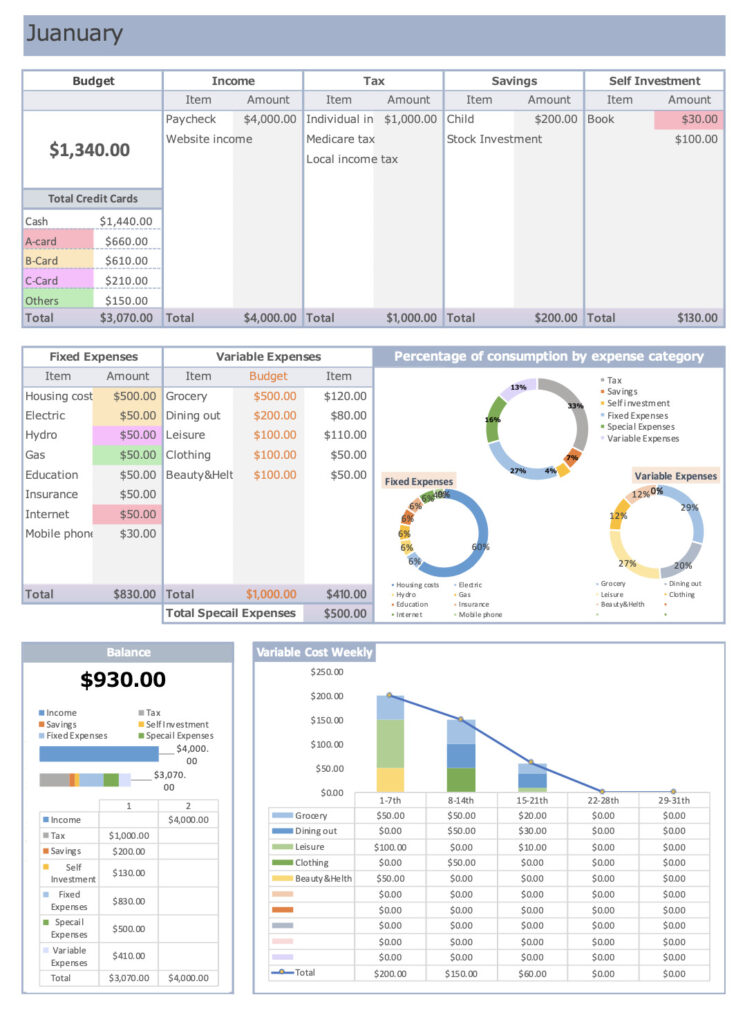

Tables and Graphs

Income, taxes, savings, actual expenses for fixed expenses, and budget for variable expenses are entered.

For personal investments, enter the details and actual expenses.

The amount entered for special expenses is automatically entered in the Special Expenses Total column.

Budget for this month

Displays this month's budget (Income - (Taxes + Savings + Self-investment + Fixed Expenses + Special Expenses).

Use this as a reference when entering a budget for variable expenses.

Total Amount Spent by Credit Card

Displays the amount spent by credit card.

Income/Expenses for this month

The remaining budget for this month (Income - (Taxes + Savings + Personal Investments + Fixed Expenses + Special Expenses + Variable Expenses)) is displayed.

The bar graph shows the total income at the top and the total expense amount at the bottom.

After all entries have been made, the remaining amount is displayed.

Variable Expenses Weekly

The graph reflects what you have entered in the Gantt chart of variable expenses.

The total amount of each expense item for the week is displayed on the reserve graph.

Expense Percentage by Expense Item

- Percentage of expenses for major items

Percentage of taxes, savings, fixed expenses, special expenses, and variable expenses - Expense ratio of fixed expenses

- Expense ratio of variable expenses

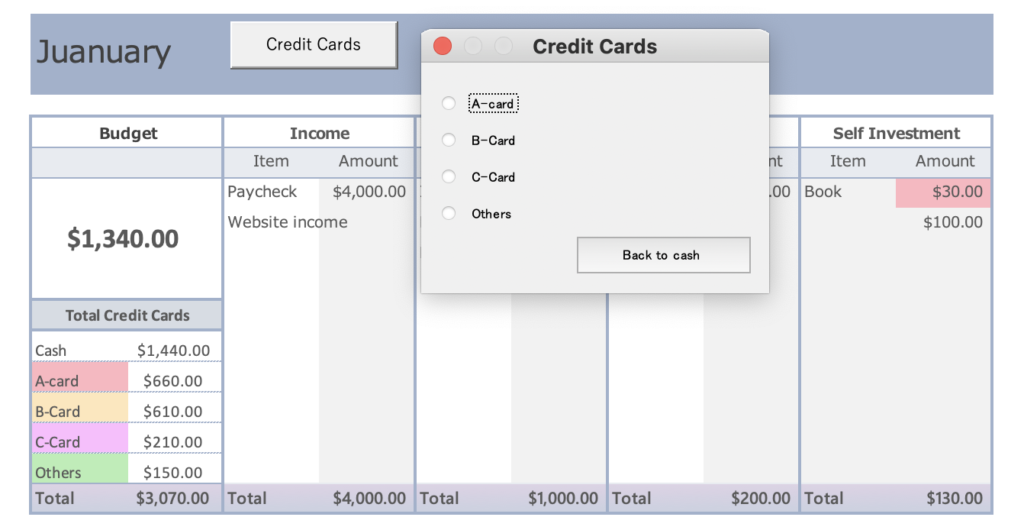

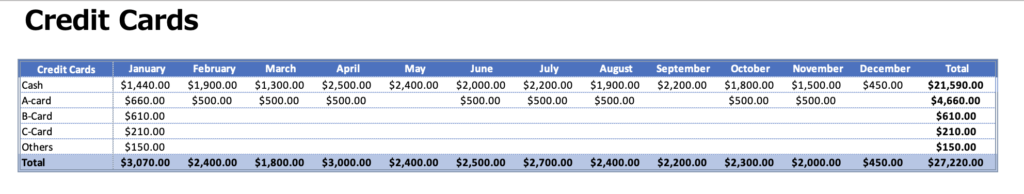

How to record a credit card

- Click on the "Credit Card" button.

- The name of the card you named in the settings will be displayed.

- Click on the name of the card you wish to record.

- Enter the amount in the Taxes, Savings, Personal Investments, Fixed Expenses, and Variable Expenses fields.

(Amounts entered will be colored) - Click on "Cash" to return to the cash entry.

(Cash will not be colored) - Close the user form (credit name table)

(Be sure to click on the "Cash" button to erase it.)

The total by credit card is the sum of all fixed expenses, variable expenses, personal investments, special expenses, savings, and taxes.

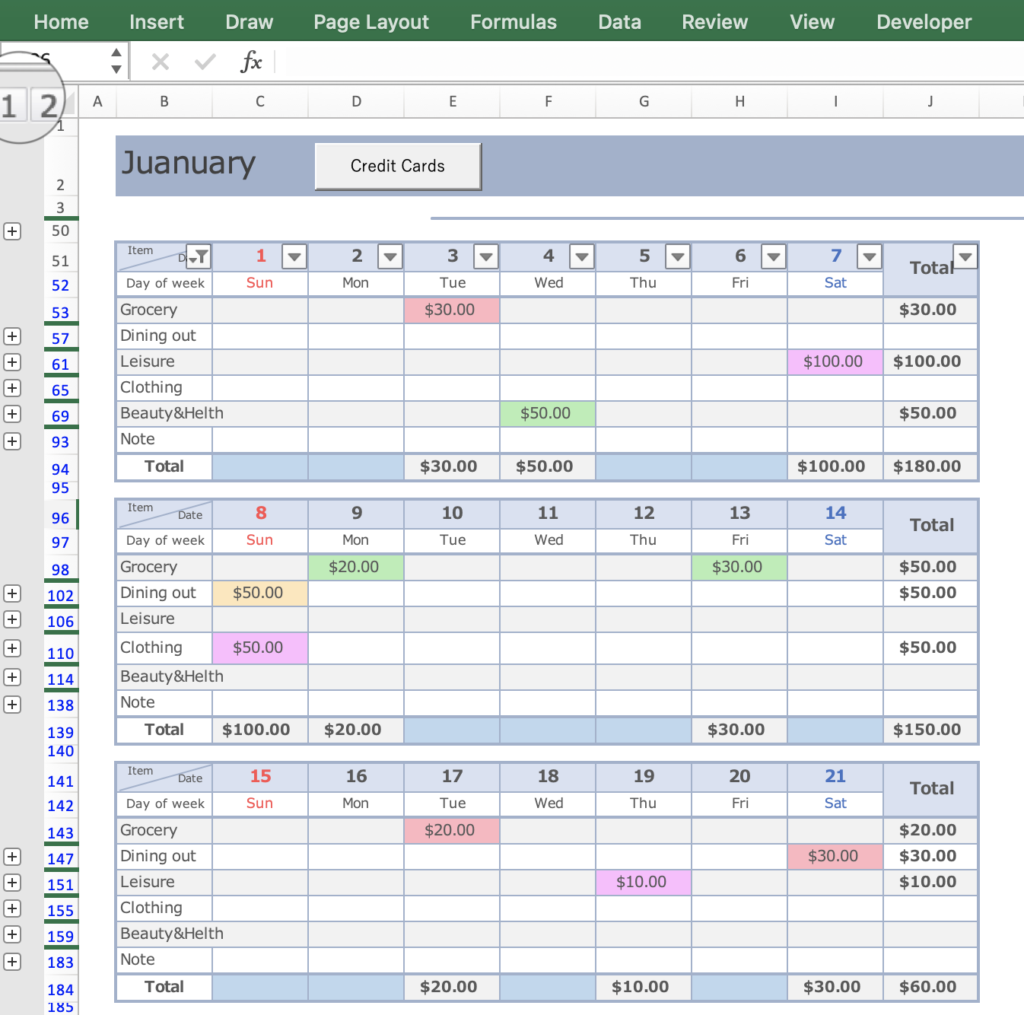

Entering Variable Expenses

Below the tables and graphs, there is a Gantt chart of variable expenses.

Clicking the 1 button in the upper left corner hides the table and graph, making it easier to enter the data.

To record credit cards, click on the Credit Card button.

It will be converted to the color shown in the table of totals by credit card.

If you wish to record more than three credit cards, enter them in the Other field.

If I use more than one credit card for the same expense on the same day

If I split my food expenses into multiple accounts on the same day, how do I enter them?

You can enter up to three of the same item on the same day.

Click the + button to the left of the variable expense item you wish to enter.

Two lines will be added, use this if you used multiple accounts.

Click the two buttons in the upper left corner to increase all items to three.

To return to the tables and graphs, click on the two buttons in the upper left corner.

Credit Card Trends

View annual credit card spending trends.

Annual Trends

The information you entered in the monthly section will be reflected and you can check the annual transition in the table and graph.

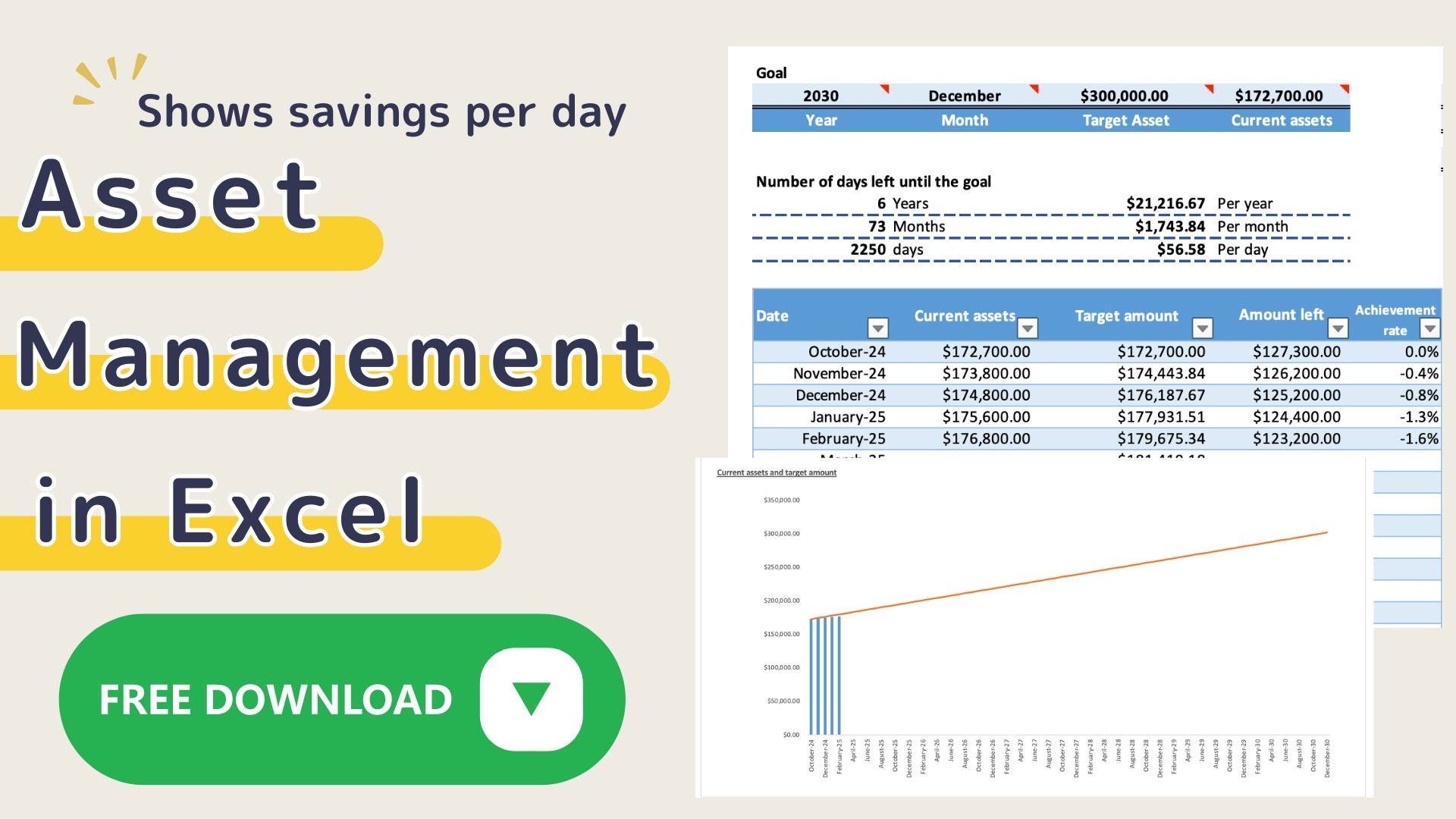

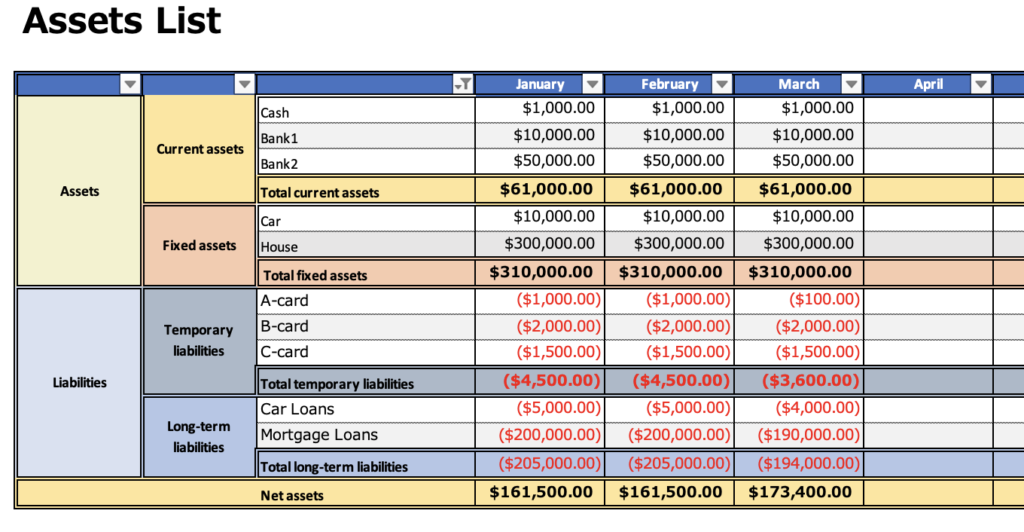

Creating a List of Assets

In planning for your life, it is important to understand how many assets and liabilities you currently have.

Knowing how your assets have changed will make it easier to plan for the future.

This sheet is not linked to the setup sheet, so please input the information directly into this table.

You can find out how much of your property you have accumulated (total assets), how much you owe others (liabilities), and how much you have in pure assets minus liabilities.

Assets

Current assets: Assets that can be converted into cash within a year.

Typical examples of current assets are cash (savings), securities (stocks, investment trusts, receivables, etc.), and insurance.

Fixed assets: Assets held for more than one year

Typical items that fall under fixed assets are real estate (land, buildings, etc.).

Other assets include automobiles, which can be converted to cash if sold, so their saleable value is an asset.

Jewelry and brand-name goods also fall into the fixed assets category.

Liabilities

Temporary liabilities: liabilities that will be paid off in less than one year.

Typical current liabilities are credit cards and unpaid taxes.

Fixed liabilities: Liabilities to be borrowed for more than one year.

Typical fixed liabilities include the borrowed portion of land and buildings owned (mortgage), car and scholarship loans.

Enter the amount of liabilities as a negative figure.

Net Assets

Net Assets = Assets - Liabilities

This shows how much money you have that you do not have to repay.

-

-

[2025version]Kakeibo linked to assets for those who want to manage their money well."Free template"

This Excel household account book is an Excel household account book that works in conjunction with the household account book to show daily asset movements. ...

Free Download

Sample sheets are included in the Excel Household Budget Book.

You can download it for free by clicking the download button.

This excel kakeibo is based on the calendar year 2023.

A ZIP file will be downloaded, and you can use it by unzipping it.

Click here for the 2024 version